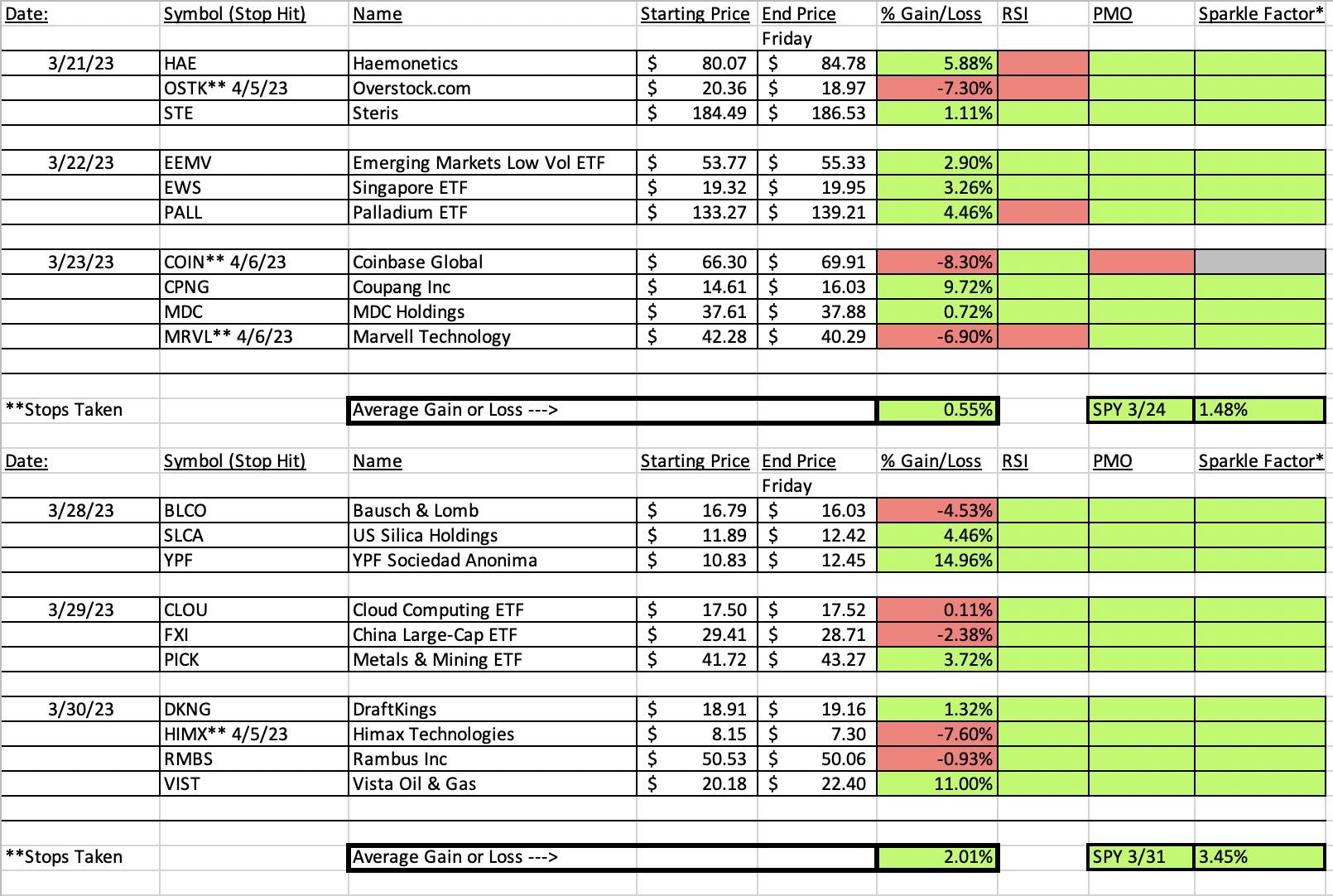

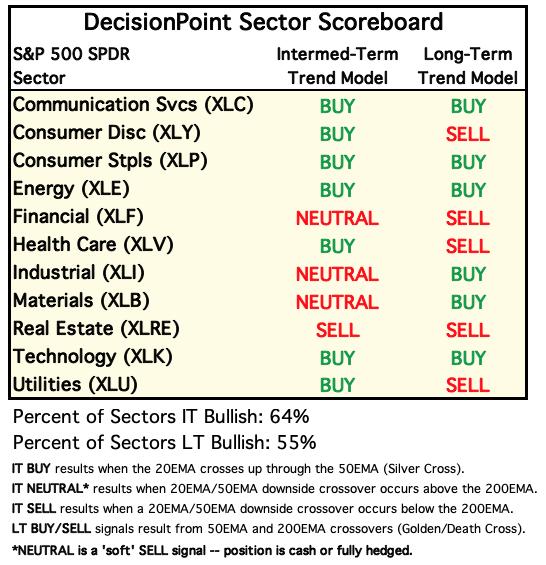

Yesterday's Reader Requests struggled today, but they only had one day to mature. Good news is the prior three weeks are all on average daily gains, not losses. This week finished down -0.38% on average, but like the prior three weeks, they can easily mature and move into positive territory. It may take some time on yesterday's reader requests.

"Diamonds in the Rough" were down slightly on the week mainly because reader requests were saddled with a decline today. The "Darling" was Intercept Pharmaceuticals (ICPT) which is up 7.88% since it was picked on Tuesday. The "Dog" this week is yesterday's Tellurian (TELL). It triggered the stop on one day of action.

The "Sector to Watch" is not what I picked in the Diamond Mine as I didn't like how participation and relative strength looked on Materials (XLB). Instead I opted to go with Energy (XLE). When we reviewed industry groups in the trading room, the majority of Energy groups looked very good. Ultimately the "Industry Group to Watch" is Exploration & Production (PXE). I was able to find this ETF to mimic $DJUSOS which is not a tradable index.

I will say that Commodity Chemicals were looking good this morning and two symbols you can review in the group are LUNMF and SCCO.

Have a great weekend!

Good Luck & Good Trading,

Erin

RECORDING LINK (4/14/2023):

Topic: DecisionPoint Diamond Mine (4/14/2023) LIVE Trading Room

Passcode: April@14th

REGISTRATION for 4/21/2023:

When: Apr 21, 2023 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (4/21/2023) LIVE Trading Room

Register in advance for this webinar HERE

After registering, you will receive a confirmation email containing information about joining the webinar.

Our latest DecisionPoint Trading Room recording (4/10/2023):

A few items about the spreadsheet: I've put on the spreadsheet whether the RSI is positive (green) or negative (red). The PMO column tells you if it is rising (green) or falling (red). Finally I've added my own "Sparkle Factor" that gives you my assessment going forward, bullish (green), bearish (red) or neutral (gray). The Sparkle Factor is basically my thoughts on whether I expect it to rise or fall. A neutral means it could really go either way so it could be added to a watch list. If you're in a stock I consider "neutral" going forward, the ball is in your court.

Darling:

Intercept Pharmaceuticals, Inc. (ICPT)

EARNINGS: 05/04/2023 (BMO)

Intercept Pharmaceuticals, Inc. operates as a biopharmaceutical company. The firm engages in the research, development, and commercialization of novel therapeutics in treating chronic liver diseases. Its product pipeline includes OCALIVA, which is used for the treatment of biliary cholangitis, nonalcoholic steatohepatitis, sclerosing cholangitis and biliary atresia. The company was founded by Mark E. Pruzanski and Roberto Pellicciari on September 4, 2002 and is headquartered in Morristown, NJ.

Predefined Scans Triggered: New CCI Buy Signals

Below are the commentary and chart from Tuesday (4/11):

"ICPT is up +4.00% in after hours trading. This one has had a powerful price thrust that has changed the entire complexion of this chart. The RSI has now moved in positive territory. The PMO just triggered a crossover BUY signal. Volume definitely came in on the rally based on the rise of the OBV. Stochastics are in positive territory and rising almost vertically. Biotechs are slowly beginning to outperform and this group has plenty of choices. ICPT is outperforming in a big way (naturally given these two days of rally) and looks on track to continue to outperform. The stop is deep, but given the 5%+ gain today, it was somewhat unavoidable. I've set it around the 20-day EMA at 8.2% or $14.67."

Here is today's chart:

As the indicators suggested, the rally has continued to run hot with a breakout yesterday. Indicators are still very strong, but the rising trend is very steep and therefore vulnerable to a breakdown. I would look for that pause or pullback for better entry. It is definitely a hold.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Dud:

Tellurian Inc. (TELL)

EARNINGS: 05/03/2023 (BMO)

Tellurian, Inc. engages in the production of natural gas and investing in natural gas projects. It operates through the following segments: Upstream, Midstream, and Marketing and Trading. The Upstream segment produces, gathers, and delivers natural gas and acquires and develops natural gas assets. The Midstream segment includes development, construction, and operation of LNG terminals and pipelines. The Marketing and Trading segment involves the purchasing and selling of natural gases. The company was founded by Charif Souki and Martin Houston in 1957 and is headquartered in Houston, TX.

Predefined Scans Triggered: P&F Descending Triple Bottom Breakdown, Stocks in a New Uptrend (Aroon), Moved Above Upper Price Channel, Entered Ichimoku Cloud and P&F Double Bottom Breakout.

Below are the commentary and chart from yesterday (4/13):

"TELL is up +1.75% in after hours trading. Today we have a bullish engulfing candlestick that is coming off a bearish filled black candlestick. I look at that as very positive. The RSI is positive and the PMO just moved above the zero line. Stochastics are above 80 and the OBV is rising strongly so price is following volume. Relative strength for the group is improving based on the jump in Crude Oil. With Oil breaking out, I believe Energy positions will do well a bit longer. TELL appears to be a leader given its increasing relative strength against the group. The stop is set a bit tighter than I'd like, but getting it below support meant a 9%+ stop and I'm not comfortable with that. I've set it at 7.5% or $1.58. This reminds me that given this is low-priced, it will be volatile so make sure you are okay with that risk."

Here is Thursday's chart:

I'm not exactly sure what went wrong for this one, but reading the commentary above, I'm wishing I had set that 9%+ stop as this one still could produce given it is still above support, although barely which is why I've listed it with a "red" Sparkle Factor. Today's candlestick was a bearish engulfing too. The PMO is still rising and the RSI is still positive. Stochastics did turn down but remain above 80. This one could make the turn as it is a part of the "Industry Group to Watch" and though relative strength stumbled a bit today, it could make the turn. I just think there are better choices like VOC and CNQ.

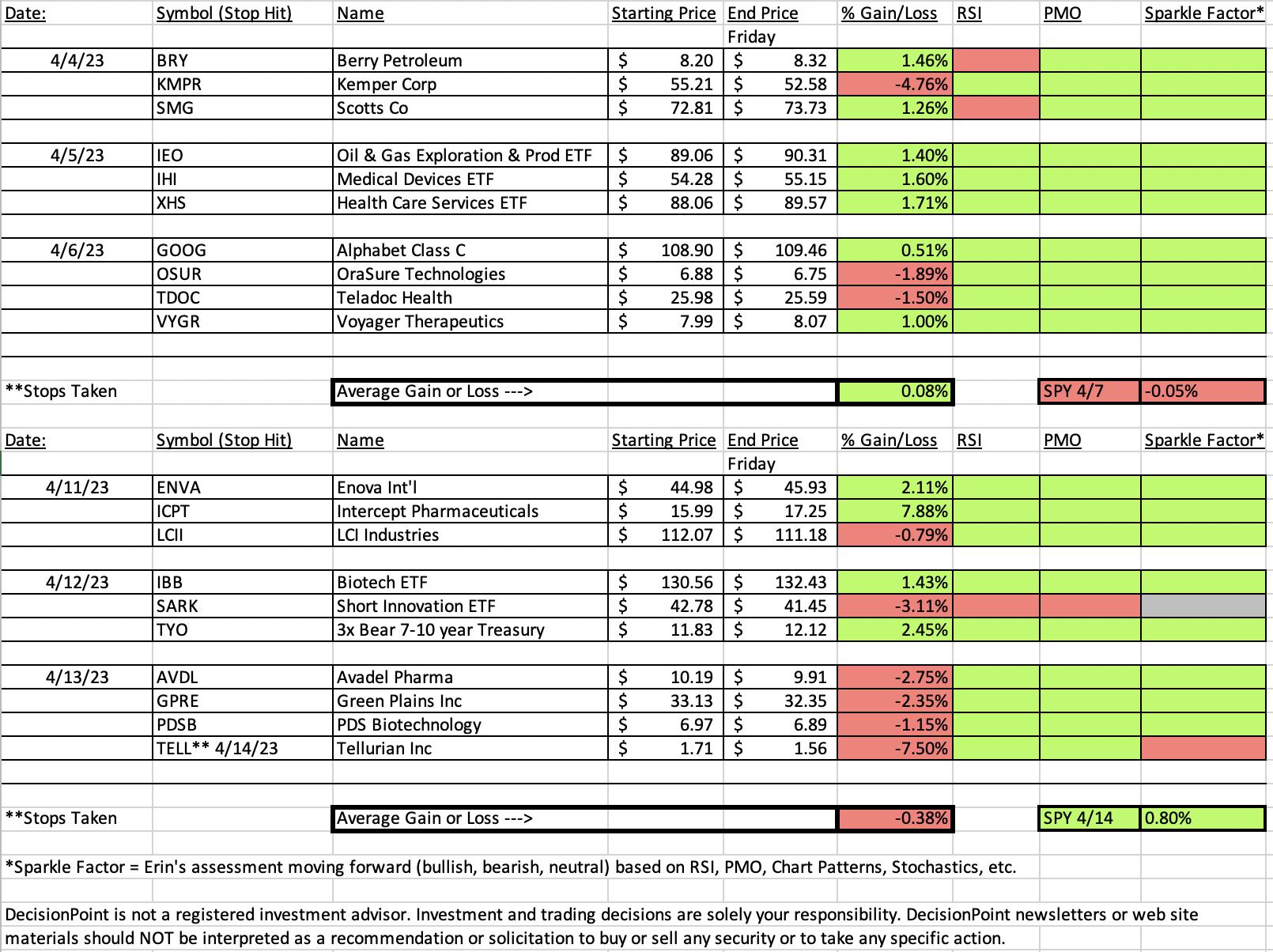

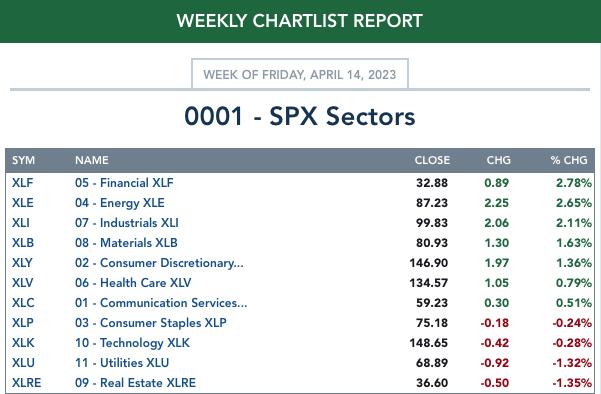

THIS WEEK's Sector Performance:

DecisionPoint Sector Scoreboard (Mechanical Trend Model Signals):

Click Here to view Carl's annotated Sector ChartList!

Sector to Watch: Energy (XLE)

Price is breaking out of a cluster and there is plenty of upside before resistance is met. The RSI is positive and the PMO rising. My primary reason for picking it is the strong participation of stocks above their 20/50/200-day EMAs. The Silver Cross Index is rising and the Golden Cross Index just had a positive crossover. Relative strength is increasing as well. I liked Consumer Discretionary (XLY) and Materials (XLB), and felt this sector was stronger given all of its industry groups had positive charts overall.

Industry Group to Watch: Exploration & Production (PXE)

I didn't annotate it, but it is clear that the declining tops trendline has been broken on the current rally. The RSI is positive and the PMO just cleared the zero line. Stochastics are oscillating above 80. PXE is showing increasing relative strength against the SPY. A few symbols to consider in this group are CNQ and VOC.

Go to our Sector ChartList on DecisionPoint.com to get an in-depth view of all the sectors. On StockCharts.com you can find the Industry Summary.

Good Luck & Good Trading!

- Erin

erin@decisionpoint.com

Full Disclosure: I'm 26% long, 2% short.

Watch the latest episode of the DecisionPoint Trading Room with Carl & Erin Swenlin on Mondays 3:00p EST!

Technical Analysis is a windsock, not a crystal ball. --Carl Swenlin

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

(c) Copyright 2023 DecisionPoint.com