Thank you for your patience as we continue to work on our website publishing process. We are having technical issues, so not only am I publishing late while traveling, the website is having problems. Hopefully, you are getting this via the normal route on our website. If not, I'll be sending it out like I did last night with links to the charts embedded within the report. The DP Alert hasn't been able to publish, so I may be up late figuring that out.

I'll throw some pictures at the end of tonight's report. It was beautiful in Zion today, but I am very fatigued after over 4 miles of hiking up and down trails. How very fortunate I am to be able to work on the road!

I have five interesting selections tonight. I noticed that Broker-Dealers are beginning to outperform so I have included the ETF as well as Morgan Stanley (MS) to take advantage of this new strength.

Today's "Diamonds in the Rough" are: CLAR, CLFD, IAI, MS and TT.

** WORKING VACATION - June 28th to July 9th **

It's that time of year again! Last year it was a road trip to Alabama and back, this year it is a road trip to Utah and back! We hit Las Vegas and have arrived at Zion. Next up are Spanish Fork, Bryce Canyon, back to the Grand Canyon, Bull Head City and finally back home. I'll include my travel diary and pictures just like last year for Diamonds readers!

I plan on writing, but trading rooms will be postponed until I return home. Diamond Report publishing will vary depending on travel and activities, but you WILL get your 10 "Diamonds in the Rough" per week.

TENTATIVE SCHEDULE NEXT WEEK:

Five stocks on Wednesday (6/30), five stocks on Thursday (7/1) and then a Recap on Friday (7/2).

Diamond Mine Information:

Diamond Mine Information:

RECORDING LINK Wednesday (6/23):

Topic: BONUS DecisionPoint Diamond Mine Wednesday (6/23)

Start Time : Jun 23, 2021 09:01 AM

6/23 Diamond Mine Recording Link.

Access Passcode: June-23rd

RECORDING LINK (Friday 6/18):

Topic: DecisionPoint Diamond Mine (06/18/2021) LIVE Trading Room

Start Time : Jun 18, 2021 08:59 AM

6/18 Diamond Mine Recording Link.

Access Passcode: June-18th

REGISTRATION FOR FRIDAY Diamond Mine:

When: Jun 25, 2021 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (6/25) LIVE Trading Room

Register in advance for FRIDAY's webinar HERE

Save the registration confirmation email with login instructions in case Zoom doesn't notify you in time.

Free DP Trading Room RECORDING LINK:

Topic: DecisionPoint Trading Room

Start Time : Jun 14, 2021 09:00 AM

Free DP Trading Room Recording LINK.

Access Passcode: June/14th

For best results, copy and paste the access code to avoid typos.

Welcome to DecisionPoint Daily Diamonds, wherein I highlight five "Diamonds in the Rough." These are selected from the results of my DecisionPoint scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

Clarus Corp. (CLAR)

EARNINGS: 8/9/2021 (AMC)

Clarus Corp. engages in development, manufacture, and distribution of outdoor equipment and lifestyle products focused on the climb, ski, mountain, and sport categories. It operates through the Black Diamond and Sierra segment. The Black Diamond segment designs, manufactures, and markets outdoor engineered equipment and apparel for climbing, mountaineering, backpacking, skiing, and a range of other year-round outdoor recreation activities. The Sierra segment produces bullets and ammunition for both rifles and pistols. The company was founded in 1989 and is headquartered in Salt Lake City, UT.

CLAR was up +1.66% in after hours trading. Today it broke out strongly and if after hours trading is any indication, it will continue to rise. The RSI is positive and not overbought. The PMO, as with all of these, is rising and nearing a BUY signal. There is a bit of a negative divergence with the OBV, but the SCTR is first rate and it is a clear outperformer. The stop is set near the 20-EMA.

We have bullish pennant and price has popped out of it. The weekly RSI is overbought, but the PMO, while overbought, is rising strongly. Volume is coming in on the weekly chart.

Clearfield Inc. (CLFD)

EARNINGS: 7/22/2021 (AMC)

Clearfield, Inc. designs, manufactures, and distributes fiber optic management, protection and delivery products for communications networks. The firm's products include fiber cabinets, patch cards, assemblies, cassettes, frames, panels, microduct, terminals, vaults, wall boxes, and box enclosures. It offers its products under the Clearview brand. The company was founded in 1979 and is headquartered in Brooklyn Park, MN.

CLFD was unchanged in after hours trading. The RSI is just hitting positive territory. There is small bull flag and looking in the thumbnail, this breakout should begin the execution of the pattern. The upside target is past the all-time high. PMO is nearing a BUY signal in oversold territory and the SCTR is now in the "hot zone" above 75. The stop could be set deeper to reach support, but I prefer not to go to 10% or higher for a stop.

Upside target is past the all-time high, but I have marked it to show you about how far all-time highs are. The weekly RSI is positive and not overbought. I'm not thrilled with the declining weekly PMO nor the negative divergence on the weekly OBV. Consider this investment short-term in nature.

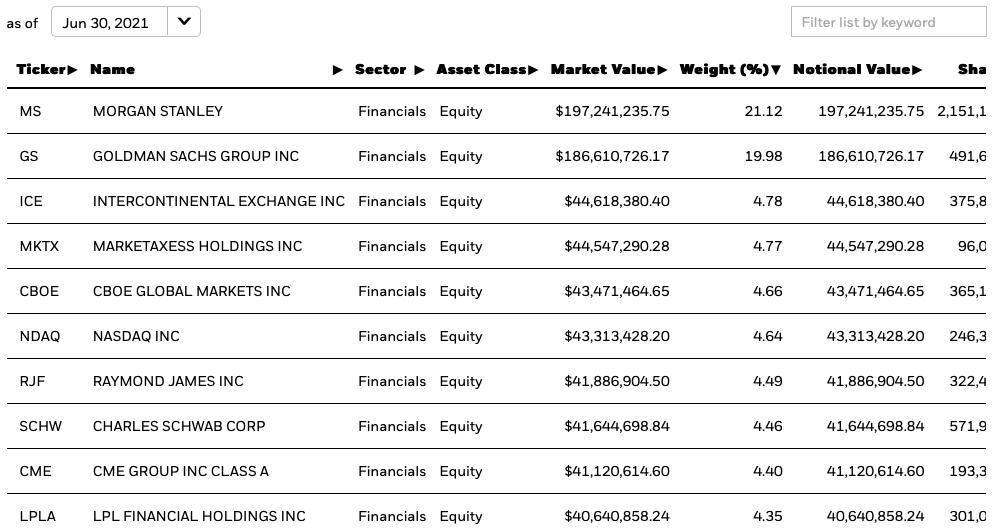

iShares U.S. Broker-Dealers & Securities Exchanges ETF (IAI)

EARNINGS: N/A

IAI tracks a market-cap-weighted index of investment service providers as well as securities and commodities exchanges.

Top Ten Holdings:

IAI was up +0.33% in after hours trading. The RSI is positive and rising. The PMO is nearing a BUY signal. Volume is coming in and the group is outperforming the SPX. The SCTR tells us that it is in the top 5% of ETFs.

The weekly RSI is positive, but the weekly PMO and OBV aren't as bullish as I'd like them to be so consider this more short term.

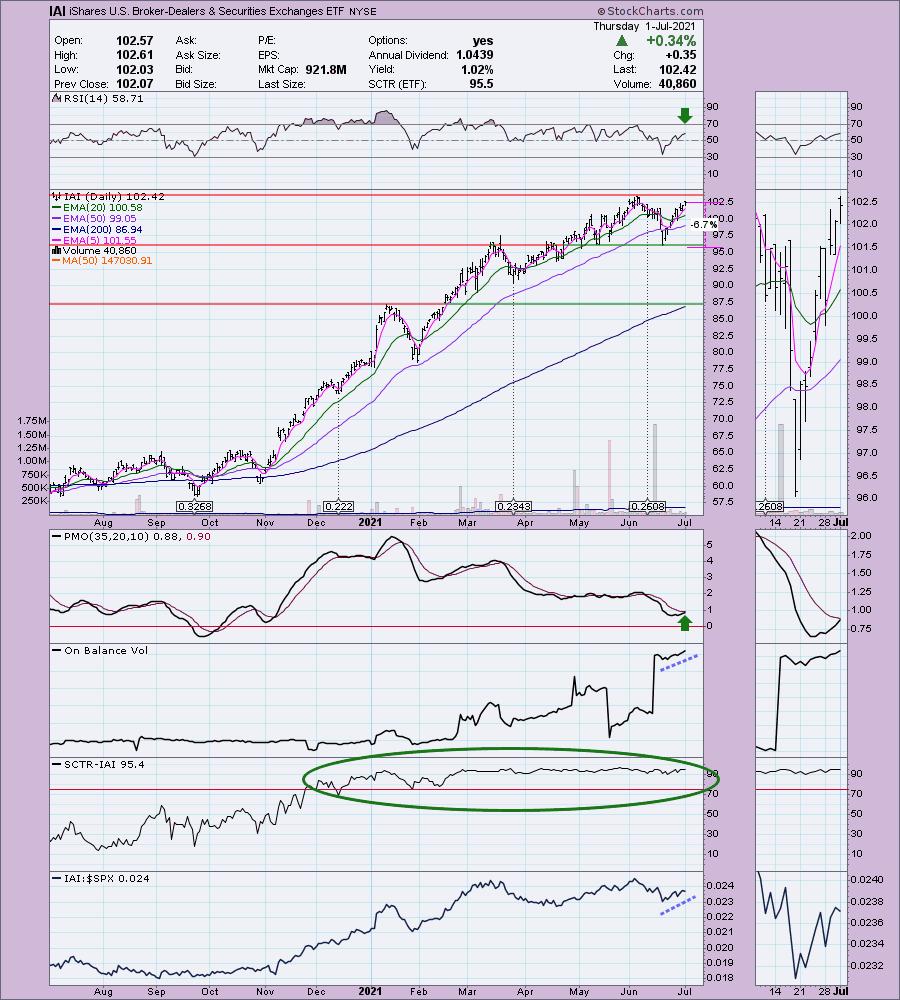

Morgan Stanley (MS)

EARNINGS: 7/15/2021 (BMO)

Provides diversified financial services including brokerage, investment management and venture capital services

MS was up +0.12% in after hours trading. You'll note that MS is the top holding in IAI so you can decide how diversified you want to be in this industry group. The RSI is positive and not overbought. The PMO is about to give us a crossover BUY signal in oversold territory. Performance against the group and SPX is very good. You can also see that the industry group is prospering as well. The stop is set at support.

The weekly chart is very bullish. The only issue is a weekly PMO SELL signal, but you can see it is already beginning to decelerate. Price is headed up to test the top of its rising trend channel which would definitely mean new all-time highs.

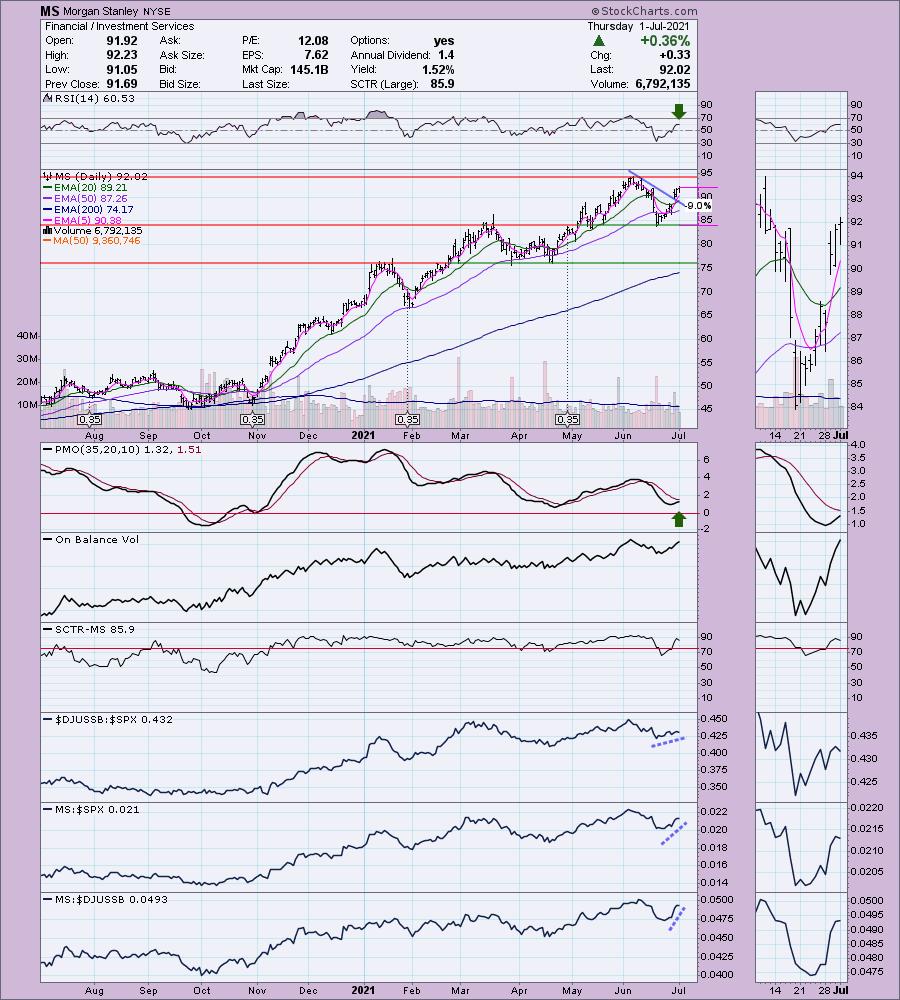

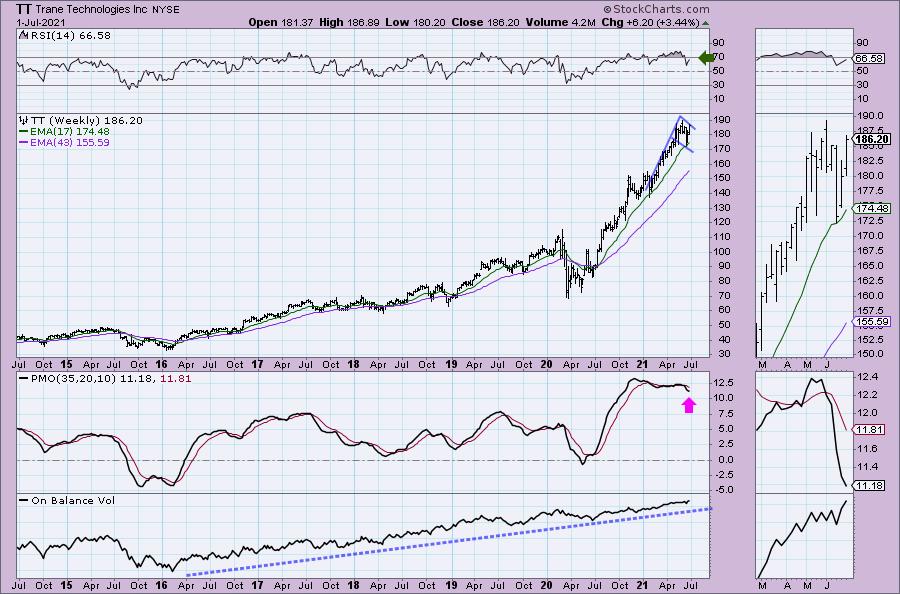

Trane Technologies Inc (TT)

EARNINGS: 7/28/2021 (BMO)

Trane Technologies Plc engages in the provision of products, services, and solutions to enhance the quality, energy, and comfort of air in homes and buildings, transport and protect food and perishables and increase industrial productivity and efficiency. It operates through the following segments: Americas, EMEA, and Asia Pacific. The Americas segment encompasses commercial heating and cooling systems, building controls, and energy services and solutions; residential heating and cooling; and transport refrigeration systems and solutions in North America and Latin America region. The EMEA segment encompasses heating and cooling systems, services and solutions for commercial buildings, and transport refrigeration systems and solutions in Europe, Middle East and Africa region. The Asia Pacific segment encompasses heating and cooling systems, services and solutions for commercial buildings and transport refrigeration systems and solutions in Asia Pacific region. The company was founded in 1871 and is headquartered in Swords, Ireland.

TT was down -0.38% in after hours trading. I'm not thrilled that overhead resistance is nearing, but the indicators look positive and suggest a breakout. The RSI is positive and PMO rising toward an oversold BUY signal. Volume is coming in as it nears this likely breakout. It is performing very well and the industry group is beginning to outperform as well. The stop is set at support.

The weekly chart shows a bull flag and positive weekly RSI that isn't overbought. I like the rising OBV line, I'm just not thrilled with the PMO. It is beginning to decelerate though.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

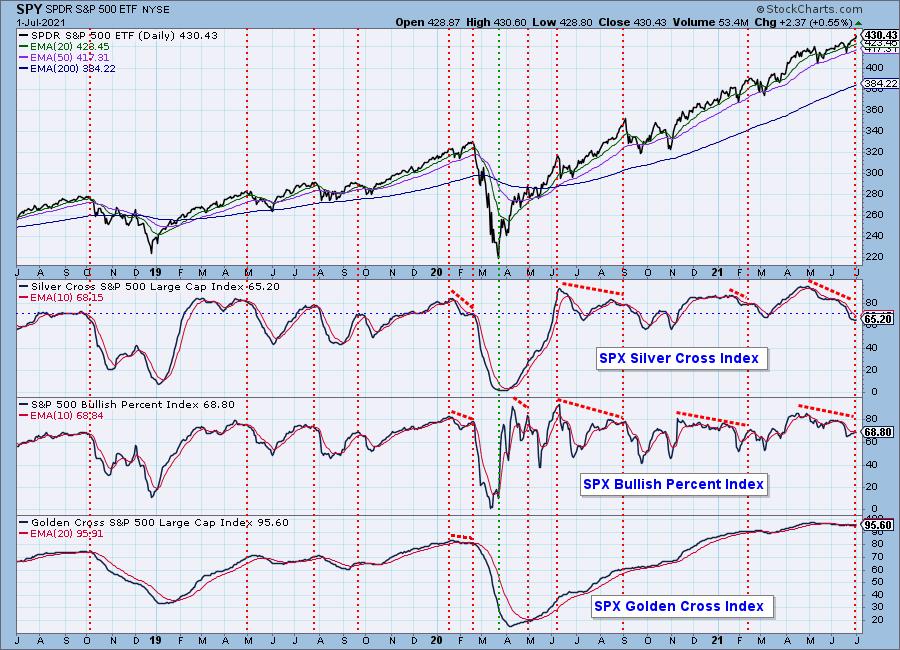

Current Market Outlook:

Market Environment: It is important to consider the odds for success by assessing the market tides. The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA)

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA)

- The Bullish Percent Index (BPI) shows the percentage of SPX stocks on Point & Figure BUY signals.

Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page.

Here is the current chart:

Full Disclosure: I'm about 50% invested and 50% is in 'cash', meaning in money markets and readily available to trade with.

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

erin@decisionpoint.com

Zion Trail Hikes:

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "Diamonds in the Rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com