I decided to explore how well "Diamonds in the Rough" have been doing compared to the SPY over the past two months. The SPY had a better percentage three of the past eight weeks but on two of those weeks, we still had positive numbers. Not bad considering the market minefield. This week we were 2.85% better than the SPY, although we did finish down -0.37% today. I'll take that.

Picking an industry group to watch was difficult. I just wrote a free article that tells everyone that only two industry groups have rising momentum, Oil Equipment & Services and Gold Miners. I presented the inverse Gold Mining ETF (DUST) on Wednesday, but I'm going to take that one back as I think (for risk takers) we could see some positive action from that group in the coming week.

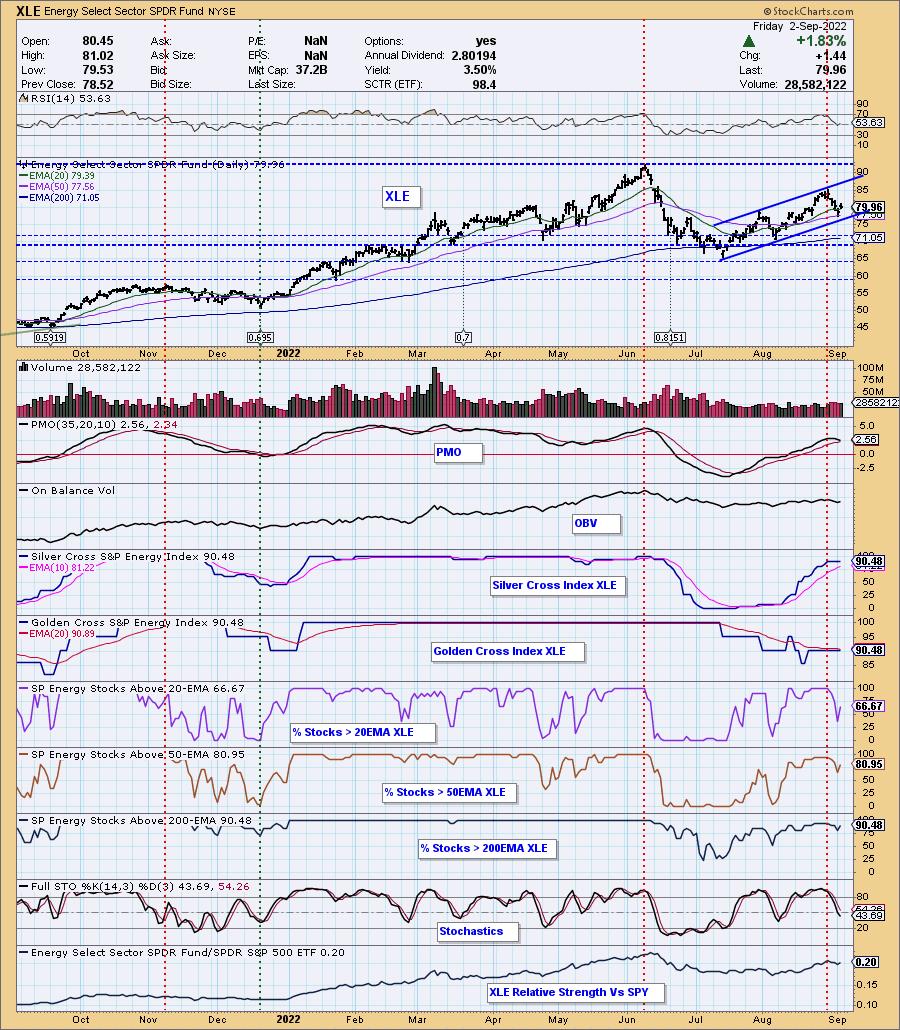

Sector to Watch has to be Energy (XLE). It's seeing a shift in momentum and it is the only sector with broad participation. This is entirely dependent on Crude Oil. If crude can't get its act together, this won't be a good place for exposure. I've closed my Energy positions until the USO chart gets healthy.

Hope you have an excellent holiday weekend. I'm heading to the USC v Rice game tomorrow. It promises to be scorching temperatures, but we have friends flying out so we will brave it! Fight on!

Good Luck & Good Trading,

Erin

TODAY'S RECORDING LINK (9/2/2022):

Topic: DecisionPoint Diamond Mine (9/2/2022) LIVE Trading Room

Start Time: Sept 2, 2022 09:00 AM

Meeting Recording Link

Access Passcode: Sept#2nd

REGISTRATION For Friday 9/9 Diamond Mine:

When: Sep 9, 2022 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (9/9/2022) LIVE Trading Room

Register in advance for this webinar HERE

Save the registration confirmation email with login instructions in case Zoom doesn't notify you in time.

Here is the link to the August 29th DecisionPoint Trading Room:

A few items about the spreadsheet: I've put on the spreadsheet whether the RSI is positive (green) or negative (red). The PMO column tells you if it is rising (green) or falling (red). Finally I've added my own "Sparkle Factor" that gives you my assessment going forward, bullish (green), bearish (red) or neutral (gray). The Sparkle Factor is basically my thoughts on whether I expect it to rise or fall. A neutral means it could really go either way so it could be added to a watch list. If you're in a stock I consider "neutral" going forward, the ball is in your court.

Darling:

Banco Santiago (BSAC)

EARNINGS: 10/28/2022 (BMO)

Banco Santander Chile SA engages in the provision of commercial and retail banking services. It operates through the following segments: Retail Banking, Middle-Market, Corporate and Investment Banking, and Other. The Retail banking segment offers consumer loans, credit cards, automobile loans, commercial loans, foreign exchange, mortgage loans, debit cards, checking accounts, savings products, mutual funds, stock brokerage, and insurance brokerage. The Middle-Market segment serves institutions such as universities, government entities, local and regional governments, and companies engaged in the real estate industry who carry out projects to sell properties to third parties. The Corporate and Investment Banking segment consists of foreign and domestic multinational companies. The Other segment represents the results of is financial management division, which develops global management functions, including managing inflation rate risk, foreign currency gaps, interest rate risk and liquidity risk. The company was founded on September 7, 1977 and is headquartered in Santiago, Chile.

Predefined Scans Triggered: Improving Chaikin Money Flow, Bullish MACD Crossovers and Parabolic SAR Buy Signals.

Below are the commentary and chart from 8/30:

"BSAC is up +0.21% in after hours trading. Given this came up on my scan, I will be keeping a close eye on Banks. The relative strength line for the group is beginning to trend up. The set up is excellent. Price broke above the 50-day EMA and closed above it today. The RSI moved into positive territory and the PMO has bottomed above its signal line. There is a strong OBV positive divergence leading into this rally. Stochastics are back in positive territory. If you're going to go with Banks, this one is a clear outperformer against the group and consequently the SPY. The stop is set at 8.1% or $14.95. I would likely set it a bit deeper to accommodate support, but that is a 9%+ stop."

Here is today's chart:

This one is a bit of a surprise given the sector and industry group it is in, but the chart was strong so I presented it. It pulled back the past two days, but got a giant boost today. I would look at the decline this week as a flag on a flagpole. I expect a breakout as indicators continue to look strong.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Dud:

Vanda Pharmaceuticals Inc. (VNDA)

EARNINGS: 11/2/2022 (AMC)

Vanda Pharmaceuticals, Inc. engages in the development and commercialization of therapies for high unmet medical needs. The firm intends to treat schizophrenia, jet lag disorder, atopic dermatitis, central nervous system disorders, and circadian rhythm sleep disorder. Its product portfolio includes HETLIOZ, Fanapt, Tradipitant, Trichostatin, and AQW051. The company was founded by Mihael Hristos Polymeropoulos and Argeris N. Karabelas in 2002 and is headquartered in Washington, DC.

Predefined Scans Triggered: Improving Chaikin Money Flow, New CCI Buy Signals, Moved Above Upper Bollinger Band, Moved Above Ichimoku Cloud and Parabolic SAR Buy Signals.

Below are the commentary and chart from 8/30:

"VNDA is unchanged in after hours trading. I covered VNDA on April 21st 2021. The position is closed but was up 27%+ before topping and triggering the stop. I hesitated to include this one as the Healthcare sector is very weak right now. However, the Pharma group is showing a tiny bit of rise in its relative strength line. The PMO just triggered a crossover BUY signal. The RSI is now in positive territory, as are Stochastics. Relatively speaking, VNDA is beginning to really outperform. The stop is set at 8.5% around $10.01."

Here is today's chart:

The Pharma group is trending up slightly in relative strength, but VNDA isn't participating. Today it formed a bearish engulfing candlestick that suggests more downside ahead. Support is nearby, but I don't like where this chart is going right now. Certainly you could play "wait and see" as far as support holding, but best to watch list this one or concentrate on new "Diamonds in the Rough" next week.

THIS WEEK's Sector Performance:

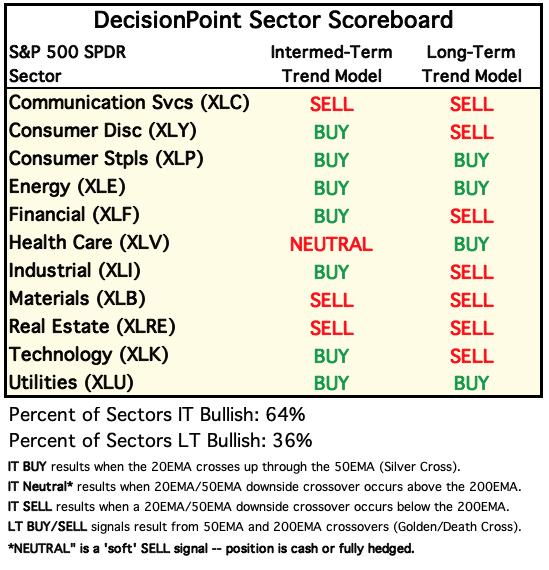

DecisionPoint Sector Scoreboard (Mechanical Trend Model Signals):

Click Here to view Carl's annotated Sector ChartList!

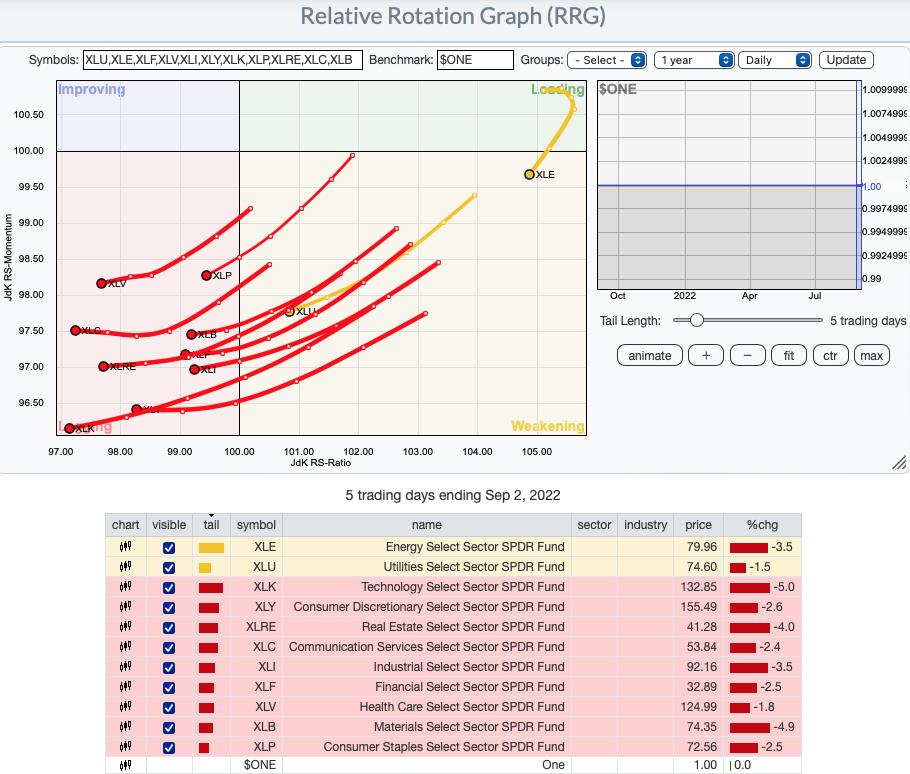

RRG® Daily Chart ($ONE Benchmark):

Ugly RRG. It basically tells us what we already know. There is no place to hide out. Every single sector has a bearish heading, with the exception of XLC and XLI which are trying to turn northward. Those small improvements are not enough to start engaging in trading.

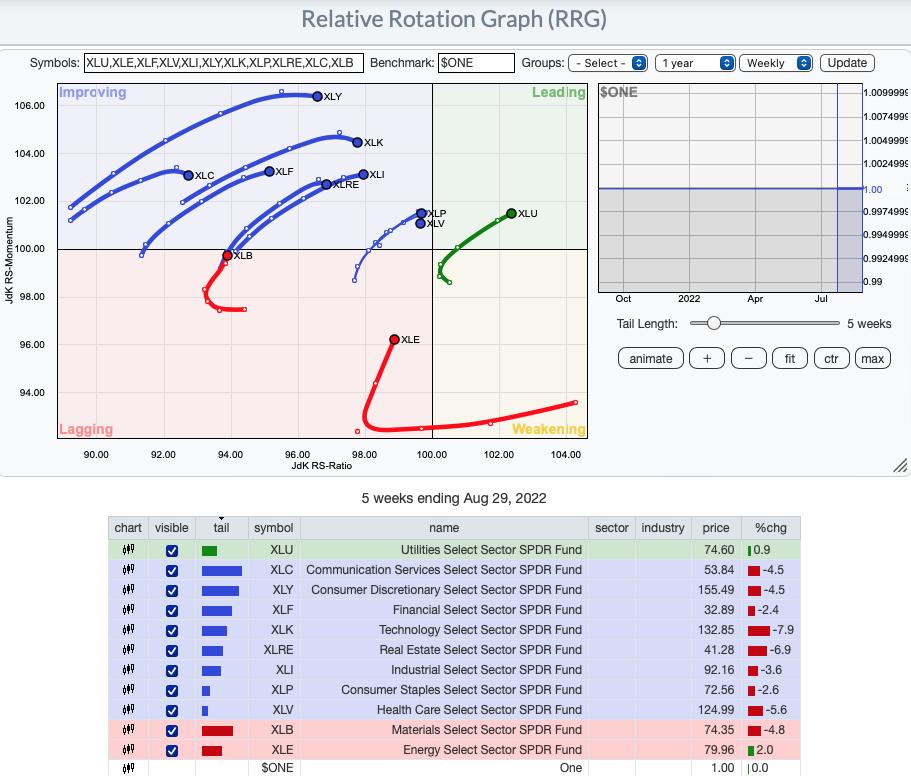

RRG® Weekly Chart ($ONE Benchmark):

The weekly RRG is deteriorating very slowly. All of the sectors were enjoying bullish northeast headings, but they are deteriorating with XLY, XLK, XLC, XLV and XLRE showing moves southward. XLU is in Leading and has performed better than the others, but again, we don't feel any sector is safe right now.

RRG® charts show you the relative strength and momentum for a group of stocks. Stocks with strong relative strength and momentum appear in the green Leading quadrant. As relative momentum fades, they typically move into the yellow Weakening quadrant. If relative strength then fades, they move into the red Lagging quadrant. Finally, when momentum starts to pick up again, they shift into the blue Improving quadrant.

CLICK HERE for an animated version of the RRG charts.

Sector to Watch: Energy (XLE)

We're going with Energy again this week. It is the only sector showing improvements in participation and already has a solid foundation given the Silver Cross Index (SCI) and Golden Cross Index (GCI) are over 90%. More stocks are moving above their 20/50/200-day EMAs. If any sector has a chance to improve further, it would be Energy. Still, be careful until Crude Oil begins to show more strength.

Industry Group to Watch: Gold Miners (GDX)

I'm really going out on a limb here. I think GDX has some opportunity to improve and will probably catch investor's eyes next week. If it continues to rally, there are going to be some exceptional bargains. The problem is it hasn't overcome resistance and there is zero participation. Watch this chart next week. If we get the breakout and see stocks begin to move above their 20-day EMAs, we may be able to catch a ride higher. This means the inverse ETF I presented on Wednesday (DUST) should be reconsidered.

Go to our Sector ChartList on DecisionPoint.com to get an in-depth view of all the sectors. On StockCharts.com you can find the Industry Summary.

Have a great weekend! Good Luck & Good Trading!

- Erin

erin@decisionpoint.com

Full Disclosure: I'm 15% exposed.

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

Technical Analysis is a windsock, not a crystal ball. --Carl Swenlin

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

(c) Copyright 2022 DecisionPoint.com