Thank you for sending in your requests! Most of them came from the industry group themes we have had lately. I am still very bullish on Utilities and Consumer Staples. Biotechs still are interesting, but as I told one subscriber, I would be very careful trading leveraged Biotech ETFs like LABU. These stocks are already volatile and adding that extra "juice" is extra dangerous.

I had many ask me about my huge increase in exposure yesterday. I had quite a few symbols to add and should've position sized a bit smaller. I'm in the process of paring that down to 40% by selling small portions of the positions into strength. There are finally pockets of strength to take advantage of so that is what I am doing. EVERY position has a stop.

Tomorrow is the Diamond Mine trading room! We will check out this week's Diamonds, do an in-depth sector/industry group review followed by "mining" for symbols and then taking symbol requests. Register now!

Thank you to those who made it to my TradersCorner trading demo this morning. I had some technical issues so we got started late, but overall it went well. The recording should be sent to registrants. I don't have a copy of the recording, but I can send you a copy of my PowerPoint slides if you'd like.

Good Luck & Good Trading!

Erin

Today's "Diamonds in the Rough": AMPH, AVA, KHC, RBA and STRO.

Other Requests: AMZN, PYPL, LABU, ELV, MCK, K, JKS, MRCY, EBR, RGA, SR, TAC, DXPE.

RECORDING LINK (6/24/2022):

Topic: DecisionPoint Diamond Mine (6/24/2022) LIVE Trading Room

Start Time: Jun 24, 2022 09:02 AM

Meeting Recording Link

Access Passcode: June#24th

REGISTRATION FOR Friday 7/1 Diamond Mine:

When: Jul 1, 2022 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (7/1/2022) LIVE Trading Room

Register in advance for this webinar HERE.

Save the registration confirmation email with login instructions in case Zoom doesn't notify you in time.

Free DP Trading Room (6/27/2022) RECORDING LINK:

Topic: DecisionPoint Trading Room

Start Time: Jun 27, 2022 08:59 AM

Meeting Recording Link

Access Passcode: June#27th

For best results, copy and paste the access code to avoid typos.

Welcome to DecisionPoint Daily Diamonds, wherein I highlight ten "Diamonds in the Rough" per week. These are selected from the results of my DecisionPoint Scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

"Predefined Scans Triggered" are taken from StockCharts.com using the "Symbol Summary" option instead of a "SharpChart" on the workbench.

Amphastar Pharmaceuticals, Inc. (AMPH)

EARNINGS: 8/8/2022 (AMC)

Amphastar Pharmaceuticals, Inc. engages in developing, manufacturing, marketing, and selling technically challenging generic and proprietary injectable, inhalation, and intranasal products, and insulin active pharmaceutical ingredient. It operates through Finished Pharmaceutical Products and Active Pharmaceutical Ingredients Products segments. The Finished Pharmaceutical Products segment manufactures, markets, and distributes Primatene Mist, enoxaparin, naloxone, phytonadione, lidocaine, and other critical and non-critical care drugs. The Active Pharmaceutical Ingredients Products segment offers RHI API and porcine insulin API for external customers and internal product development. The company was founded by Zi-Ping Luo and Yong Feng Zhang on February 29, 1996 and is headquartered in Rancho Cucamonga, CA.

Predefined Scans Triggered: None.

AMPH is unchanged in after hours trading. I covered this one last month on May 17th 2022. The position was doing well until that June two-day correction took out the stop. There was a large bearish double-top, but it never reached its minimum downside target. Instead price rebounded off the 200-day EMA. It's been on a steady rally since and today broke above the 50-day EMA. The RSI is positive, rising and not overbought. The PMO triggered a crossover BUY signal and Stochastics are rising in positive territory. Relative strength studies show the group is enjoying outperformance. Since the correction, AMPH has been outperforming. The stop is set below the late May lows.

This bounce didn't come of horizontal support, but it did bounce off the 43-week EMA. The weekly RSI is back in positive territory and the weekly PMO is starting to decelerate. The SCTR is top-notch at 97.5.

Avista Corp. (AVA)

EARNINGS: 8/3/2022 (BMO)

Avista Corp. is a holding company, which engages in the provision of electric and natural gas utility business. It operates through the Avista Utilities, and Alaska Electric Light and Power Company (AEL&P) segments. The Avista Utilities segment includes electric distribution and transmission, and natural gas distribution services in parts of eastern Washington, Northern Idaho, and Northeastern and Southwestern Oregon. The AEL&P segment offers electric services in Juneau. The company was founded on March 13, 1889 and is headquartered in Spokane, WA.

Predefined Scans Triggered: None.

AVA is unchanged in after hours trading. I covered AVA on February 26th 2020. The COVID crash took this position out. It is set up well again, but bear markets can take everything with it. Hence the reason stops are required. There is now a double-bottom forming. It won't be confirmed until we get a breakout above the confirmation line at the May top. The RSI is positive, the PMO is on a BUY signal and Stochastics are above 80. Relative strength is excellent across the board. You can set a thin stop below the February low.

This is a trading range type stock. The upside potential is about 10.5%. Given the tight stop this is an appropriate upside target, but I do expect it to breakout further given the newly positive weekly RSI and weekly PMO that is bottoming. The SCTR is excellent.

Kraft Heinz Co. (KHC)

EARNINGS: 7/27/2022 (BMO)

The Kraft Heinz Co. engages in the manufacture and market of food and beverage products. The firm operates through the following geographical segments: United States, Canada and International. Its brands include Oscar Meyer, Velveeta, Smart Ones, Caprisun, Kool-Aid, Golden circle and Honig. The company was founded on July 2, 2015, and is headquartered in Pittsburgh, PA.

Predefined Scans Triggered: P&F Double Top Breakout.

KHC is down -0.42% in after hours trading. I covered KHC on December 14th 2021. The position is still open and up +9.66%. This stock is in an area I like, but this stock in particular is looking a bit shaky for two reasons. Stochastics have turned down and price is struggling at the 50-day EMA. On the flip side there is plenty to like. The RSI is positive and the PMO is on an oversold BUY signal. This could be the formation of a bull flag as price consolidates above support at the 200-day EMA and January price top. It is performing somewhat poorly against its group over the past week, but overall it does tend to outperform the group and is doing just fine against the SPY. The stop is set below the lowest close in June.

The weekly chart shows us this is another trading range type stock, at least it has been through 2021 and 2022. The weekly RSI is almost to positive territory. The weekly PMO has decelerated and looks ready to bottom. The SCTR is bullish at 87.9%. I like to find stocks with a SCTR at least above 60, but best case is above 75. Upside potential if it reaches the top of the trading range is almost 17%.

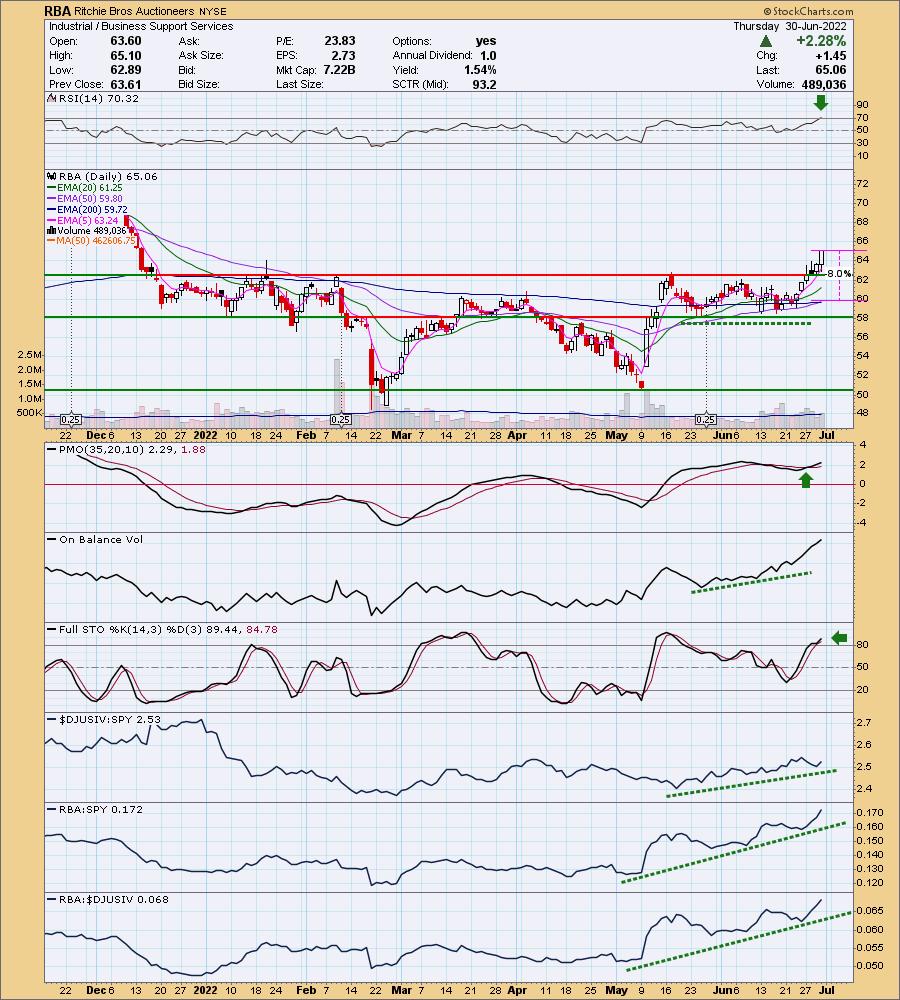

Ritchie Bros Auctioneers (RBA)

EARNINGS: 8/4/2022 (AMC)

Ritchie Bros. Auctioneers, Inc. is an industrial auctioneer, which engages in the sale of equipment to on-site and online bidders. It operates through the following segments: Auctions and Marketplaces, Ritchie Bros. Financial Services and Mascus. The Auctions and Marketplaces segment consists of live on site auctions, online auctions and marketplaces, and brokerage service. The Ritchie Bros. Financial Services segment refers to the financial brokerage service. The Mascus segment includes online listing service. The company was founded by David Edward Ritchie in 1958 and is headquartered in Burnaby, Canada.

Predefined Scans Triggered: P&F Low Pole.

RBA is up +0.06% in after hours trading. I covered this one back on June 22nd 2021. The position was up over 20%, but ultimately the stop was triggered on the gap down in February. The PMO gave us plenty of warning with a crossover SELL signal in overbought territory back at the end of November, before that 20% gain evaporated.

This was probably my favorite chart of the day and is very tempting for me. The RSI just hit overbought territory. That is the only negative I see on this chart right now. Price strongly broke out this week. Today we have a brand new "Golden Cross" LT Trend Model BUY signal. The PMO triggered a BUY signal this week. The OBV held a strong positive divergence with price lows going into this rally. Stochastics are above 80 and rising again. Relative strength is excellent for the group and RBA is clearly outperforming both the group and the SPY. The stop is set at the 200-day EMA.

The breakout looks great on the weekly chart too. My only concern is that overhead resistance at the 2021 Q2 top is arrive soon. The weekly RSI is positive, rising and not overbought. The weekly PMO just hit positive territory after triggering an oversold crossover BUY signal. The SCTR is an excellent 93.2.

Sutro Biopharma Inc. (STRO)

EARNINGS: 8/9/2022 (AMC)

Sutro Biopharma Inc. engages in the drug discovery, development and manufacture of pharmaceutical products. It focuses on the next generation cancer and autoimmune therapeutics. The company was founded by James R. Swartz and Sutanto Widjaja on April 21, 2003 and is headquartered in South San Francisco, CA.

Predefined Scans Triggered: Hollow Red Candles.

STRO is down -2.60% in after hours trading (typical volatile Biotech). I like this group, but would be careful with picks in the group as they vary widely on volatility. This is one that has potential for deep swings because it is priced so low. Position size appropriately. The chart is firming up. It has a hollow red candlestick and that is bullish for the next day. It tells us that price did close higher than the open, but it wasn't able to close above the previous day's close. This suggests bulls are taking control. Price is holding above support, but it is struggling to overcome the 50-day EMA, although it closed on it today. The RSI is positive, volume is definitely coming in, Stochastics are rising and the PMO is on an oversold BUY signal, rising strongly. Relative performance of the group has been exceptional. STRO has been increasing outperformance, but it is still mild. I've set the stop just below the earlier June top.

We have to be very careful here. It is coming off all-time lows, not support. This is a very beat down stock within a bear market so use extreme caution. The weekly RSI is rising out of oversold territory. The weekly PMO has turned up. The SCTR is an anemic 26.5%. This means that of all small-cap stocks in its "universe", it's relative performance lists it near the bottom quartile among its brethren. If price can recapture prior support at the 2019/2020 lows, that would be a sizable 40%+ gain. I'm not convinced it will reach it though.

Don't forget, on Thursdays I look at reader-requested symbols, click HERE to send me an email. I read every email I receive and try to answer them all!

Current Market Outlook:

Market Environment: It is important to consider the odds for success by assessing the market tides. The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA)

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA)

Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page.

Here is the current chart:

Full Disclosure: I'm 50% exposed. I'll be paring back to 40% as I'm able.

I'm required to disclose if I currently own a stock I mention and/or may buy/short it within the next 72 hours.

"Technical Analysis is a windsock, not a crystal ball." - Carl Swenlin

(c) Copyright 2022 DecisionPoint.com

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "Diamonds in the Rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com