I've decided that I need to have a "Mailbag" day as I do get interesting questions via email regarding DecisionPoint analysis techniques or indicators or even pet questions. I've decided that Reader Request Day will be set aside for Mailbag. That said, send in those questions! I also take symbol requests all week long until Thursday at Noon PT to be included in the Reader Request Thursday reports. Let me help you be the best trader you can be.

Today's themes were Marine Transportation and Consumer Staples of all things! Themes are determined by prominence in my DP scans. Materials and Energy (Coal) were also players today. I didn't pick a Coal stock, but ARLP and BTU did come up.

Good Luck & Good Trading,

Erin

Today's "Diamonds in the Rough": INSW, SGML and UTZ.

Runner-ups: CELH, POST, ARLP, BTU, SJT, DHT and FLNG.

RECORDING LINK (1/13/2023):

Topic: DecisionPoint Diamond Mine (1/13/2023) LIVE Trading Room

Passcode: January#13

REGISTRATION for 1/20/2022:

When: Jan 20, 2023 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (1/20/2023) LIVE Trading Room

Register in advance for this webinar HERE

After registering, you will receive a confirmation email containing information about joining the webinar.

Here is the last recording (No show 1/16):

Welcome to DecisionPoint Diamonds, wherein I highlight ten "Diamonds in the Rough" per week. These are selected from the results of my DecisionPoint Scans which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

"Predefined Scans Triggered" are taken from StockCharts.com using the "Symbol Summary" option instead of a "SharpChart" on the workbench.

Stop levels are all rounded down.

International Seaways, Inc. (INSW)

EARNINGS: 03/02/2023 (BMO)

International Seaways, Inc. engages in the transportation of crude oil and petroleum products. It operates through the following segments: Crude Tankers and Product Carriers. The Crude Tankers segment consists of a fleet of vessels that transport unrefined petroleum. The Product Carriers segment focuses on crude and refined petroleum products. The company was founded on December 6, 1999 and is headquartered in New York, NY.

Predefined Scans Triggered: New CCI Buy Signals, Moved Above Upper Price Channel and Entered Ichimoku Cloud.

INSW is up +0.35% in after hours trading. It had a big day so a small pullback would make this one especially attractive. Today the 5-day EMA crossed above the 20-day EMA which triggers a Short-Term Trend Model BUY signal. The RSI is positive and the PMO has just had a crossover BUY signal in oversold territory. Stochastics are rising strongly. Interestingly, relative strength for the group is not good so it is surprising that I had three different stocks in this group hit my scan results. The other two are DHT and FLNG. I selected INSW due its excellent new strength against the group as well as its high StockCharts Technical Rank (SCTR) that you'll see on the weekly chart. The stop is set below the 20-day EMA at 7% or around $36.82.

The weekly chart is mostly positive. The weekly PMO is really the only drawback here as it is still declining. However, price is breaking out of a giant flag formation. The weekly RSI is positive and the SCTR is an excellent 95.1%. The chart pattern calls for a rally the magnitude of the flagpole. That's overly optimistic. I think a move to the all-time high is definitely doable.

Sigma Lithium Corp. (SGML)

EARNINGS: N/A

Sigma Lithium Corp. engages in the production a lithium property. It focuses its project in Minas Gerais. The firm also plans to build a world-class commercial-scale lithium concentration plant. The company was founded on June 8, 2011 and is headquartered in Sao Paulo, Brazil.

Predefined Scans Triggered: P&F Low Pole.

SGML is up +2.76% in after hours trading. It'll be interesting to see how it actually opens tomorrow given the big move in after hours trading. I really like this one on the pullback today. The RSI is still positive and the PMO is rising on an oversold crossover BUY signal. There is a positive OBV divergence leading into this rally which bodes well. Let's not forget this breakout is also coming out of a bullish falling wedge. The group is beginning to see a loss in relative strength, but SGML is picking up relative strength. Notice also this one has also triggered a ST Trend Model BUY (5EMA > 20EMA). The stop is set at 7.4% around $27.51.

The weekly chart isn't favorable, but we do see a positive weekly RSI and a very strong SCTR. Given the deep decline the weekly PMO is in, I would keep a close eye on this position as it is clearly a short-term trade based on this chart. If I'd seen a breakout from the long-term declining trend, I'd feel differently.

Utz Brands, Inc. (UTZ)

EARNINGS: 03/02/2023 (BMO)

UTZ Brands, Inc. manufactures, markets, and distributes branded snacking products. It offers a broad range of salty snacks, including potato chips, pretzels, cheese, veggie, other snacks and pork skins. The firm's brands include Utz, Zapp's, Golden Flake, Good Health, Boulder Canyon and Hawaiian. The company was founded in 1921 and is headquartered in Hanover, PA.

Predefined Scans Triggered: New CCI Buy Signals, Moved Above Upper Bollinger Band and Moved Above Upper Price Channel.

UTZ is up +0.24% in after hours trading. I sense that the reason Staples are showing up is that market concerns usually lead to investment in defensive areas. Most are still quite bearish but they want to take advantage of the possibility of being wrong. One way is to go to defensive areas. We'll see if this plays out as I think, but for now I'm happy with just picking strong stocks with strong charts. The RSI is positive on UTZ and today's breakout was quite impressive. I like the bottoming formation associated with today breakout above key moving averages. The PMO just triggered a crossover BUY signal in oversold territory. Stochastics are above 80. Relative strength isn't great for the group, but the spotlight has been on growth stocks. UTZ is outperforming its group and I believe it will soon outperform the SPY. The stop is set below the 200-day EMA at 5.9% or $15.95.

We have a mixed weekly chart. The weekly RSI is positive and the SCTR is okay. The PMO is above its signal line, but acting a bit toppy. Price is showing higher lows set at the end of 2022 so that rising trend should prevail based on this last bottom. If it can reach the 2022 high that would be an over 19% gain.

Don't forget, on Thursdays I look at reader-requested symbols, click HERE to send me an email. I read every email I receive and try to answer them all!

Current Market Outlook:

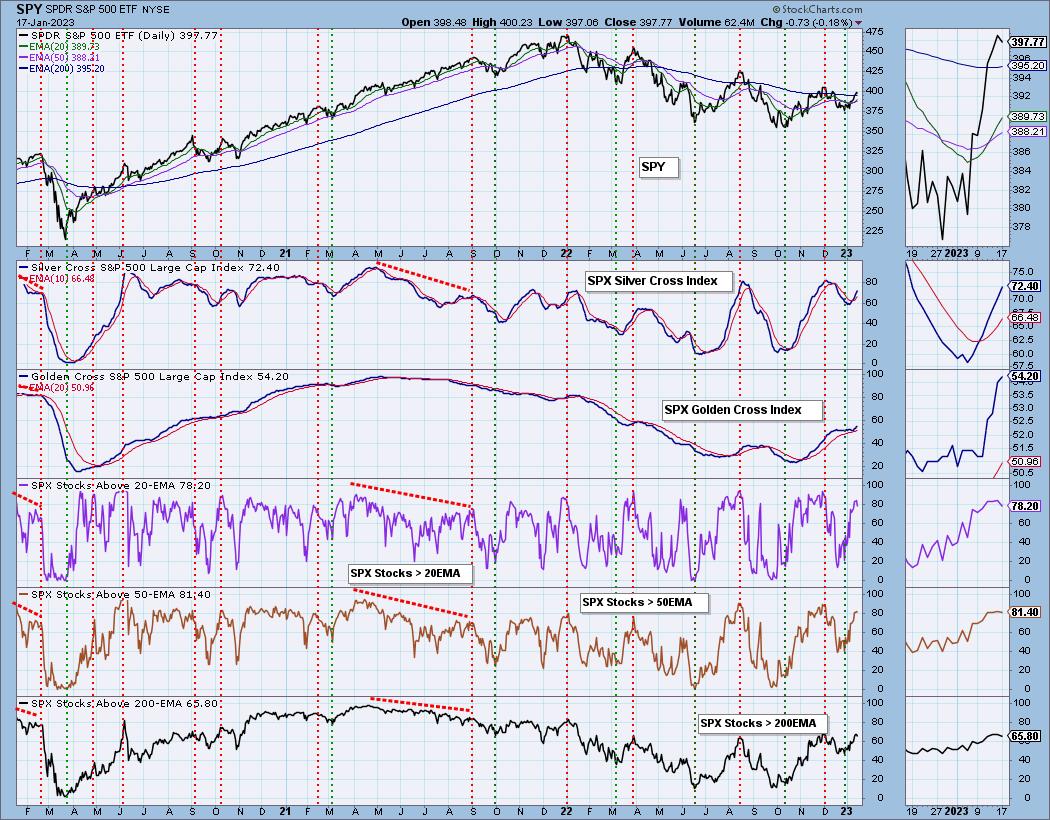

Market Environment: It is important to consider the odds for success by assessing the market tides. The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA)

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA)

Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page.

Here is the current chart:

Full Disclosure: I am 20% exposed.

I'm required to disclose if I currently own a stock I mention and/or may buy/short it within the next 72 hours.

"Technical Analysis is a windsock, not a crystal ball." - Carl Swenlin

(c) Copyright 2023 DecisionPoint.com

Watch the latest episode of DecisionPoint Trading Room with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "Diamonds in the Rough."

Regarding BUY/SELL Signals: The signal status reported herein is based upon mechanical trading model signals and crossovers. They define the implied bias of the price index/stock based upon moving average relationships and momentum, but they do not necessarily call for a specific action. They are information flags that should prompt chart review. Further, they do not call for continuous buying or selling during the life of the signal. For example, a BUY signal will probably (but not necessarily) return the best results if action is taken soon after the signal is generated. Additional opportunities for buying may be found as price zigzags higher, but the trader must look for optimum entry points. Conversely, exit points to preserve gains (or minimize losses) may be evident before the model mechanically closes the signal.

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com