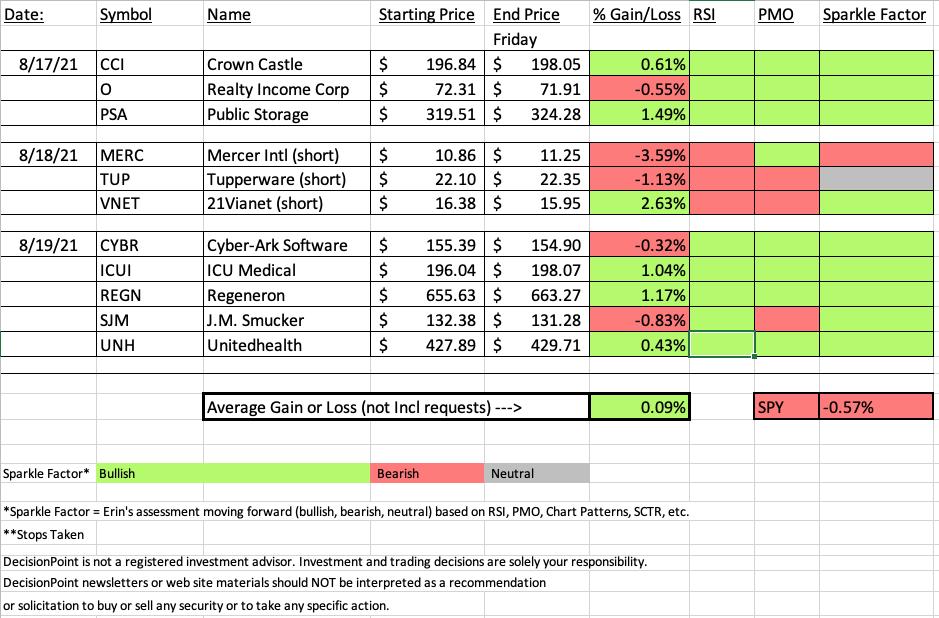

It was a difficult week for the market so while our positions ultimately finished higher, it was by a thin margin. Still I'll take it.

This week our "Darling" of the week is the short on VNET. It looks like it will go lower so the position still looks very good.

This week's "Dud" was one of the other shorts, MERC, which was up 3.59% since picking it for a short. I don't like it anymore. I'll explain below.

I've changed the format for symbol requests. Please send in your requests for Friday's Diamond Mine during the week before I open the room. I will cover all email requests. The first 15 minutes of the trading rooms will be available for live requests. Of course, best case, send in your requests before I write Thursday's Reader Requests and any I don't cover that you want me to cover, I can look at on Friday.

Register now for next Friday's Diamond Mine trading room below or right HERE.

RECORDING LINK Friday (8/20):

Topic: DecisionPoint Diamond Mine (8/20/2021) LIVE Trading Room

Start Time : Aug 20, 2021 08:58 AM

Meeting Recording LINK.

Access Passcode: August/20th

REGISTRATION FOR FRIDAY 8/27 Diamond Mine:

When: Aug 27, 2021 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (8/27/2021) LIVE Trading Room

Register in advance for this webinar HERE.

Save the registration confirmation email with login instructions in case Zoom doesn't notify you in time.

RECORDING LINK for DP Free Trading Room:

Topic: DecisionPoint Trading Room

Start Time : Aug 16, 2021 09:01 AM

Meeting Recording LINK.

Access Passcode: August-16

A few items about the spreadsheet: I've put on the spreadsheet whether the RSI is positive (green) or negative (red). The PMO column tells you if it is rising (green) or falling (red). Finally I've added my own "Sparkle Factor" that gives you my assessment going forward, bullish (green), bearish (red) or neutral (gray). The Sparkle Factor is basically my thoughts on whether I expect it to rise or fall. A neutral means it could really go either way so it could be added to a watch list. If you're in a stock I consider "neutral" going forward, the ball is in your court.

Darling:

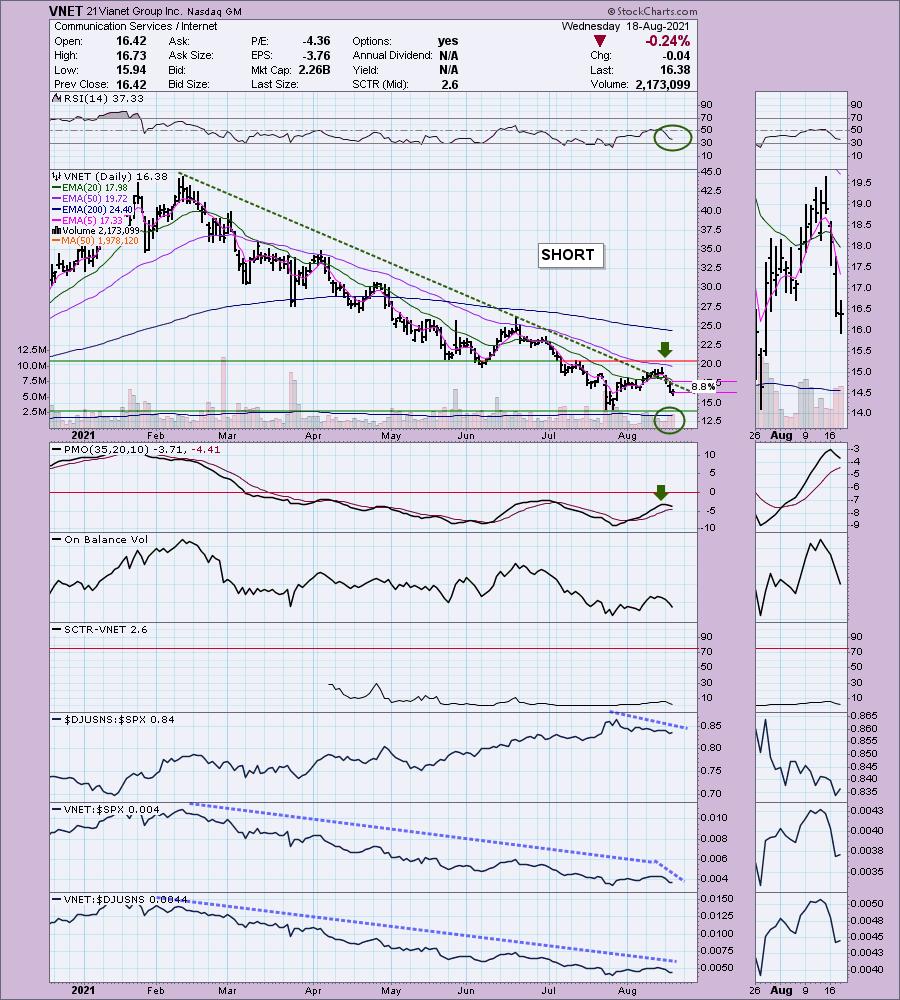

21Vianet Group Inc. (VNET)

EARNINGS: 8/24/2021 (AMC) ** Reports Earnings Next Week **

21Vianet Group, Inc. is a holding company, which engages in the provision of carrier-neutral internet data center services. Its services include interconnectivity, colocation or data center managed hosting services, and cloud services. The company was founded by Sheng Chen and Jun Zhang on October 16, 1999 and is headquartered in Beijing, China.

Below is the commentary and chart from Wednesday:

"VNET is unchanged in after hours trading. It does report next week so that is a crap shoot. Notice that this stock is headquartered in China. We know the recent meddling by the Chinese government has hit many China centric stocks. The latest news was that President Xi will be asking the wealthy to give back. This could mean continued regulation on "private" companies within China which will mean lower stock prices will likely continue. VNET saw heavy selling over the past few days. The RSI is very negative and not oversold yet. Notice price failed to overcome resistance at the 50-EMA and the PMO has topped well below the zero line. I would consider the stop level to be above the 20-EMA. I'd like to bring it to the 50-EMA but that would mean a large loss on a short position. Relative strength shows a sickly group and a stock that is underperforming both the SPX and this sickly industry group."

Here is today's chart:

This short still looks viable. The RSI is negative and not oversold. The PMO just triggered a crossover SELL signal well below the zero line. We are still seeing heavy volume on the selling. I would continue to look for more decline.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Dud:

Mercer Intl, Inc. (MERC)

EARNINGS: 10/28/2021 (AMC)

Mercer International, Inc. is engaged in the manufacture and sale of pulp. It operates through Pulp and Wood Products segments. The Pulp segment consists of the manufacture, sales, and distribution of NBSK pulp, electricity, and other by-products at three pulp mills. The Wood Products segment involves in manufacture, sales, and distribution of lumber, electricity and other wood residuals at the Friesau Facility. The company was founded on July 1, 1968 and is headquartered in Vancouver, Canada.

Below is the commentary and chart from Tuesday:

"MERC is unchanged in after hours trading. Today price broke down and closed beneath support. A new LT Trend Model SELL signal was triggered on the "death cross" of the 50/200-EMAs. The RSI is negative and still falling. Even if the RSI gets oversold, you can see based on history that rally are short-lived. The PMO has topped well-below the zero line and should trigger a crossover SELL signal soon. The OBV is confirming the decline. Relative performance stinks which is exactly what we want when looking for shorting opportunities. The stop to the upside is set above the 20-EMA. Note that it generally fails at the 20-EMA to we want to account for that by setting the stop higher."

Below is today's chart:

I believe this one is still a dog, but it is bouncing off strong support. Today bounce was what put this position down -3.59% this week. I wouldn't look at this as BUY, but the PMO is improving. Maybe this industry group is ready to rebound. I just wouldn't take a chance given the bearish configuration of this chart right now.

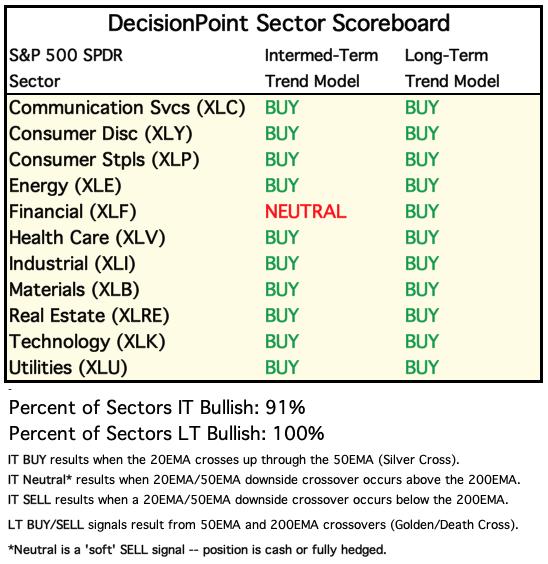

THIS WEEK's Sector Performance:

DecisionPoint Sector Scoreboard (Mechanical Trend Model Signals):

Click Here to view Carl's annotated Sector ChartList!

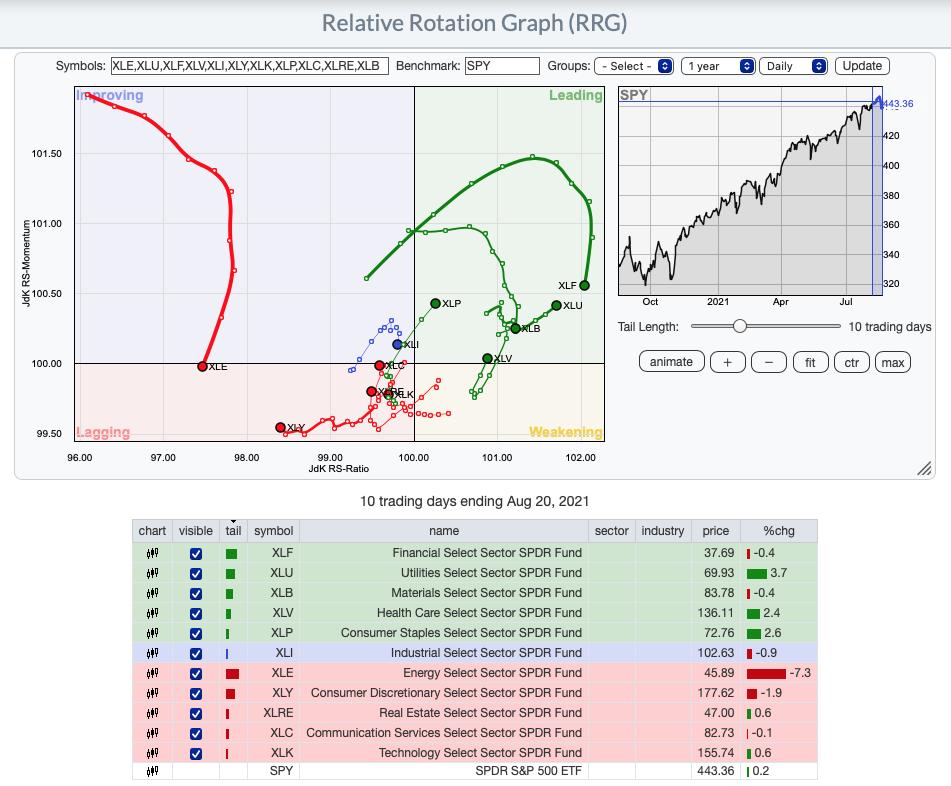

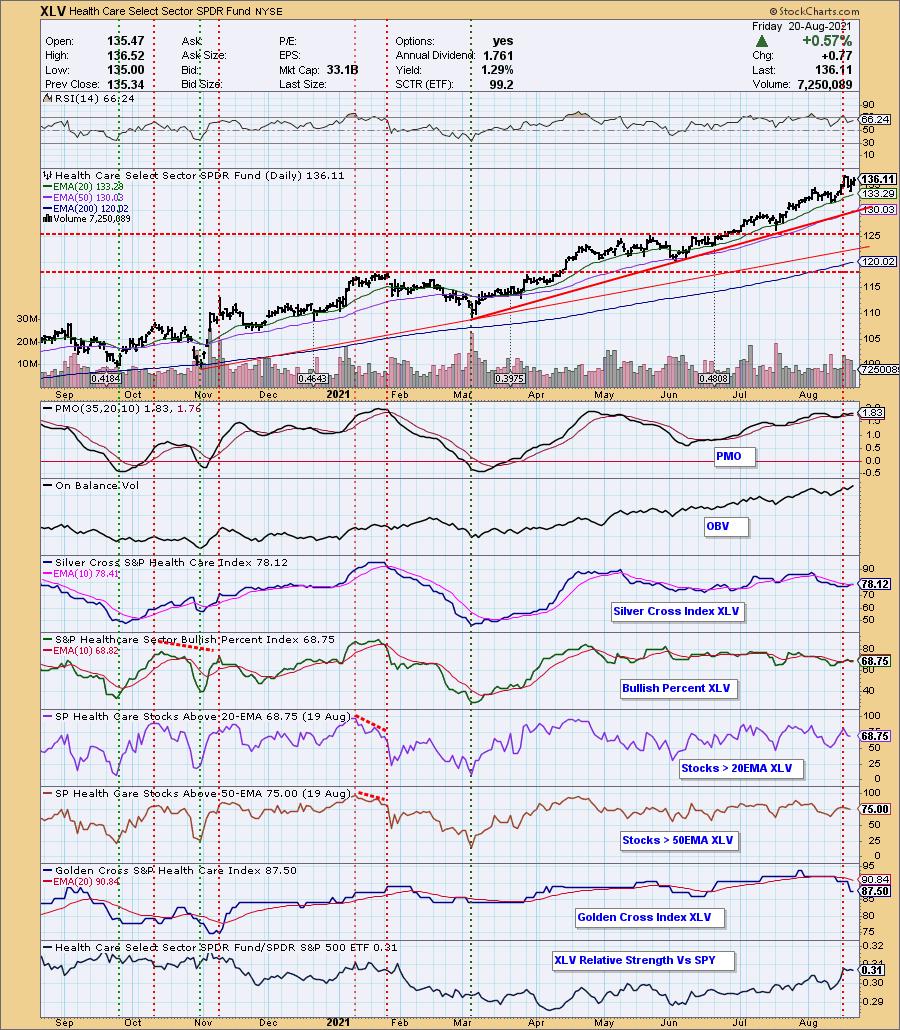

Short-term RRG: The three sectors that I looked at today as the "sector to watch" are obvious on the RRG. XLU, XLP and XLV. Since I like to see new momentum, I prefer Healthcare, but I expect the other two sectors to continue to outperform.

Sector to Watch: Healthcare (XLV)

XLV paused this week, but is ready to make another move higher. The RSI is positive and not overbought and the PMO is rising on a new whipsaw BUY signal. Price found support along the 20-EMA. The OBV looks healthy. The SCI is particularly bullish as it is bottoming. Participation is still good and isn't overbought. I suspect this sector will begin to outperform next week.

Industry Group to Watch: Health Care Providers ($DJUSHP)

There are strong areas in this sector but I think this one will carry the week. It is beginning to outperform the SPX. The RSI is now positive. Today's breakout looks great and it comes alongside a positive 5/20-EMA crossover for a ST Trend Model BUY signal.

Go to our Sector ChartList on DecisionPoint.com to get an in depth view of all the sectors.

Technical Analysis is a windsock, not a crystal ball.

Have a great weekend & Happy Charting! Next Diamonds Report is Tuesday 8/24.

- Erin

erin@decisionpoint.com

Full Disclosure: I'm about 35% invested right now and 65% is in 'cash', meaning in money markets and readily available to trade with.

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

(c) Copyright 2021 DecisionPoint.com