I apologize for the delay in publishing today. We had a family medical emergency on top of my travel home. Everyone is fine, but Mom has been admitted to the hospital. Prayers are welcomed.

I managed to find five interesting stocks for you to view. Healthcare is showing strength and interestingly I saw quite a few industrials in my scan results. Forgive my brevity tonight.

Good Luck & Good Trading!

Erin

Today's "Diamonds in the Rough": HRB, HRMY, MIRM, PGTI and VTYX.

RECORDING LINK (7/1/2022):

Topic: DecisionPoint Diamond Mine (7/1/2022) LIVE Trading Room

Start Time: Jul 1, 2022 09:00 AM

Meeting Recording Link

Access Passcode: July@1st

REGISTRATION FOR Friday 7/8 Diamond Mine:

When: Jul 8, 2022 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (7/8/2022) LIVE Trading Room

Register in advance for this webinar HERE

Save the registration confirmation email with login instructions in case Zoom doesn't notify you in time.

Free DP Trading Room (7/5/2022) RECORDING LINK:

Topic: DecisionPoint Trading Room

Start Time: Jul 5, 2022 08:55 AM

Meeting Recording Link

Access Passcode: July$5th

For best results, copy and paste the access code to avoid typos.

Welcome to DecisionPoint Daily Diamonds, wherein I highlight ten "Diamonds in the Rough" per week. These are selected from the results of my DecisionPoint Scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

"Predefined Scans Triggered" are taken from StockCharts.com using the "Symbol Summary" option instead of a "SharpChart" on the workbench.

H & R Block, Inc. (HRB)

EARNINGS: 8/11/2022 (AMC)

H&R Block, Inc. engages in the provision of tax preparation and other services. The firm offers assisted income tax return preparation and related services through a system of retail offices operated directly by the company or by franchisees. It also develops and markets DIY income tax preparation software online, as well as through third-party retail stores and direct mail, and provides DIY tax services, including federal and state income tax returns, access to tax tips, advice, and tax-related news, use of calculators for tax planning, and error checking and electronic filing. In addition, the company offers Refund Transfers and H&R Block Emerald Prepaid Mastercard, which enables clients to receive their tax refunds, Peace of Mind extended service plans, H&R Block Emerald Advance lines of credit, Tax Identity Shield that provides clients assistance in helping protect their tax identity and access to services to help restore their tax identity, refund advance loans, H&R Block Instant Refund, and H&R Block Pay With Refund services. The company was founded by Henry W. Bloch and Richard A. Bloch on January 25, 1955, and is headquartered in Kansas City, MO.

Predefined Scans Triggered: New 52-week Highs.

HRB was up +0.03% in after hours trading. I covered HRB on March 31st 2021. The position is still open and is up +68.6%. Not sure we'll get that much out of it here, but the chart is quite favorable. My only problem with it is the flat PMO. The RSI is positive and the OBV is confirming the rising trend. Stochastics are rising above 80 and I like relative strength studies. I've set the stop below the late June dip.

The RSI is overbought, so we should be careful in the longer term. The SCTR is about as high as you can get and volume is confirming the trend. It is making new 52-week highs so I'd set an upside target around 14% or $41.90.

Harmony Biosciences Holdings Inc. (HRMY)

EARNINGS: 8/2/2022 (BMO)

Harmony Biosciences Holdings, Inc. is a commercial-stage pharmaceutical company, which engages in the development and commercialization of therapies for the treatment of neurological disorders. Its product, WAKIX, is a molecule with a novel mechanism of action designed to increase histamine signaling in the brain by binding to H3 receptors. The company was founded by Jeffrey S. Aronin on July 25, 2017 and is headquartered in Plymouth Meeting, PA.

Predefined Scans Triggered: Moved Above Upper Keltner Channel, New 52-week Highs, Stocks in a New Uptrend (ADX), Moved Above Upper Price Channel and P&F Double Top Breakout.

HRMY was up +0.18% in after hours trading. I covered HRMY on March 9th 2022. The position was up over 13%, but on the April decline it was stopped out. I love today's breakout to new 52-week highs. The RSI is positive and only slightly overbought. The PMO is rising on an oversold BUY signal and isn't that overbought. Stochastics are rising and oscillating above 80. Relative strength is potent. The stop is set below the breakout point at 8.3%.

Ah, it is at all-time highs, it's not just a new 52-week high. Excellent breakout with weekly RSI positive and the weekly PMO rising on a BUY signal. The SCTR is an exceptional 99.3.

Mirum Pharmaceuticals Inc. (MIRM)

EARNINGS: 8/4/2022 (BMO)

Mirum Pharmaceuticals, Inc. is a biopharmaceutical company. The firm focuses on the development and commercialization of a late-stage pipeline of novel therapies for debilitating liver diseases. Its products include Maralixibat and Volixibat. The company was founded by Niall O'Donnel, Michael Grey and Christopher Peetz in May 2018 and is headquartered in Foster City, CA.

Predefined Scans Triggered: P&F Double Top Breakout.

MIRM was unchanged in after hours trading. I covered MIRM on April 5th 2022. The position is closed. We have a bullish double-bottom pattern that was confirmed with yesterday's breakout. While price closed slightly lower today, it traded above the confirmation line of the double-bottom. The RSI is positive and the PMO just triggered a crossover BUY signal. The OBV isn't confirming given the negative divergence between price tops (rising) and OBV tops (falling). Stochastics just moved above 80 and relative strength is excellent. The stop is set below the 200-day EMA.

The weekly RSI just moved into positive territory and while the PMO is on a SELL signal, it is bottoming. The SCTR is very bullish at 95.5.

PGT, Inc. (PGTI)

EARNINGS: 7/26/2022 (BMO)

PGT Innovations, Inc. engages in the manufacture and supply of windows and doors under the brand names PGT Custom Windows + Doors, CGI, WinDoor, Western Window Systems, Eze-Breeze, and CGI Commercial. It operates through the Southeast and Western geographical segments. The company was founded by Rodney Hershberger in 1980 and is headquartered in Nokomis, FL.

Predefined Scans Triggered: P&F Low Pole.

PGTI was unchanged in after hours trading. There is a nice cup-shaped price bottom and price ventured above the 50-day EMA today. The RSI is positive and the PMO generated a BUY signal today. The OBV is definitely confirming this rising trend. Stochastics are above 80 and relative strength is positive. The stop is set below the May low.

We have a bullish falling wedge on the weekly chart, but price is pushing against long-term resistance. Still, the weekly RSI is rising and the weekly PMO has bottomed. Best part of this chart is the strong OBV positive divergence. The SCTR is acceptable, but I do prefer to see them at least above 70. Upside potential is over 29%.

Ventyx Biosciences Inc. (VTYX)

EARNINGS: 8/11/2022 (AMC)

Ventyx Biosciences, Inc. is a clinical-stage biopharmaceutical company, which focuses on developing novel small molecule therapeutics for the treatment of autoimmune diseases. Its clinical stage pipeline includes VTX958, a Phase 1 allosteric TYK2 inhibitor for the treatment of a broad range of autoimmune diseases, VTX002, a Phase 2-ready S1P1 receptor modulator for the treatment of ulcerative colitis, and VTX2735, a Phase 1-ready peripheral inhibitor of the NLRP3 inflammasome, which is a mediator of multiple inflammatory conditions. The company was founded on November 21, 2018 and is headquartered in Encinitas, CA.

Predefined Scans Triggered: Bullish MACD Crossovers.

VTYX is unchanged in after hours trading. It hasn't quite broken out yet, but the chart is shaping up. The RSI is negative, but rising. The PMO is rising, but no BUY signal yet. Stochastics are above 50 and rising. Relative strength is improving. There is a tiny filled black candlestick, so be sure to time your entry or wait for the breakout. The stop is set below support at the late April and mid-May lows.

The weekly chart doesn't have much information, but the weekly RSI is rising. I don't care for the drop on the OBV. Probably best to wait on the breakout. If it does breakout, it has potential to reach the Q2 high.

Don't forget, on Thursdays I look at reader-requested symbols, click HERE to send me an email. I read every email I receive and try to answer them all!

Current Market Outlook:

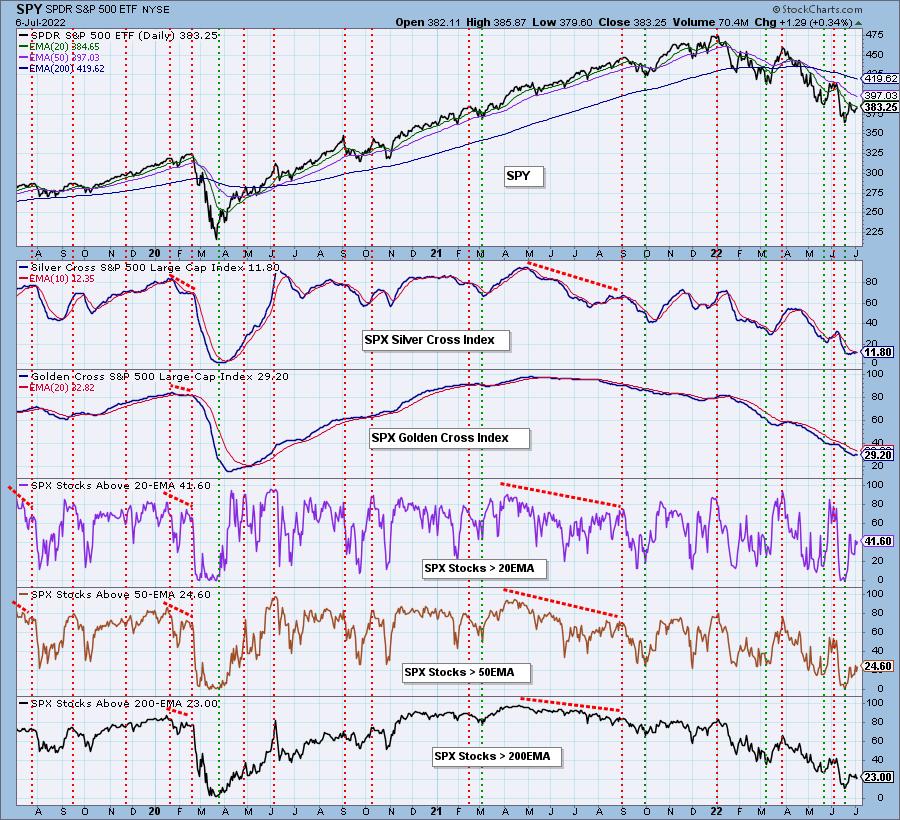

Market Environment: It is important to consider the odds for success by assessing the market tides. The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA)

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA)

Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page.

Here is the current chart:

Full Disclosure: I'm 45% exposed.

I'm required to disclose if I currently own a stock I mention and/or may buy/short it within the next 72 hours.

"Technical Analysis is a windsock, not a crystal ball." - Carl Swenlin

(c) Copyright 2022 DecisionPoint.com

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "Diamonds in the Rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com