I'm having trouble with Excel and the spreadsheet, but I was able to at least get this week's sheet updated before Excel choked on the spreadsheet trying to reopen it. It may take some time to rebuild it so hopefully it will be up and running for next week's picks. Thank you for your patience in advance should I have problems. I am contemplating only following Diamonds in the Rough on the spreadsheet for only the past two weeks. It gets corrupted as we move in and out of short positions as the declines don't generally last for a month. If you have a problem with this, please feel free to email me. I'll take it into account this week when rebuilding the spreadsheet.

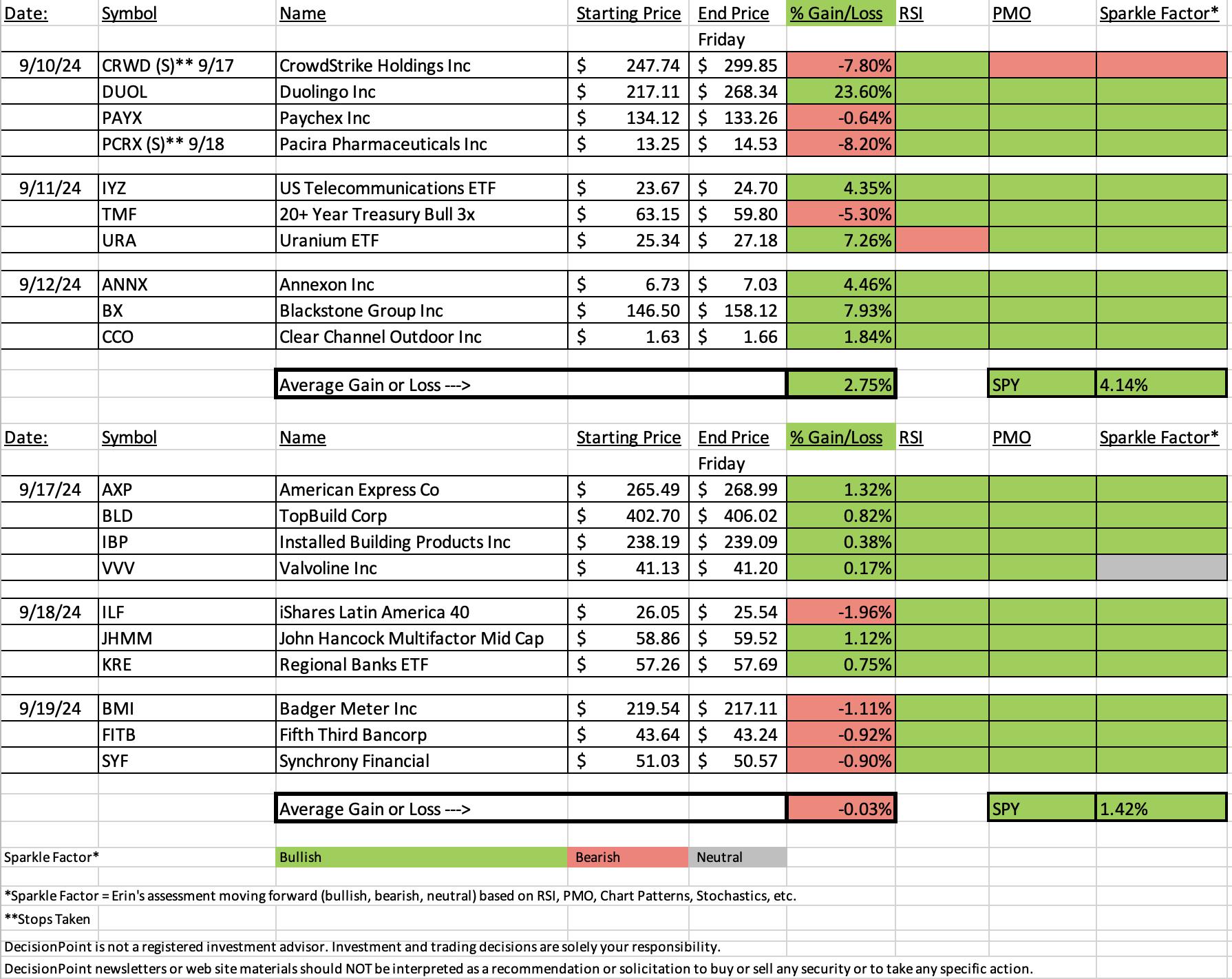

The market cooled today and it took our Reader Requests down with it. They weren't terrible picks, I see them as looking good in the future, it was just a bad day. The other loser was the Latin America 40 ETF (ILF). It was not a great pick and the chart is falling apart.

I'm happy with the performance of the other Diamonds in the Rough this week. As noted, I have green Sparkle Factors for all but two of the positions, meaning they look bullish moving forward. This week's Darling was America Express (AXP) which was up +1.32% on the week since being picked. It is well positioned.

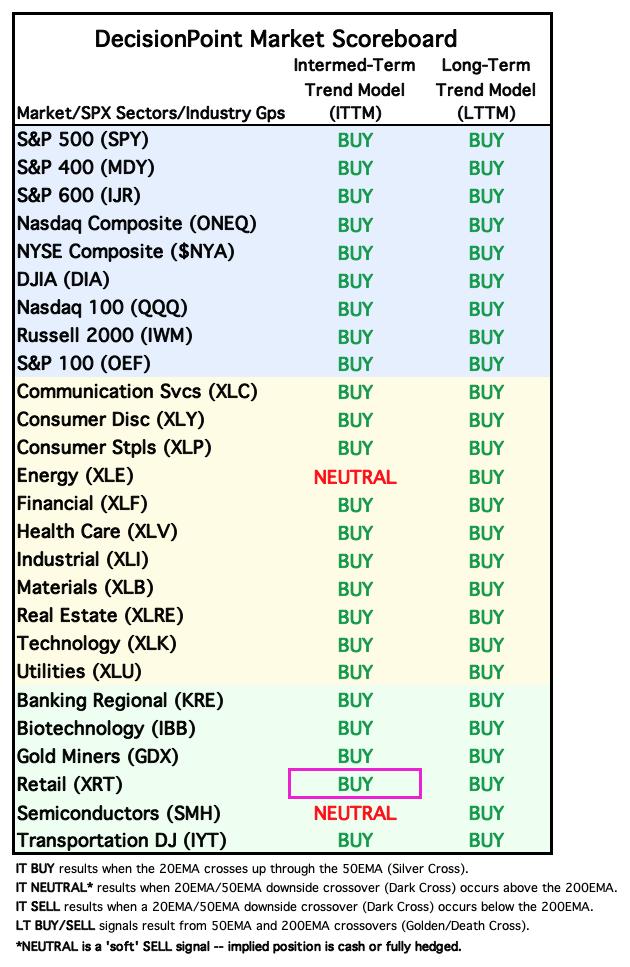

The Sector to Watch this week is going to be Technology (XLK) but I must say that I and the members of the trading room this morning don't have a lot of conviction behind the choice as the market is acting like it wants to pull back and that wouldn't be good for XLK. We also liked XLI, XLF and XLB. All are showing good upward momentum and all should benefit from a lower Fed funds rate.

The Industry Group to Watch is Computer Hardware with Apple (AAPL) leading the way to higher prices. We found the following symbols of interest in that group: AAPL, CNXN, STX and ROKU.

I had a chance to run a few scans at the end of the trading room and I came up with some more symbols for you to review going into next week: KEYS, KLG, SKT, CAH and VTOL.

Have a great weekend! I'll see you in Monday's trading room.

Good Luck & Good Trading,

Erin

Diamond Mine Trading Room:

RECORDING & DOWNLOAD LINK (9/20/2024):

Topic: DecisionPoint Diamond Mine (9/20t/2024) LIVE Trading Room

Recording & Download Link HERE

Passcode: September#20

REGISTRATION for 9/27/2024:

When: September 27, 2024 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine LIVE Trading Room

Register in advance for this webinar HERE

After registering, you will receive a confirmation email containing information about joining the webinar.

Below is the latest free DecisionPoint Trading Room recording from 9/16. You'll find these recordings posted on Mondays to our DP YouTube Channel. Be sure and subscribe HERE.

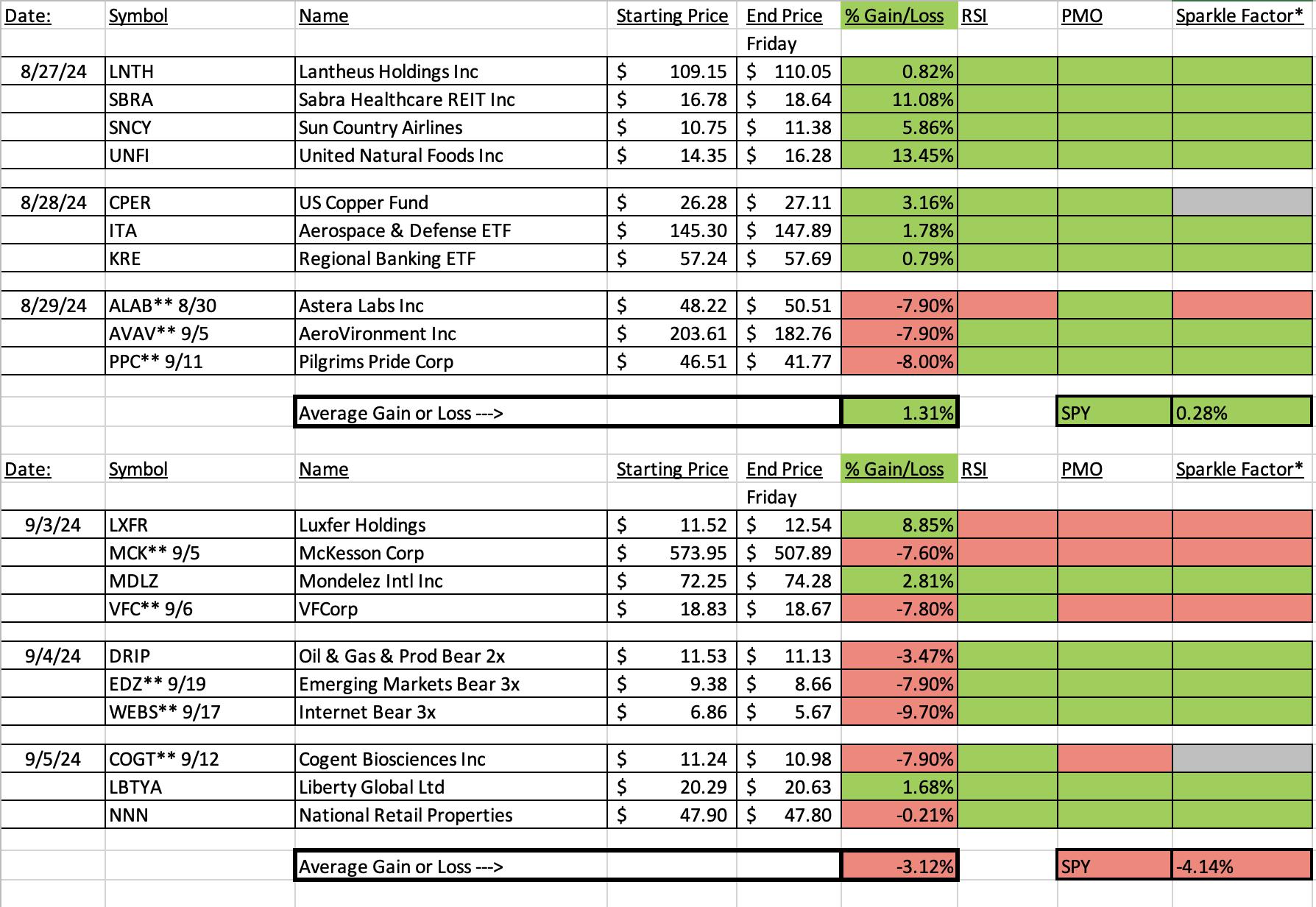

A few items about the spreadsheet: I've put on the spreadsheet whether the RSI is positive (green) or negative (red). The PMO column tells you if it is rising (green) or falling (red). Finally I've added my own "Sparkle Factor" that gives you my assessment going forward, bullish (green), bearish (red) or neutral (gray). The Sparkle Factor is basically my thoughts on whether I expect it to rise or fall. A neutral means it could really go either way so it could be added to a watch list. If you're in a stock I consider "neutral" going forward, the ball is in your court.

Darling:

American Express Co. (AXP)

EARNINGS: 2024-10-18 (BMO)

American Express Co. is an integrated payments company, which engages in the provision of credit and charge cards to consumers, small businesses, mid-sized companies, and large corporations. It operates through the following segments: the United States Consumer Services (USCS), Commercial Services (CS), International Card Services (ICS), Global Merchant and Network Services (GMNS), and Corporate and Other. The USCS segment includes proprietary consumer cards and provides services to consumers including travel and lifestyle services as well as banking and non-card financing products. The CS segment offers proprietary corporate and small business cards and provides services to businesses including payment and expense management, banking, and non-card financing products. The ICS segment focuses on providing services to international customers including travel and lifestyle services and managing certain international joint ventures and loyalty coalition businesses. The GMNS segment is involved in operating a global payments network that processes and settles card transactions, acquires merchants, and provides multi-channel marketing programs and capabilities, services and data analytics. The Corporate and Other segment covers corporate functions and certain other businesses and operations. The company was founded by Henry Wells, William G. Fargo, and John Warren Butterfield on March 28, 1850 and is headquartered in New York, NY.

Predefined Scans Triggered: Moved Above Upper Bollinger Band, Moved Above Upper Price Channel, P&F Double Top Breakout and New 52-week Highs.

Below are the commentary and chart from Tuesday, 9/17:

"AXP is down -0.04% in after hours trading. I loved today's breakout and move to new 52-week highs. It looks primed for more follow through, but may pause after breaking out. The RSI is not overbought and the PMO is rising on a Crossover BUY Signal above the zero line. Stochastics are now above 80 and relative strength is improving across the board. It is doing particularly well against the SPY right now. The stop is set as close to support as possible at 7.7% or $245.04."

Here is today's chart:

The rally continued as expected on the chart. The indicators are still looking very bullish. I especially like that the RSI is not overbought right now. What went right? The breakout was a good indication that we would see follow through. We have a strongly rising OBV and relative strength was on our side. I like this one moving forward.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Dud:

iShares Latin America 40 ETF (ILF)

EARNINGS: N/A

ILF tracks a market-cap-weighted index of 40 of the largest Latin American firms. Click HERE for more information.

Predefined Scans Triggered: None.

Below are the commentary and chart from Wednesday, 9/18:

"ILF is up +0.39% in after hours trading. The large reverse head and shoulders sold me on this chart. I also like that I don't have to have a very deep stop. The RSI is positive and not at all overbought. There is a new PMO Crossover BUY Signal that occurred above the zero line. Stochastics are now above 80 and we do see some outperformance against the SPY. The stop is set thinly at 5.6% or $24.59."

Here is today's chart:

What went wrong here? I got too enamored of the reverse head and shoulders chart pattern, but admittedly that is really all I can point to given the indicators were lined up well. The PMO was above the zero line and Stochastics were above 80. The RSI was positive, but maybe reading a little too low. In any case, this one should be sold.

THIS WEEK's Performance:

DecisionPoint Market Scoreboard (Mechanical Trend Model Signals):

Friday signal changes are outlined in purple.

Click Here to view Carl's annotated "Under the Hood" ChartList!

Sector to Watch: Technology (XLK)

If the market melts up next week, this sector should prosper. It is not overbought and we have nice readings under the hood. We recently saw an IT Trend Model Silver Cross BUY Signal. The Silver Cross Index is rising above its signal line. While the Golden Cross Index is below its signal line, it is reading at a robust 72%. Participation is in the 70th percentile leaving us room for improvement and sitting at a healthy level. Stochastics are above 80. If the market opens down next week, then we should pass on this sector. We will see what this rally has in store.

Industry Group to Watch: Computer Hardware ($DJUSCR)

We have a nice strong rally this week and today saw a higher high and higher low. I will admit I'm not liking the shooting star candlestick here coming right below resistance. The RSI is not overbought and we have a nearing PMO Crossover BUY Signal above the zero line. Stochastics are rising strongly and we see some outperformance coming in. The stocks of interest from this area are: AAPL, CNXN, STX and ROKU.

Go to our Under the Hood ChartList on DecisionPoint.com to get an in-depth view of all the sectors. On StockCharts.com you can find the Industry Summary.

Good Luck & Good Trading!

- Erin

erin@decisionpoint.com

Full Disclosure: I'm 60% long, 0% short.

Watch the latest episode of the DecisionPoint Trading Room with Carl & Erin Swenlin HERE!

Technical Analysis is a windsock, not a crystal ball. --Carl Swenlin

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

(c) Copyright 2024 DecisionPoint.com