It was negative finish to the week for the SPY as it was down -0.22%. Meanwhile, "Diamonds in the Rough" managed to average +0.99% for the week, that is 1.21% better than the SPY. I'm very happy with this week's picks.

The Darling this week was Marathon Petroleum (MPC) which finished up +2.5%. The Dud this week wasn't that much of a Dud. Warrior Met Coal (HCC) was down only -0.62% in one day of trading. The chart is still constructive and could still be considered for an add.

We had a productive time in the Diamond Mine this morning. We ran a number of scans at the end of the program that netted the following symbols that are good for your watch list or to add next week: EHAB, GNRC, PIPR, SXT, TMHC, GFI and UVV.

Picking a Sector to Watch this week was difficult. The best looking sectors are overbought so I did have to go with Industrials (XLI) which is seeing a PMO Surge above the signal line. The Industry Group to Watch is Delivery Services with the following symbols looking good for entry: FDX and UPS.

We did dabble in the Industrial Machinery industry group and I found: MRC, CR and KRNT as possible watch list material for next week.

Have a great weekend! See you in the free DecisionPoint Trading Room on Monday at Noon ET!

Good Luck & Good Trading,

Erin

RECORDING & DOWNLOAD LINK (3/8/2024):

Topic: DecisionPoint Diamond Mine (3/8/2024) LIVE Trading Room

Recording & Download LINK

Passcode: March#8th

REGISTRATION for 3/15/2024:

When: Mar 15, 2024 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (3/15/2024) LIVE Trading Room

Register in advance for this webinar HERE

After registering, you will receive a confirmation email containing information about joining the webinar.

Below is the latest free DecisionPoint Trading Room recording from 3/4. You'll find these recordings posted on Mondays to our DP YouTube Channel. Be sure and subscribe HERE.

A few items about the spreadsheet: I've put on the spreadsheet whether the RSI is positive (green) or negative (red). The PMO column tells you if it is rising (green) or falling (red). Finally I've added my own "Sparkle Factor" that gives you my assessment going forward, bullish (green), bearish (red) or neutral (gray). The Sparkle Factor is basically my thoughts on whether I expect it to rise or fall. A neutral means it could really go either way so it could be added to a watch list. If you're in a stock I consider "neutral" going forward, the ball is in your court.

Darling:

Citizens Financial Group Inc. (CFG)

EARNINGS: 04/17/2024 (BMO)

Citizens Financial Group, Inc. engages in the provision of commercial banking services. It operates through the Consumer Banking and Commercial Banking segments. The Consumer Banking segment includes deposit products, mortgage and home equity lending, student loans, auto financing, credit cards, business loans, and wealth management and investment services. The Commercial Banking segment offers lending and leasing, trade financing, deposit and treasury management, foreign exchange and interest rate risk management, corporate finance and debt, and equity capital markets. The company was founded in 1828 and is headquartered in Providence, RI.

Predefined Scans Triggered: Moved Above Upper Bollinger Band, Moved Above Ichimoku Cloud and Moved Above Upper Price Channel.

Below are the commentary and chart from Tuesday, 3/5:

"CFG is unchanged in after hours trading. Today was a very strong rally, one of the biggest by all the banks I looked at today. This is a big bullish engulfing candlestick that implies tomorrow should be another advance. The RSI is not overbought despite today's big move. The PMO was already rising and it has now triggered a Crossover BUY Signal above the zero line suggesting new strength. The OBV is jumping higher on high volume moves. Stochastics are nearly above 80. You can see how relative strength was boosted by today's love given to Banks. This bodes well for the group. CFG has excellent relative strength against the group and consequently the SPY. The stop is set around the 50-day EMA at 7.4% or $31.11."

Here is today's chart:

We now have a breakout on the chart. The RSI is getting overbought, but I think we will still see some more upside from this one as the PMO is beginning to flash pure strength as it accelerates above the zero line. Stochastics did top so maybe we will see a small decline before more rally follow through. It would offer a good entry.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Dud:

Warrior Met Coal Inc. (HCC)

EARNINGS: 05/01/2024 (AMC)

Warrior Met Coal, Inc. engages in the production and export of metallurgical coal. It is a U.S.-based, environmentally and socially minded supplier to the global steel industry and dedicated entirely to mining non-thermal steelmaking coal used as a critical component of steel production by metal manufacturers in Europe, South America and Asia. The company was founded on September 3, 2015 and is headquartered in Brookwood, AL.

Predefined Scans Triggered: Moved Above Upper Bollinger Band, Moved Above Upper Price Channel, P&F Double Top Breakout and P&F Triple Top Breakout.

Below are the commentary and chart from Thursday, 3/7:

"HCC is unchanged in after hours trading. I saw a textbook reverse head and shoulders on this chart and couldn't resist given yesterday's rally confirmed the pattern. The minimum upside target of the pattern would take price to about $67.00. This is a nice setup given the new PMO Crossover BUY Signal. The RSI is also not at all overbought so it can accommodate much more upside. Stochastics have moved above 80. As with CENX it may not be outperforming the group at the moment, but it is a leader in this space. It is doing very well against the SPY and the group is really getting going. The stop was set arbitrarily at 7% or $57.03."

Here is today's chart:

It's too bad that this one was listed as a Dud this week. It still has upside promise as far as I'm concerned. The reverse head and shoulders pattern looks viable and the PMO looks very bullish. It was just one day of trading and it happened to be a down day otherwise this one wouldn't be considered a Dud. If anything I think "Diamond in the Rough" RH looks worse, but it doesn't even look that bad.

THIS WEEK's Performance:

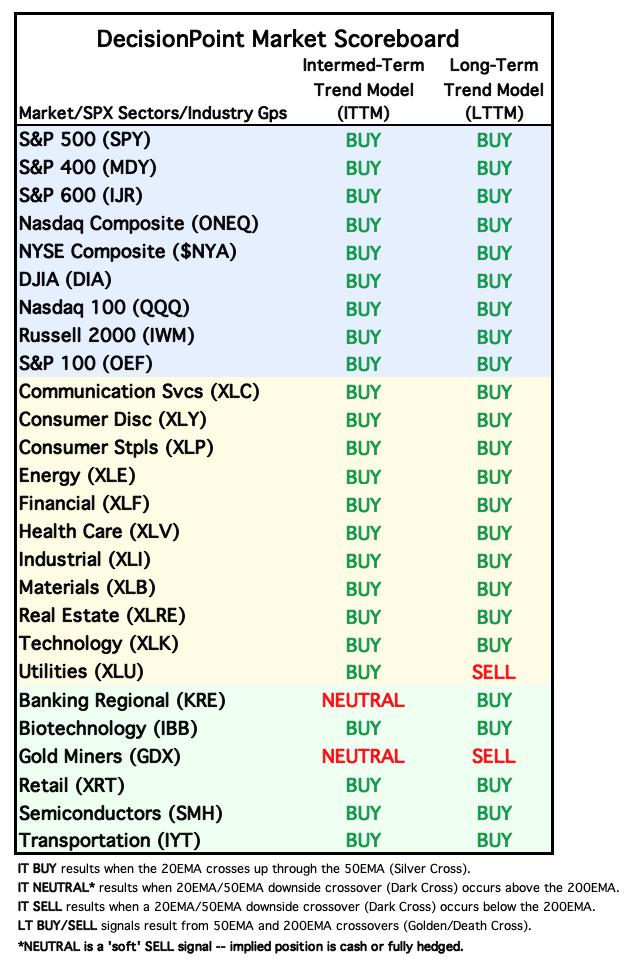

DecisionPoint Market Scoreboard (Mechanical Trend Model Signals):

Click Here to view Carl's annotated "Under the Hood" ChartList!

Sector to Watch: Industrials (XLI)

It isn't a perfect chart. Since the close, we did see the Silver Cross Index drop beneath its signal line for a Bearish Shift, but participation remains robust, reading well above our 50% bullish threshold. The primary reason I picked industrials was the PMO. We have a PMO Surge above the signal line and it is well above the zero line. It has been on a nice strong rally that is holding the rising trend with no problem. We also have a rising relative strength line.

Industry Group to Watch: Delivery Services ($DJUSAF)

This is a group that is slowly making a comeback after a disastrous finish to January. The PMO is below the zero line so we have to look at this as diminishing weakness, but when it reaches the zero line it will be considered strength. The RSI is positive and not overbought and Stochastics are rising above 80. I was able to fish FDX and UPS from this group which look like they will continue to rally higher.

Go to our Under the Hood ChartList on DecisionPoint.com to get an in-depth view of all the sectors. On StockCharts.com you can find the Industry Summary.

Good Luck & Good Trading!

- Erin

erin@decisionpoint.com

Full Disclosure: I'm 60% long, 0% short. I didn't like trading action this afternoon and opted not to expand.

Watch the latest episode of the DecisionPoint Trading Room with Carl & Erin Swenlin on Mondays 3:00p EST!

Technical Analysis is a windsock, not a crystal ball. --Carl Swenlin

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

(c) Copyright 2024 DecisionPoint.com