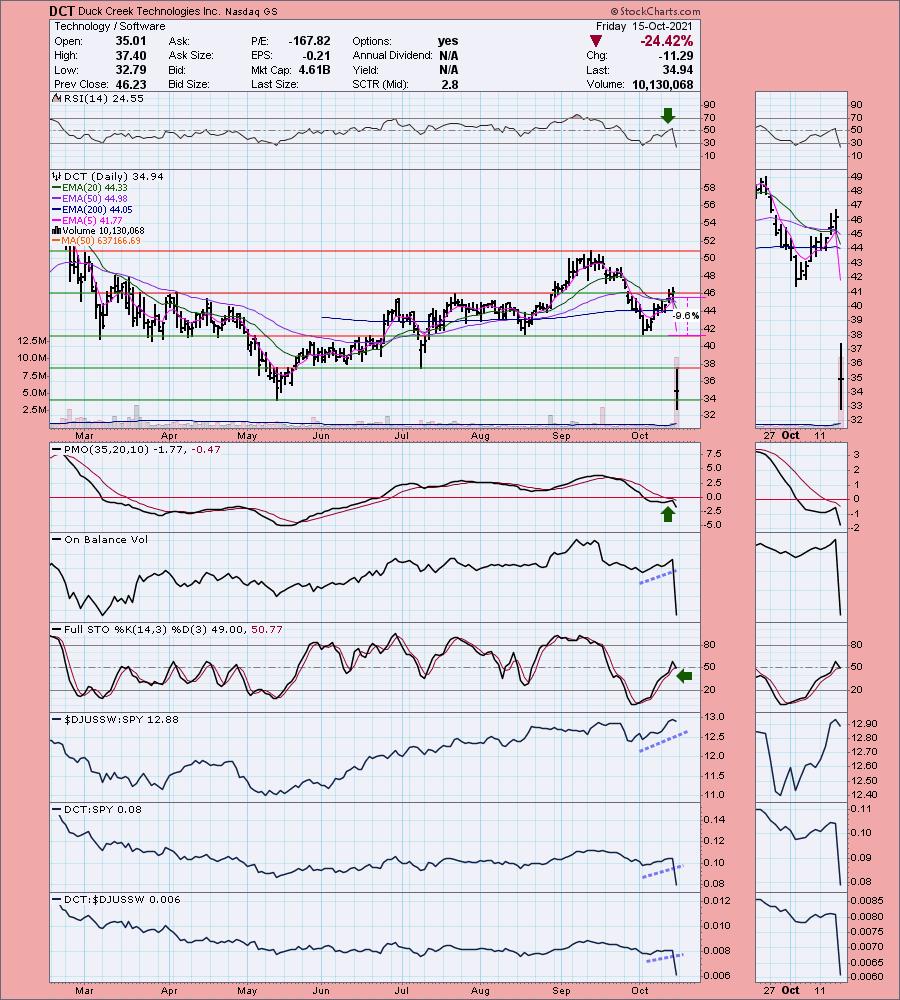

"Diamonds in the Rough" were down overall on the week, but the picks for Tuesday were great with three out of four up over 3% and the other up 1.49%. Wednesday I brought two solar stocks to the table just in time for the pullback yesterday and today. The good news is, if you got in yesterday on the dip, you should be just fine right now. These stocks all look good moving into next week.

Thursday was reader request day. These stocks had one day to "mature" on the recap this week and they finished mixed.

The big drag was on Duck Creek Technologies (DCT). The stock was down 24% today on a huge gap down that would've triggered the 9.6% stop, but only at the highest price on the day at best. That would still register a loss of over 20%. No matter how you slice it, that "black swan" was killer. Why the big loss? I researched and apparently the EPS beats, etc. were not based on GAAP accounting standards. When that was applied, the company looks very very weak. This triggered downgrades and the rest is history. Here is an article I found if you're interested.

This week's "Darling" was Extra Space Storage (EXR), but the other REITs I picked that day also are "Darlings" in my opinion. This one just happened to finish slightly higher than the others.

Register now for next Friday's Diamond Mine trading room below or right HERE.

RECORDING LINK Friday (10/15):

Topic: DecisionPoint Diamond Mine (10/15/2021) LIVE Trading Room

Start Time : Oct 15, 2021 09:00 AM

Meeting Recording LINK.

Access Passcode: October$15

REGISTRATION FOR FRIDAY 10/15 Diamond Mine:

When: Oct 22, 2021 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (10/22/2021) LIVE Trading Room

Register in advance for this webinar HERE.

Save the registration confirmation email with login instructions in case Zoom doesn't notify you in time.

Free DP Trading Room (10/11) RECORDING LINK:

Topic: DecisionPoint Trading Room

Start Time : Oct 11, 2021 09:00 AM

Meeting Recording LINK.

Access Passcode: October#11

For best results, copy and paste the access code to avoid typos.

A few items about the spreadsheet: I've put on the spreadsheet whether the RSI is positive (green) or negative (red). The PMO column tells you if it is rising (green) or falling (red). Finally I've added my own "Sparkle Factor" that gives you my assessment going forward, bullish (green), bearish (red) or neutral (gray). The Sparkle Factor is basically my thoughts on whether I expect it to rise or fall. A neutral means it could really go either way so it could be added to a watch list. If you're in a stock I consider "neutral" going forward, the ball is in your court.

Darling:

Extra Space Storage Inc. (EXR)

EARNINGS: 10/27/2021 (AMC)

Extra Space Storage, Inc. is a real estate investment trust. It operates through the following segments: Self-Storage Operations and Tenant Reinsurance. The Self-Storage Operations segment includes rental operations of wholly-owned stores. The Tenant Reinsurance segment includes reinsurance of risks relating to the loss of goods stored by tenants in stores. The company was founded by Kenneth Musser Woolley on April 30, 2004 and is headquartered in Salt Lake City, UT.

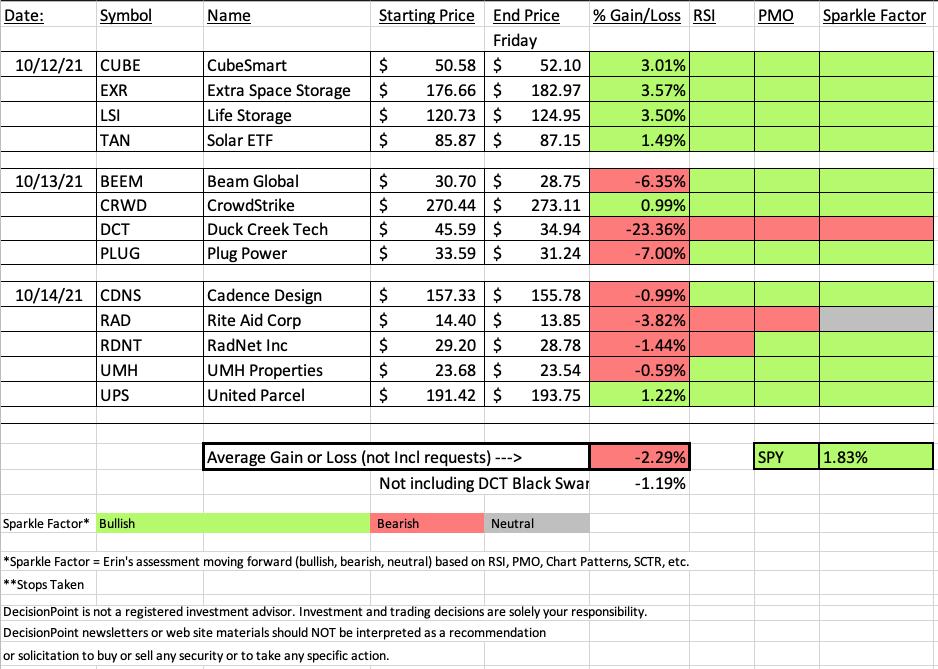

Below is the commentary and chart from Tuesday:

"EXR is unchanged in after hours trading. I covered EXR in the May 11th 2020 Diamonds Report. The timing on this one was just a bit off. After the breakout, it declined and just barely hit the 10% stop. If the position were opened about a week later, the position would be up a whopping 92.3%.

As noted above these charts are almost identical so I won't spend a lot of time reviewing. The RSI is now positive, the PMO is turning up in oversold territory. The 5-EMA is headed for a positive crossover the 20-EMA for a ST Trend Model BUY signal. Like CUBE it is outperforming. In this case the stop can be set a bit tighter at 6.9%."

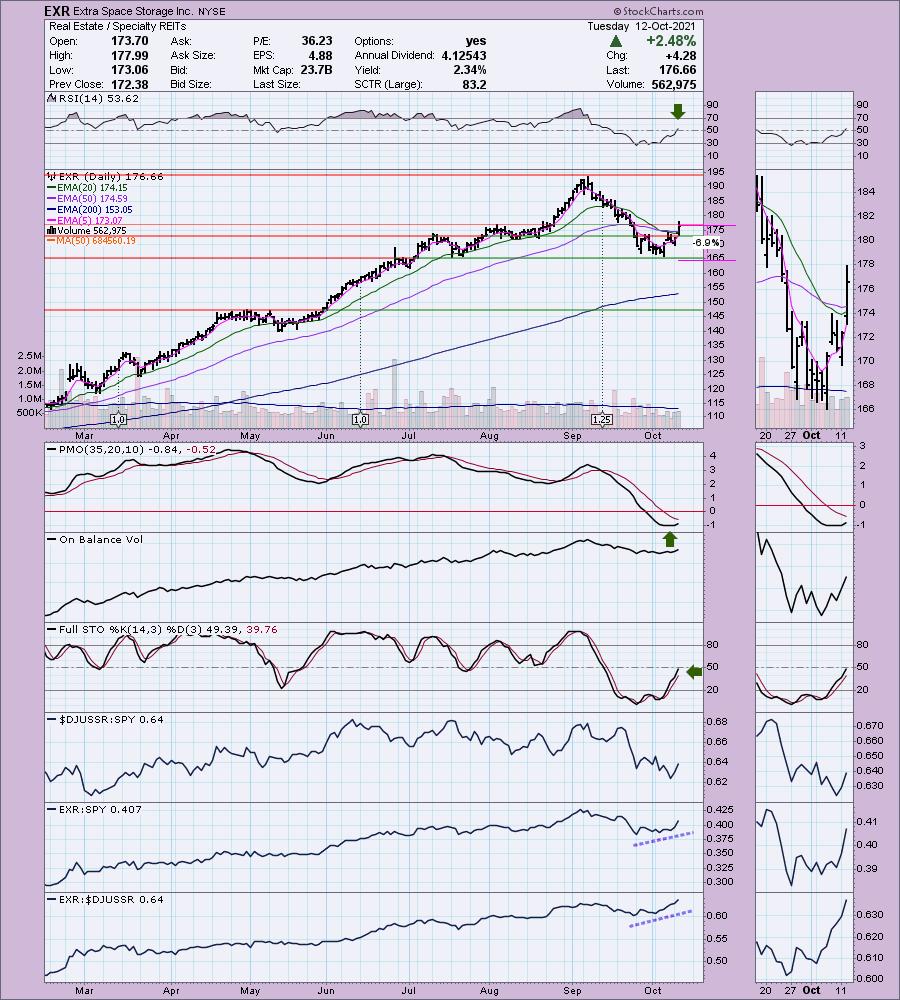

Here is today's chart:

Everything looks good. It's progressing as expected. I still like this one, but it may experience a pullback or at least a pause. That would be the time to consider entry.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Dud:

Duck Creek Technologies Inc. (DCT)

EARNINGS: 10/14/2021 (AMC)

Duck Creek Technologies, Inc. provides SaaS platform solutions for the property and casualty insurance industry. Its products include Duck Creek policy, billing, claims, insights, ratings, distribution management, digital engagement, reinsurance management, and Duck Creek industry content. The company was founded in 2000 and is headquartered in Boston, MA.

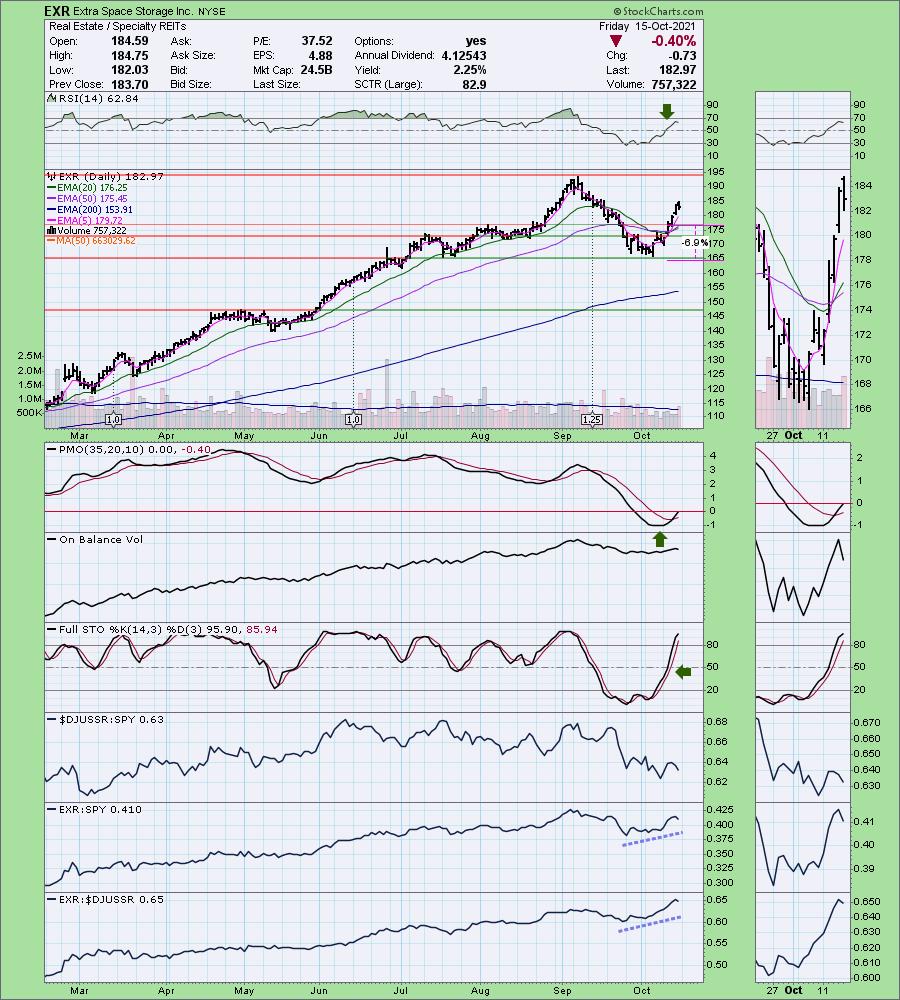

Below is the commentary and chart from Wednesday:

"DCT is up +1.34% in after hours trading. NOTE: It reports earnings tomorrow! It should do well given the technicals. The RSI just entered positive territory and the PMO is turning back up just below the zero line. We have a "V" bottom pattern that has retraced more than 1/3rd of the pattern moving back up. The expectation is a breakout above the left side of the "V". The OBV is confirming the rally and Stochastics are ripening as %K is nearly above net neutral (50). The stop is deep here. You could tighten it up considerable by moving it just below the 200-EMA."

Below is today's chart:

This is a great example of why you don't want to hold through earnings. There was absolutely nothing we could have done on this one. A true "black swan" that our stop wouldn't have protected against. Not much to say about this one except avoid it in the future. You can see from the commentary above that it was progressing in a bullish fashion and then bang, 20% loss. I did warn everyone that they were reporting earnings last night. Ugly ugly ugly.

THIS WEEK's Sector Performance:

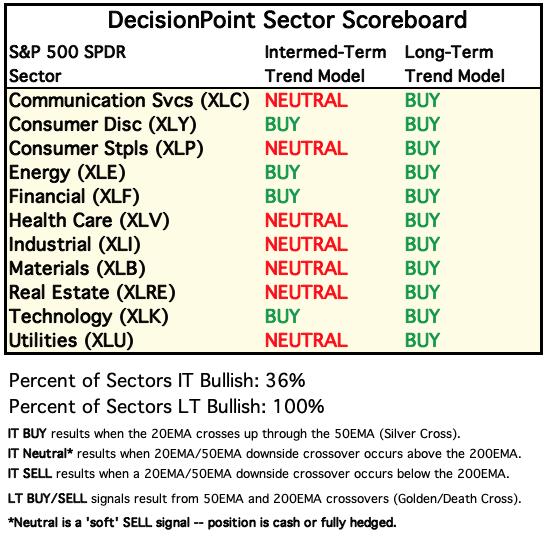

DecisionPoint Sector Scoreboard (Mechanical Trend Model Signals):

Click Here to view Carl's annotated Sector ChartList!

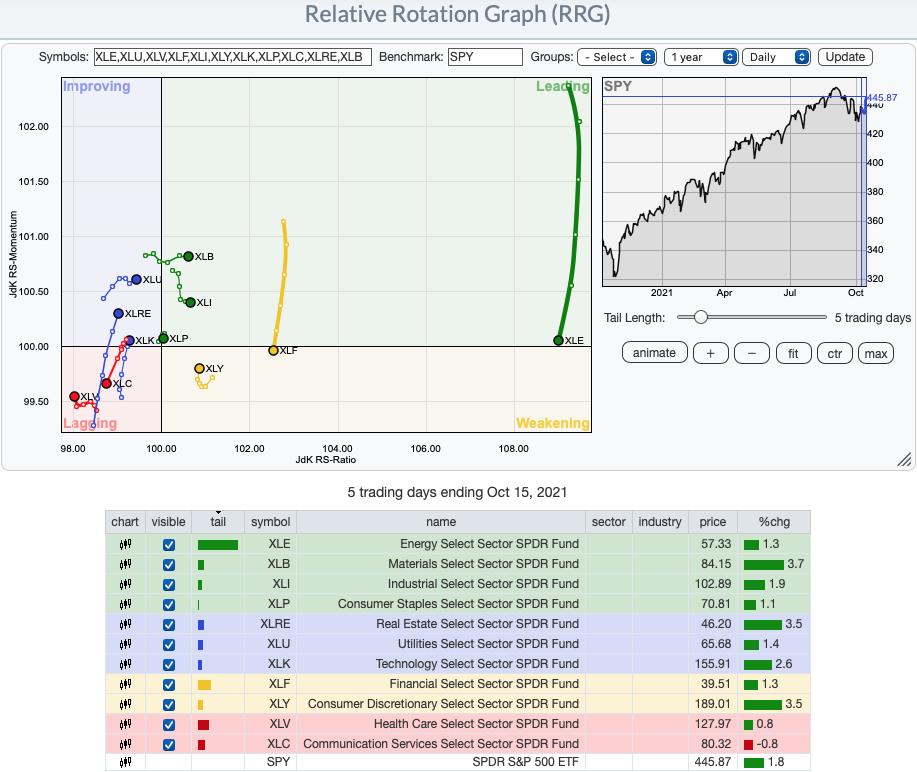

Short-term RRG: XLE and XLF dropped out of the sky today. They were already headed toward Weakening, but now XLF has reached it. XLB, XLI and XLP are now within Leading. XLP is very close to the center (the SPX) so relative strength is mostly nil and it hasn't really moved anywhere all week. Interesting sectors moving forward? XLRE and XLK are making moves. XLU is traveling in the bullish northeast heading, but I am leery of this sector given the high cost of energy.

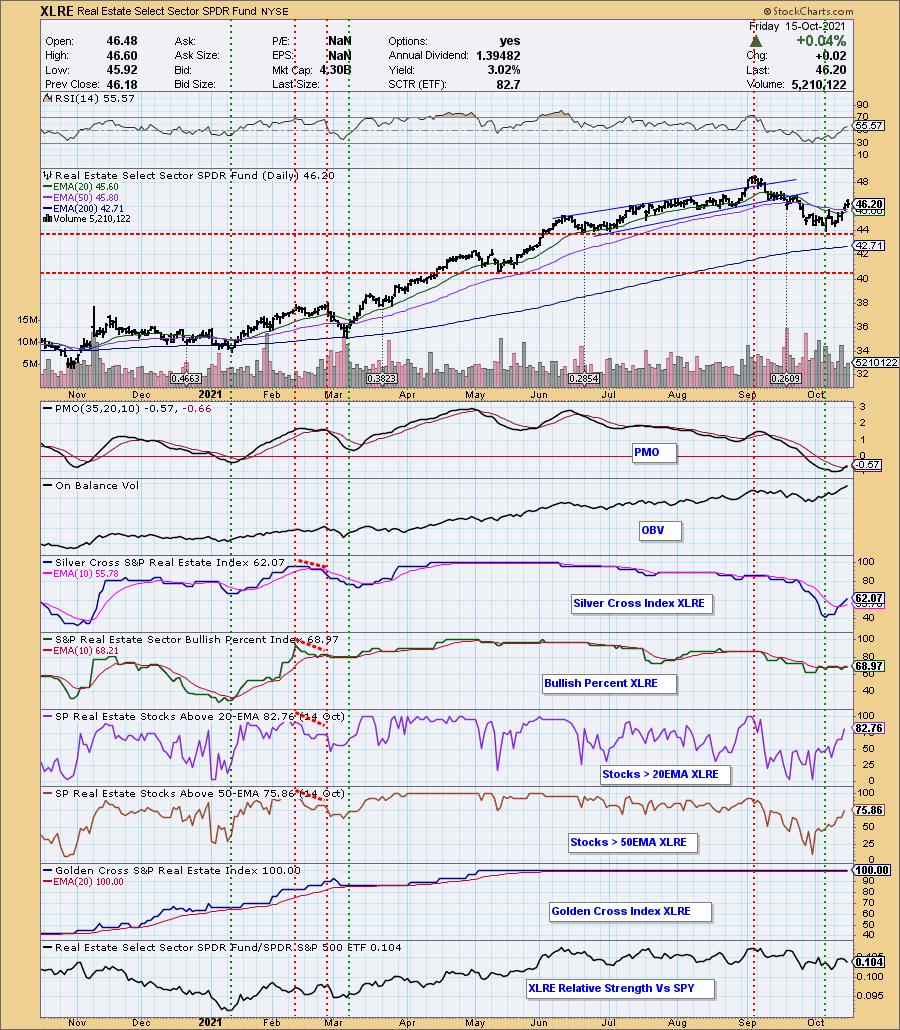

Sector to Watch: Real Estate (XLRE)

I think I was onto something with REITs given the successful scan picks on Tuesday from the "Specialty REITs" industry group. This was the best looking sector chart in my opinion. Mainly due to the positive SCI and rising participation that isn't really that overbought.

Industry Group to Watch: Specialty REITs ($DJUSSR)

Tuesday's picks came from this industry group and looking at the various industry groups within XLRE, I liked this one best (although there are other choices). We have a double-bottom that was confirmed when price moved past the confirmation line. It is hitting strong overhead resistance soon that aligns with the 50-EMA. The RSI hasn't entered positive territory, but given the breakout and close above the 20-EMA it is set up nicely.

Go to our Sector ChartList on DecisionPoint.com to get an in depth view of all the sectors.

Technical Analysis is a windsock, not a crystal ball.

Have a great weekend & Happy Charting! Next Diamonds Report is Tuesday 10/19.

- Erin

erin@decisionpoint.com

Full Disclosure: I'm about 70% invested right now and 30% is in 'cash', meaning in money markets and readily available to trade with. I have moved primarily into energy and materials. I will be offloading a position or two next week that would bring my exposure to 60% or lower depending on how many and how much.

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

(c) Copyright 2021 DecisionPoint.com