The market was down -0.19% on the week. It wasn't a good week for most of this week's "Diamonds in the Rough", but one stock in particular really shined after a very strong trading day. The Interest Rate Hedge (PFIX) did well too, just not as well as Palomar Holdings (PLMR).

We took one stop this week after Livent (LTHM) tanked today. It's unfortunate as the chart looked pretty good. We will look at it more closely below.

This week's Sector to Watch is Utilities (XLU). I was leaning toward Consumer Staples (XLP) in today's Diamond Mine trading room. However, after looking closely at the participation numbers after the close, I decided XLU showed the most promise.

This week's Industry Group to Watch is Conventional Electricity ($DJUSEU). Unfortunately there are no ETF equivalents, but I'll share a few symbols of interest in that section.

Have a great weekend!

Good Luck & Good Trading,

Erin

RECORDING LINK (2/17/2023):

Topic: DecisionPoint Diamond Mine (2/17/2023) LIVE Trading Room

Recording Link HERE

Passcode: Feb$17th

REGISTRATION for 2/24/2023:

When: Feb 24, 2023 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (2/24/2023) LIVE Trading Room

Register in advance for this webinar HERE

After registering, you will receive a confirmation email containing information about joining the webinar.

Our latest DecisionPoint Trading Room recording (2/13/2023):

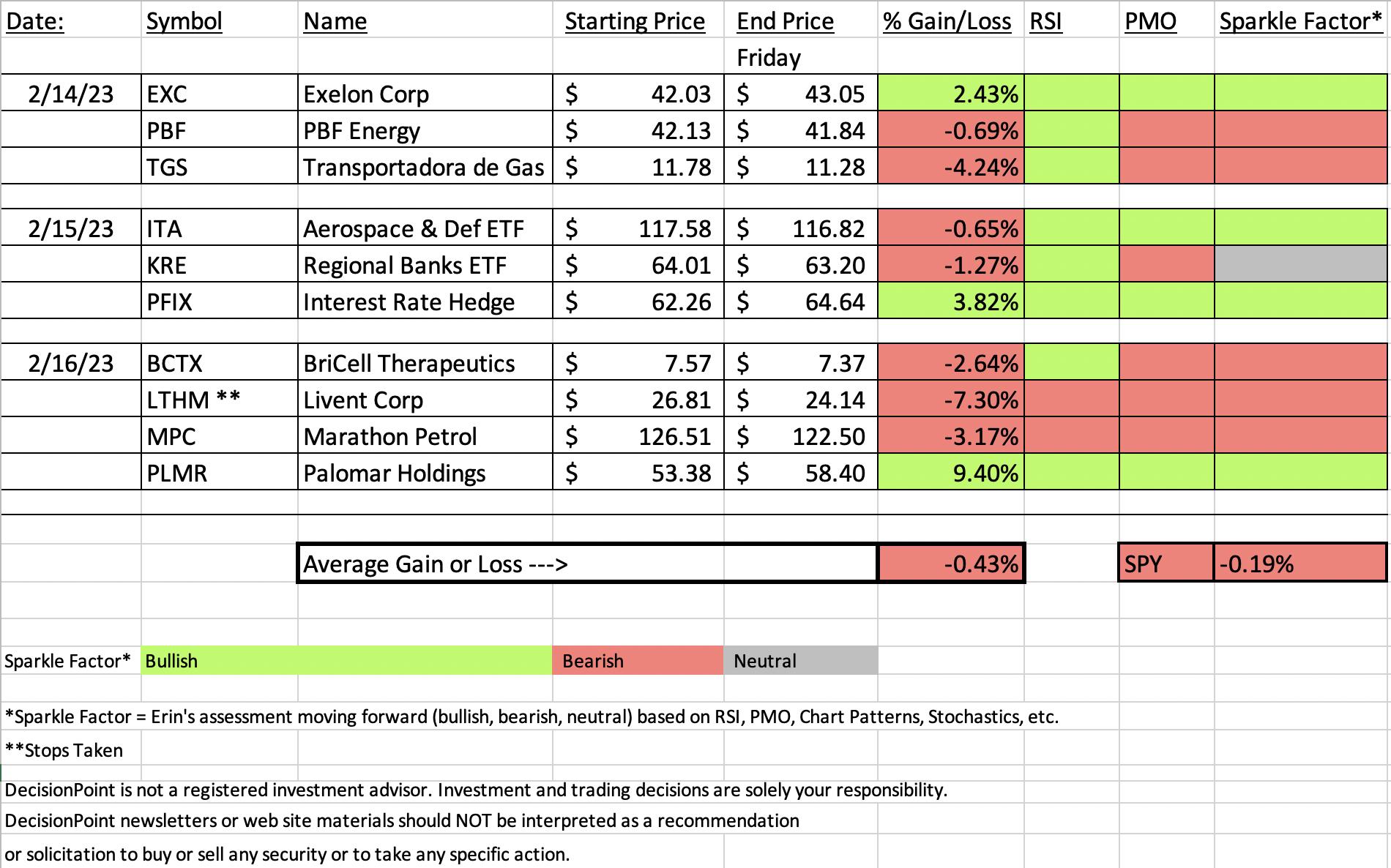

A few items about the spreadsheet: I've put on the spreadsheet whether the RSI is positive (green) or negative (red). The PMO column tells you if it is rising (green) or falling (red). Finally I've added my own "Sparkle Factor" that gives you my assessment going forward, bullish (green), bearish (red) or neutral (gray). The Sparkle Factor is basically my thoughts on whether I expect it to rise or fall. A neutral means it could really go either way so it could be added to a watch list. If you're in a stock I consider "neutral" going forward, the ball is in your court.

Darling:

Palomar Holdings, Inc. (PLMR)

EARNINGS: 02/15/2023 (AMC) ** REPORTED TODAY **

Palomar Holdings, Inc. operates as an insurance holding company. The firm focuses on the residential and commercial earthquake markets in earthquake-exposed states such as California, Oregon, Washington and states with exposure to the New Madrid Seismic Zone. It offers property and casualty insurance. The company was founded by Armstrong Mac & Fisher Heath on October 4, 2013 and is headquartered in La Jolla, CA.

Predefined Scans Triggered: New CCI Buy Signals, Parabolic SAR Buy Signals, P&F Double Top Breakout and P&F Triple Top Breakout.

Below are the commentary and chart from yesterday (2/16):

"PLMR is down -1.44% in after hours trading. They just reported after the bell today so I'd avoid any overnight orders. It's been stuck beneath resistance at the July 2022 low, but today it did manage to trade just above it. It did finish back below resistance. I would look for a breakout given the positive RSI and very bullish PMO bottom above the signal line. Stochastics are rising, but aren't quite in positive territory yet. Relative strength studies are favorable and improving. The stop is set deeply, but I felt it necessary to protect against a drop below support. I set it at 8.7% around $58.02."

Here is today's chart:

I had to admit in this morning's trading room that this pick was not actually a reader request, it was one that I slipped in as I really liked the chart. I almost didn't include it because it had just reported earnings. This one could've gone the opposite direction on earnings, so I feel I got a bit lucky on this one. The chart was set up bullishly so the expectation of an upside breakout made sense. I would look for PLMR to move even higher on the earnings glow. The stop can now be brought up toward the January/February tops.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Dud:

Livent Corp. (LTHM)

EARNINGS: 05/02/2023 (AMC)

Livent Corp. engages in the production of performance lithium compounds. Its products include battery-grade lithium hydroxide, butyllithium, and purity lithium metal which are used in various performance applications. It operates through the following geographical segments: North America, Europe, Middle East, and Africa, Latin America, and Asia Pacific. The company was founded in 1942 and is headquartered in Philadelphia, PA.

Predefined Scans Triggered: Hollow Red Candles, P&F Low Pole and Entered Ichimoku Cloud.

Below are the commentary and chart from yesterday (2/16):

"LTHM is down -0.04% in after hours trading. The RSI is positive and not overbought. The PMO bottomed on a whipsaw BUY signal and is rising and not overbought. We have a cup with handle pattern that executed with yesterday's breakout. Today price pulled back toward the breakout point somewhat harmlessly. While it closed below resistance, it formed a bullish hollow red candlestick. There is a positive OBV divergence going into this rally and Stochastics are rising strongly. Relative strength is improving for the group and LTHM in the very short term. The stop is set below the 20/50-day EMAs around 7.3% or $24.85."

Here is today's chart:

This chart looked excellent in my opinion. We had a strong breakout followed by a small pullback to the breakout point. I'm not sure why it dumped today. Earnings weren't near. So, in one fell swoop, this chart when from great to terrible. I don't see any hints that this would happen today.

THIS WEEK's Sector Performance:

DecisionPoint Sector Scoreboard (Mechanical Trend Model Signals):

Click Here to view Carl's annotated Sector ChartList!

Sector to Watch: Utilities (XLU)

XLU looks bullish again. It isn't that healthy, but it appears that money is beginning to rotate back into the defensive sectors. As noted in the opening, XLP was a close second. Participation was more robust for Utilities and I liked the breakout above the 20-day EMA. XLP has a PMO crossover BUY signal already. XLU is working its way toward one. We did see a "death cross" of the 50/200-day EMAs, but a move above the 50/200-day EMAs will eventually fix that problem. Most notable is the rising Silver Cross Index. We have far more stocks with price above their 20/50-day EMA versus those with "silver crosses". This means the Silver Cross Index will continue to expand. I'd like to see the RSI and Stochastics move into positive territory. We do see that relative strength is finally beginning to build.

Industry Group to Watch: Conventional Electricity ($DJUSEU)

I decided the weekly chart is a better representation than the daily chart which is rather messy given the trading zone it has been in. We don't have the breakout just yet. The indicators are very favorable. The weekly RSI is positive and the weekly PMO just moved above the zero line on a crossover BUY signal. When we ran the "momentum sleepers" scan this morning, four stocks came up in this industry group. I found ALE and AVA had bullish charts.

Go to our Sector ChartList on DecisionPoint.com to get an in-depth view of all the sectors. On StockCharts.com you can find the Industry Summary.

Good Luck & Good Trading!

- Erin

erin@decisionpoint.com

Full Disclosure: I'm 20% exposed.

Watch the latest episode of the DecisionPoint Trading Room with Carl & Erin Swenlin on Mondays 3:00p EST!

Technical Analysis is a windsock, not a crystal ball. --Carl Swenlin

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

(c) Copyright 2023 DecisionPoint.com