It might sound strange that stocks can be in a "bull market" when we're in an overall bear market for the indexes (and most stocks). When I say that a stock is in a "bull market", I mean that the 50-day EMA is above the 200-day EMA; that means, a stock is in a bullish configuration. It hasn't been participating with the indexes and has held its own.

As many know, I've been trying to avoid "reversal plays" while we're in a bear market. One way to avoid that is to insist that the 50-day EMA is above the 200-day EMA. I've not done this 100%, but it is a guideline that I do try to follow.

Being a stock picker and investor in this market environment has been a huge challenge! For myself, I've limited my exposure to 15%. I do see some interesting stocks below that are more defensive in nature and pay dividends, so I could expand my exposure tomorrow or Friday. Today seemed a terrible time to open my exposure...too many filled black candlesticks and bearish engulfing candlesticks.

It may be time to wade back into Energy given its great showing yesterday and today. I'd be very careful right now, but they are on my radar again. Take a look at Cheniere (LNG)--very interesting.

Before I leave... here were the "themes" I found in my scans today: Food Products/Tobacco, Insurance groups as well as Conventional Electricity. I've picked a name in all three as well as a Heavy Construction name that caught my attention.

Good Luck & Good Trading!

Erin

Today's "Diamonds in the Rough": ED, KBR, POST and RLI.

Stocks to Review: UVV, FTS, LNG, BGS, FHI, PCYO, IDA, PUK and LRN.

RECORDING LINK (6/24/2022):

Topic: DecisionPoint Diamond Mine (6/24/2022) LIVE Trading Room

Start Time: Jun 24, 2022 09:02 AM

Meeting Recording Link

Access Passcode: June#24th

REGISTRATION FOR Friday 7/1 Diamond Mine:

When: Jul 1, 2022 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (7/1/2022) LIVE Trading Room

Register in advance for this webinar HERE.

Save the registration confirmation email with login instructions in case Zoom doesn't notify you in time.

Free DP Trading Room (6/27/2022) RECORDING LINK:

Topic: DecisionPoint Trading Room

Start Time: Jun 27, 2022 08:59 AM

Meeting Recording Link

Access Passcode: June#27th

For best results, copy and paste the access code to avoid typos.

Welcome to DecisionPoint Daily Diamonds, wherein I highlight ten "Diamonds in the Rough" per week. These are selected from the results of my DecisionPoint Scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

"Predefined Scans Triggered" are taken from StockCharts.com using the "Symbol Summary" option instead of a "SharpChart" on the workbench.

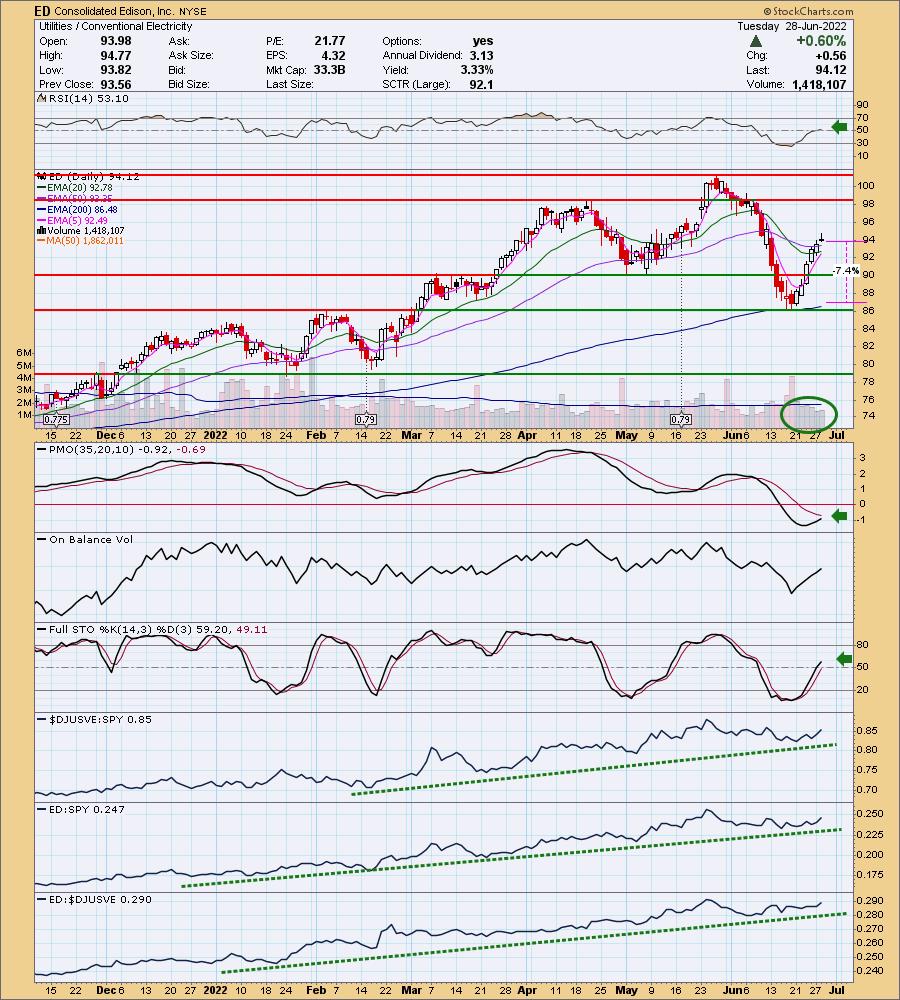

Consolidated Edison, Inc. (ED)

EARNINGS: 8/4/2022 (AMC)

Consolidated Edison, Inc. operates as a holding company, which through its subsidiaries engages in the business of regulated electric, gas, and steam delivery. It operates through the following segments: Consolidated Edison Company of New York(CECONY), Orange and Rockland Utilities(O&R), Con Edison Clean Energy Businesses and Con Edison Transmission. The Consolidated Edison Co. of New York involves regulated electric, gas, and steam utility businesses. The Orange & Rockland Utilities covers regulated electric and gas utility delivery businesses. The Con Edison Clean Energy Businesses develops, owns and operates renewable and energy infrastructure projects and provides energy-related products and services to wholesale and retail customers. The Con Edison Transmission invests in electric and gas transmission projects. The company was founded in 1823 and is headquartered in New York, NY.

Predefined Scans Triggered: Bullish MACD Crossovers, Moved Above Ichimoku Cloud and P&F Low Pole.

ED is up +1.48% in after hours trading. I've covered Edison twice before: March 10th 2020 (position closed) and March 2nd 2022 (position open and up +8.30% despite the June correction). Volume is really come in on ED on this rally off support at the February high. Price blew through the 20/50-day EMAs as well as the May lows. The PMO is about to have a crossover BUY signal. The RSI and Stochastics just hit positive territory. Relative strength has been pretty good overall this year despite the bear market. I've set the stop below the March lows and at the 200-day EMA; however, you could certainly tighten this up to just below the May low.

This bounce also occurred on very strong support at the 2019/2020 highs. The weekly RSI is positive and rising. The PMO is a bit suspect but is decelerating. There is a strong positive OBV divergence with price lows and the SCTR is first-rate. If it reaches all-time highs, that would be an 8% gain, but I would expect it to move higher than that. Consider an upside target of 15% around $108.24.

KBR Inc. (KBR)

EARNINGS: 7/28/2022 (BMO)

KBR, Inc. engages in the provision of differentiated professional services and technologies across the asset and program life-cycle within the government services and hydrocarbons industries. It operates through the following segments: Government Solutions, Technology Solutions, Energy Solutions, Non-strategic Business, and Other. The Government Solutions segment provides full life-cycle support solutions to defense, space, aviation, and other programs and missions for military and other government agencies. The Technology Solutions segment combines KBR's proprietary technologies, equipment, and catalyst supply and associated knowledge-based services into a global business for refining, petrochemicals, inorganic, and specialty chemicals as well as gasification, syngas, ammonia, nitric acid, and fertilizers. The Energy Solutions segment provides full life-cycle support solutions across the upstream, midstream and downstream hydrocarbons markets. The Non-strategic Business segment represents the operations or activities which the company intends to exit upon completion of existing contracts. The Other segment includes corporate expenses and general and administrative expenses not allocated to the business segments above. The company was founded on March 21, 2006 and is headquartered in Houston, TX.

Predefined Scans Triggered: Bullish MACD Crossovers.

KBR is unchanged in after hours trading. There is a huge double-bottom chart pattern forming. It will be confirmed with a breakout above $52, so we're not there yet. The bottoms have a positive divergence with the OBV (notice the huge spike in volume on Friday). Price did pull back today, but remains above the 5/20-day EMAs. The RSI is positive and the PMO is in the process of generating a crossover BUY signal. Stochastics are rising and just hit positive territory. Relative strength is pretty good overall. You can deepen the stop to below the double-bottom, but I don't believe that is necessary. If price pulls back below the 200-day EMA, you'd probably want to remove it.

The weekly chart isn't that great unfortunately. The weekly RSI is turning lower in negative territory and the weekly PMO is in decline. However, that double-bottom coming off the 2021 top looks very interesting. Upside potential is almost 20%.

Post Holdings, Inc. (POST)

EARNINGS: 8/4/2022 (AMC)

Post Holdings, Inc. operates as a consumer packaged goods holding company. The firm engages in the operation of center-of-the-store, refrigerated, food service, food ingredient, active nutrition, and private brand food categories. It operates through the following segments: Post Consumer Brands, Weetabix, Foodservice, Refrigerated Retail and BellRing Brands. The Post Consumer Brands segment manufactures, markets, and sells branded and private label ready-to-eat (RTE) cereal and hot cereal products. The Weetabix segment focuses on the marketing and distribution of branded and private label RTE cereal products. The Foodservice segment includes egg and potato products. The Refrigerated Retail segment produces and/or distributes egg products, sausage, side dishes, cheese, and other refrigerated products to retail and foodservice customers. The BellRing Brands segment consists of ready-to-drink (RTD) protein shakes, other RTD beverages, powders, and nutrition bars. The company was founded by Charles William Post in 1895 and is headquartered in St. Louis, MO.

Predefined Scans Triggered: New 52-week Highs, P&F Double-Top Breakout and P&F Triple Top Breakout.

POST is unchanged in after hours trading. POST is very interesting on the pullback today. It reached new 52-week highs, broke out and then pulled back. This seems natural after a near vertical rally. The indicators are still looking good with the PMO nearing a crossover BUY signal. The RSI positive and Stochastics are rising after reaching above 80 today. Relative strength is excellent and I like this defensive area of the market. Kellogg's (K) chart looks interesting too, but POST came through in my scans and I like that it is making new highs. The stop can be set thinly at 6%.

The weekly chart is very strong. The weekly RSI has been in positive territory the entire 2nd quarter. The PMO just bottomed above its signal line and is not at all overbought. The SCTR is excellent. Since it is flirting with all-time highs, consider an upside target of 15% around $93.77.

RLI Corp. (RLI)

EARNINGS: 7/20/2022 (AMC)

RLI Corp. operates as a holding company, which engages in the provision of insurance and underwriting services. It operates through the following segments: Casualty, Property and Surety. The Casualty segment offers healthcare and transportation insurance. The Property segment consists of commercial fire, earthquake, difference in conditions, marine, facultative and treaty reinsurance, including crop and select personal lines policies, including pet insurance and homeowners reinsurance services. The Surety segment engages in writing contract surety coverage, licenses and bonds for commercial, energy and industrial sectors. The company was founded by Gerald D. Stephens in 1965 and is headquartered in Peoria, IL.

Predefined Scans Triggered: Moved Above Ichimoku Cloud and Bullish MACD Crossovers.

RLI is unchanged in after hours trading. We have a "V" bottom price pattern that implies a breakout above the May top. There is a positive OBV divergence with price lows. The RSI is positive and rising. Stochastics just hit positive territory and are rising. Relative strength is very good. The stop is set below the 200-day EMA.

The weekly RSI is positive and not overbought. Price has popped back above strong overhead resistance at the 2021 highs. The weekly PMO is bottoming above its signal line which is especially bullish.

Don't forget, on Thursdays I look at reader-requested symbols, click HERE to send me an email. I read every email I receive and try to answer them all!

Current Market Outlook:

Market Environment: It is important to consider the odds for success by assessing the market tides. The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA)

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA)

Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page.

Here is the current chart:

Full Disclosure: I'm 15% exposed.

I'm required to disclose if I currently own a stock I mention and/or may buy/short it within the next 72 hours.

"Technical Analysis is a windsock, not a crystal ball." - Carl Swenlin

(c) Copyright 2022 DecisionPoint.com

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "Diamonds in the Rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com