The market continued its decline this week culminating in a terrible trading day today. The Diamond Spreadsheet was hit particularly hard, but we did manage to outperform the SPY this week anyway. Only two positions finished in the green and the two Financial stocks picked on Tuesday really hit the skids this week.

The Darling this week was Air Products and Chemicals Inc (APD) which was up a big +6.63% this week primarily due to positive earnings reported. The Dud was the leveraged Energy 2x Bull ETF which was hit by falling Oil prices. Crude had looked ready for a breakout rebound, but it failed very quickly and took this position with it.

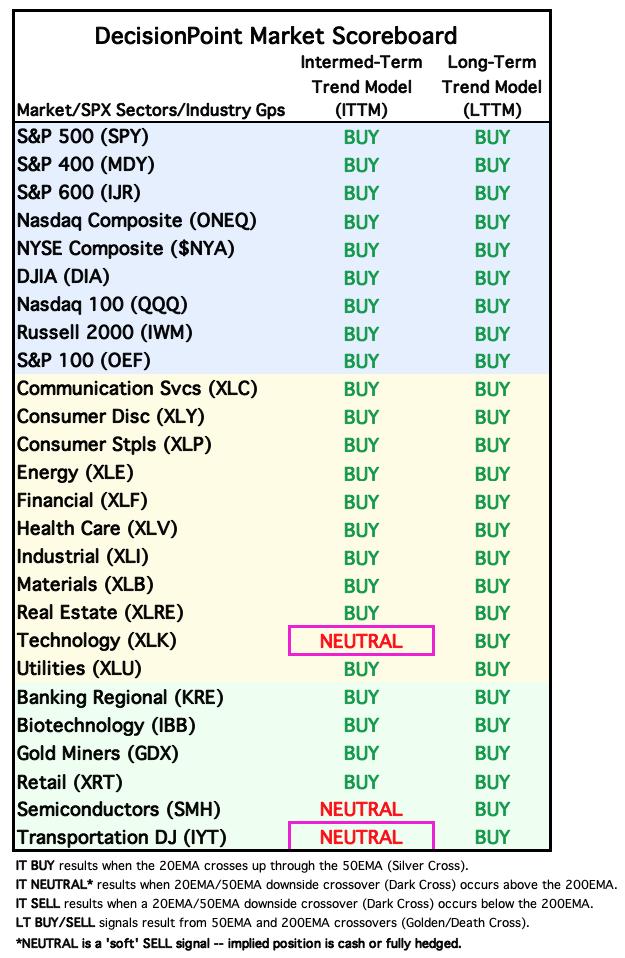

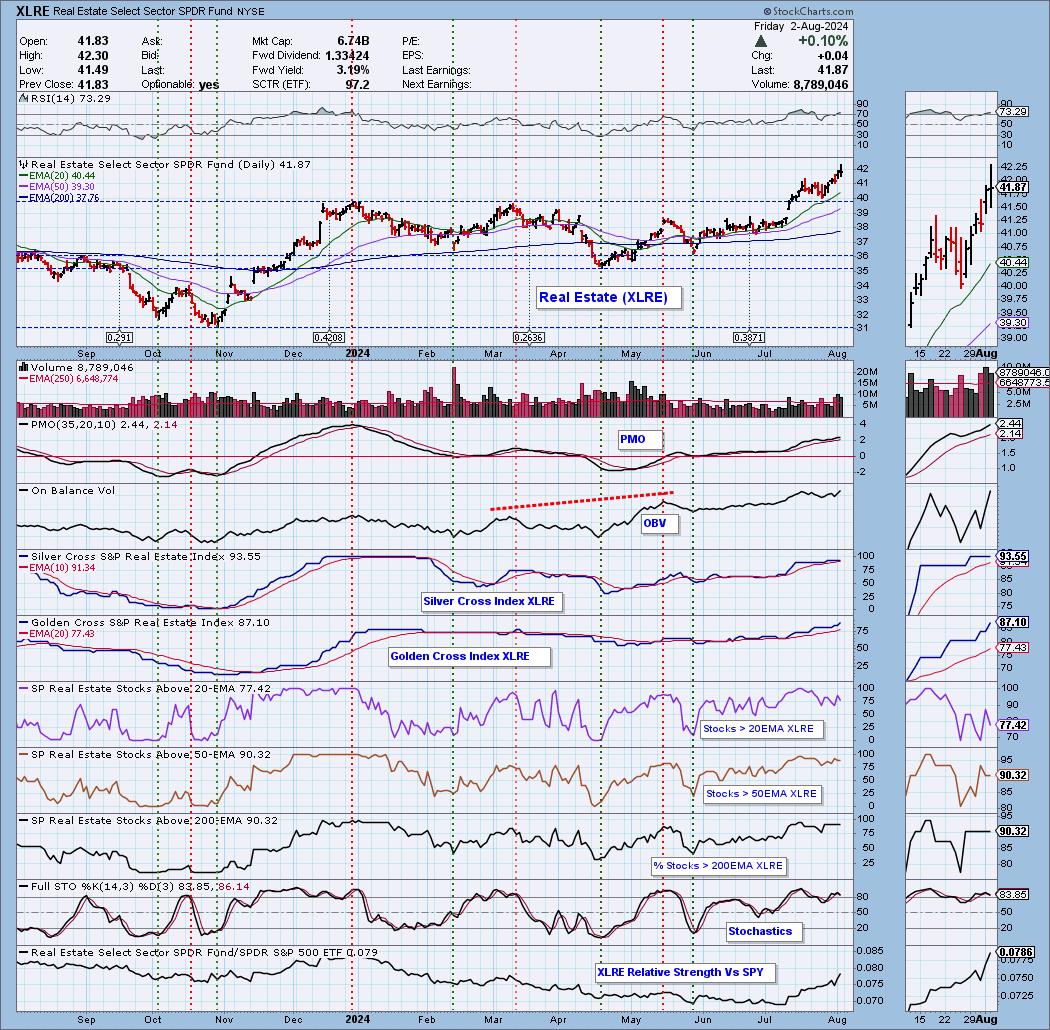

The Sector to Watch was fairly easy to pick this week. Utilities (XLU) and Real Estate (XLRE) looked the best with Consumer Staples (XLP) not far behind, but ultimately we decided on XLRE even though it has run hot and could be a bit overdone. It appears to have the best chance of continuing higher.

The Industry Group to Watch was Residential REITs which are looking very bullish. The stocks of interest in this area are: CLPR, AMH, IRT and MAA.

I did run the PMO Crossover Scan at the end of the trading room and found a handful of symbols that are worth a look going into next week: CHRW, T, NBIX and AZN.

Have a great weekend! See you in the Monday trading room!

Good Luck & Good Trading,

Erin

Diamond Mine Trading Room:

RECORDING & DOWNLOAD LINK (8/2/2024):

Topic: DecisionPoint Diamond Mine (8/2/2024) LIVE Trading Room

Download & Recording Link

Passcode: August#2

REGISTRATION for 8/9/2024:

When: August 9, 2024 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine LIVE Trading Room

Register in advance for this webinar HERE

After registering, you will receive a confirmation email containing information about joining the webinar.

Below is the latest free DecisionPoint Trading Room recording from 7/29. You'll find these recordings posted on Mondays to our DP YouTube Channel. Be sure and subscribe HERE.

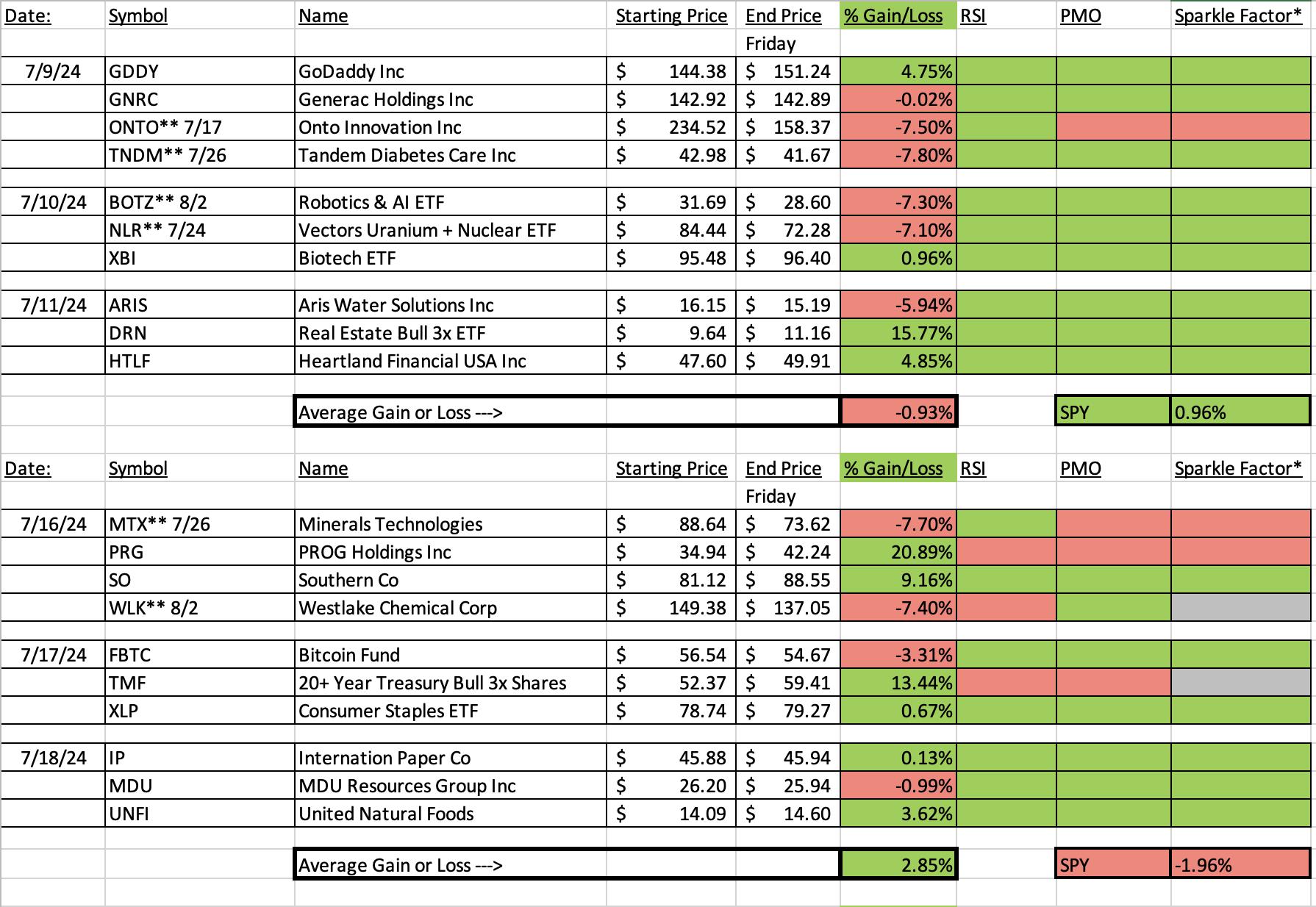

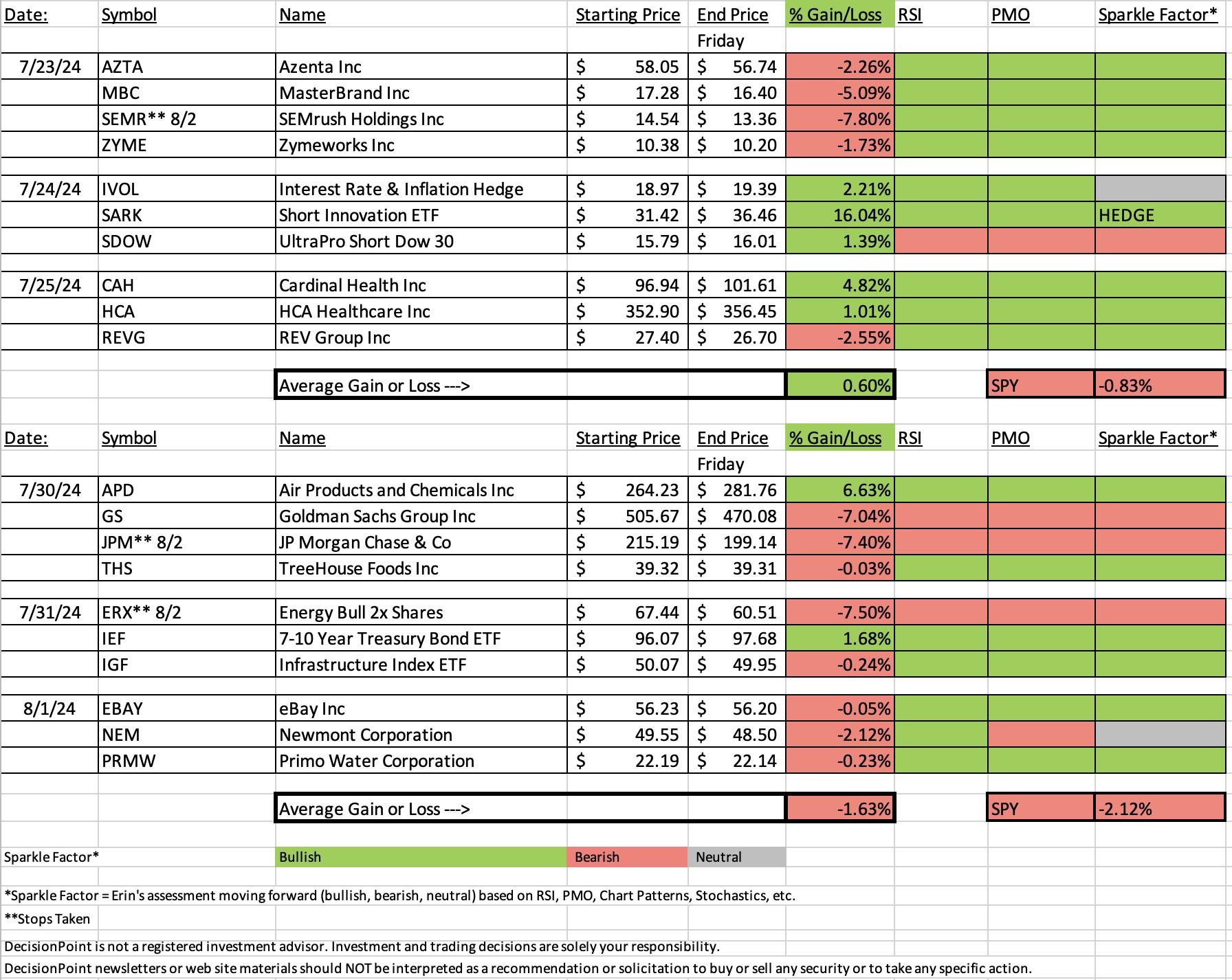

A few items about the spreadsheet: I've put on the spreadsheet whether the RSI is positive (green) or negative (red). The PMO column tells you if it is rising (green) or falling (red). Finally I've added my own "Sparkle Factor" that gives you my assessment going forward, bullish (green), bearish (red) or neutral (gray). The Sparkle Factor is basically my thoughts on whether I expect it to rise or fall. A neutral means it could really go either way so it could be added to a watch list. If you're in a stock I consider "neutral" going forward, the ball is in your court.

Darling:

Air Products and Chemicals, Inc. (APD)

EARNINGS: 2024-08-01 (BMO) ** Reports Earnings Soon **

Air Products & Chemicals, Inc. engages in the manufacture and distribution of atmospheric gases. It operates through the following segments: Americas, Asia, Europe, Middle East and India, and Corporate and Other. The Americas, Asia, Europe, and Middle East and India segments focuses on producing and selling gases to customers, including those in refining, chemicals, metals, electronics, manufacturing, medical, and food industries. The Corporate and Other segment is involved in sales of cryogenic and gas processing equipment for air separation that is sold worldwide to customers in a variety of industries, including chemical and petrochemical manufacturing, oil and gas recovery and processing, and steel and primary metals processing. The company was founded by Leonard Parker Pool on September 30, 1940 and is headquartered in Allentown, PA.

Predefined Scans Triggered: None.

Below are the commentary and chart from Tuesday, 7/30:

"APD is up +3.32% in after hours trading. The big double bottom caught my eye on the CandleGlance and I was happy to see that the rest of the chart is cooperating. It does report in a few days, but it is set up well. The RSI is positive and not at all overbought. There is a new PMO Crossover BUY Signal. Stochastics are rising in positive territory and relative strength lines are all angling higher. I set the stop below the pattern at 7.6% or $244.14."

Here is today's chart:

What went right with APD? Earnings. The chart was set up well going into earnings and they were clearly well received yesterday. We did see a pullback, but given the big gap up, I would look for more upside here. It may be a little late for entry, but the RSI is not overbought so it could be considered.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Dud:

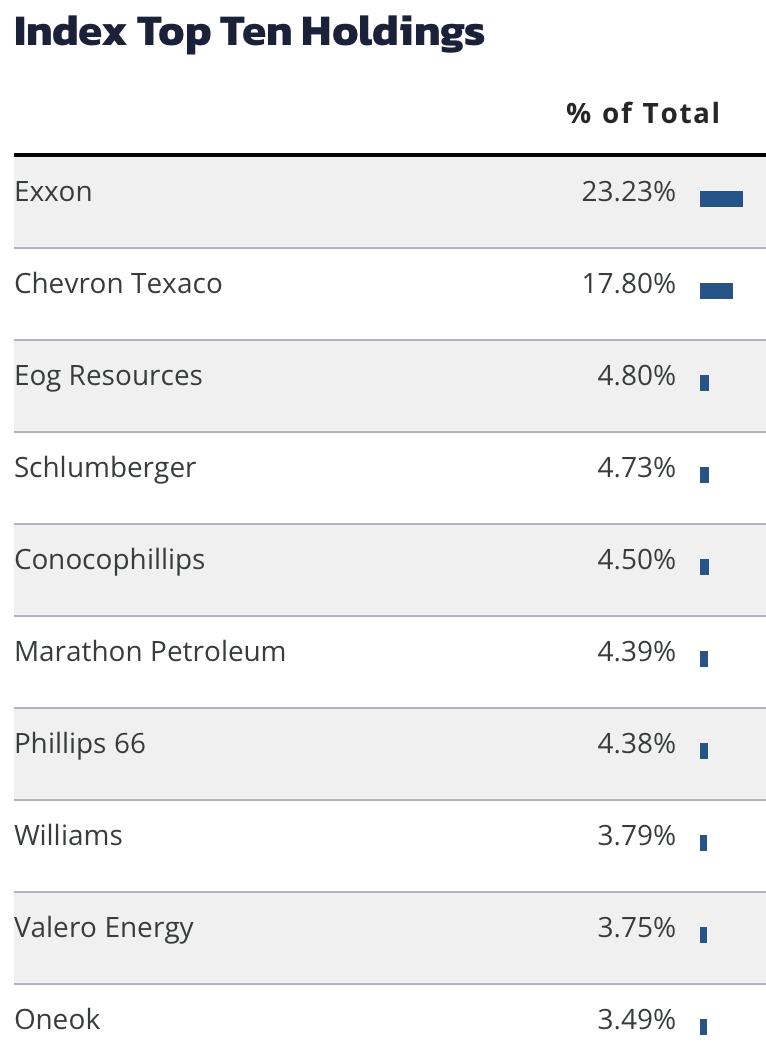

Direxion Daily Energy Bull 2x Shares (ERX)

EARNINGS: N/A

ERX provides 2x leveraged exposure to a market-cap-weighted index of US large-cap companies in the energy industry. Click HERE for more information.

Predefined Scans Triggered: Filled Black Candles and New CCI Buy Signals.

Below are the commentary and chart from Wednesday, 7/31:

"ERX is up +0.49% in after hours trading. Here we have a nice basing pattern in a rounded bottom. Price popped above overhead resistance. It is a filled black candlestick so this one could see a decline tomorrow, but if after hours trading is any indication, maybe it will rally after all. The RSI is positive and not overbought. The PMO bottomed above the signal line and Stochastics are rising in positive territory. Relative strength is gaining. This is leveraged so position size wisely. The stop is set beneath the 200-day EMA at 7.5% or $62.38."

Here is today's chart:

What went wrong here? The Crude Oil trade went south and that put immense downside pressure on Energy. Unfortunately this one was leveraged so it took a major hit. My apologies, I should've gone with a non-leveraged ETF given this rising trend was still somewhat new. I also see that I picked this on a filled black candlestick, that could also have been a problem, but ultimately it comes down to Crude.

THIS WEEK's Performance:

DecisionPoint Market Scoreboard (Mechanical Trend Model Signals):

Friday signal changes are outlined in purple.

Click Here to view Carl's annotated "Under the Hood" ChartList!

Sector to Watch: Real Estate (XLRE)

It's interesting as participation did contract slightly on today's rally, but ultimately the percentages are very robust and certainly tell us there is a strong foundation within the sector. I wouldn't be surprised if we did see a bit of a pullback next week as the RSI is overbought, but lower interest rates are making this sector especially bullish.

Industry Group to Watch: Residential REITs ($DJUSRN)

I like today's breakout move, although I am not thrilled with the shooting star candlestick that appeared at the close. It isn't enough to get bearish, but it does tell us we could see a decline to start off the week. The RSI is not overbought so there is more upside to be had. The PMO is on a Crossover BUY Signal above the zero line. Stochastics are rising strongly. A few symbols to consider: CLPR, AMH, IRT and MAA.

Go to our Under the Hood ChartList on DecisionPoint.com to get an in-depth view of all the sectors. On StockCharts.com you can find the Industry Summary.

Good Luck & Good Trading!

- Erin

erin@decisionpoint.com

Full Disclosure: I'm 20% long, 0% short.

Watch the latest episode of the DecisionPoint Trading Room with Carl & Erin Swenlin on Mondays 3:00p EST!

Technical Analysis is a windsock, not a crystal ball. --Carl Swenlin

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

(c) Copyright 2024 DecisionPoint.com