It's Reader Request Day for DP Diamonds! Here I look at all of the symbol requests sent to me and find the ones that will provide a teachable moment and/or appear strong moving forward. Today's selections fall into the latter category. I believe all of these "Diamonds in the Rough" requests have potential going into next week.

There was actually quite a bit of overlap again with my analysis results and requests so it honestly wasn't too hard to narrow down the list today. However, there are some promising setups on the "Short List" today as well.

Update on yesterday: Energy stocks slumped today which wasn't all that surprising given the strong thrust upward they've been experiencing this week. I still like Energy and my portfolio currently reflects that. Rare Earth Metals (REMX), Uranium and Lithium are still showing strength. REMX has actually experienced a bit of a pullback so you may want to take advantage of the lower prices for the ETF.

Don't forget to register for tomorrow's Diamond Mine trading room! The link is below and here too! Email your symbol requests beforehand to ensure they will be covered!

Today's "Diamonds in the Rough" are: AAP, BBWI, CDAK, DECK and ZIP.

"Short List" (no order): ATEN, MRVL, NET, M, TOL, NUV and GPC

RECORDING LINK Friday (9/10):

Topic: DecisionPoint Diamond Mine (9/10/2021) LIVE Trading Room

Start Time : Sep 10, 2021 09:02 AM

Meeting Recording Link HERE.

Access Passcode: Sept@10th

REGISTRATION FOR FRIDAY 9/17 Diamond Mine:

When: Sep 17, 2021 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (9/17/2021) LIVE Trading Room

Register in advance for this webinar HERE.

Save the registration confirmation email with login instructions in case Zoom doesn't notify you in time.

Free DP Trading Room (9/13) RECORDING LINK:

Topic: DecisionPoint Trading Room

Start Time : Sep 13, 2021 09:01 AM

Meeting Recording LINK.

Access Passcode: Sept/13th

For best results, copy and paste the access code to avoid typos.

Welcome to DecisionPoint Daily Diamonds, wherein I highlight five "Diamonds in the Rough." These are selected from the results of my DecisionPoint scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

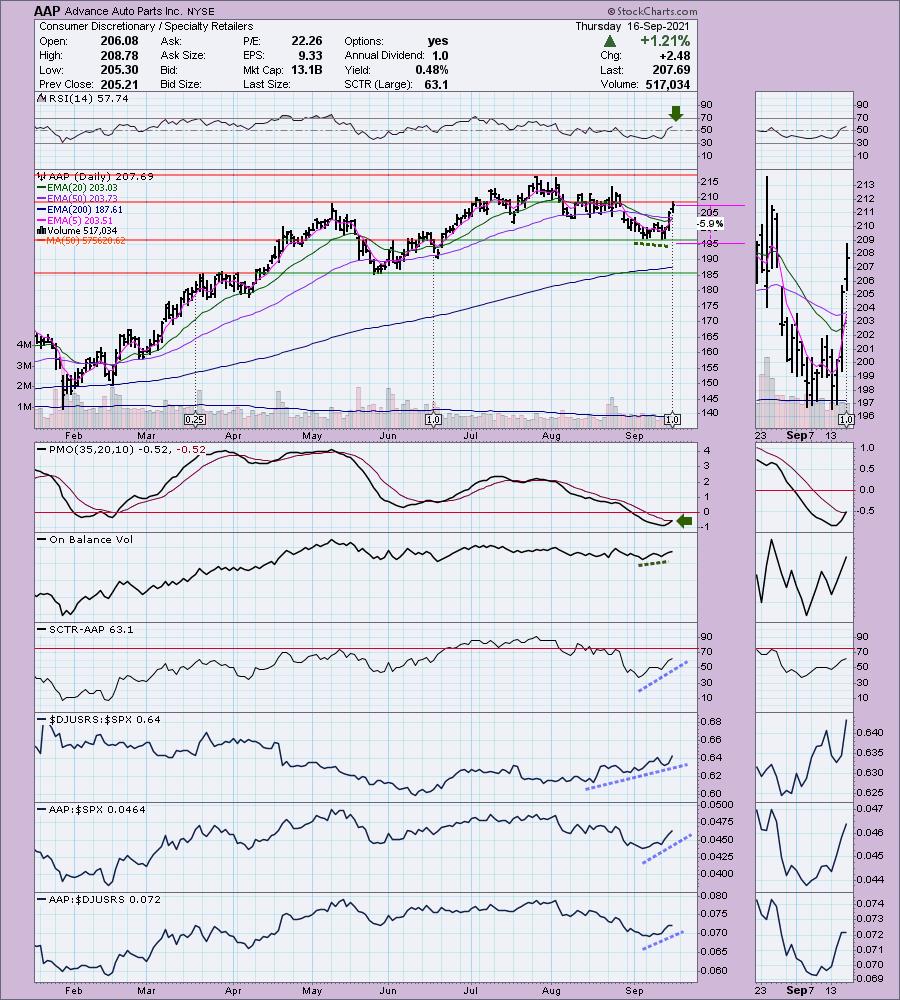

Advance Auto Parts Inc. (AAP)

EARNINGS: 11/9/2021 (BMO)

Advance Auto Parts, Inc. engages in the supply and distribution of aftermarket automotive products for both professional installers and do-it-yourself customers. It operates through the following segments: Northern Division, Southern Division, Carquest Canada, Independents and Worldpac. Advance Auto Parts offers replacement parts, performance parts, accessories, oil and fluids, engine parts, brakes, batteries, accessories, and tools and garage. The company was founded by Arthur Taubman in 1929 and is headquartered in Raleigh, NC.

AAP is unchanged in after hours trading. I've actually been watching the auto parts space, but this one is actually in the Specialty Retailers group. This request has an excellent set up. The RSI is positive and rising. The PMO is triggering a crossover BUY signal. I noticed a positive OBV divergence with price bottoms. Speaking of those price bottoms, they form a bullish double-bottom pattern. The pattern executed on yesterday's breakout and the minimum upside target was hit today (target is determined by the height of the pattern). It's now hitting resistance at the May top, but I don't see any reason why this will hold it back given it hasn't mattered much this summer. The stop is set tightly at about 6%.

The weekly chart is pretty good with a positive RSI. The PMO does appear to be decelerating. My main concern: I'm seeing a rounded top on price. Consider an upside target about 15% higher than the current price which would put it around $239.

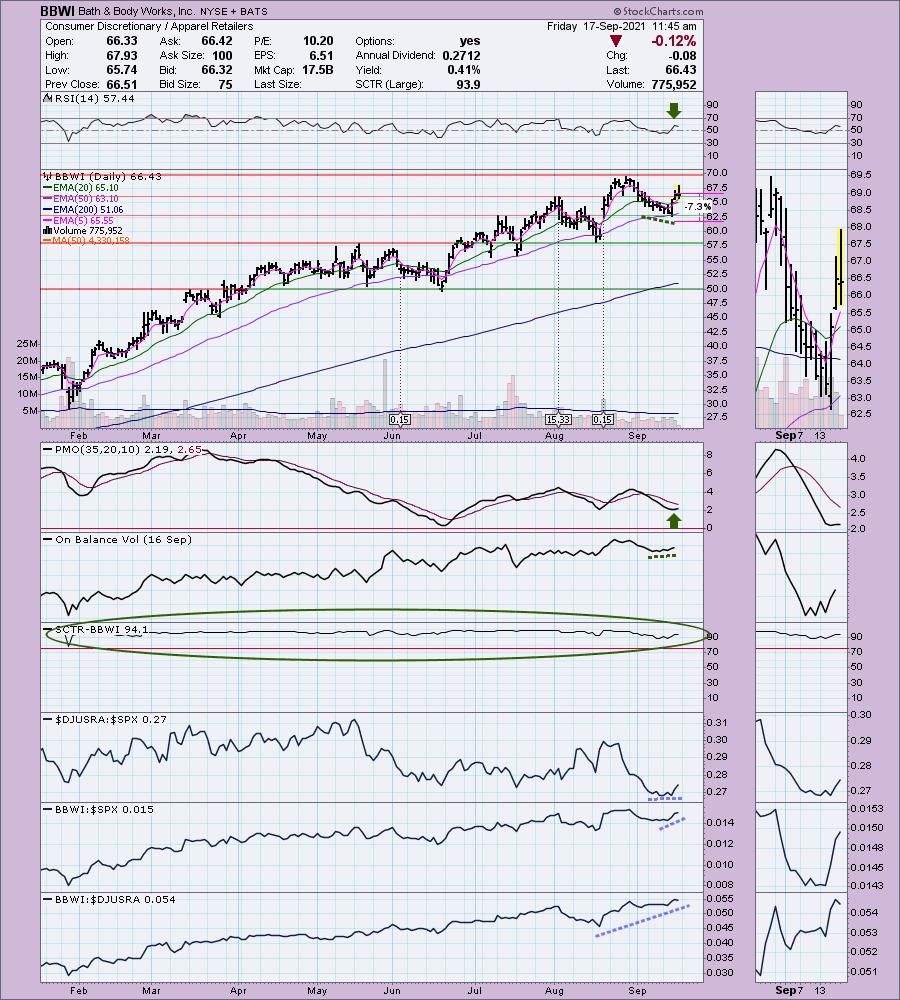

Bath & Body Works, Inc. (BBWI)

EARNINGS: 11/17/2021 (AMC)

Bath & Body Works, Inc. is a specialty retailers and home to America's Favorite Fragrances, offering a breadth of exclusive fragrances for the body and home, including the selling collections for fine fragrance mist, body lotion and body cream, 3-wick candles, home fragrance diffusers and liquid hand soap. The company was founded by Leslie Herbert Wexner in 1963 and is headquartered in Columbus, OH.

BBWI is up +0.74% in after hours trading. I covered BBWI on June 24th 2021 when it was L-Brands (LB). Price was adjusted on the change so the position's starting price was adjusted to $58.16. The stop was never hit, so the position is currently up +14.4%. The RSI is positive and best of all, the PMO has just turned up so we could be getting in early on the move higher. We have a positive OBV divergence between price bottoms and OBV bottoms. The SCTR has been in the "hot zone" above 75 the majority of the past 8 months. Relative strength is good against the SPX and the group, however the group itself is still working on outperforming. Currently it is doing about as well as the market.

The weekly RSI is positive and not overbought. The weekly PMO has been in decline, but I don't view that as a negative given price has been rallying through. It is a characteristic of price rising steadily with no new acceleration. The PMO does appear ready to turn back up.

Codiak Biosciences Inc. (CDAK)

EARNINGS: 11/4/2021

Codiak BioSciences, Inc. engages in the development and manufacturing of exosomes. It engages in harnessing exosomes, therapeutic applications, diagnostic applications, and proprietary production. The firm develops engEx Platform, a proprietary and versatile exosome engineering and manufacturing platform, to expand upon the innate properties of exosomes to design novel exosome therapeutics. Codiak BioSciences was founded by Douglas E. William, Raghu Kalluri, and Eric S. Lander in 2015 and is headquartered in Cambridge, MA.

CDAK is unchanged in after hours trading. It rallied strongly today so I would expect to see it pullback tomorrow, but the chart is set up nicely. The RSI is positive and not overbought and the PMO just triggered a positive crossover today. Price popped above resistance at the March tops and early July top. More importantly price has busted above all of the key moving averages. The longer-term picture looks quite interesting as a large bullish double-bottom appears to be forming. Relative strength for Biotechs is weak, but CDAK is beginning to outperform it and the SPX. The stop was difficult to set given today's giant rally. If you are able to get in on this one at a lower price point, then you could set it at the optimum spot beneath support at the September low.

We don't have a lot of information on the weekly chart because it only starting trading at the end of 2020. However, I do note a positive RSI. Additionally, the double-bottom is even more clear on the weekly chart. It will need to break above the confirmation line at the August top to confirm the pattern. Even somewhat conservatively I think we could see an over 40% gain if it follows through on the positive daily indicators.

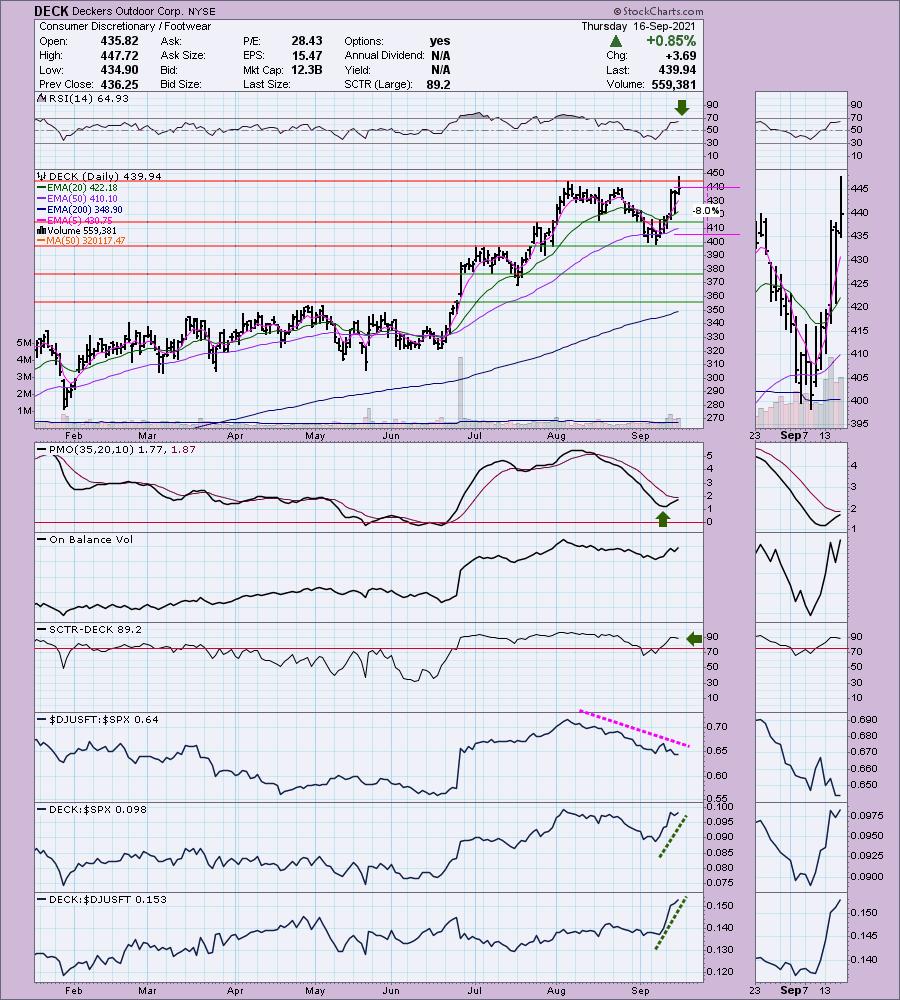

Deckers Outdoor Corp. (DECK)

EARNINGS: 10/28/2021 (AMC)

Deckers Outdoor Corp. engages in the business of designing, marketing, and distributing footwear, apparel, and accessories developed for both everyday casual lifestyle use and high performance activities. It operates through the following segments: UGG Brand, HOKA Brand, Teva Brand, Sanuk Brand, Other Brands, and Direct-to-Consumer. The UGG Brand segment offers a line of premium footwear, apparel, and accessories. The HOKA Brand segment sells footwear and apparel that offers enhanced cushioning and inherent stability with minimal weight, originally designed for ultra-runners. The Teva Brand segment focuses on the sport sandal and modern outdoor lifestyle category, such as sandals, shoes, and boots. The Sanuk Brand segment originated in Southern California surf culture and has emerged into a lifestyle brand with a presence in the relaxed casual shoe and sandal categories. The Other Brands segment includes the Koolaburra by UGG brand. The Direct-to-Consumer segment comprises of retail stores and e-commerce websites. The company was founded by Douglas B. Otto in 1973 and is headquartered in Goleta, CA.

DECK is up +0.24% in after hours trading. This one has popped in and out of my scan results and I've avoided it mainly because the industry group is underperforming. However, it doesn't seem to be bothering DECK. The RSI is positive and the PMO has bottomed in oversold territory. We should see the crossover BUY signal next week. The SCTR is in the "hot zone" and OBV higher lows are confirming the current rally. Price was unable to close above resistance, but it did foray above today. The stop is set below the 50-EMA at 8%, but if you aren't as risk averse, you could set it at the September low.

We can see that DECK is now flirting with all-time highs once again. The RSI is a little over bought but I really like the PMO bottoming above the signal line right now. I would set upside potential at around 18% or $563.

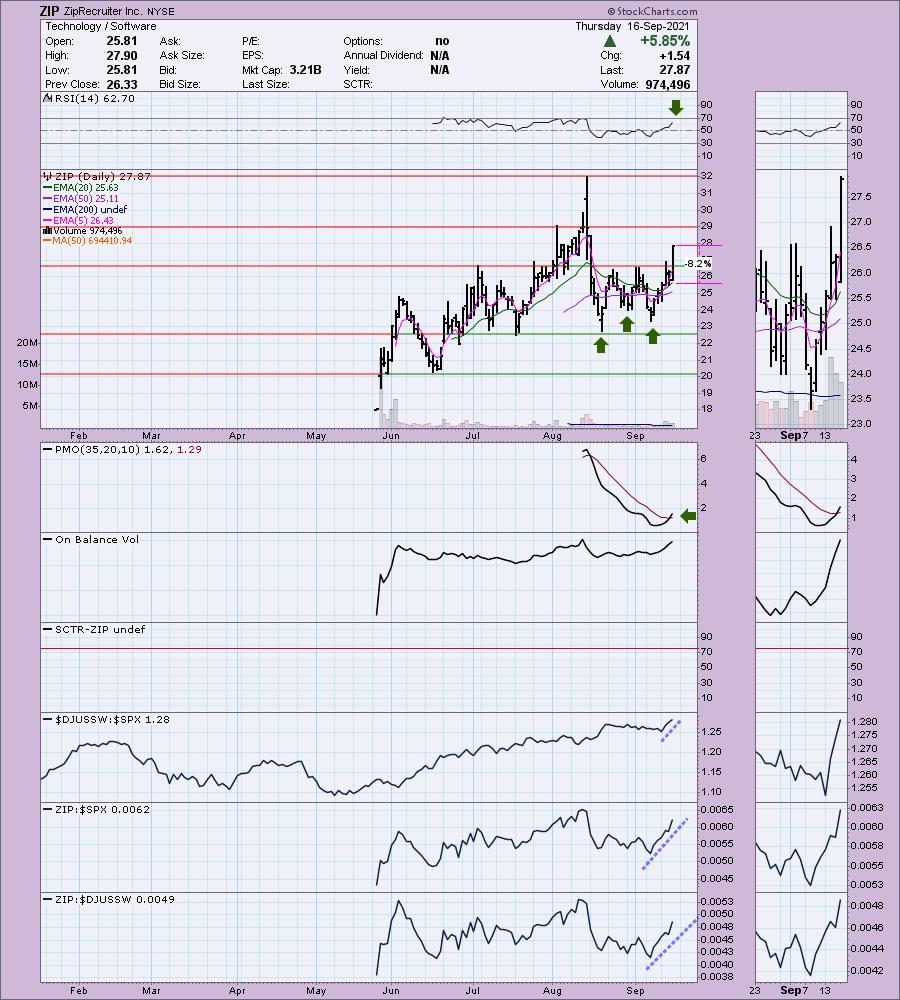

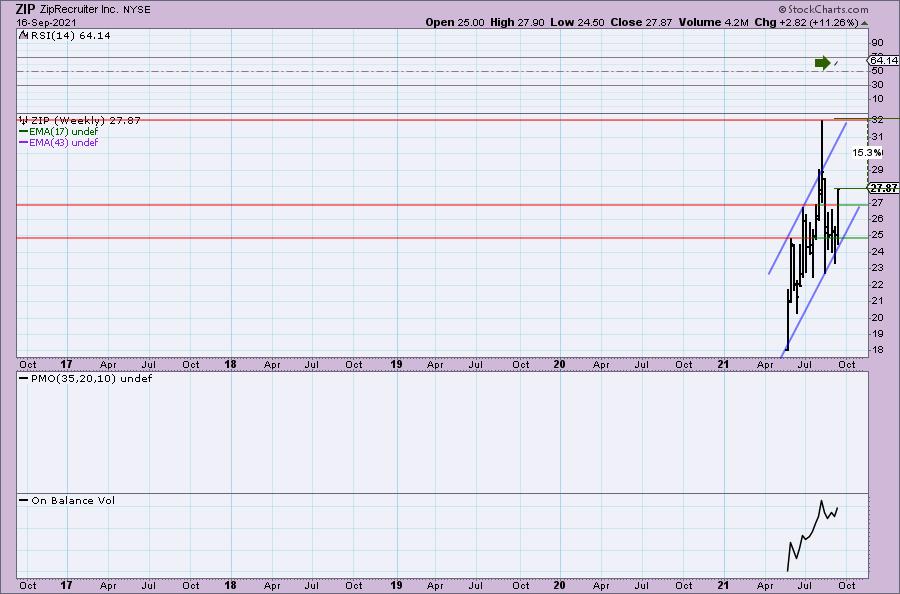

ZipRecruiter Inc. (ZIP)

EARNINGS: 11/11/2021 (AMC)

ZipRecruiter, Inc. operates as web-based hiring platform for small and medium sized businesses. It streamlines the hiring process and offers reseller programs, ATS integrations, and email alert program. The company was founded by Ian Siegel, Joe Edmonds, Ward Poulos, and Willis Redd in 2010 and is headquartered in Santa Monica, CA.

ZIP is down -3.12% in after hours trading, so a better entry is likely to be had. I'd probably hold off on purchasing until I saw how that decline will run in tomorrow's trading. I would probably take it off the watch list if it closed well below prior resistance. We do have a bullish triple-bottom (or double-bottom, however you wish to look at it) and that suggests that price should recapture its all-time high at the August top. This is why I have the stop set near the 20/50-EMAs. The RSI is positive and the PMO just triggered a crossover BUY signal. Relative performance is strong for the group and ZIP is outperforming both the SPX and the group.

Not much information on the weekly chart given the stock only recently started trading. However I note that we have a strong rising trend channel and volume appears to be confirming this rising trend. Upside potential if it can reach its all-time high is over 15%.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

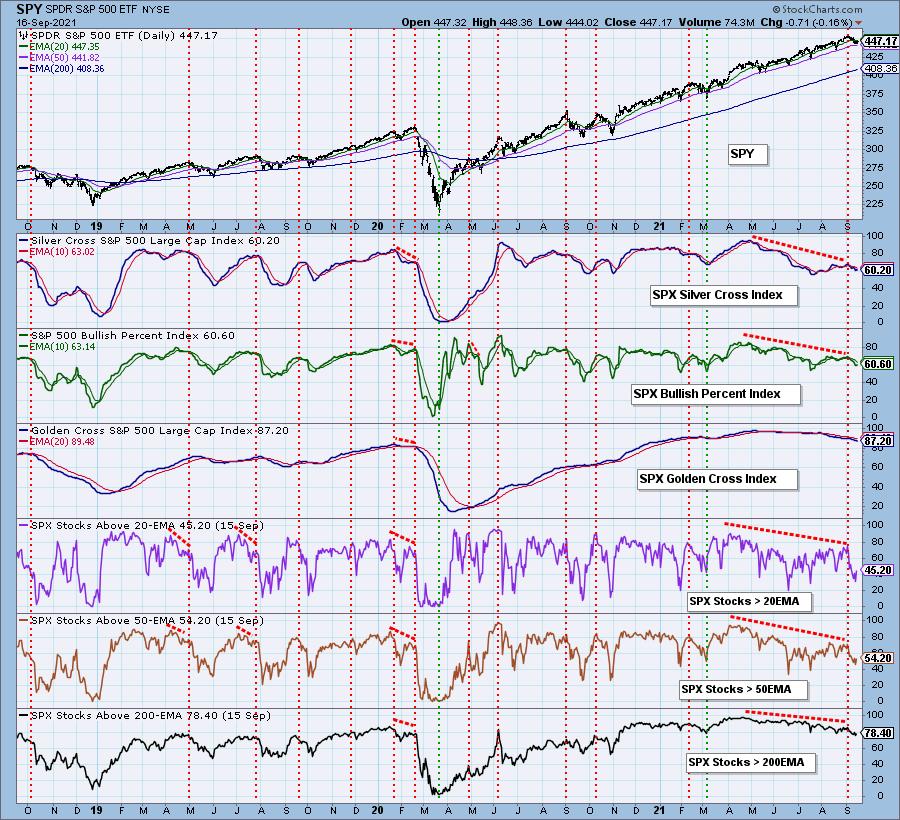

Current Market Outlook:

Market Environment: It is important to consider the odds for success by assessing the market tides. The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA)

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA)

- The Bullish Percent Index (BPI) shows the percentage of SPX stocks on Point & Figure BUY signals.

Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page.

Here is the current chart:

Full Disclosure: I'm about 70% invested and 30% is in 'cash', meaning in money markets and readily available to trade with. I am contemplating expanding my exposure in Energy with a possible purchase of one of today's "Diamonds in the Rough". Their charts will tell me tomorrow which it will be if I do decide to pull the trigger.

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

erin@decisionpoint.com

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "Diamonds in the Rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com