It was a rough week for the market so I'm happy to report that "Diamonds in the Rough" finished higher while the SPY finished lower on the week. It would probably have been an even better week had today's rally not been as strong since we did have two short positions on Wednesday.

There are pockets of strength that can be exploited. Today I'll add Recreational Services, our "Industry Group to Watch" to Biotechs and Gold Miners as a pocket of strength.

The Sector to Watch was not easy this week as most of the sectors have negative momentum and weak participation. However, after the close today it seemed obvious that Real Estate (XLRE) should be our "Sector to Watch". I'll explain further down in the report.

This week's "Darling" was Sutro Biopharma (STRO), a low-priced Reader Request in the Biotech space. These are either big winners or big losers so selectivity is important within that industry group. These trades can be tricky.

The "Dud" was the Bloomin' Brands (BLMN) which finished down -2.94% since being picked on Tuesday. A market downturn didn't help BLMN at all and today's rally had no effect.

Overall, play defense. On the week, defensive sectors led with the exception of Technology. Usually defensive sectors outperformance leads to market declines shortly thereafter. We think that the decline will resume next week so keep your stops in play and consider limiting exposure.

Have a great weekend!

Good Luck & Good Trading,

Erin

RECORDING LINK (5/5/2023):

Topic: DecisionPoint Diamond Mine (5/5/2023) LIVE Trading Room

Passcode: May##5th

REGISTRATION for 5/12/2023:

When: May 12, 2023 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (5/12/2023) LIVE Trading Room

Register in advance for this webinar HERE

After registering, you will receive a confirmation email containing information about joining the webinar.

Our latest DecisionPoint Trading Room recording (5/1/2023):

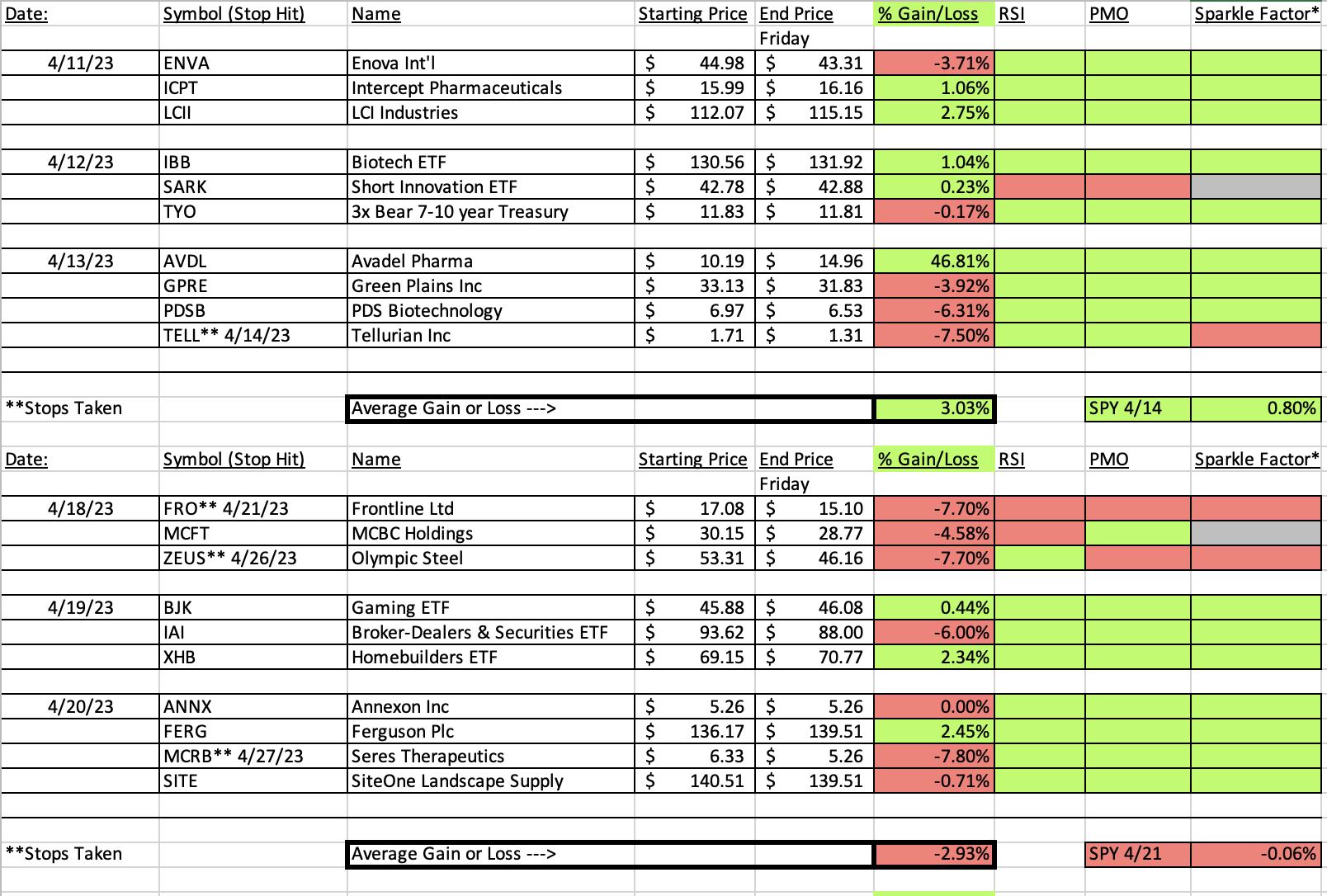

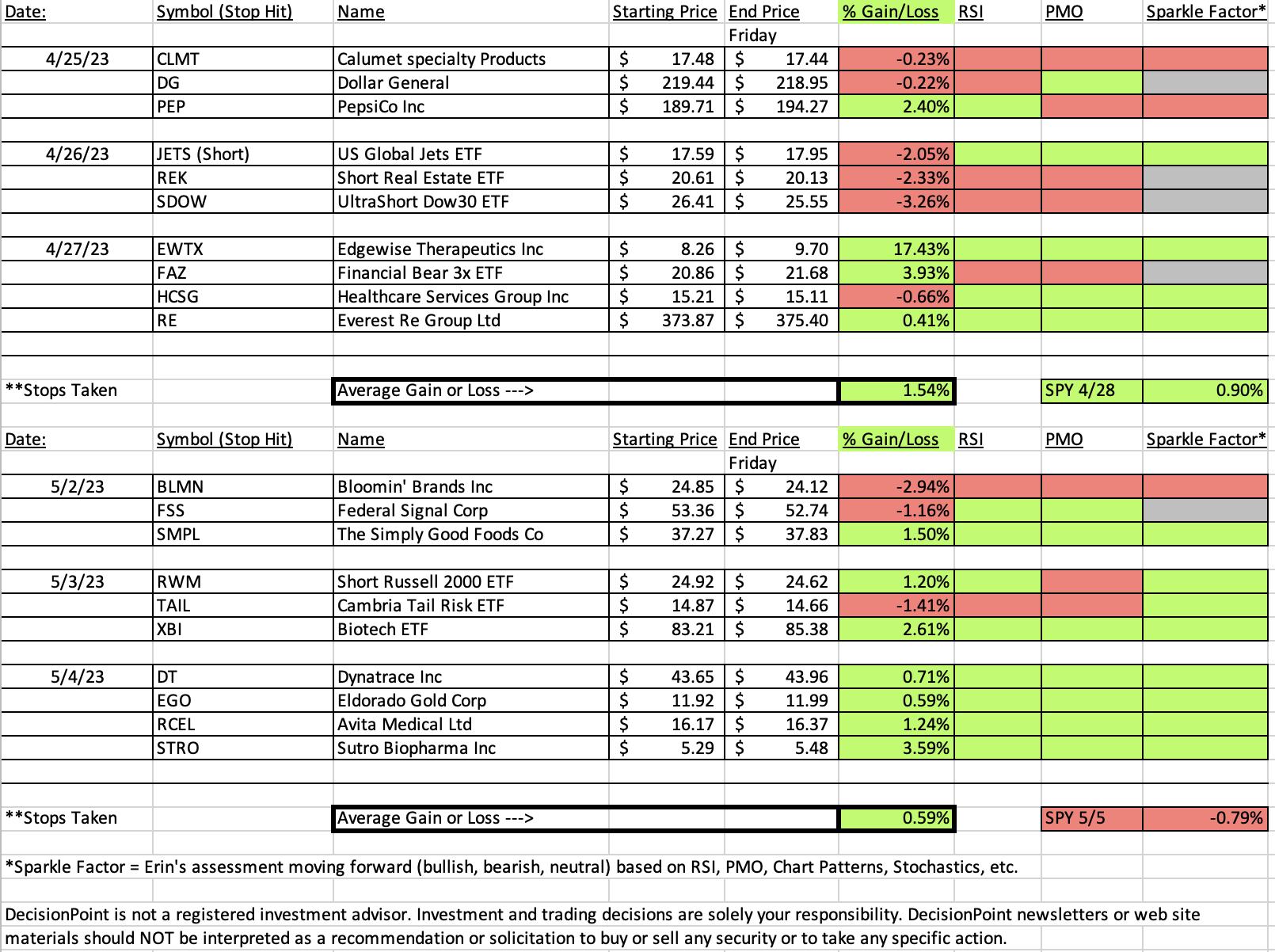

A few items about the spreadsheet: I've put on the spreadsheet whether the RSI is positive (green) or negative (red). The PMO column tells you if it is rising (green) or falling (red). Finally I've added my own "Sparkle Factor" that gives you my assessment going forward, bullish (green), bearish (red) or neutral (gray). The Sparkle Factor is basically my thoughts on whether I expect it to rise or fall. A neutral means it could really go either way so it could be added to a watch list. If you're in a stock I consider "neutral" going forward, the ball is in your court.

Darling:

Sutro Biopharma Inc. (STRO)

EARNINGS: 05/15/2023 (AMC)

Sutro Biopharma Inc. engages in the drug discovery, development and manufacture of pharmaceutical products. It focuses on the next generation cancer and autoimmune therapeutics. The company was founded by James R. Swartz and Sutanto Widjaja on April 21, 2003 and is headquartered in South San Francisco, CA.

Predefined Scans Triggered: Entered Ichimoku Cloud.

Below are the commentary and chart from yesterday (5/4):

"STRO is down -0.57% in after hours trading. I would've liked this one a bit better on a pullback like RCEL because I expect we could see some profit taking. Any decline would offer a nice entry as long as it stays above new support. There is a double-bottom pattern that has been confirmed so we should expect the minimum upside target to be reached at $6.00. The indicators suggest it could move higher than that. The RSI is positive and the PMO has surged above its signal line (bottom above the signal line). Volume is coming in and Stochastics are rising in positive territory. Relative strength is also picking up. The stop is set beneath the confirmation line of the double-bottom pattern at 7.5% or $4.89."

Here is today's chart:

The chart is getting better after today's continuation rally. Indicators remain positive. The double-bottom was confirmed with the breakout. The upside target of the pattern has nearly been reached just under $6. The PMO is rising and not overbought yet. Overall it's a very strong chart that is getting stronger.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Dud:

Bloomin' Brands Inc. (BLMN)

EARNINGS: 07/28/2023 (BMO)

Bloomin' Brands, Inc. engages in the acquisition, operation, design, and development of restaurant concepts. It operates through the U.S. and International geographical segments. The U.S. segment operates in the USA and Puerto Rico. The International segment operates in Brazil, South Korea, Hong Kong, and China. Its brands include Outback Steakhouse, Carrabba's Italian Grill, Bonefish Grill, and Fleming's Prime Steakhouse and Wine Bar. The company was founded by Chris Thomas Sullivan, Robert Danker Basham and John Timothy Gannon in March 1988 and is headquartered in Tampa, FL.

Predefined Scans Triggered: P&F High Pole.

Below are the commentary and chart from Tuesday (5/2):

"BLMN is unchanged in after hours trading. Price is attempting to breakout from a bullish falling wedge. It does have overhead resistance to deal with at $25.00, but I like the way the indicators are shaping up in anticipation of a breakout. The RSI is in positive territory now and the PMO is about to trigger a Crossover BUY Signal. The OBV is confirming the rally and Stochastics are rising strongly. I'm beginning to wonder if Restaurants and Bars should be in Consumer Staples. Look at how impressive this group's relative strength has been. BLMN is now taking advantage of that strength. The stop is set below support at 7.8% or $158.85."

Here is today's chart:

The chart immediately went south after it was picked. It hasn't lost that much, but I would avoid this if you haven't entered and I would prepare for price to get close to the stop if you are holding it so you have to decide if you want to ride it down first. The bullish falling wedge could now be re-annotated using the recent high so the bullish pattern still remains. I think the big problem here is that it is digesting the recent rally and could need a test of the bottom of the wedge before breaking out again.

THIS WEEK's Sector Performance:

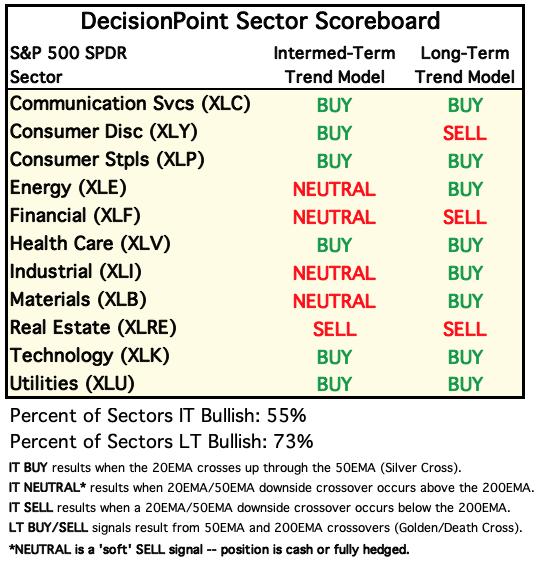

DecisionPoint Sector Scoreboard (Mechanical Trend Model Signals):

Click Here to view Carl's annotated Under the Hood ChartList!

Sector to Watch: Real Estate (XLRE)

I had to go with Real Estate today given the PMO Surge above the signal line and rising Silver Cross Index (SCI) that is above its signal line. Participation of stocks above their 20/50-day EMAs is above our 50% bullish threshold and those percentages are higher than the Silver Cross Index so we know the SCI will continue rising. Stochastics have also turned up. While I'm not bullish enough to buy this sector fund, I will tell you that Diversified REITs and Hotel/Lodging REITs look very bullish.

Industry Group to Watch: Recreational Services ($DJUSRQ)

I like everything about this chart. We have a confirmed double-bottom price pattern. The upside target of the pattern would be around $78, but remember, that is a "minimum" upside target for the pattern. I believe price will move higher given the very bullish indicators. The RSI is positive and rising and the PMO has overcome the zero line. Stochastics have reversed higher and relative strength is excellent and getting even better. Two stock symbols we "mined" this morning in the Diamond Mine trading room were RCL and MSGS.

Go to our Sector ChartList on DecisionPoint.com to get an in-depth view of all the sectors. On StockCharts.com you can find the Industry Summary.

Good Luck & Good Trading!

- Erin

erin@decisionpoint.com

Full Disclosure: I'm 30% long, 4% short.

Watch the latest episode of the DecisionPoint Trading Room with Carl & Erin Swenlin on Mondays 3:00p EST!

Technical Analysis is a windsock, not a crystal ball. --Carl Swenlin

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

(c) Copyright 2023 DecisionPoint.com