Today, I didn't see much of a "theme" within my scan results, except to say that results were thinner than usual. That is a theme I don't like... the market hits new intraday all-time highs but there are fewer stocks to choose from? Pockets of strength have been developing though.

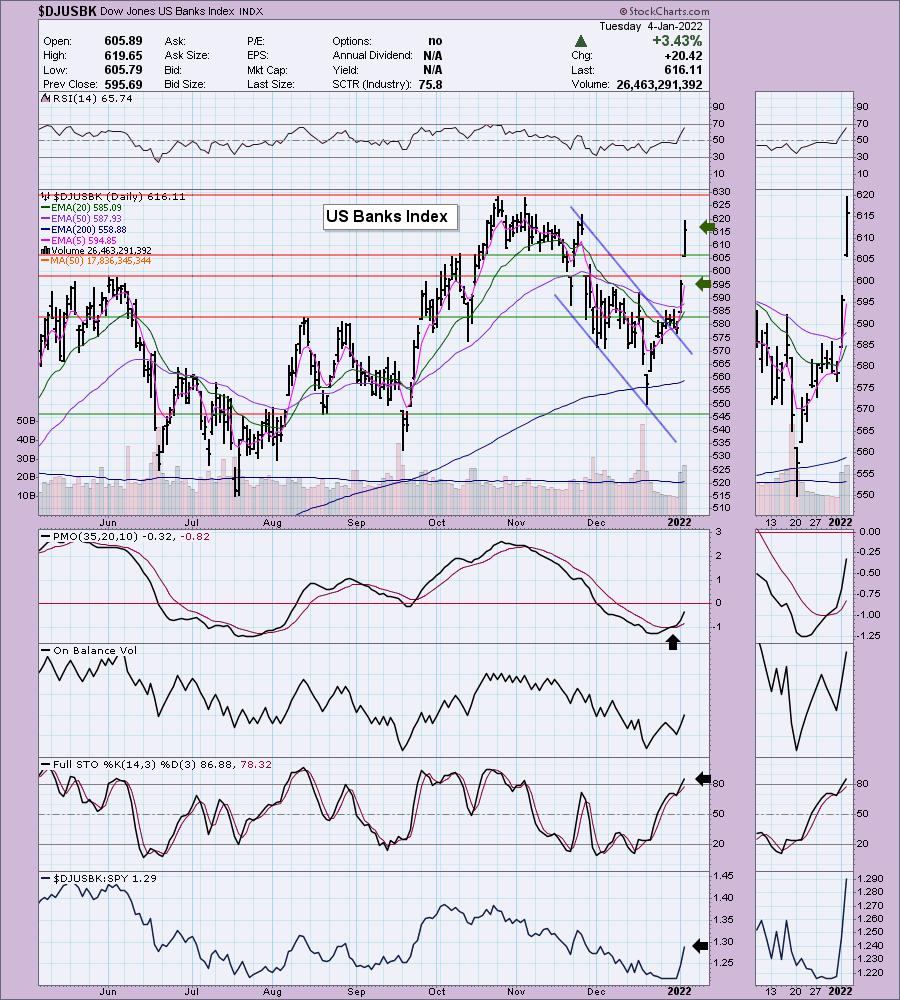

I mentioned Banks as a theme back on 12/9 along with a handful of others. I emphasized them again on 12/22. They appeared heavily in my scan results, but I didn't think they were quite ready for primetime as a "Diamond in the Rough". Monday they broke out strongly and today saw incredible follow-through. Below is the Banks Index chart. You can see the break from the declining trend. When I presented this chart on Wednesday of last week, I expressed concern that resistance hadn't been broken at the 50-day EMA.

On Wednesday I did give you a handful of bank stocks that I liked. I've added them to the "Stocks to Review" today and I picked my favorite from Wednesday's list to present today.

Today's "Diamonds in the Rough": PLL, TBK, TTEK and VRTV.

"Stocks to Review": AX, CNOB, LOB, NBHC, SBSI, and TBK.

RECORDING LINK Thursday (12/30):

Topic: DecisionPoint Diamond Mine THURSDAY (12/30/2021) LIVE Trading Room

Start Time: Dec 30, 2021 09:00 AM

Meeting Recording Link.

Access Passcode: Diamond#30

REGISTRATION FOR 1/7 Diamond Mine:

When: Jan 7, 2022 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (1/7/2022) LIVE Trading Room

Register in advance for this webinar HERE.

Save the registration confirmation email with login instructions in case Zoom doesn't notify you in time.

Free DP Trading Room (12/27) RECORDING LINK:

Topic: DecisionPoint Trading Room

Start Time: Dec 27, 2021 09:00 AM

Meeting Recording Link.

Access Passcode: Holiday@2

For best results, copy and paste the access code to avoid typos.

Welcome to DecisionPoint Daily Diamonds, wherein I highlight ten "Diamonds in the Rough" per week. These are selected from the results of my DecisionPoint scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

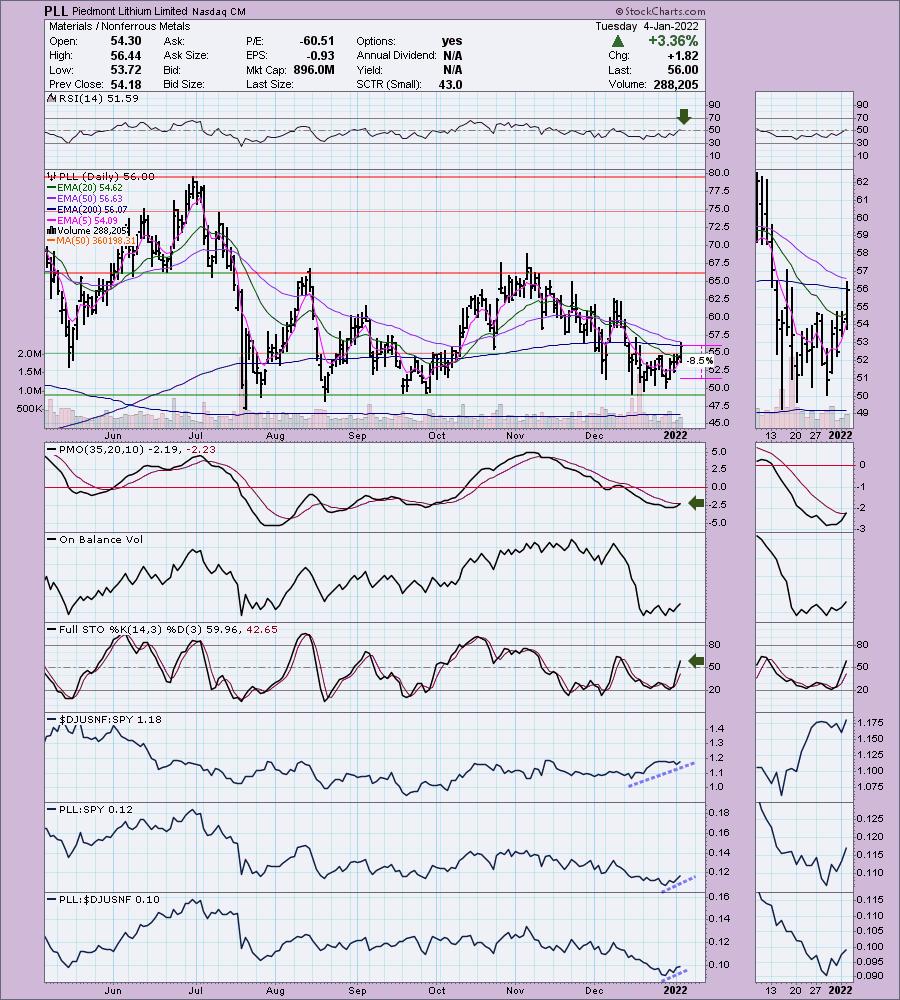

Piedmont Lithium Limited (PLL)

EARNINGS: 3/10/2022 (BMO)

Piedmont Lithium, Inc. is an exploration stage company, which engages in the exploration and development of mineral properties. The firm focuses on developing and manufacturing battery quality lithium hydroxide for the electric vehicle industry. Its projects include Carolina Lithium, Quebec, and Ghana. The company is headquartered in Belmont, NC.

Predefined Scans Triggered: P&F Double top Breakout.

PLL is unchanged in after hours trading. I covered PLL on January 20th 2021. The position did not hit its stop so it is currently up +27.6%. PLL hasn't been too exciting the past six months as it is traveling within a wide trading range. Price is about 1/3rd of the way up into the range. I personally own Lithium, but not this stock. It looks good right now as it has rallied back to the 50/200-day EMAs. Price will need to get back above the 200-day EMA if it wants to avoid a "death cross" with the 50-day EMA. I don't think it will have a problem given the newly positive RSI and new PMO crossover BUY signal. The group has been outperforming most of December and it is beginning to outperform both the SPY and the group. The stop is rather deep as I set it at the early December low.

The weekly chart suggests that if price can reach the top of the current trading range it would be an over 25% gain. The RSI is moving back up toward positive territory, but the PMO is still configured negatively. If it turns up here, that would be an excellent intermediate-term buy signal given it is sitting in oversold territory above the zero line.

Tristate Capital Holdings, Inc. (TSC)

EARNINGS: 1/26/2022 (AMC)

TriState Capital Holdings, Inc. is bank holding company, which provides commercial banking, private banking, and investment management services. It operates through the following segment: Bank, and Investment Management, and Parent and Other. The Bank segment focuses in commercial banking products and services to middle-market businesses and private banking products and services to high-net-worth individuals. The Investment Management segment delivers advisory and sub-advisory investment management services primarily to institutional investors, mutual funds and individual investors. The Parent and Other consists of the general operating activity of the company. The company was founded on May 25, 2006 and is headquartered in Pittsburgh, PA.

Predefined Scans Triggered: Moved Above Upper Keltner Channel, New 52-week Highs, Moved Above Upper Bollinger Band, Moved Above Upper Price Channel and P&F Double Top Breakout.

TSC is unchanged in after hours trading. Today's breakout from the trading range looks fantastic. We could see price pull back toward the breakout point before it continues higher. The RSI is positive and rising and the PMO is nearing a crossover BUY signal. Stochastics have turned up above 80 which suggests internal strength. The group as I noted earlier is taking off... maybe on higher interest rates continuing? It seems to be a consistent outperformer within the group and it is improving its relative strength against the SPY. The stop is set in the middle of the November December trading range, lining up with early November lows.

Love the bull flag breakout and very positive weekly PMO. The weekly RSI is overbought, but it can maintain that condition should the rally continue. It's at all-time highs so consider setting an 18% upside target at around $66.08.

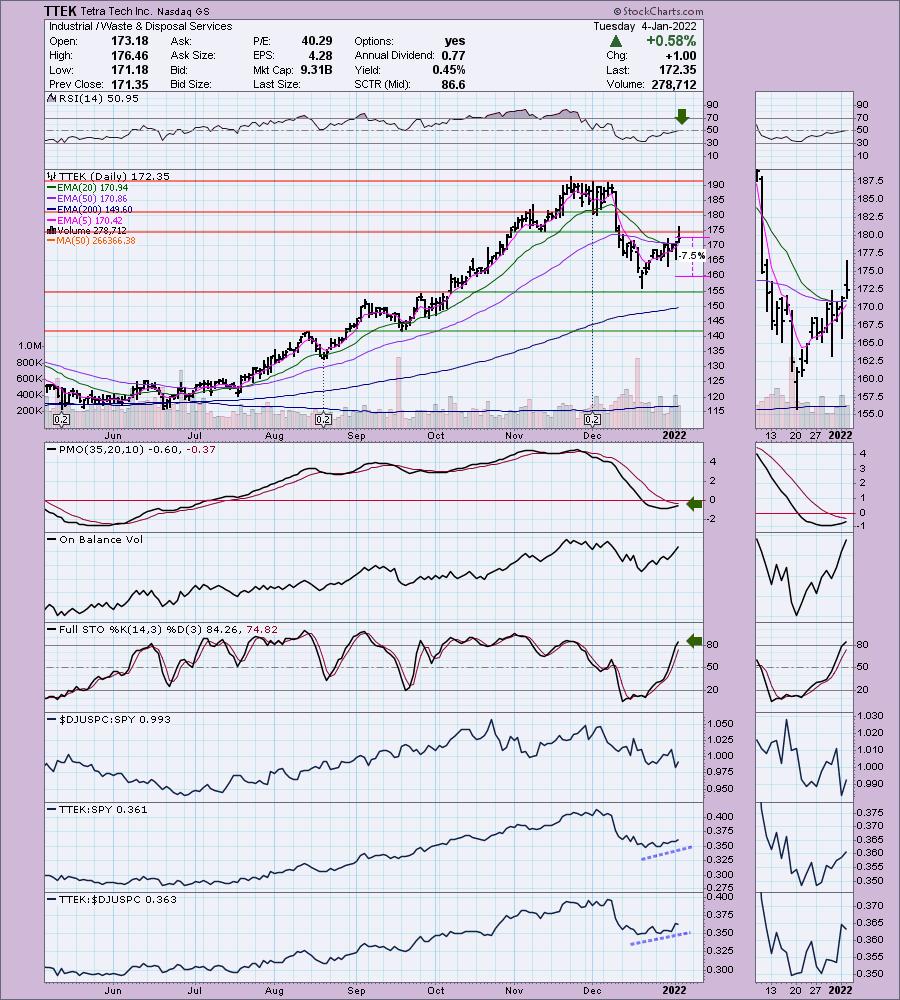

Tetra Tech Inc. (TTEK)

EARNINGS: 1/26/2022 (AMC)

Tetra Tech, Inc. engages in the provision of consulting and engineering services. It operates through the following segments: Government Services Group (GSG), Commercial and International Services Group (CIG), and Remediation and Construction Management (RCM). The GSG segment offers consulting and engineering services primarily to United States government clients such as federal, state and local, and development agencies worldwide. The CIG segment includes infrastructure and related environmental and geotechnical services, testing, engineering, and project management services to commercial and local government clients across Canada. The RCM segment focuses on the results of the wind-down of its non-core construction activities. The company was founded in 1966 and is headquartered in Pasadena, CA.

Predefined Scans Triggered: Filled Black Candles and P&F Double Top Breakout.

TTEK is unchanged in after hours trading. This one is just firming up. The RSI is now positive and the PMO is rising gently into a crossover BUY signal. Stochastics are now above 80 suggesting internal strength. The group is anemic right now, but TTEK appears to be okay as it is outperforming the SPY. The stop is set just below the closing December low.

The weekly PMO isn't bullish right now, but the weekly RSI is positive and I note that price didn't have to go all the way down to test support at the 43-week EMA or early 2021 tops.

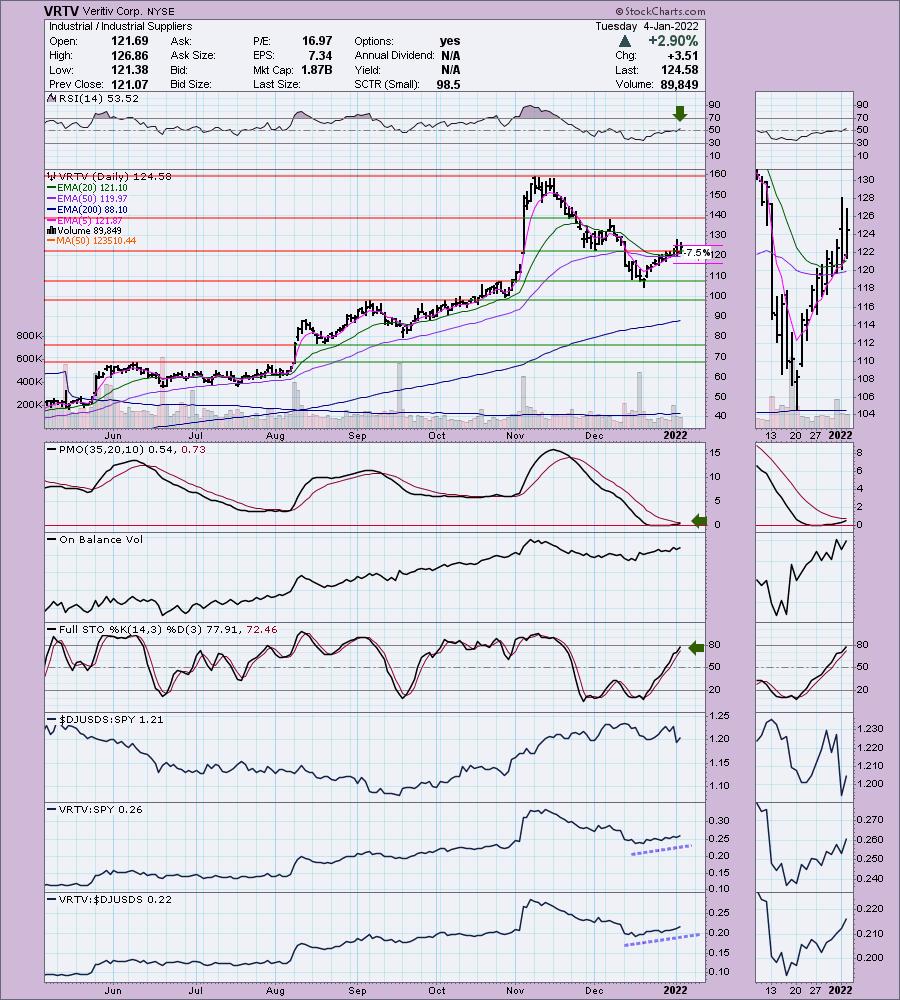

Veritiv Corp. (VRTV)

EARNINGS: 3/2/2022 (BMO)

Veritiv Corp. engages in business-to-business distributor of print, publishing, packaging, facility solutions, print and publishing products and services. The firm provides logistics and supply chain management solutions to its customers. It operates through the following segments: Print, Publishing, Packaging and Facility Solutions. The Print segment sells and distributes commercial printing, writing, copying, digital, wide format and specialty paper products, graphics consumables and graphics equipment primarily in the U.S., Canada and Mexico. The Publishing segment involves in sale and distribution of coated and uncoated commercial printing papers to publishers, retailers, converters, printers and specialty businesses for use in magazines, catalogs, books, directories, gaming, couponing, retail inserts and direct mail. The Packaging segment provides standard as well as custom and comprehensive packaging solutions for customers based in North America and in key global markets. The Facility Solutions segment sources and sells cleaning, break-room and other supplies such as towels, tissues, wipers and dispensers, can liners, commercial cleaning chemicals, soaps and sanitizers, sanitary maintenance supplies and equipment, safety and hazard supplies, and shampoos and amenities primarily in the U.S., Canada and Mexico. The company was founded in July 10, 2013 and is headquartered in Atlanta, GA.

Predefined Scans Triggered: None.

VRTV is unchanged in after hours trading. The PMO turned around above the zero line and is nearing a crossover BUY signal. I always like to see a PMO BUY signal arrive just above the zero line. Stochastics are rising strongly and the RSI just hit positive territory above net neutral (50). The group's performance has been hit or miss over the past two months, but since mid-December VRTV has been outperforming both the group and the SPY. The stop is set just under prior gap resistance from early November. It is also aligned below the 20/50-day EMAs.

VRTV has a mixed weekly chart. The weekly RSI is positive, but the weekly PMO is declining on a crossover SELL signal. If it can retrace prior all-time highs that would be an over 27% gain.

Don't forget, on Thursdays I look at reader-requested symbols, click HERE to shoot me an email. I read every email I receive and try to answer them all!

Current Market Outlook:

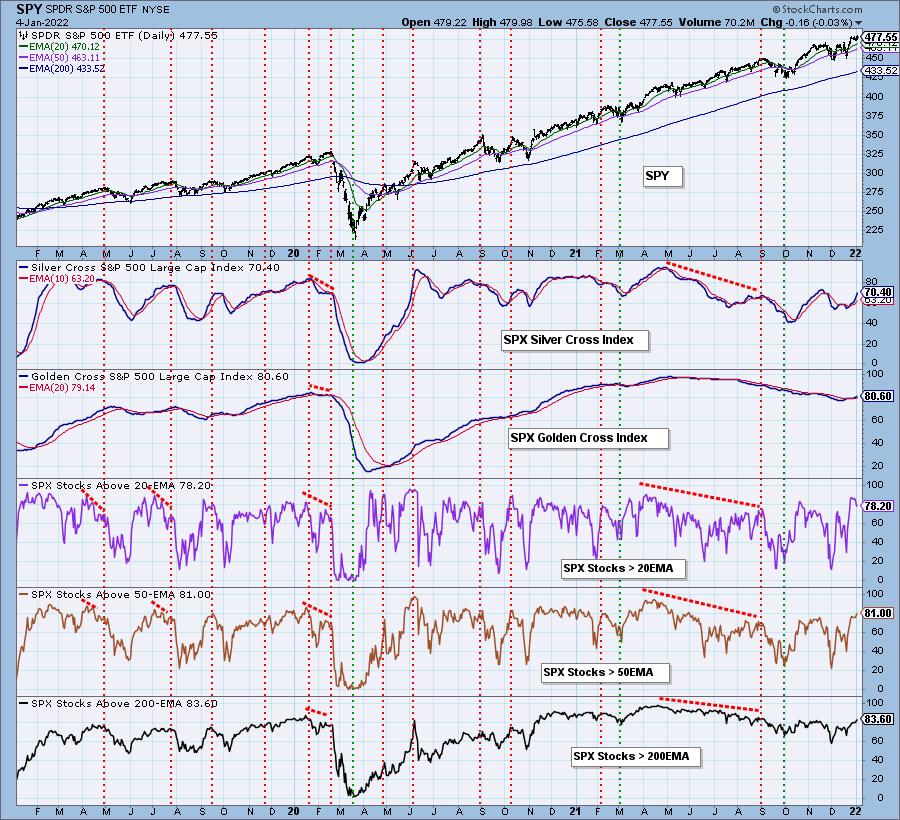

Market Environment: It is important to consider the odds for success by assessing the market tides. The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA)

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA)

Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page.

Here is the current chart:

Full Disclosure: I'm 10% invested and 90% is in 'cash', meaning in money markets and readily available to trade with.

I'm required to disclose if I currently own a stock and/or may buy it within the next 72 hours.

Happy Charting!

- Erin

erin@decisionpoint.com

Technical Analysis is a windsock, not a crystal ball.

(c) Copyright 2022 DecisionPoint.com

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "Diamonds in the Rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com