The market spent the week within its trading range, finishing down just -0.25% on the week. "Diamonds in the Rough" were no exception, spending much of the time in a trading range.

Coinbase (COIN) was the "Dud" this week. I had warned that this stock (a Reader Request) was highly volatile and while upside potential was tasty, swings in the down direction could be just as harsh as a rise is fantastic. Interestingly, I still do like the chart's setup so it moves forward with a Bullish Sparkle Factor.

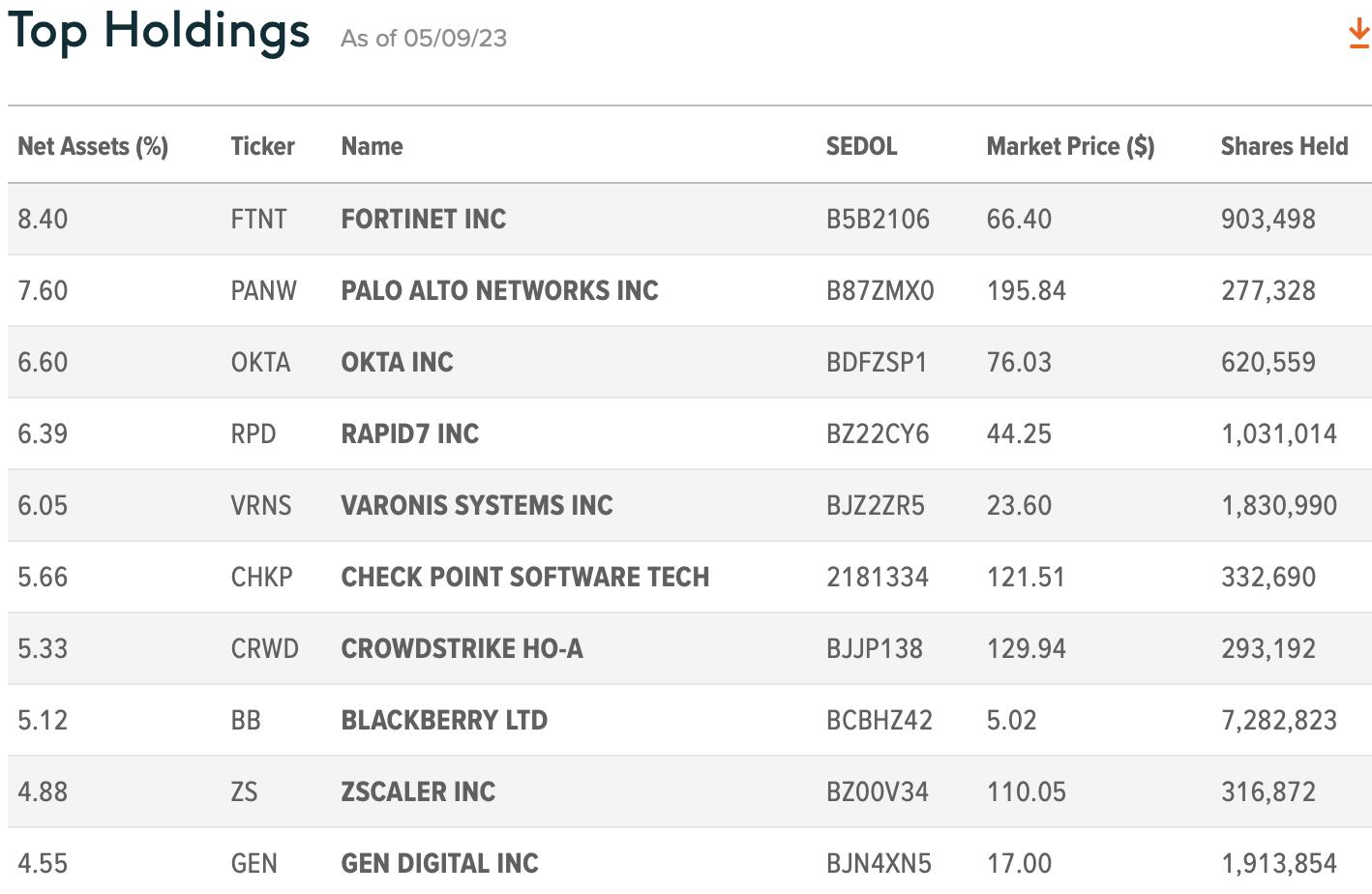

ETF Day presented us with the "Darling" this week, the Cybersecurity ETF (BUG) finished up +1.45% since being picked on Wednesday. It definitely has the best setup moving forward from this week's Diamonds.

Thank you for your patience in the distribution of the Recap being late. I thought I wouldn't be able to make it, but on Friday I was able to just slide out of the trading room in time to make it to my stepson's college graduation. What an amazing kid! He got his degree in Economics from San Diego State. If anyone has any leads for him, they would of course be welcome!

See you in the free DecisionPoint Trading Room tomorrow!

Good Luck & Good Trading,

Erin

RECORDING LINK (5/12/2023):

Topic: DecisionPoint Diamond Mine (5/12/2023) LIVE Trading Room

Passcode: May$11th

REGISTRATION for 5/19/2023:

When: May 19, 2023 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (5/19/2023) LIVE Trading Room

Register in advance for this webinar HERE

After registering, you will receive a confirmation email containing information about joining the webinar.

Our latest DecisionPoint Trading Room recording (5/8/2023):

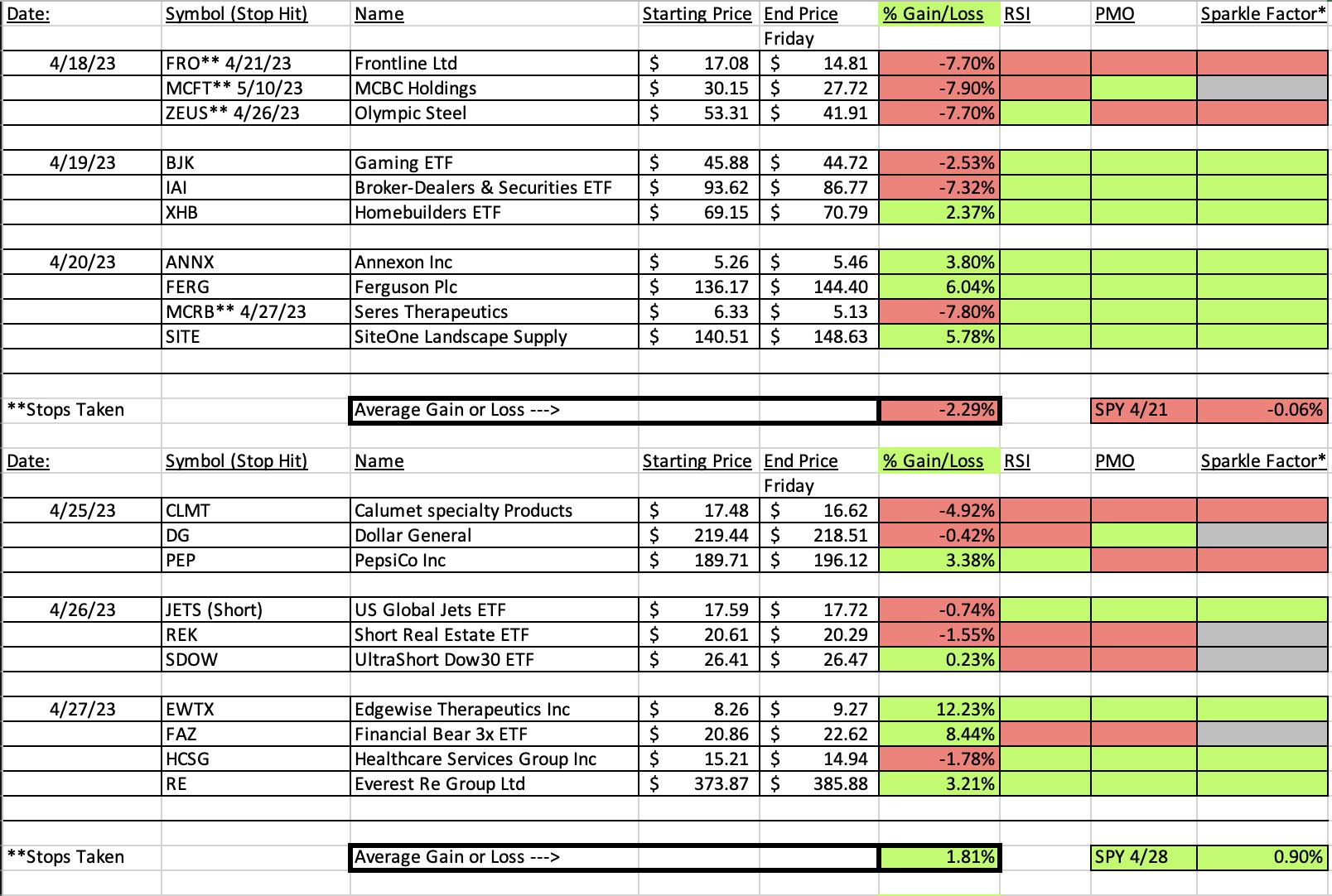

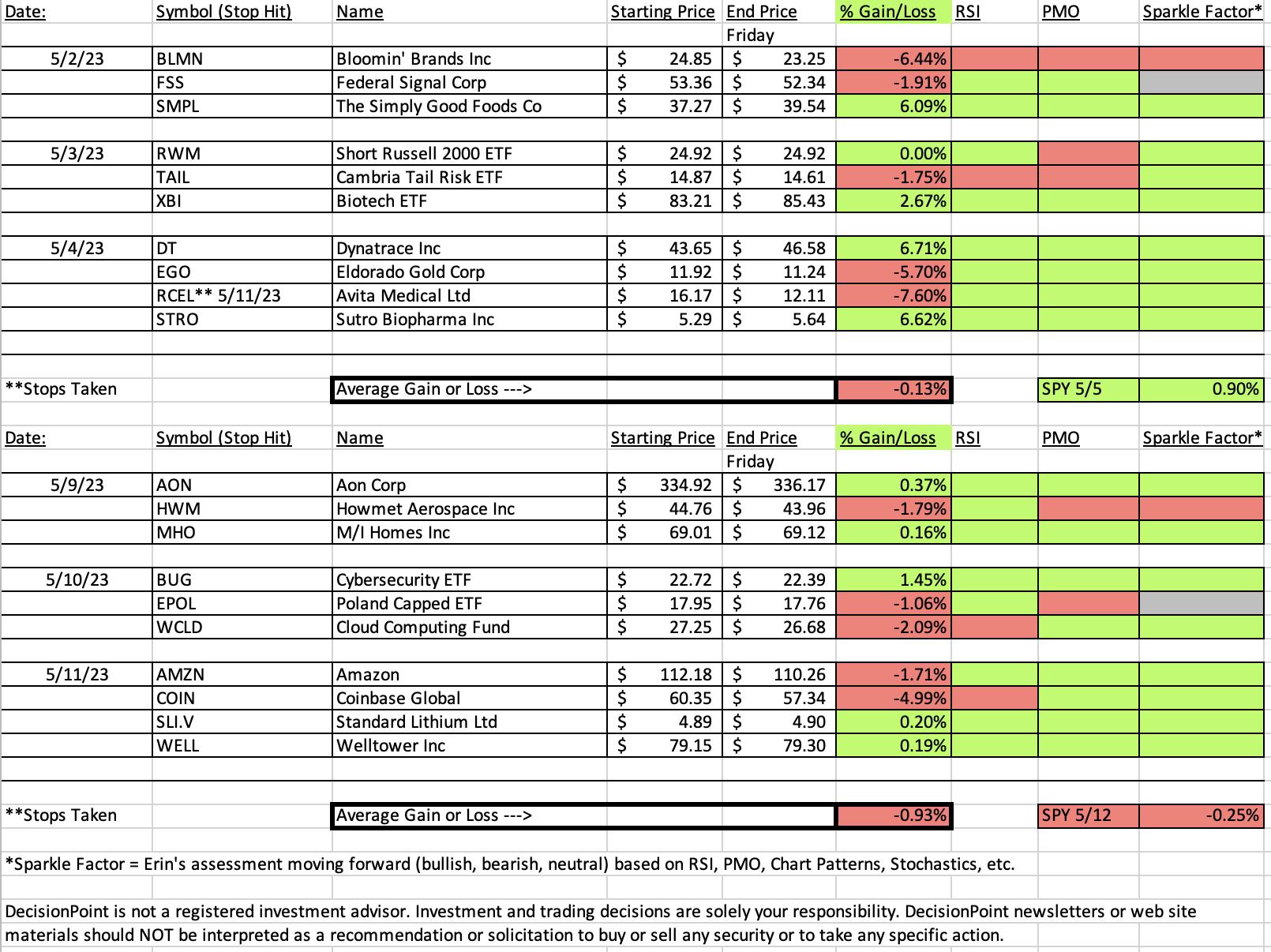

A few items about the spreadsheet: I've put on the spreadsheet whether the RSI is positive (green) or negative (red). The PMO column tells you if it is rising (green) or falling (red). Finally I've added my own "Sparkle Factor" that gives you my assessment going forward, bullish (green), bearish (red) or neutral (gray). The Sparkle Factor is basically my thoughts on whether I expect it to rise or fall. A neutral means it could really go either way so it could be added to a watch list. If you're in a stock I consider "neutral" going forward, the ball is in your court.

Darling:

Global X Cybersecurity ETF (BUG)

EARNINGS: N/A

BUG tracks a modified market-cap-weighted global index of companies selected on the basis of revenue related to cybersecurity activities. Click HERE for more information.

Predefined Scans Triggered: Moved Above Ichimoku Cloud.

Below are the commentary and chart from Wednesday (5/10):

"BUG is up +0.22% in after hours trading. The rally off support is strong and forceful. It has changed the character of the chart. Notice that Monday's gap up moved above prior gap resistance and held. The 5-day EMA has crossed above the 20-day EMA for a ST Trend Model BUY Signal. The RSI is positive, rising and not at all overbought. The PMO just triggered a Crossover BUY Signal today. The OBV is mostly confirming the rally (it did flatten out a bit). Stochastics are very strong and nearing territory above 80. Outperformance is visible with the rising relative strength line. The stop is set at 6.1% or $21.33."

Here is today's chart:

BUG did pullback on Friday, but this looks like a mechanical pullback to the breakout point at $22. I would probably wait to pick this one up if you haven't already. I want to see a bounce off gap support. Indicators are all positive with Stochastics just now getting above 80. I would keep the same stop level.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Dud:

Coinbase Global Inc. (COIN)

EARNINGS: 08/08/2023 (AMC)

Coinbase Global, Inc. engages in technology and financial infrastructure products and services. It offers crypto-powered technologies including self-custody wallets, decentralized apps and services, and open community engagement platforms. The company was founded by Brian Armstrong in 2012 and is headquartered in San Francisco, CA.

Predefined Scans Triggered: Ichimoku Cloud Turned Red.

Below are the commentary and chart from Thursday (5/11):

"COIN is up +0.56% in after hours trading. Price previously dropped out of its intermediate-term price trend and promptly rebounded back into it. It had a bad day but did avoid forming a bearish engulfing candlestick. Price pulled back to the 50-day EMA and closed above it. This seems a good place for another move higher. The RSI did fall on today's deep decline, but it remains in positive territory. There is a new PMO Crossover BUY Signal and the OBV is rising with price in confirmation. Stochastics are now above 80 and relative strength is increasing for the group and the stock. I would like to set the stop deeper, but 8% is generally the top of my stop range. This stop is at that 8% or $55.52."

Here is today's chart:

This chart is actually somewhat similar to BUG. As noted in the opening, I still believe COIN has some promise. This looks very much like a breakout with a mechanical pullback to the breakout point. I would find this one very interesting should it hold gap support at $55. The decline did put the RSI in negative territory, but the PMO is still on the rise despite the nearly 5% decline. If you own it, it would still be a hold. You could wait to see if you get the bounce and then possibly add to the position. This stock is volatile so while the decline was heavy, it shouldn't be a big surprise. If you don't own it, picking it up on a bounce would be very interesting.

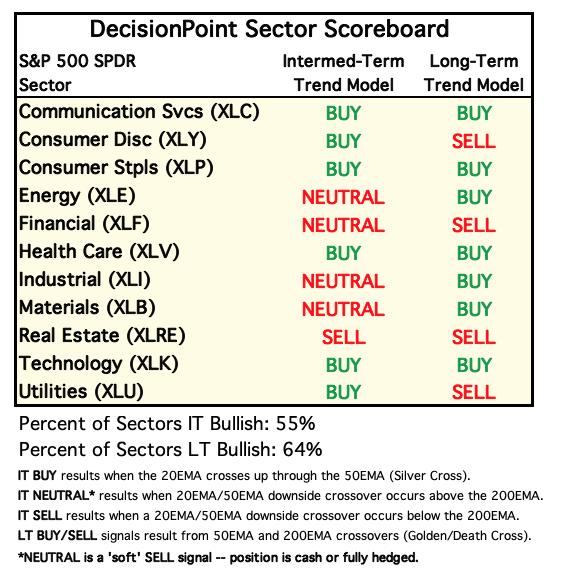

THIS WEEK's Sector Performance:

DecisionPoint Sector Scoreboard (Mechanical Trend Model Signals):

Click Here to view Carl's annotated Under the Hood ChartList!

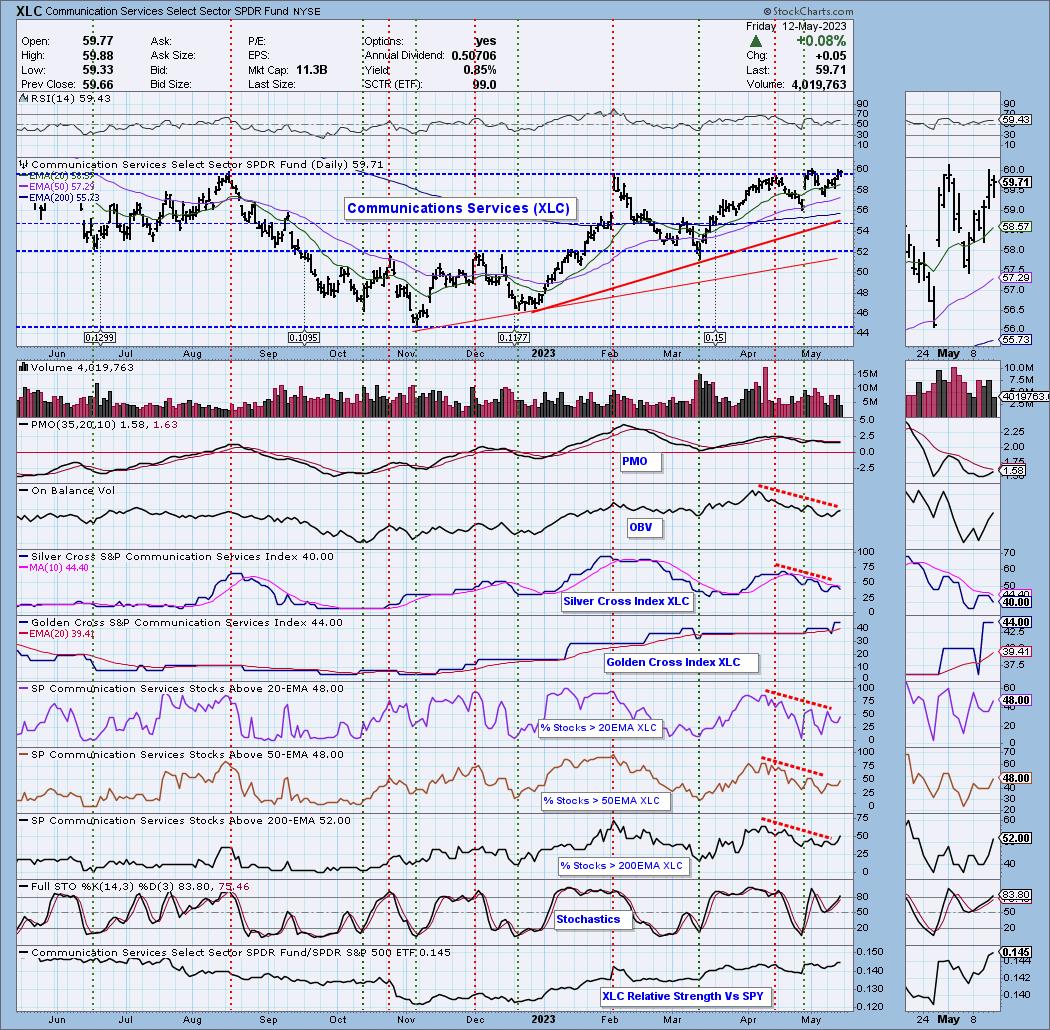

Sector to Watch: Communication Services (XLC)

Picking this week's Sector to Watch was fairly easy. XLC was the only sector with a rising PMO. This speaks to the weakness we are currently seeing in the overall market. It also tells us we probably shouldn't be invested too deeply so be careful, even with this sector.

Participation is still very thin and the Silver Cross Index is in decline after topping once again beneath the signal line which is especially bearish. We also see that %Stocks > 20/50-day EMAs are below our 50% threshold. Negative divergences are visible going into this tiny breakout. Stochastics are now above 80 which is positive. Relative strength is improving, but remember it could still outperform and move lower. It'll outperform the SPY if it moves lower slower.

Industry Group to Watch: Internet ($DJUSRQ)

This is one of the sectors keeping XLC afloat. Alphabet (GOOGL) is leading this industry group higher and looks good for investing or holding. The group is vulnerable to this being a reverse island formation, implying a gap down could be ahead. However, the indicators look far too healthy. That is not to say it won't go down, I just don't expect a gap down. You certainly can't beat this kind of outperformance to the SPY.

Go to our Sector ChartList on DecisionPoint.com to get an in-depth view of all the sectors. On StockCharts.com you can find the Industry Summary.

Good Luck & Good Trading!

- Erin

erin@decisionpoint.com

Full Disclosure: I'm 18% long, 7% short.

Watch the latest episode of the DecisionPoint Trading Room with Carl & Erin Swenlin on Mondays 3:00p EST!

Technical Analysis is a windsock, not a crystal ball. --Carl Swenlin

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

(c) Copyright 2023 DecisionPoint.com