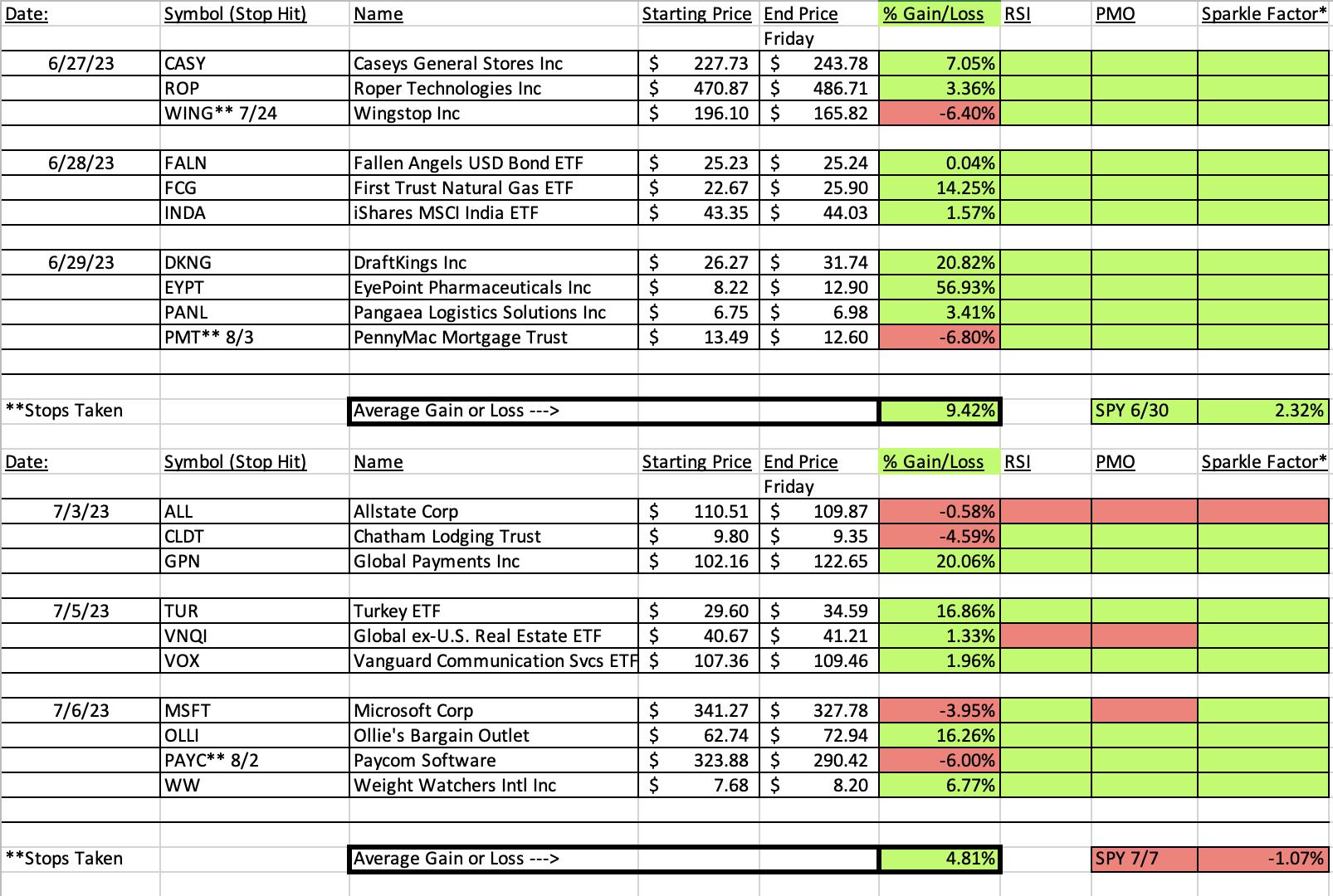

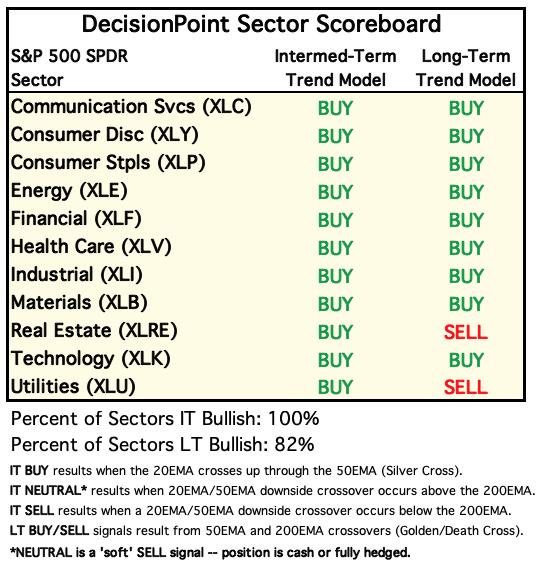

I was very pleased with the performance of "Diamonds in the Rough" this week given they averaged up +0.55% and the SPY was down -2.21% on the week. ETF Day was the big winner and certainly lifted the average this week as two of the three were up over 5%.

The market is turning over and I believe we will see a correction, not a pullback. Make sure your stops are in place and PMOs are rising on your positions. If momentum is starting to fail, it is likely a good time to divest. I've lightened my exposure to 15% and added a 4% in hedges.

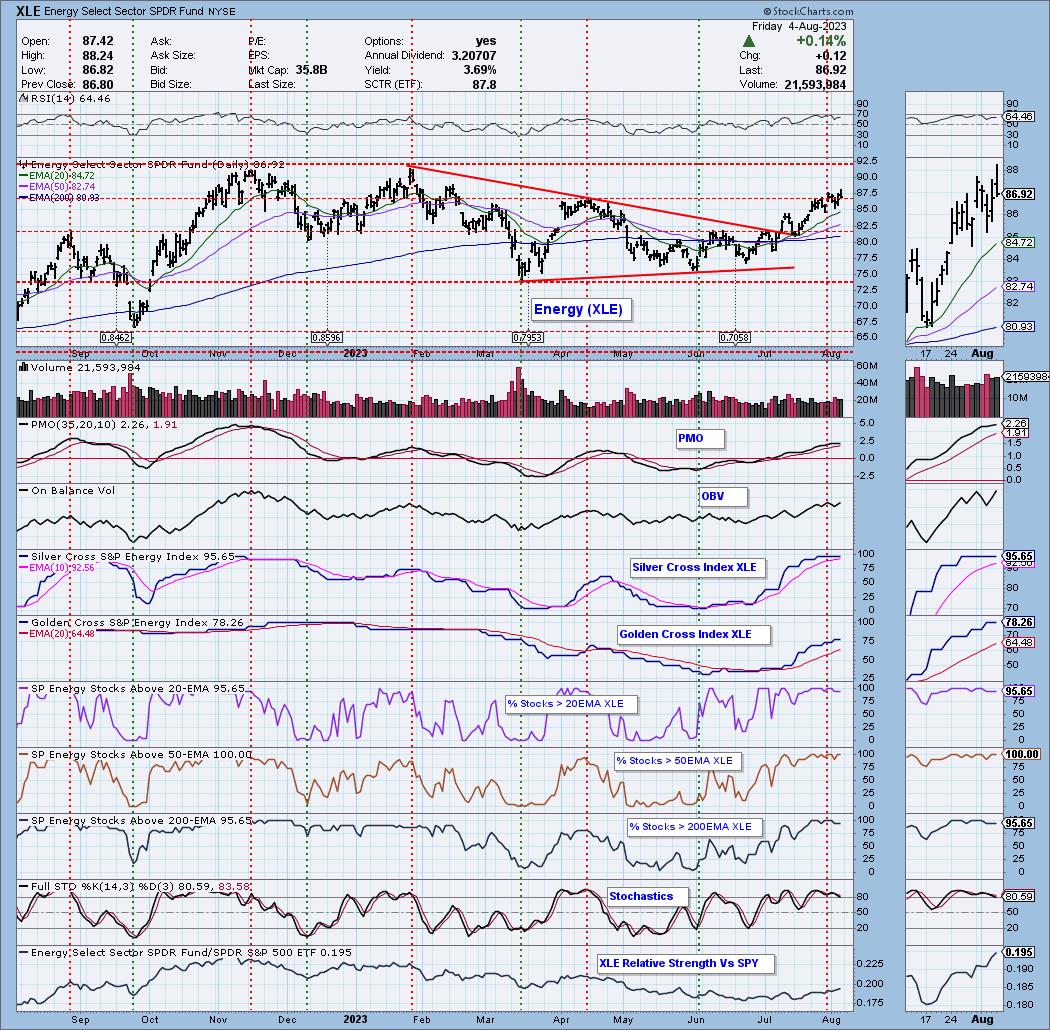

It was inevitable that this week's Sector to Watch would be Energy (XLE). I was trying hard to find something else, but the bearish bias is too strong on all of the other sector charts.

I have three Industry Groups that you should keep an eye on next week, but will only present Regional Banks (KRE). I also like Life Insurance and Mortgage Finance is off the chart (overbought though). I had hoped given the financial groups I like that the Financial sector itself would look bullish, but it does not. Be careful out there if you expand exposure. While these look pretty good, a major market correction would tend to carry nearly everyone down.

See you next week!

Good Luck & Good Trading,

Erin

RECORDING LINK (8/4/2023):

Topic: DecisionPoint Diamond Mine (8/4/2023) LIVE Trading Room

Passcode: August#4th

REGISTRATION for 8/11/2023:

When: Aug 11, 2023 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (8/11/2023) LIVE Trading Room

Register in advance for this webinar HERE

After registering, you will receive a confirmation email containing information about joining the webinar.

Our latest DecisionPoint Trading Room recording (7/31):

A few items about the spreadsheet: I've put on the spreadsheet whether the RSI is positive (green) or negative (red). The PMO column tells you if it is rising (green) or falling (red). Finally I've added my own "Sparkle Factor" that gives you my assessment going forward, bullish (green), bearish (red) or neutral (gray). The Sparkle Factor is basically my thoughts on whether I expect it to rise or fall. A neutral means it could really go either way so it could be added to a watch list. If you're in a stock I consider "neutral" going forward, the ball is in your court.

Darling:

Simplify Interest Rate Hedge ETF (PFIX)

EARNINGS: N/A

PFIX is actively managed to provide a hedge against a sharp increase in long-term interest rates. The fund holds OTC interest rate options, US Treasuries, and US Treasury Inflation-Protected Securities (TIPS). Click HERE for more information.

Predefined Scans Triggered: Moved Above Upper Bollinger Band, P&F Ascending Triple Top Breakout and P&F Double Top Breakout.

Below are the commentary and chart from Wednesday (8/2):

"PFIX is up +2.02% in after hours trading. As noted in the opening, PFIX had a strong breakout. The RSI just moved into overbought territory but that condition can be sustained should this strong rally continue. The PMO is getting overbought. Stochastics are above 80. This is likely to be a short-term trade given overbought conditions are arriving. This one would be great on a pullback but if after hours trading is correct, we may not have that opportunity. I've set the stop below support at 5.7% or $68.02. It can be adjusted higher or lower."

Here is today's chart:

It would've been hard to get in at the price it was when I presented it, but I think a pullback will offer an opportunity to jump in. It should pullback a bit given today's bearish engulfing candlestick. I still believe rates will continue to rise and put downside pressure on Bonds and the market as a whole. It is very overbought right now so entry may have to wait.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Dud:

Crinetics Pharmaceuticals, Inc. (CRNX)

EARNINGS: 08/09/2023 (AMC)

Crinetics Pharmaceuticals, Inc. operates as a clinical stage pharmaceutical company focused on the discovery, development, and commercialization of novel therapeutics for rare endocrine diseases and endocrine-related tumors. Its product candidate, CRN00808, is an oral nonpeptide somatostatin agonist for the treatment of acromegaly. The firm is also developing other oral nonpeptide somatostatin agonists for neuroendocrine tumors and hyperinsulinism, as well as an oral nonpeptide ACTH antagonist for the treatment of Cushing's disease. The company was founded by R. Scott Struthers, Yun-Fei Zhu and Stephen F. Betz in 2008 and is headquartered in San Diego, CA.

Predefined Scans Triggered: Elder Bar Turned Green and Bullish MACD Crossovers.

Below are the commentary and chart from Tuesday (8/1):

"CRNX is down -2.31% in after hours trading. It appears that today's gain may be erased tomorrow if after hours trading is any indication. The set-up is very positive so this may offer a better entry. There is a bullish double-bottom beginning to form and today saw a new PMO Crossover BUY Signal. The RSI just moved into positive territory and Stochastics are rising again. As noted in the opening, the group itself isn't doing very well so this does carry additional risk. CRNX is beginning to show outperformance against the SPY and the group. The stop is set below support at 7.4% or $18.01."

Here is today's chart:

As noted in the commentary above, I did feel this one carried additional risk due to after hours trading taking out the prior gain after being picked. We have a double-bottom developing, but with price already turning down at key moving averages, I'd put this one on the watch list. If you bought it, you could hold it, but I have a feeling this one will keep declining given the reversal of the PMO and Stochastics. The RSI is negative as well. This is probably too risky given the internal weakness in the broad market.

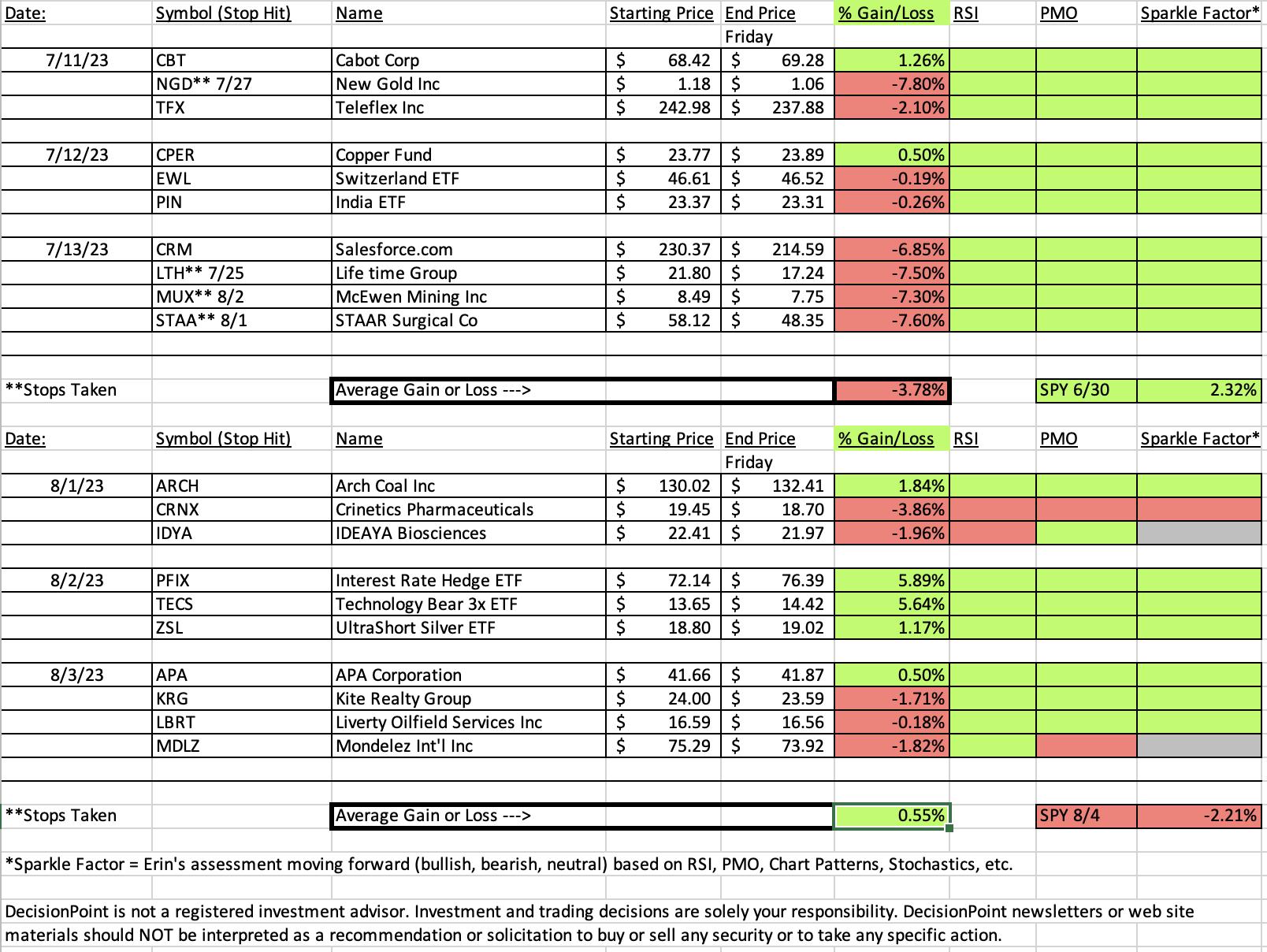

THIS WEEK's Sector Performance:

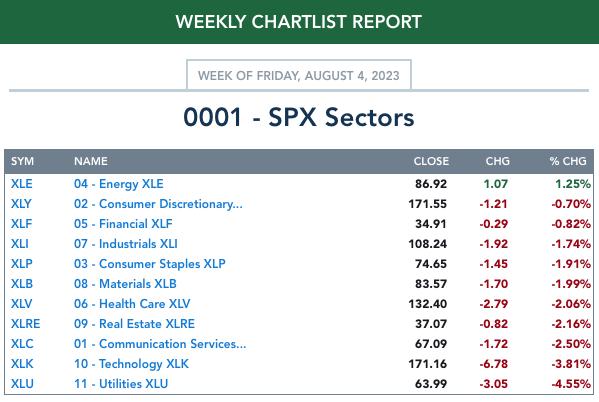

DecisionPoint Sector Scoreboard (Mechanical Trend Model Signals):

Click Here to view Carl's annotated Under the Hood ChartList!

Sector to Watch: Energy (XLE)

This is the only sector that has a bullish bias. I think Energy will perform better than the rest of the market. It is overbought in terms of participation; there is nowhere for the Silver Cross Index to go but down. Participation is very strong, but also has no room to move higher. Energy positions should be safe moving forward, but downside market pressure on a downturn will make it slow going.

Industry Group to Watch: Regional Banks (KRE)

Regional Banks (KRE) has a nice bullish flag formation with a breakout. It is stunted below the 200-day EMA right now so I would wait until we have a confirmation with a breakout above that level. It is definitely worth watching next week. We did see some decline in %Stocks above their 20-day EMA, but that indicator remains at a strong 90% reading. The Silver Cross Index is still on the rise and the Golden Cross Index is picking up speed. There is a large rounded bottom on price that could provide a nice base to further rally. The PMO appears to be surging above the signal line. A few symbols to consider in this area: CVBF, IBCP and SRCE. They are overbought so best would be a purchase on a pullback.

Go to our Under the Hood ChartList on DecisionPoint.com to get an in-depth view of all the sectors. On StockCharts.com you can find the Industry Summary.

Good Luck & Good Trading!

- Erin

erin@decisionpoint.com

Full Disclosure: I'm 15% long, 4% short.

Watch the latest episode of the DecisionPoint Trading Room with Carl & Erin Swenlin on Mondays 3:00p EST!

Technical Analysis is a windsock, not a crystal ball. --Carl Swenlin

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

(c) Copyright 2023 DecisionPoint.com