In preparation for my webinar this afternoon, I took a fresh look at where I'm seeing new strength. I presented my "Diamond of the Week" during yesterday's DecisionPoint show. I still very much like this pick and while it isn't necessarily a typical Diamond in the Rough, the chart is looking very good. Likely because an industry group that is tied to this stock is beginning to show signs of life again.

That industry group is Renewable Energy. I was noticing a few of these stocks in my scan results, but I wasn't convinced they were ripe. I believe they are now so the Diamond of the Week was Tesla (TSLA) and the pick from Solar is Enphase (ENPH).

Other groups of interest were Telecom and Pharma, so I've got Nokia (NOK) and PDS Biotech (PDSB). I'm seeing some rumblings in the Biotech group, but haven't found a stock that I like there. Maybe you have some for reader request Thursday or to present in tomorrow's Diamond Mine trading room.

The short list today isn't that robust, but as always they are interesting to look at.

Don't forget to register for tomorrow's BONUS Diamond Mine trading room right HERE or below!

Today's "Diamonds in the Rough" are: ENPH, NOK, PDSB and TSLA.

Stocks to Review ** (no order): ALRM, AMKR, AMAT, APAM, COG, DSU, MRTX, AMGN and PGR.

** The "Stocks to Review" are stocks that were on my short list for the day.

RECORDING LINK Friday (7/23):

Topic: DecisionPoint Diamond Mine (07/23/2021) LIVE Trading Room

Start Time : Jul 23, 2021 09:00 AM

Recording link for 7/23 Diamond Mine is HERE.

Access Passcode: July/23rd

THERE WAS NO RECORDING FOR FRIDAY (7/30), I forgot to hit record.

REGISTRATION FOR Wednesday 8/4 Bonus Diamond Mine:

When: Aug 4, 2021 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Make-Up Diamond Mine (8/4/2021) LIVE Trading Room

Register in advance for this webinar HERE.

REGISTRATION FOR FRIDAY 8/6 Diamond Mine:

When: Aug 6, 2021 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (8/6/2021) LIVE Trading Room

Register in advance for this webinar HERE.

Save the registration confirmation email with login instructions in case Zoom doesn't notify you in time.

Tom Bowley joined Erin in the DP Trading Room August 2nd!

Free DP Trading Room (8/2) RECORDING LINK:

Topic: DecisionPoint Trading Room

Start Time : Aug 2, 2021 08:41 AM

Meeting Recording Link HERE.

Access Passcode: August/2nd

For best results, copy and paste the access code to avoid typos.

Welcome to DecisionPoint Daily Diamonds, wherein I highlight five "Diamonds in the Rough." These are selected from the results of my DecisionPoint scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

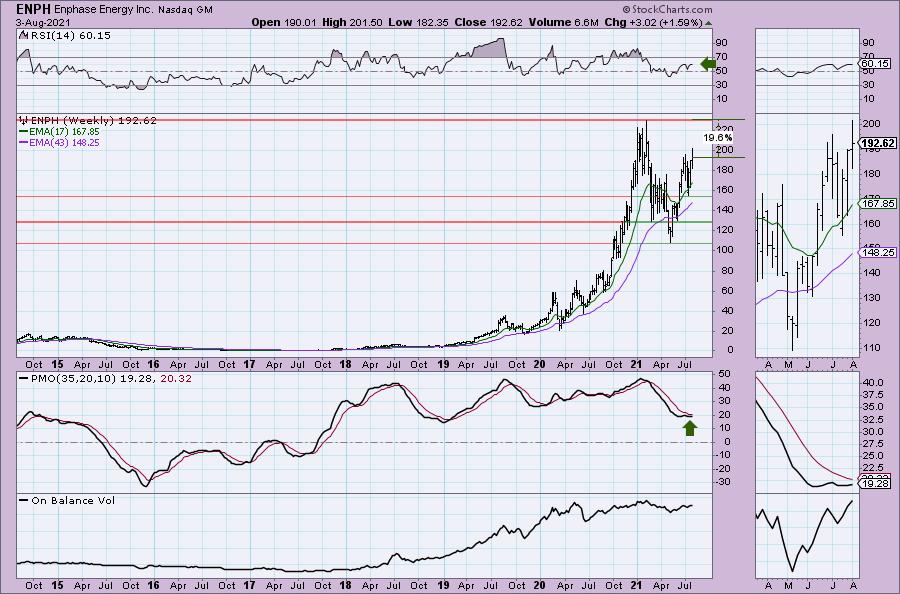

Enphase Energy Inc. (ENPH)

EARNINGS: 10/26/2021 (AMC)

Enphase Energy, Inc. engages in the design, development, manufacture and sale of micro inverter systems for the solar photovoltaic industry. Its products include IQ 7 Microinverter Series, IQ Battery, IQ Envoy, IQ Microinverter Accessories, IQ Envoy Accessories and Enlighten & Apps. The company was founded by Raghuveer R. Belur and Martin Fornage in March 2006 and is headquartered in Fremont, CA.

ENPH is down -0.40% in after hours trading. I've covered this one frequently. In order, May 4th 2020 (We were eventually shaken out of the position and the 7.6% stop was hit, but that was after being up over 56%), July 6th 2020 (Best timed position, stop never hit and position up 284%!), April 27th 2021 (stop hit, jumped the gun), and May 20th 2021 (Better timing, position is up 35.8%).

ENPH is one of the strongest performers in the Renewable Energy space and looking at relative strength, it's a strong performer against the SPX. Right now, even after a 5% plus gain today, this one looks very good. The RSI is positive and PMO is nearing a crossover BUY signal. There is a reverse head and shoulders that is about to execute (rising neckline not punctured). However, I don't think we have to wait for the neckline to be punctured.

The weekly chart is looking very interesting right now. There is a positive and not overbought weekly RSI. The weekly PMO is rising again and should trigger a crossover BUY signal in oversold territory. (Full disclosure: I own ENPH)

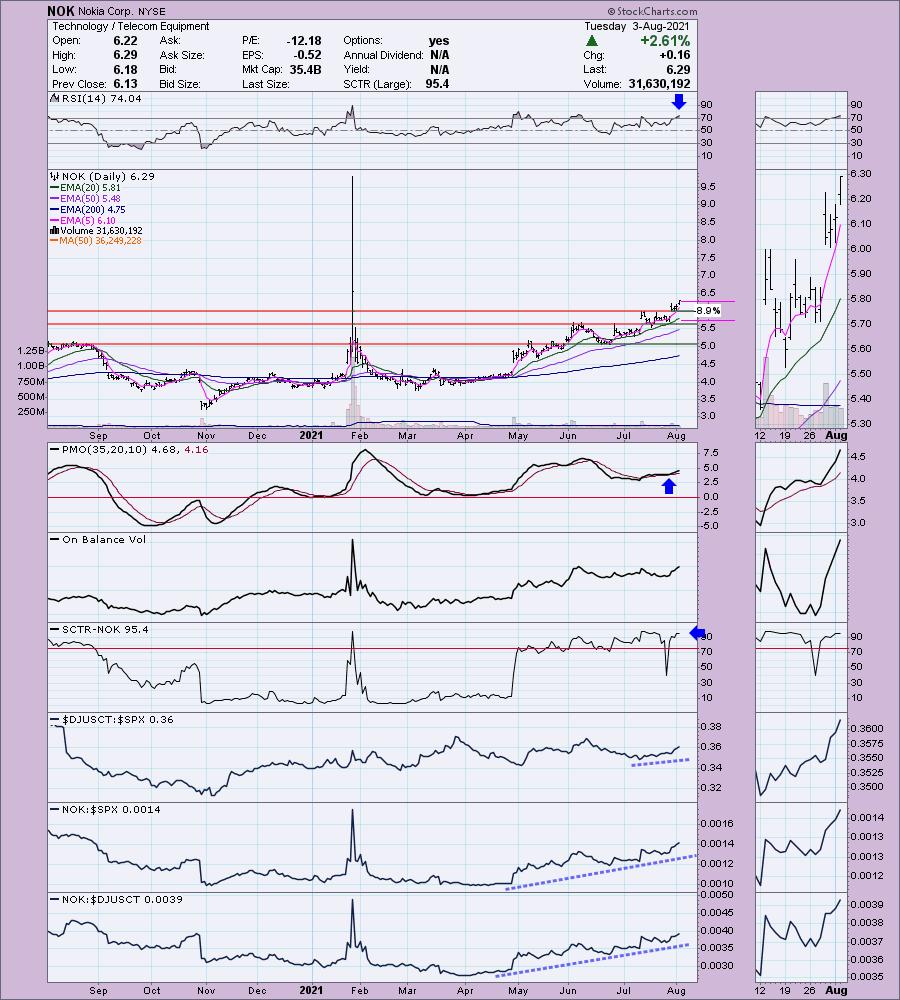

Nokia Corp. (NOK)

EARNINGS: 10/28/2021

Nokia Oyj engages in the provision of network infrastructure, technology, and software services. It operates through the following segments: Networks, Nokia Software, Nokia Technologies, and Group Common and Other. The Networks segment comprises mobile networks, services, fixed networks, and optical networks. The Nokia Software segment offers cloud core software portfolio. The Nokia Technologies segment focuses on the innovation and research and development in technologies used. The company was founded by Fredrik Idestam in 1865 and is headquartered in Espoo, Finland.

NOK is unchanged in after hours trading. The one heartburn I have over NOK is the overbought RSI. However, it is still rising so we could eke out more gains before it corrects. The steady rally has really turned NOK into a major relative outperformer. I expect more given the PMO is rising after a very bullish bottom above the signal line. Volume is coming in and the SCTR is in the "hot zone" above 75. The stop is somewhat deep at 8.9%, but you could tighten that up to match with the bottom of gap support around $5.70.

NOK is approaching overhead resistance at the 2017 and 2019 tops which is why the overbought daily and weekly RSIs could be a problem. However, the weekly PMO is rising very strongly. If price can reach the 2014 high, that would be a 23.3% gain.

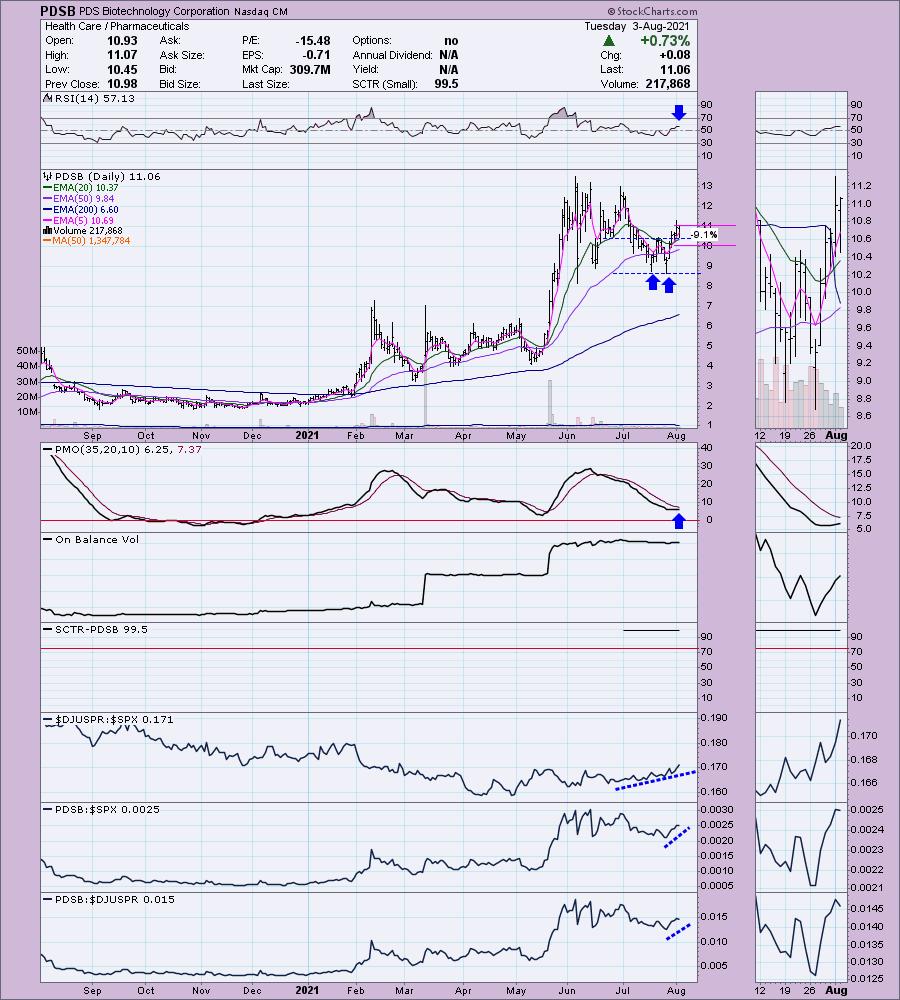

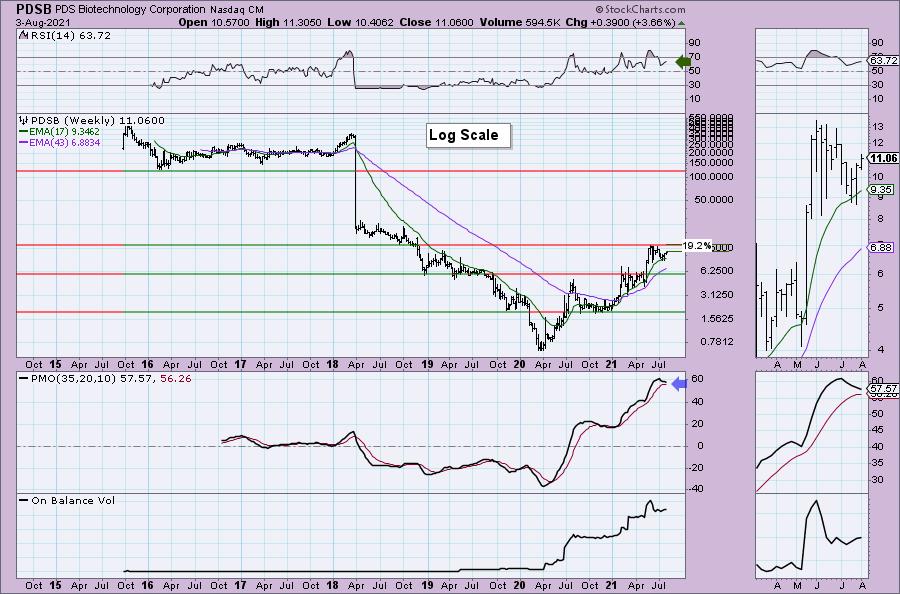

PDS Biotechnology Corporation (PDSB)

EARNINGS: 8/12/2021 (BMO)

PDS Biotechnology Corp. engages in the development of clinical-stage immunotherapies to treat various early-stage and late-stage cancers, including head and neck cancer, prostate cancer, breast cancer, cervical cancer, anal cancer, and other cancers. Its products PDS0101, is an off the shelf immunotherapeutic that is administered by subcutaneous injection. The company was founded by Frank K. Bedu-Addo on March 15, 2019 and is headquartered in Princeton, NJ.

PDSB is already up +1.45% in after hours trading. Interest is high for this stock and it is poised to outperform further. The RSI is positive and the PMO is rising toward an oversold crossover BUY signal. It's a bit new to the SCTR universe, but it is in the 99th percentile among all small-cap stocks. Relative strength is showing for the group and PDSB is outperforming the group as well as the SPX. The stop is deep, but again, you can tighten that up closer to the confirmation line of the bullish double-bottom around $10.20.

The weekly chart is mixed with a positive RSI but a less than perfect PMO. The weekly PMO is attempting to decelerate. I had to use a log scale on this chart so we could see price action. If price can simply test the June high, that would be a nearly 20% gain.

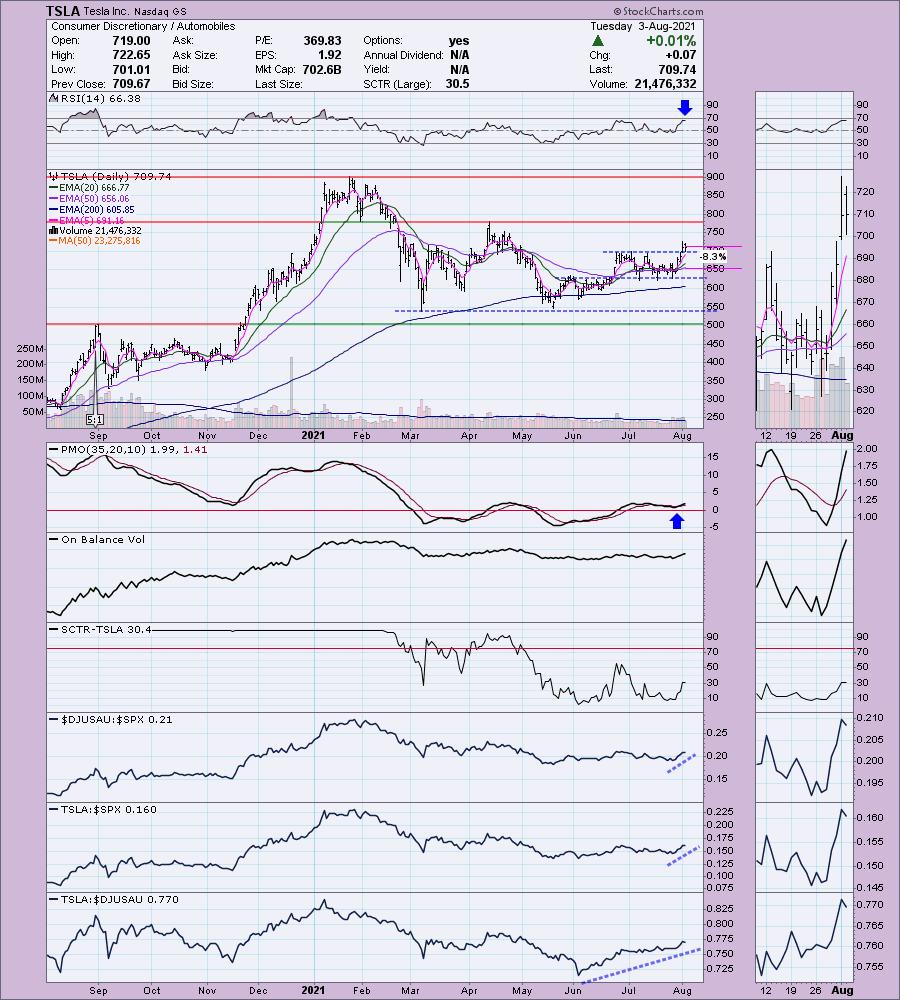

Tesla Inc. (TSLA)

EARNINGS: 10/20/2021 (AMC)

Tesla, Inc. engages in the design, development, manufacture, and sale of fully electric vehicles, energy generation and storage systems. It also provides vehicle service centers, supercharger station, and self-driving capability. The company operates through the following segments: Automotive and Energy Generation and Storage. The Automotive segment includes the design, development, manufacture and sale of electric vehicles. The Energy Generation and Storage segment includes the design, manufacture, installation, sale, and lease of stationary energy storage products and solar energy systems, and sale of electricity generated by its solar energy systems to customers. It develops energy storage products for use in homes, commercial facilities and utility sites. The company was founded by Jeffrey B. Straubel, Elon Reeve Musk, Martin Eberhard, and Marc Tarpenning on July 1, 2003 and is headquartered in Palo Alto, CA.

TLSA is up +0.04% in after hours trading. I often will avoid presenting stocks that everyone is already looking at, but the Auto industry group is showing some outperformance. If you're going to be in this group, TSLA is one of the best performers. It is also tied to the solar industry which is showing new relative strength. I like the breakout and price's ability to sustain above support at the breakout point. The RSI is positive and not yet overbought and the PMO whipped into a crossover BUY signal last week. The stop is set around the 50-EMA at 8.3%.

The weekly chart is looking very interesting. The RSI is positive and the weekly PMO is attempting to bottom. Upside potential is 27.2% and I believe it will make its way back there. (Full disclosure: I own TSLA)

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

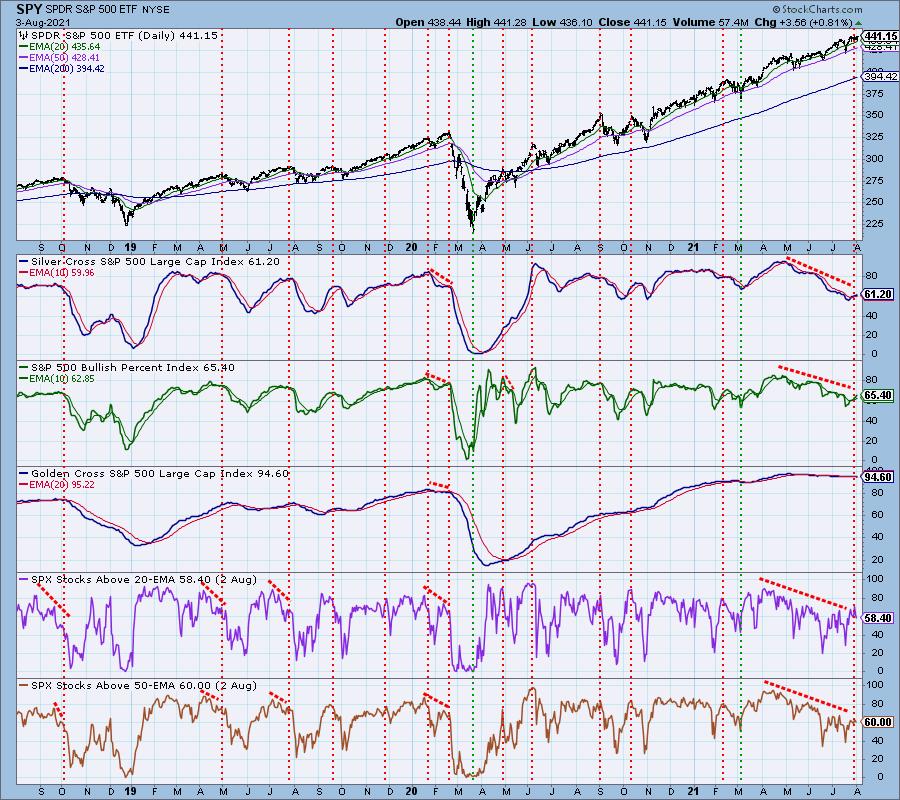

Current Market Outlook:

Market Environment: It is important to consider the odds for success by assessing the market tides. The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA)

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA)

- The Bullish Percent Index (BPI) shows the percentage of SPX stocks on Point & Figure BUY signals.

Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page.

Here is the current chart:

Full Disclosure: I'm about 50% invested and 50% is in 'cash', meaning in money markets and readily available to trade with. I own ENPH and TSLA.

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

erin@decisionpoint.com

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "Diamonds in the Rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com