"Diamonds in the Rough" had a very good week and a good reason was the last two days of trading this week that kept the market in a slight rising trend.

Last week's "Diamonds in the Rough" matured as well. The last three weeks have Diamonds averaging up not down. This is a relief after the decline that took out many of our older positions.

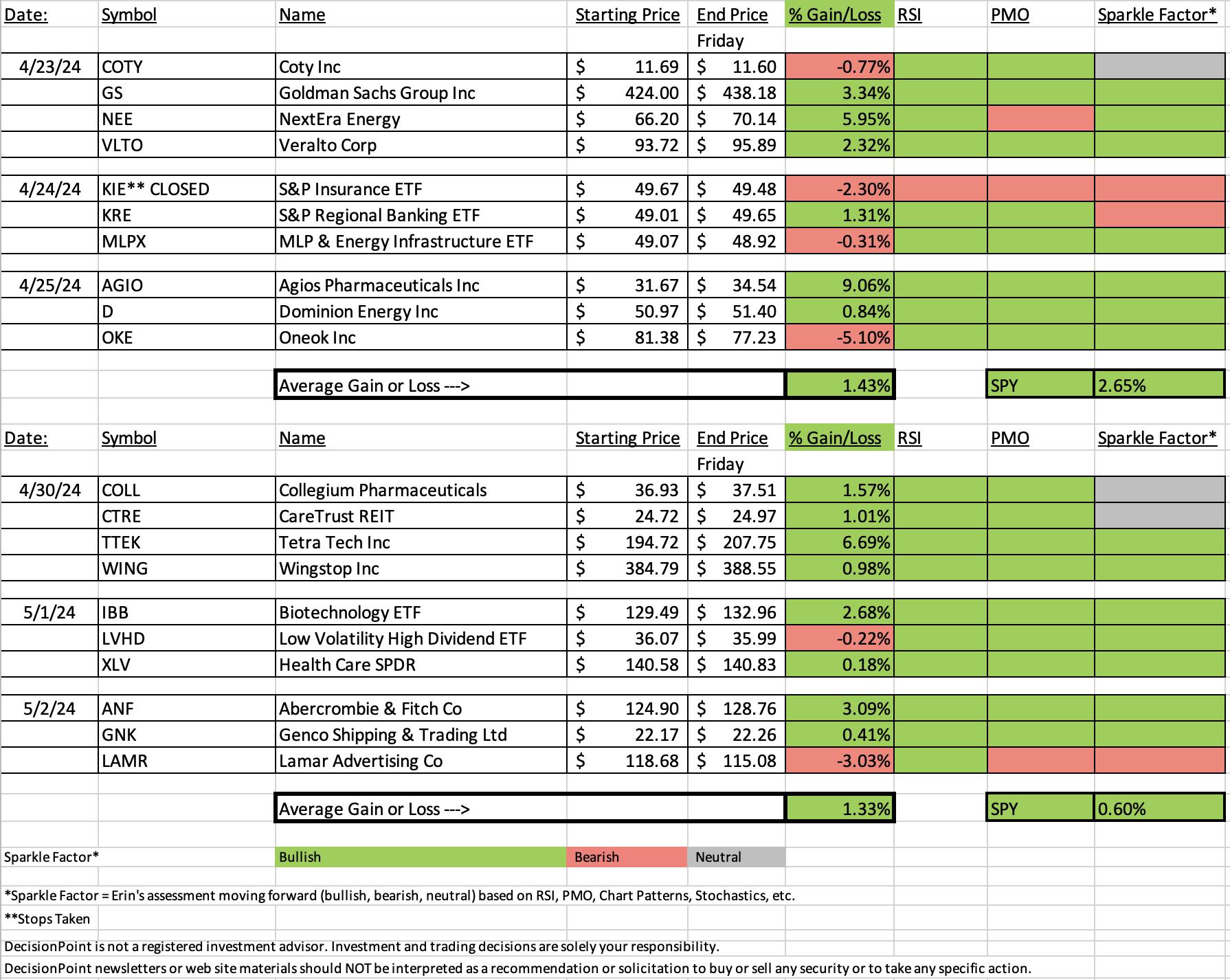

This week's "Darling" was Tetra Tech (TTEK) which was up +6.69% since being picked on Tuesday. It had some help with a nice rally on earnings. This week's "Dud" was yesterday's Lamar Advertising (LAMR) which looked quite good yesterday. The chart went completely south today and warrants the name "Dud" as it was down -3.03%.

The Sector to Watch was determined in the Diamond Mine trading room this morning and it didn't change after the close. Real Estate (XLRE) is showing some excellent expansion in participation as it rallies higher.

The Industry Group to Watch was Real Estate Development. We found four symbols from the group that could be placed on watch lists, FOR, RDFN, HHH and SDHC.

We ran the Momentum Sleepers Scan this morning and also found more symbols of interest: ARE, BL, GPS and WGO. I really liked WGO but opted not to pick it up. It's on my watch list.

Have a great weekend! See you in the free DecisionPoint Trading Room on Monday at Noon ET!

Good Luck & Good Trading,

Erin

RECORDING & DOWNLOAD LINK (5/3/2024):

Topic: DecisionPoint Diamond Mine (5/3/2024) LIVE Trading Room

Recording & Download Link

Passcode: May##3rd

REGISTRATION for 5/10/2024:

When: May 10, 2024 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (5/10/2024) LIVE Trading Room

Register in advance for this webinar HERE

After registering, you will receive a confirmation email containing information about joining the webinar.

Below is the latest free DecisionPoint Trading Room recording from 4/29. You'll find these recordings posted on Mondays to our DP YouTube Channel. Be sure and subscribe HERE.

A few items about the spreadsheet: I've put on the spreadsheet whether the RSI is positive (green) or negative (red). The PMO column tells you if it is rising (green) or falling (red). Finally I've added my own "Sparkle Factor" that gives you my assessment going forward, bullish (green), bearish (red) or neutral (gray). The Sparkle Factor is basically my thoughts on whether I expect it to rise or fall. A neutral means it could really go either way so it could be added to a watch list. If you're in a stock I consider "neutral" going forward, the ball is in your court.

Darling:

Tetra Tech Inc. (TTEK)

EARNINGS: 05/01/2024 (AMC) ** Reports Tomorrow! **

Tetra Tech, Inc. engages in the provision of consulting and engineering services that focus on water, environment, infrastructure, renewable energy, and international development. It operates through the following segments: Government Services Group (GSG) and Commercial and International Services Group (CIG). The GSG segment offers consulting and engineering services primarily to United States government clients such as federal, state and local, and development agencies worldwide. The CIG segment provides consulting and engineering services to US commercial clients and international clients inclusive of the commercial and government sectors, as well as infrastructure, environmental, engineering, and project management services across Canada, Australia, New Zealand, the United Kingdom, Brazil, and Chile. The company was founded in 1966 and is headquartered in Pasadena, CA.

Predefined Scans Triggered: New CCI Buy Signals, New 52-week Highs, Stocks in a New Uptrend (Aroon), P&F Ascending Triple Top Breakout and P&F Double Top Breakout.

Below are the commentary and chart from Tuesday, 4/30:

"TTEK is up +1.04% in after hours trading. This one is also seeing a positive run going into earnings. They report tomorrow after the close. We have a tiny breakout, but it put TTEK at new 52-week highs. If it tops here, I wouldn't stick around long as that would set up a bearish double top. The indicators suggest that won't happen. The RSI is positive and not overbought. The PMO is going in for a Crossover BUY Signal well above the zero line. Stochastics are above 80 and the OBV is rising to confirm the rally. Relative strength is really picking up. I've set the stop beneath support at 7.0% or $181.09."

Here is today's chart:

We got the breakout we wanted on earnings and this one looks as if we will see some follow through. It is overbought right now which makes an entry a little dangerous. I'd wait and see if we get at least a pause in the rally. It is overdue for a pullback now. One other issue is that the group is beginning to underperform. Watch for a pullback for possible entry.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Dud:

Lamar Advertising Co. (LAMR)

EARNINGS: 05/02/2024 (BMO) ** Reported Today **

Lamar Advertising Co. engages in advertising services. The firm rents advertising space on billboards, buses, shelters, benches, logo plates, and in airport terminals. The company was founded in 1902 and is headquartered in Baton Rouge, LA.

Predefined Scans Triggered: Stocks in a New Uptrend (ADX) and Moved Above Upper Bollinger Band.

Below are the commentary and chart from Thursday, 5/2:

"LAMR is unchanged in after hours trading. Earnings were received well today. It hasn't broken out yet, but if earnings were good, I do expect to see more upside follow through. The RSI is positive and rising. The PMO has given us a Crossover BUY Signal above the zero line. Stochastics are above 80. Relative strength for the group is okay as it is inline with the SPY. LAMR is a clear leader within the group and it is outperforming the SPY. The stop is set at support at 8% or $109.18."

Here is today's chart:

It's funny because this one had already reported earnings and we saw a rally. Something must have been a problem because today it saw a big decline and a bearish engulfing candlestick. The PMO has topped and Stochastics are falling now. We could turn this one off, no need to keep it around.

THIS WEEK's Performance:

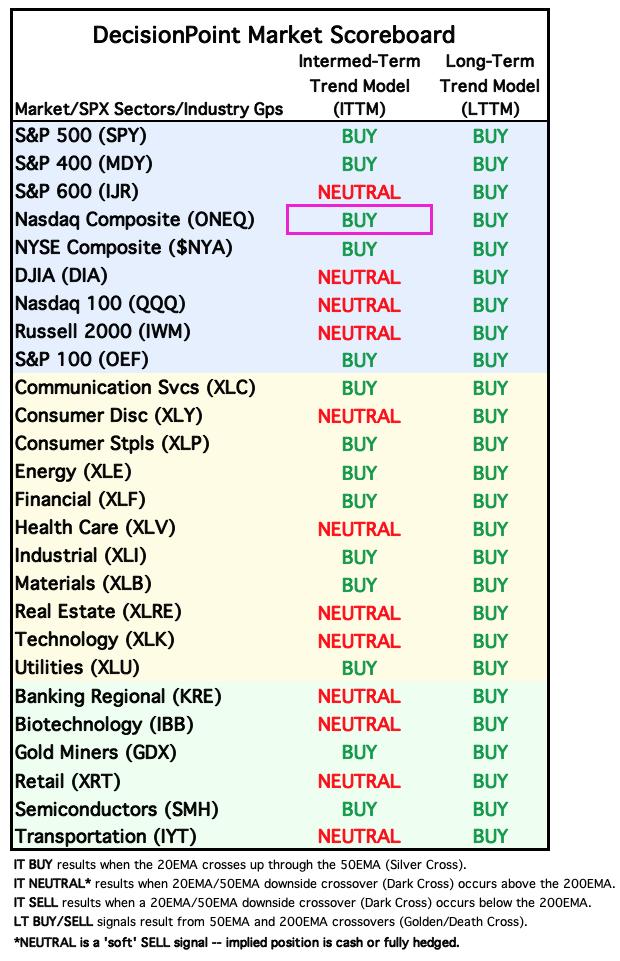

DecisionPoint Market Scoreboard (Mechanical Trend Model Signals):

Friday signal changes are outlined in purple.

Click Here to view Carl's annotated "Under the Hood" ChartList!

Sector to Watch: Real Estate (XLRE)

I liked today's breakout, it brought this sector front and center. Technology (XLK) looked good, but participation is still below 50% on key indicators. XLRE has just given us a new PMO Crossover BUY Signal. The Silver Cross Index is rising after crossing above its signal line for a Bullish Shift. Participation readings are above 50% and Stochastics are rising. Relative strength isn't much to write home about, but it is not negative.

Industry Group to Watch: Real Estate Holding & Development ($DJUSEH)

We have a bearish filled black candlestick, but the overriding factor is the bullish "V" Bottom that suggests far more upside ahead. The RSI is positive and there is a strong PMO Crossover BUY Signal. Stochastics are above 80 and relative strength looks great. The symbols we found in this area were FOR, RDFN, HHH and SDHC.

Go to our Under the Hood ChartList on DecisionPoint.com to get an in-depth view of all the sectors. On StockCharts.com you can find the Industry Summary.

Good Luck & Good Trading!

- Erin

erin@decisionpoint.com

Full Disclosure: I'm 30% long, 0% short.

Watch the latest episode of the DecisionPoint Trading Room with Carl & Erin Swenlin on Mondays 3:00p EST!

Technical Analysis is a windsock, not a crystal ball. --Carl Swenlin

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

(c) Copyright 2024 DecisionPoint.com