"Diamonds in the Rough" smoked the market as they were up on average +3.64% while the SPY only managed a weekly close up +0.83%. The spreadsheet is very green which is indicative of the strong rally out of the October lows. Of course, they were pretty good picks too!

This week's "Darling" was Robinhood (HOOD) which was one of our "boom or bust" stocks. It was up +7.87% since being picked on Tuesday. The "Dud" was Annovis Bio (ANVS) as it was unchanged on the week.

The Sector to Watch this upcoming week is Energy (XLE) which has shown new momentum. The Industry Group to Watch is Exploration and Production which is starting to show new momentum itself within XLE. A few symbols to consider from this group are: PARR, CVI, TRGP and OBE.

Have a great weekend!

Good Luck & Good Trading,

Erin

RECORDING LINK (12/1/2023):

Topic: DecisionPoint Diamond Mine (12/1/2023) LIVE Trading Room

Passcode: December#1

REGISTRATION for 12/8/2023:

When: Dec 8, 2023 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (12/8/2023) LIVE Trading Room

Register in advance for this webinar HERE

After registering, you will receive a confirmation email containing information about joining the webinar.

Our latest DecisionPoint Trading Room recording (11/27):

A few items about the spreadsheet: I've put on the spreadsheet whether the RSI is positive (green) or negative (red). The PMO column tells you if it is rising (green) or falling (red). Finally I've added my own "Sparkle Factor" that gives you my assessment going forward, bullish (green), bearish (red) or neutral (gray). The Sparkle Factor is basically my thoughts on whether I expect it to rise or fall. A neutral means it could really go either way so it could be added to a watch list. If you're in a stock I consider "neutral" going forward, the ball is in your court.

Darling:

Robinhood Markets Inc. (HOOD)

EARNINGS: 02/07/2024 (AMC)

Robinhood Markets, Inc is a financial services platform that pioneered commission-free stock trading with no account minimums and fractional share trading. The firm is focused on providing retail brokerage and offers trading in U.S. listed stocks and Exchange Traded Funds, related options, and cryptocurrency trading, as well as cash management, which includes debit cards services. The company was founded by Vladimir Tenev and Baiju Prafulkumar Bhatt in 2013 and is headquartered in Menlo Park, CA.

Predefined Scans Triggered: P&F Double Bottom Breakdown and P&F Triple Bottom Breakdown.

Below are the commentary and chart from Tuesday (11/28):

"HOOD is down -0.12% in after hours trading. This is a reversal stock and a Boom or Bust stock. What attracted me to this chart was the small short-term bullish double bottom pattern. It hasn't been confirmed with a breakout yet so it is early. The RSI hasn't reached positive territory yet, but there is a new PMO Crossover BUY Signal. I noted a slight positive divergence between price lows and OBV bottoms. Stochastics are rising strongly. The Software group has been outperforming for some time. HOOD hasn't been so fortunate, but it is showing signs of improvement to relative strength. The stop is set deeply so it lines up with support at 9% or $7.86."

Here is today's chart:

HOOD boomed today after forming a bearish engulfing candlestick yesterday. This is testament to internal strength in my opinion. Price closed well above overhead resistance at the 50-day EMA. You should be able to raise the stop now. The upside target of the double bottom pattern is around $10, but targets on patterns are "minimum" upside/downside targets so it could breakout there.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Dud:

Annovis Bio Inc. (ANVS)

EARNINGS: 03/28/2024 (AMC)

Annovis Bio, Inc. is a clinical stage drug platform company, which engages in the development of drugs which aims to treat neurodegenerative diseases such as Alzheimer's (AD) and Parkinson's (PD). Its lead product candidate, Buntanetap, is designed to address AD, PD, and potentially other chronic neurodegenerative diseases. Its product pipeline also includes ANVS405 and ANVS301, which focus on the treatment of traumatic brain injury, stroke, and advanced AD. The company was founded by Maria Luisa Maccecchini in May 2008 and is headquartered in Berwyn, PA.

Predefined Scans Triggered: Stocks in a New Uptrend (Aroon), P&F Double Top Breakout and Shooting Star.

Below are the commentary and chart from Thursday (11/30):

"ANVS is up +0.12% in after hours trading. Admittedly this is a parabolic rally and they do tend to fail in order to get a less steep rising trend. You may want to wait on that given it is just now reaching overhead resistance. The chart is favorable and does suggest we will see a breakout. Be careful, P/E is negative. I try to avoid that. The RSI is positive and not yet overbought. The PMO is rising strongly and isn't overbought yet. Volume has been flying in so interest is there. Stochastics aren't above 80, but they are technically rising and should get there soon. Relative strength is definitely picking up for Biotechs (part of the reason I selected IBB today). ANVS is showing leadership based on rising relative strength against the group and consequently the SPY. The stop is set below the 50-day EMA at 7.5% or $7.85."

Here is today's chart:

Today ANVS formed a bearish filled black candlestick. This is happening at overhead resistance so we may be in for a bit of decline, possibly a 'handle' on the cup shaped bottom. I believe it is a hold candidate. I would wait to enter if you still wish to based on the likely decline ahead.

THIS WEEK's Performance:

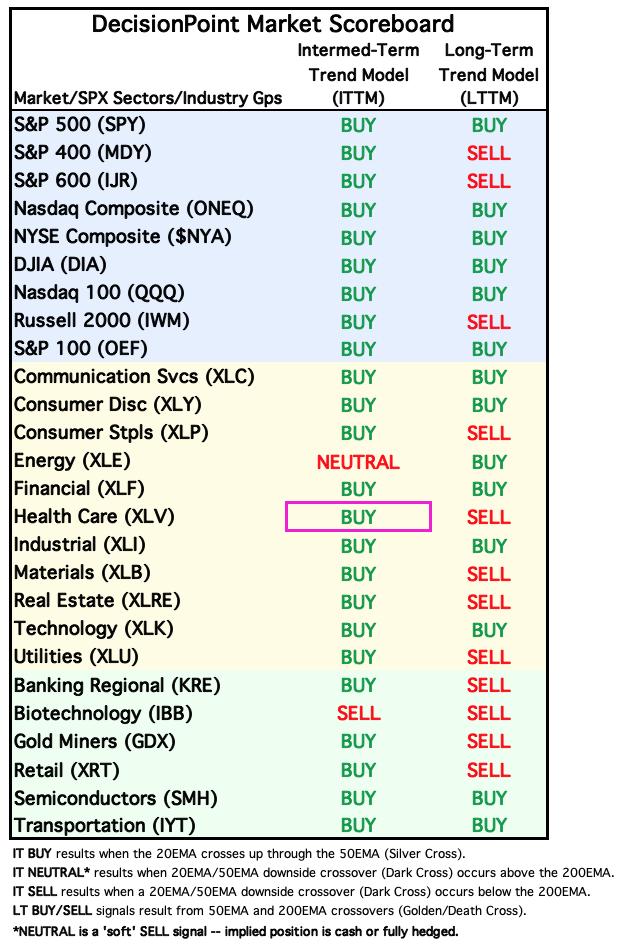

DecisionPoint Market Scoreboard (Mechanical Trend Model Signals):

Friday's signal changes are outlined in purple.

Click Here to view Carl's annotated "Under the Hood" ChartList!

Sector to Watch: Energy (XLE)

XLE is the only sector showing new momentum. Almost all of the other sectors have rising PMOs that are getting overbought. This looks like a good reversal point for XLE. Currently it is struggling beneath the 50-day EMA, but given new momentum, I'm looking for a breakout. Internals aren't very strong yet. Both the Silver Cross Index and Golden Cross Index are below their signal lines. %Stocks > 20/50EMAs are not expanding yet. All of those percentages are less than the Golden/Silver Cross Indexes so it is really early. I would likely wait on the sidelines a little longer with Energy, but it is certainly an area of the market to keep an eye on.

Industry Group to Watch: Exploration & Production (XOP)

Since there is an ETF for this industry group, I opted to present it. The chart looks much like the Energy chart above. It's at an excellent area for a reversal, it just hasn't gotten going yet. The PMO is nearing a Crossover BUY Signal so we should see some rally. There is a positive OBV divergence with price. Stochastics are rising, albeit slowly. Relative strength definitely needs some help. As with XLE, it is early for XOP. A few symbols we found in the Diamond Mine trading room this morning: PARR, CVI, TRGP and OBE.

Go to our Under the Hood ChartList on DecisionPoint.com to get an in-depth view of all the sectors. On StockCharts.com you can find the Industry Summary.

Good Luck & Good Trading!

- Erin

erin@decisionpoint.com

Full Disclosure: I'm 70% long, 0% short.

Watch the latest episode of the DecisionPoint Trading Room with Carl & Erin Swenlin on Mondays 3:00p EST!

Technical Analysis is a windsock, not a crystal ball. --Carl Swenlin

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

(c) Copyright 2023 DecisionPoint.com