I did not expand my portfolio as I had thought I would. I'm skittish about current market churn. I do regret not getting into yesterday's Energy stock, but I got to the computer too late to make the purchase. I have two more Energy stocks for you as well as a Technology find.

One interesting theme in the scan results was Hotels. I nearly included two, PEB and PLYA. They are on the "Stocks to Review". I'm contemplating PUMP for purchase along with yesterday's LFG which was a big winner today. I'm trying to be careful with too much exposure in one sector (Energy), but winners do seem to keep on winning now that Crude Oil has broken out.

Tomorrow is Reader Request Day! Send your symbols in. It isn't a "test or quiz", I will often include symbols that have something to say even if they aren't really "Diamonds in the Rough". Use this link to easily send. Continue to be careful out there and make sure those stops are set!

Good Luck & Good Trading,

Erin

Today's "Diamonds in the Rough": HOLI, PBF and PUMP.

Stocks to Review: PKG, NEWT, UTI, MED, PEB and PLYA.

RECORDING LINK (5/27/2022):

Topic: DecisionPoint Diamond Mine 5/27/2022) LIVE Trading Room

Start Time: May 27, 2022 09:00 AM

Meeting Recording Link.

Access Passcode: MayDP#27

REGISTRATION FOR Friday 6/3 Diamond Mine:

When: Jun 3, 2022 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (6/3/2022) LIVE Trading Room

Register in advance for this webinar HERE.

** Save the registration confirmation email with login instructions in case Zoom doesn't notify you in time.**

Free DP Trading Room (5/31) RECORDING LINK:

Topic: DecisionPoint Trading Room

Start Time: May 31, 2022 08:59 AM

Meeting Recording Link.

Access Passcode: May#31st

For best results, copy and paste the access code to avoid typos.

Welcome to DecisionPoint Daily Diamonds, wherein I highlight ten "Diamonds in the Rough" per week. These are selected from the results of my DecisionPoint Scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

"Predefined Scans Triggered" are taken from StockCharts.com using the "Symbol Summary" option instead of a "SharpChart" on the workbench.

Hollysys Automation Technologies, Ltd. (HOLI)

EARNINGS: 8/10/2022 (AMC)

HollySys Automation Technologies Ltd. is a holding company, which engages in the provision of automation control system solutions. It operates through the following segments: Industrial Automation, Rail Transportation and Mechanical and Electrical Solution. The Industrial Automation segment consists of third-party hardware-centric products such as instrumentation and actuators; its proprietary software-centric distributed control systems and programmable logic controller; and valued-added software packages. The Rail Transportation segment includes train control center and automation train protection. The Mechanical and Electrical Solution segment offers design, engineering, procurement, project management, construction and commissioning, and maintenance related services to railway transportation. The company was founded by Bai Qing Shao, Chang Li Wang, and An Luo in March 1993 and is headquartered in Beijing, China.

Predefined Scans Triggered: None.

HOLI is down -0.26% in after hours trading. I covered HOLI way back on September 9th 2020. Unbelievably, the position is still open and currently up +42.9%, but it was up over 97% at the high. I can't promise that kind of return this time, but despite shaky trading the last two days, HOLI has been doing just fine (currently up +2.25% on the week). Today price moved above all key moving averages. The RSI is just now positive and the PMO just triggered a crossover BUY signal today. Stochastics are still negative, but are gently rising. Relative strength is very good in the longer term but a little suspect in the short term given it is performing inline with the SPY. However, this trade is meant to trade with the SPY if we get that bear market rally that everyone keeps talking about. The stop is set below support.

The weekly chart is beginning to gel. The weekly RSI just recaptured positive territory and the weekly PMO is attempting to turn up above the signal line. OBV is confirming the rising trend. I've made the upside target modest on purpose. I'm not sure how much we'll get out of this one so best to be conservative.

PBF Energy Inc. (PBF)

EARNINGS: 7/28/2022 (BMO)

PBF Energy, Inc. engages in the operation of a petroleum refiner and supplies unbranded transportation fuels, heating oil, petrochemical feed stocks, lubricants, and other petroleum products in the United States. It operates through the following segments: Refining and Logistics. The Refining segment refines crude oil and other feed stocks into petroleum products. The Logistics segment owns, leases, operates, develops, and acquires crude oil and refined petroleum products terminals, pipelines, storage facilities, and logistics assets. The company was founded on March 1, 2008 and is headquartered in Parsippany, NJ.

Predefined Scans Triggered: Moved Above Upper Keltner Channel, Moved Above Upper Bollinger Band, P&F Ascending Triple Top Breakout and P&F Double Top Breakout.

PBF is up +1.07% in after hours trading. I've covered PBF three times before, May 6th 2021 (position closed), January 6th 2022 (position is up +123.5%) and May 3rd 2022 (position is up +13.0%). I know it has only been about a month since I presented this one, but it is worth a repeat on the recent breakout. The RSI just hit overbought territory, but this is likely a winner that will keep on winning. The PMO is about to trigger a crossover BUY signal. The OBV is confirming the breakout with a new high of its own. Stochastics are rising while oscillating above 80 telling us it has internal strength. Relative strength is excellent for this Energy stock. The stop is set below the early May top.

This breakout is impressive on the weekly chart. We've now surpassed the 2019 highs. The weekly RSI is overbought, but it can remain so if this one keeps running higher. The SCTR is top notch spending all of its time well above 90 all year long. Upside potential if it reaches the 2018 high would be over 47%.

ProPetro Holding Corp. (PUMP)

EARNINGS: 8/2/2022 (AMC)

ProPetro Holding Corp. is an oilfield services company that engages in the provision of hydraulic fracturing and other complementary services. It operates through the following segments: Hydraulic Fracturing, Cementing, Coil Tubing, Flowback, and Drilling. The Hydraulic Fracturing segment intends to optimize hydrocarbon flow paths during the completion phase of horizontal shale wellbores. The Cementing segment provides isolation between fluid zones behind the casing to minimize potential damage to hydrocarbon bearing formations or the integrity of freshwater aquifers and provides structural integrity for the casing by securing it to the earth. The Coil Tubing segment involves injecting coiled tubing into wells to perform various completion well intervention operations. The Flowback segment consists of production testing, solids control, hydrostatic testing and torque services. The company was founded by Dale Redman and Jeffrey David Smith in 2005 and is headquartered in Midland, TX.

Predefined Scans Triggered: New CCI Buy Signals.

PUMP is up +1.18% in after hours trading. Price broke out above the confirmation line of the double-bottom pattern. This suggests a move to at least $15. The RSI just hit positive territory and the PMO triggered a crossover BUY signal today. Stochastics are rising and should get above 80 soon. Relative strength for this stock isn't great, but with Crude prices rising, this one should be able to ride the tide. The stop is set just below the confirmation line of the double-bottom pattern.

I wish we had a breakout above the 2021 high, but it is very close and if after hours trading is any indication of rising prices tomorrow, we should see the breakout. The weekly RSI turned up in positive territory. The weekly PMO is on a SELL signal, but the PMO is already reversing toward a BUY signal. The SCTR has been above 90 all of 2022. I've set the upside target to the 2018 high.

Don't forget, on Thursdays I look at reader-requested symbols, click HERE to shoot me an email. I read every email I receive and try to answer them all!

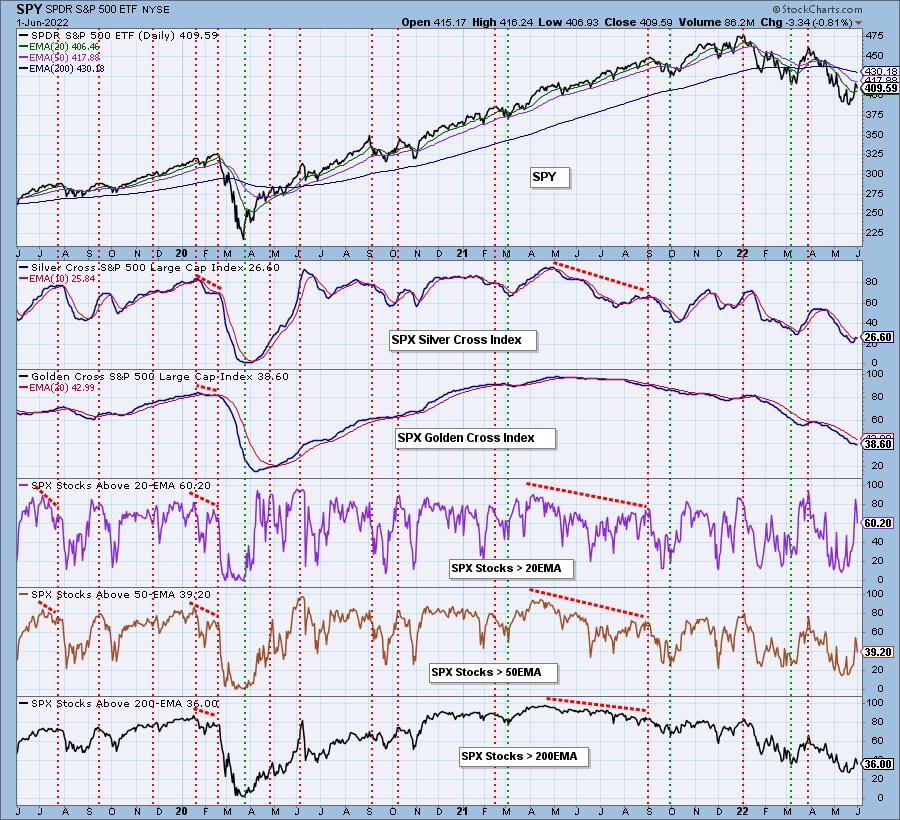

Current Market Outlook:

Market Environment: It is important to consider the odds for success by assessing the market tides. The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA)

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA)

Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page.

Here is the current chart:

Full Disclosure: I'm 15% exposed. I'm considering a purchase of LFG, PBF, PUMP and HOLI.

I'm required to disclose if I currently own a stock and/or may buy/short it within the next 72 hours.

"Technical Analysis is a windsock, not a crystal ball." - Carl Swenlin

(c) Copyright 2022 DecisionPoint.com

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "Diamonds in the Rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com