My scan results had quite a few Energy stocks. The sector has been beat down and with Crude Oil reversing, there's a lot of opportunity. I would still caution you if you're increasing your exposure. The market may've been up today, but price is now up against resistance at the all-time highs for the SPY. This rally has offered us an opportunity to sell into strength. Remember that when the market is volatile or weak, all positions should be considered "short-term" in nature.

Tomorrow is Reader Request Day so send me your ChartLists or email requests.

Today's "Diamonds in the Rough": ARCH, DEN, LPI and MGY.

"Stocks to Review": CRC, EC, NBR, OII, PTEN, AMR and WHD.

RECORDING LINK Wednesday (12/3):

Topic: DecisionPoint Diamond Mine (12/3/2021) LIVE Trading Room

Start Time: Dec 3, 2021 09:00 AM

MeetingRecording Link.

Access Passcode: December*3

REGISTRATION FOR Friday 12/10 Diamond Mine:

When: Dec 10, 2021 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (12/10/2021) LIVE Trading Room

Register in advance for this webinar HERE.

Save the registration confirmation email with login instructions in case Zoom doesn't notify you in time.

Free DP Trading Room (12/6) RECORDING LINK:

Topic: DecisionPoint Trading Room

Start Time: Dec 6, 2021 09:00 AM

Meeting Recording Link.

Access Passcode: December@6

For best results, copy and paste the access code to avoid typos.

Welcome to DecisionPoint Daily Diamonds, wherein I highlight ten "Diamonds in the Rough" per week. These are selected from the results of my DecisionPoint scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

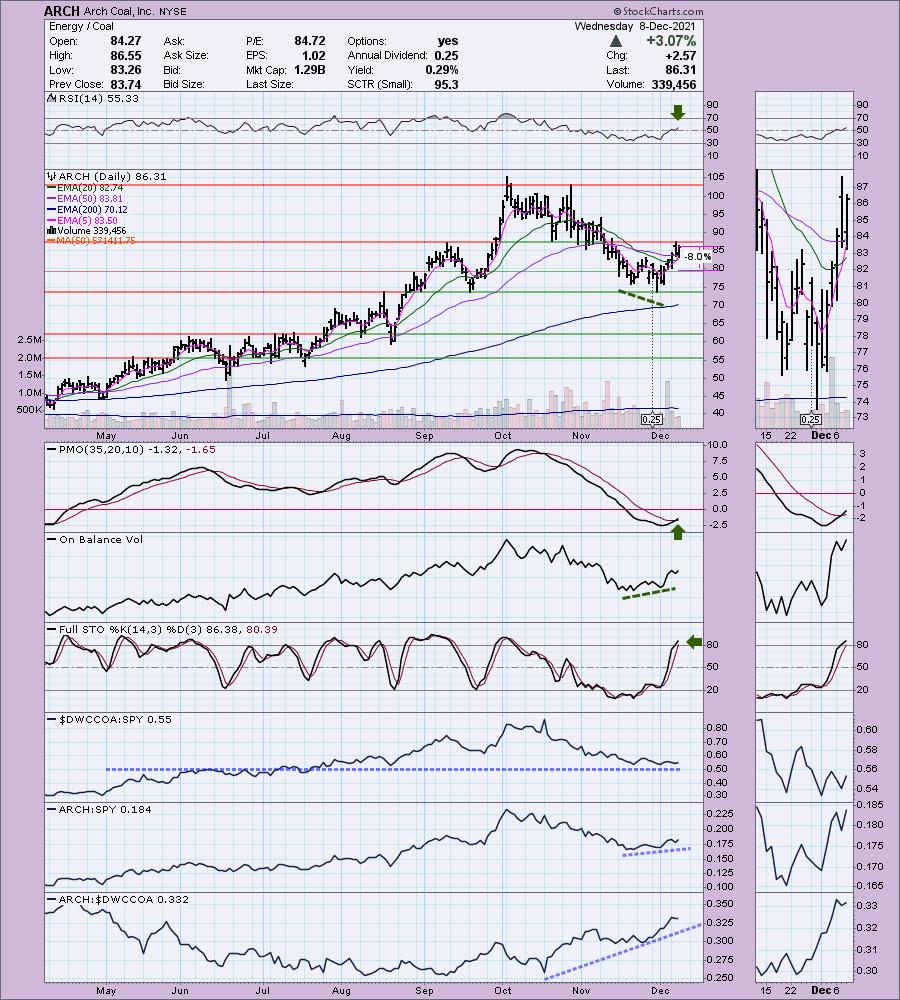

Arch Coal, Inc. (ARCH)

EARNINGS: 2/8/2022 (BMO)

Arch Resources, Inc. engages in the production and distribution of thermal coal. It operates through the following segments: Powder River Basin, Metallurgical and Other Thermal. The Powder River Basin segment contains thermal operations in Wyoming. The Metallurgical segment contains metallurgical operations in West Virginia. The Other Thermal segment contains supplementary thermal operations in Colorado, Illinois and the Coal Mac thermal operations in West Virginia. The company was founded in 1969 and is headquartered in St. Louis, MO.

Predefined Scans Triggered: None.

ARCH is unchanged in after hours trading. I covered ARCH on September 29 2021. The position was up nearly 22% at the October high, but eventually the stop was hit on the first bottom in November. There were plenty of warning signs that would've gotten you out to preserve profit. It's bottoming again and looks great. Price closed above the 20/50-EMAs today. There is a double-bottom pattern that is in a positive divergence with the OBV. The PMO had a crossover BUY signal generate. The RSI just hit positive territory and Stochastics are rising strongly. The group has hit relative support. ARCH is a clear outperformer against the group and it's performing fairly well against the SPY. The stop is set at the late August top, well below the 20-EMA.

This rebound is coming off long-term support at about $72. The weekly PMO is beginning to decelerate and the weekly RSI is positive and rising. Upside potential is over 22%.

Denbury Inc. (DEN)

EARNINGS: 2/24/2022 (BMO)

BP Midstream Partners LP engages in the operation, development, and acquisition of pipelines and other midstream assets. Its assets consist of interests in entities that own crude oil, natural gas, refined products and diluent pipelines, and refined product terminals. The company was founded on May 22, 2017 and is headquartered in Houston, TX.

Predefined Scans Triggered: P&F Double-Top Breakout and P&F Bearish Signal Reversal.

DEN is unchanged in after hours trading. I covered DEN in the August 11th 2021Diamonds Report. It hit the stop on the test of support shortly thereafter. Picked it just a hair too early given that test of support began it's slow rally higher. Yesterday price broke from a declining trend channel. The RSI is positive and the PMO is rising toward a crossover BUY signal. We have yet another positive OBV divergence. Stochastics are rising strongly. Relative strength studies are respectable. The stop is set below the 20/50-EMAs about where it would return to the declining trend channel.

Not much information on the weekly chart except to say that the weekly RSI is positive. New all-time highs are close, so I would set an upside target around $97.15 for a 15% profit.

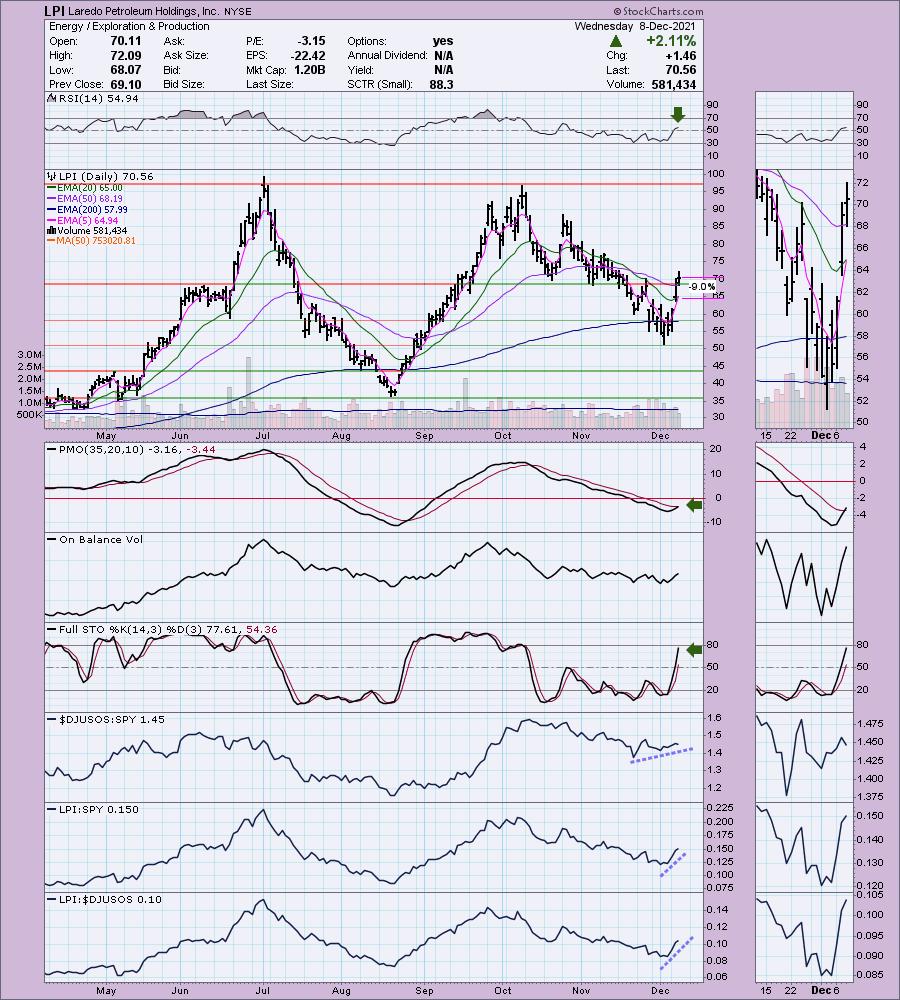

Laredo Petroleum Holdings, Inc. (LPI)

EARNINGS: 2/23/2022 (AMC)

Laredo Petroleum, Inc. engages in the exploration, development and acquisition of oil and natural gas properties. It operates in the Permian Basin in West Texas. The company was founded by Randy A. Foutch in October 2006 and is headquartered in Tulsa, OK.

Predefined Scans Triggered: P&F Double Top Breakout and P&F Bearish Signal Reversal.

LPI is unchanged in after hours trading. I covered LPI back on April 7th 2021. The position never hit its stop and is up +96.3%. It was up much higher than that at the June high. I believe it is headed back to that price level. The RSI is positive. Price broke above resistance at the early June tops and October low. The PMO just generated a crossover BUY signal. Stochastics are rising strongly and relative strength studies are very bullish. The stop is set below the 20-EMA.

The weekly chart does show us that there is strong overhead resistance at those past tops, but if it can get back there it is an almost 40% gain. The weekly RSI just reentered positive territory and the weekly PMO is decelerating. The one problem I see is that it is currently up over 27% this week and could be due for a pullback.

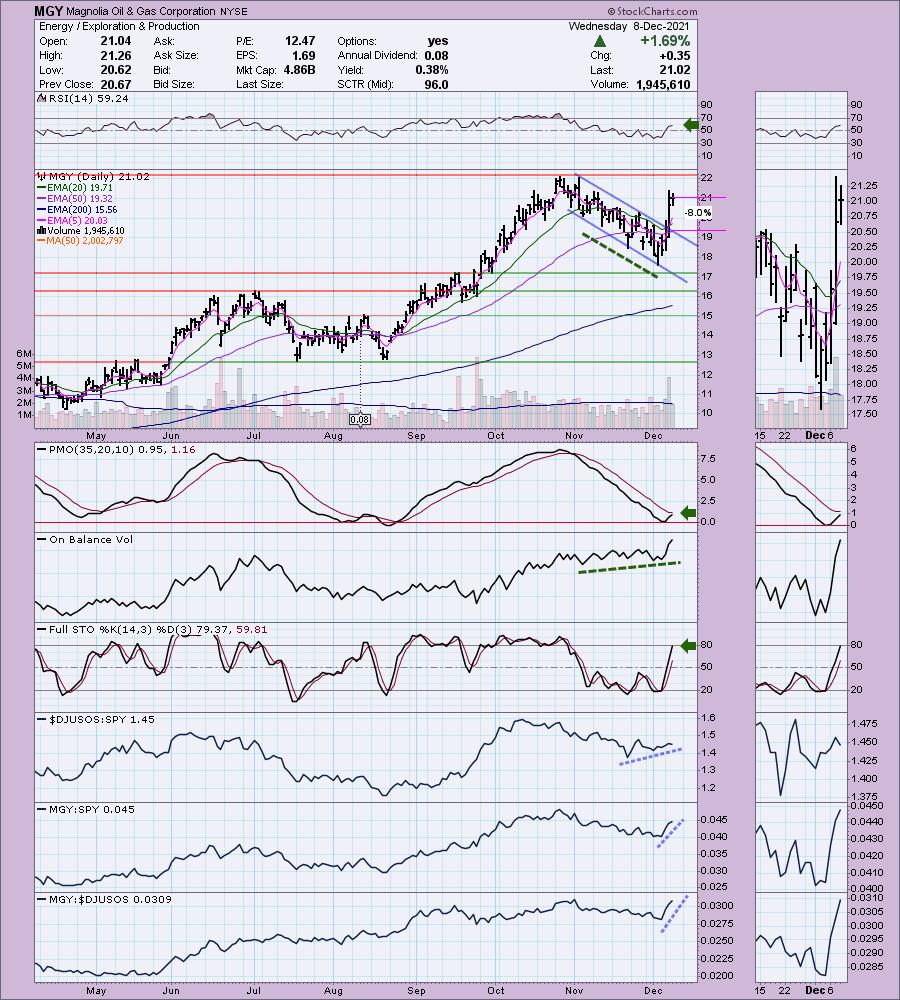

Magnolia Oil & Gas Corporation (MGY)

EARNINGS: 2/24/2022 (AMC)

Magnolia Oil & Gas Corp. engages in oil and gas exploration and production business. It operates assets located in the Eagle Ford Shale and Austin Chalk formations in South Texas. The company was founded on July 31, 2018 and is headquartered in Houston, TX.

Predefined Scans Triggered: New CCI Buy Signals and P&F Double Top Breakout.

MGY is up +0.14% in after hours trading. It saw a beautiful breakout from a declining trend channel. The RSI is positive and there is an OBV positive divergence. The PMO is about to trigger a crossover BUY signal. Stochastics are rising and relative strength studies are very bullish. I set an 8% stop at the 50-EMA.

The weekly RSI is positive and not yet overbought. The PMO has bottomed. It is very close to new all-time highs so I'd consider an upside target of about 20% at $25.22.

Don't forget, on Thursdays I look at reader-requested symbols, click HERE to shoot me an email. I read every email I receive and try to answer them all!

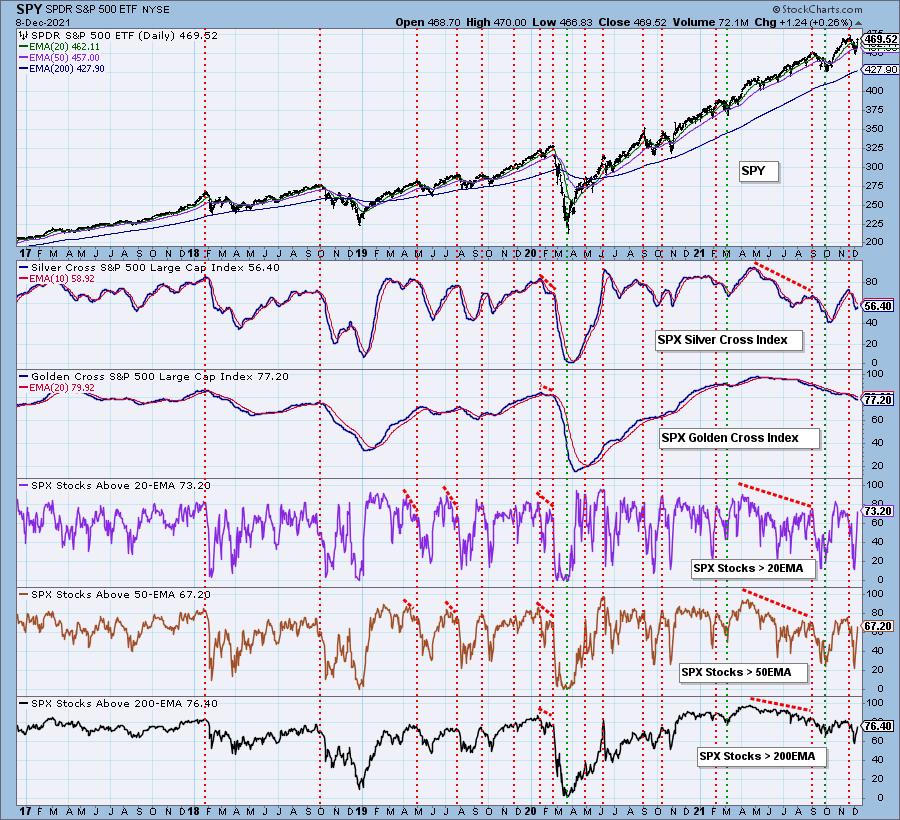

Current Market Outlook:

Market Environment: It is important to consider the odds for success by assessing the market tides. The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA)

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA)

Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page.

Here is the current chart:

Full Disclosure: I'm 15% invested and 85% is in 'cash', meaning in money markets and readily available to trade with.

I'm required to disclose if I currently own a stock and/or may buy it within the next 72 hours.

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

erin@decisionpoint.com

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "Diamonds in the Rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com