It was brought to my attention that next week there is a holiday on Thursday and therefore next week's schedule needs to be updated. There will be no Diamond Mine trading room the Friday after Thanksgiving and there will be no Recap. Instead, I will begin on Monday and present ten stock/ETF picks through Wednesday.

This morning I was waffling on which should be the Sector to Watch, but after the close I decided on Consumer Discretionary (XLY) and not Materials (XLB). I do like XLB for next week, just not as much as Discretionary which is seeing a bump on retail expectations.

Two weeks ago we went with Recreational Services as the Industry Group to Watch. It still looks favorable. I decided to go with Auto Parts as they weren't as overbought as the other areas of the sector. The sector is clicking as evidenced by the overbought groups that should still offer upside opportunity.

The "Darling" this week was Caterpillar (CAT) which was up over 2% this week. The "Dud" is Erie Indemnity (ERIE) which I picked because it was in the hot Financial sector. That didn't help it this week.

I did find symbols through my scans this morning that look pretty good: WRB and PAHL. I have included the symbols for Auto Parts in the Industry Group to Watch section. I was looking at Recreational Services as well and symbols of interest in that group are: RCL, CCL, CUK and LIND.

Have a great weekend!

Good Luck & Good Trading,

Erin

RECORDING LINK (11/17/2023):

Topic: DecisionPoint Diamond Mine (11/17/2023) LIVE Trading Room

Passcode: November#17

REGISTRATION for 12/1/2023:

When: Dec 1, 2023 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (12/1/2023) LIVE Trading Room

Register in advance for this webinar HERE

After registering, you will receive a confirmation email containing information about joining the webinar.

Our latest DecisionPoint Trading Room recording (11/13):

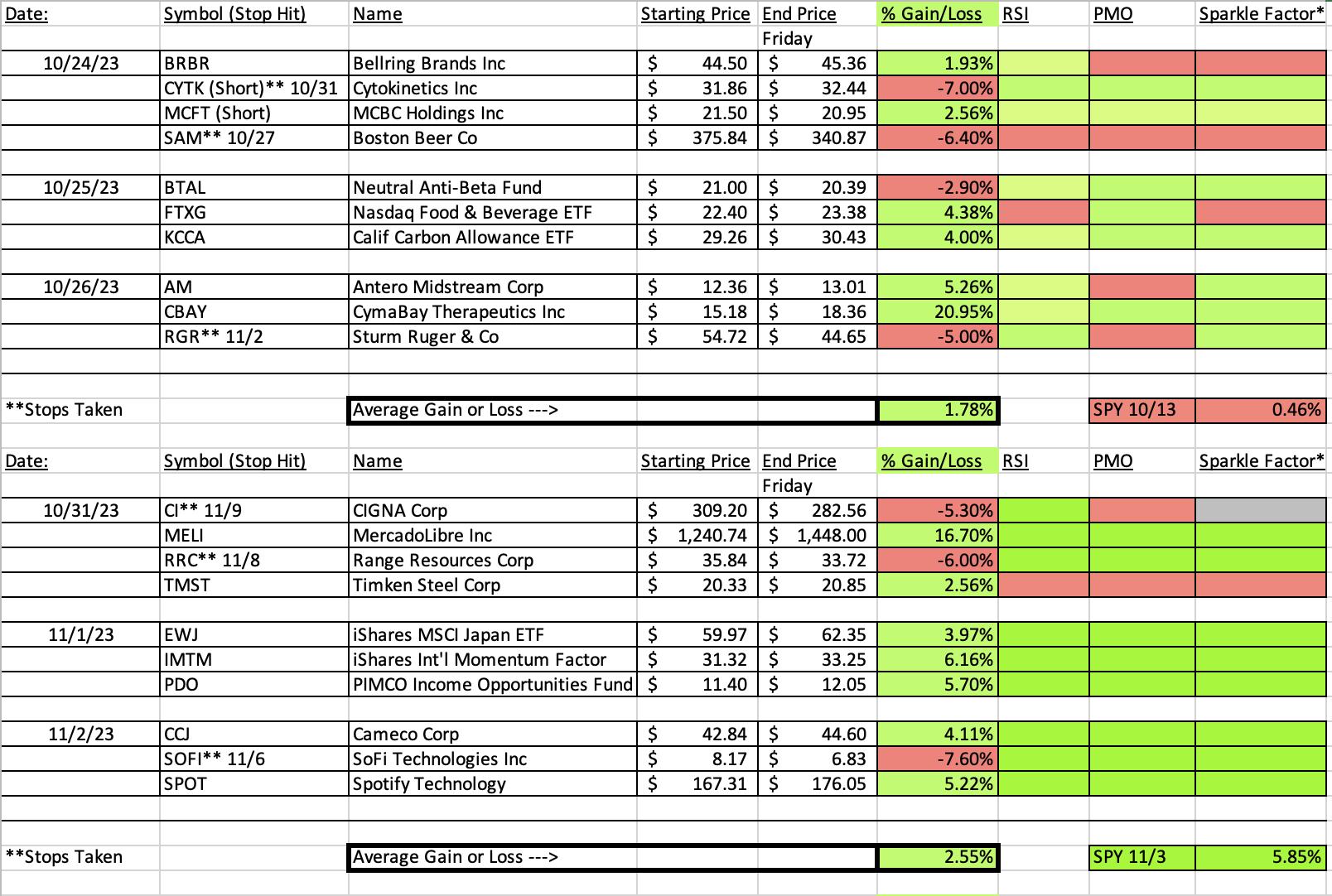

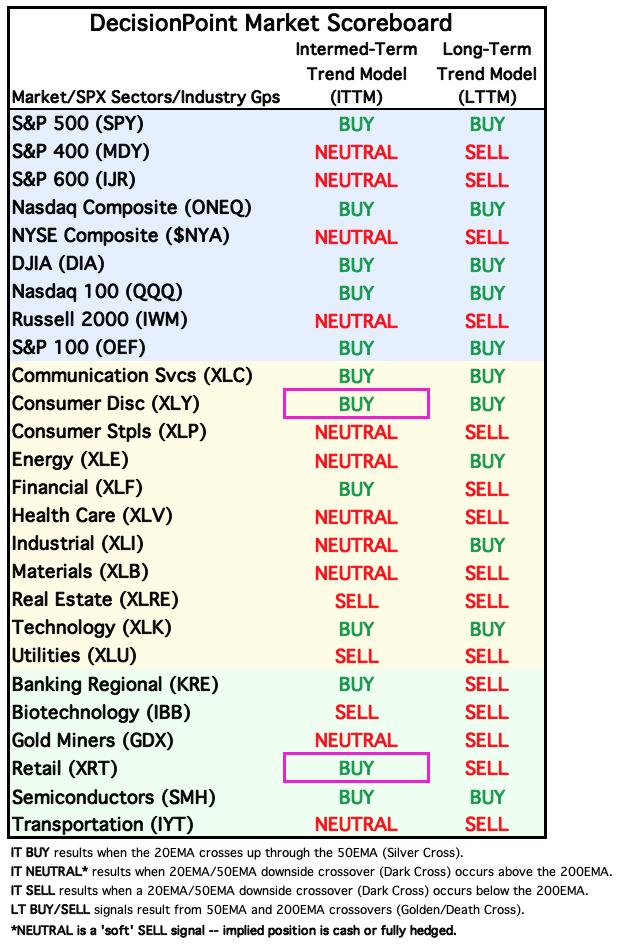

A few items about the spreadsheet: I've put on the spreadsheet whether the RSI is positive (green) or negative (red). The PMO column tells you if it is rising (green) or falling (red). Finally I've added my own "Sparkle Factor" that gives you my assessment going forward, bullish (green), bearish (red) or neutral (gray). The Sparkle Factor is basically my thoughts on whether I expect it to rise or fall. A neutral means it could really go either way so it could be added to a watch list. If you're in a stock I consider "neutral" going forward, the ball is in your court.

Darling:

Caterpillar, Inc. (CAT)

EARNINGS: 01/30/2024 (BMO)

Caterpillar, Inc. engages in the manufacture of construction and mining equipment, diesel and natural gas engines, industrial gas turbines, and diesel-electric locomotives. It operates through the following segments: Construction Industries, Resource Industries, Energy and Transportation, Financial Products, and All Other. The Construction Industries segment supports customers using machinery in infrastructure and building construction applications. The Resource Industries segment is responsible for supporting customers using machinery in mining and quarrying applications and it includes business strategy, product design, product management and development, manufacturing, marketing, and sales and product support. The Energy and Transportation segment supports customers in oil and gas, power generation, marine, rail, and industrial applications. The Financial Products segment offers a range of financing alternatives to customers and dealers for caterpillar machinery and engines, solar gas turbines, as well as other equipment and marine vessels. The All Other segment includes activities such as the business strategy, product management and development, and manufacturing of filters and fluids, undercarriage, tires and rims, engaging tools, and fluid transfers. The company was founded on April 15, 1925, and is headquartered in Irving, TX.

Predefined Scans Triggered: P&F Low Pole.

Below are the commentary and chart from Tuesday 11/14:

"CAT is up +0.04% in after hours trading. Price is reversing off strong support and only experienced a mild pullback. I like that the 50-day EMA is above the 200-day EMA, giving it a bullish bias in the long term. It's now ready to roll. The RSI is now in positive territory and there is a new PMO Crossover BUY Signal. Stochastics are rising strongly and should get above 80 shortly. Relative strength is improving for the group and for CAT. I've set the stop below support at 6.6% or $231.50."

Here is today's chart:

CAT continues to rally but it is up against overhead resistance at the 50-day EMA. Indicators continue to bullishly mature so I doubt it will have a problem eventually getting above that level and moving toward 270. I like that it is continuing to outperform the SPY.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Dud:

Erie Indemnity Co. (ERIE)

EARNINGS: 02/28/2024 (AMC)

Erie Indemnity Co. engages in the insurance business and operates as an attorney-in-fact. It manages affairs at the Erie Insurance Exchange for the benefit of the policyholders. It covers policies in auto and leisure, home and property, life, and business insurance. The company was founded by Henry Orth Hirt and Ollie Grover Crawford on April 4, 1925, and is headquartered in Erie, PA.

Predefined Scans Triggered: Bullish MACD Crossovers.

Below are the commentary and chart from Tuesday 11/14:

"ERIE is unchanged in after hours trading. This one is a little early given the PMO hasn't given us a Crossover BUY Signal yet, but I liked the arrangement of the EMAs and its membership in the Financial sector. Admittedly in recent weeks, the group hasn't performed in stellar fashion, but overall the relative strength line is rising. Price turned up on strong support and has now overcome both the 20/50-day EMAs. This essentially prevented a Dark Cross of the 20/50EMAs. The RSI just moved into positive territory and the PMO is rising. Stochastics aren't quite in positive territory but they are rising nicely. The stop is set beneath support at 6.7% or $268.86."

Here is today's chart:

I think I can pinpoint the problem with this one. Stochastics had not moved above 50 and the group in the near term was underperforming. I picked a stock in a hot sector, but not a hot industry group. This isn't to say it was doomed from the beginning. No, it was lined up well, just not a positively as it could have been.

THIS WEEK's Performance:

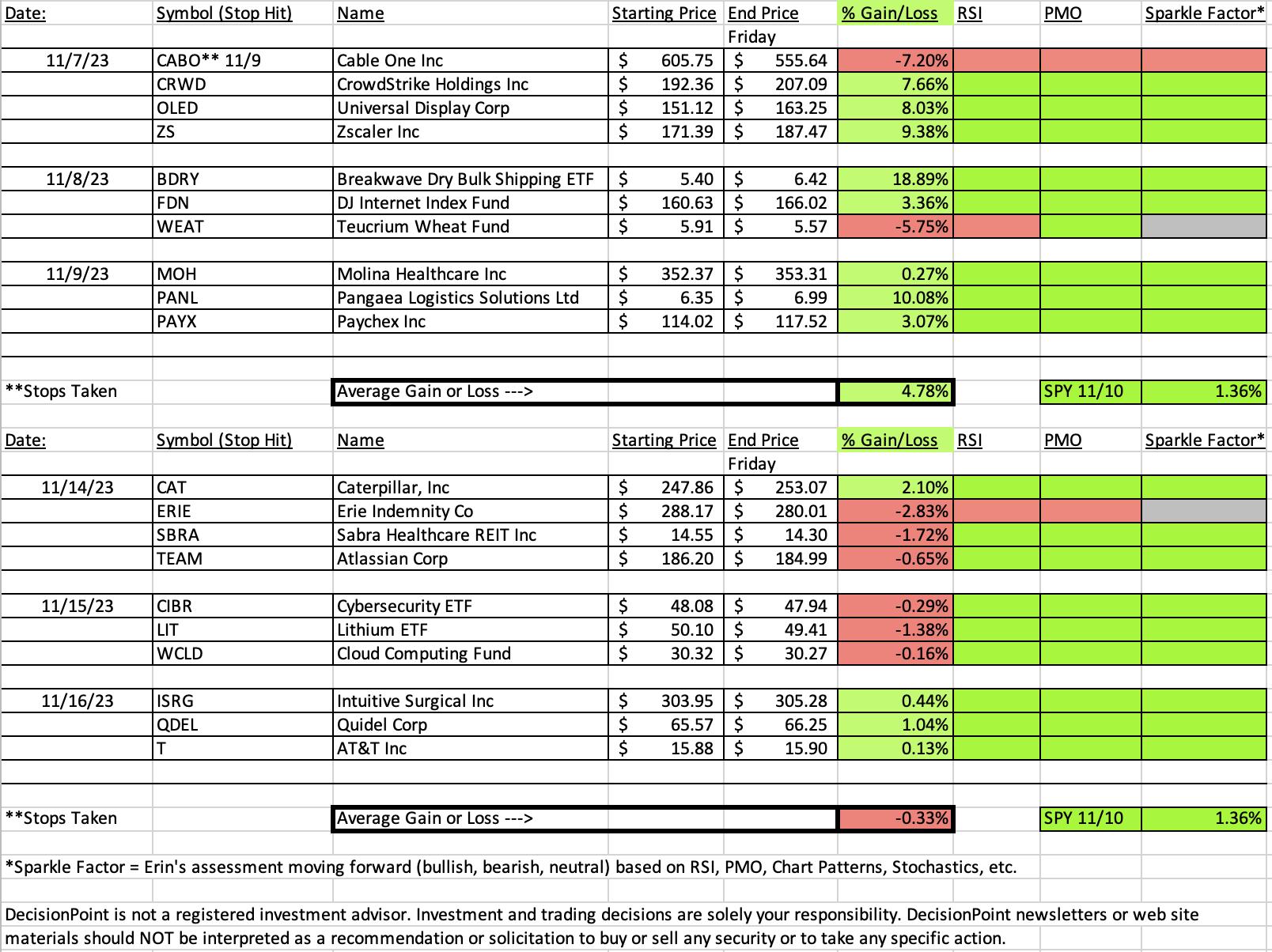

DecisionPoint Market Scoreboard (Mechanical Trend Model Signals):

Friday's signal changes are outlined in purple.

Click Here to view Carl's annotated "Under the Hood" ChartList!

Sector to Watch: Consumer Discretionary (XLY)

One of the primary reasons I selected XLY instead of XLB was the Golden Cross Index (GCI). The GCI had a Bullish Shift across its signal line which moves its long-term market bias to BULLISH. We also saw a Silver Cross on XLY where the 20-day EMA crossed above the 50-day EMA. Participation is robust and not entirely overbought. I also liked that XLY is showing outperformance against the SPY.

Industry Group to Watch: Auto Parts ($DJUSST)

I like the bullish "V" bottom that has formed. It has retraced a third of the left side of the pattern which confirms it. The expectation is a breakout above the left side of the "V" which I would mark as 515. The pattern suggests a breakout then above 515. The RSI is about to move into positive territory and the PMO is on an oversold Crossover BUY Signal. Stochastics have now moved above 80. This looks like a group ready to make a move higher. A few symbols to consider: APTV, MGA, GNTX and MPAA.

Go to our Under the Hood ChartList on DecisionPoint.com to get an in-depth view of all the sectors. On StockCharts.com you can find the Industry Summary.

Good Luck & Good Trading!

- Erin

erin@decisionpoint.com

Full Disclosure: I'm 70% long, 0% short.

Watch the latest episode of the DecisionPoint Trading Room with Carl & Erin Swenlin on Mondays 3:00p EST!

Technical Analysis is a windsock, not a crystal ball. --Carl Swenlin

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

(c) Copyright 2023 DecisionPoint.com