This week's sparkling diamond was TPI Composites (TPIC), currently up +11.62% since I picked it on Wednesday. It is in the renewable energy space and like its brethren it has rallied strongly this week. I wrote a ChartWatchers article on renewable energy earlier today that I invite you to check out. Of course, you all had prior knowledge of TPIC and my affinity for solar before ChartWatchers readers today. Since I did cover TPIC in my ChartWatchers article, I won't cover it in today's Recap. Instead I will look at BioXcel (BTAI) which was the runner-up with a +10.66% gain this week.

We finished the week ahead, but unfortunately the "Diamond of the Week" IQ skewed the entire picture. It was not just a "dud" it was a thorough "crash and burn" and by far the worst stock pick I have EVER made in my many years of investing and blogging. I'm not joking. It finished the week down a whopping -22.77%! I took the stop at -10% even though I had set it at 7.4%. With the gap down on Wednesday, the 7.4% stop wouldn't have been possible, so I took -10%. Rather than dwell on it, I have opted to cover Easterly Government Properties (DEA) which was the worst performer of the week (not counting IQ). It was down a modest -3.8%.

The new Diamond Mine registration link is available below. Remember to save your confirmation email from Zoom.

PLEASE NOTE our Holiday Schedule! The "Diamond Mine" Trading Room will be open the next two Wednesdays, not Fridays.

** HOLIDAY SCHEDULE 12/21/2020 - 1/1/2021 **

Diamonds:

Monday & Tuesday --Eleven Diamonds in the Rough (no reader requests).

Wednesday: Diamonds Recap & LIVE Diamond Mine Trading Room at 9:00a PT

DecisionPoint Alert:

Publishing Monday - Wednesday

** There will be no reports sent on 12/24 and 12/25. Additionally no reports will be sent 12/31 and 1/1 **

Diamond Mine Information:

Diamond Mine Information:

Here is today's (12/18/2020) recording link. Access Passcode: 6?i8uv&f

Register in advance for the next "DecisionPoint Diamond Mine" trading room on Wednesday (12/23/2020) 12:00p ET:

Here is the registration link for WEDNESDAY, 12/23/2020. Registration & Entry Password: merry

Please do not share these links! They are for Diamonds subscribers ONLY!

Save the registration confirmation email with login instructions in case Zoom doesn't notify you in time.

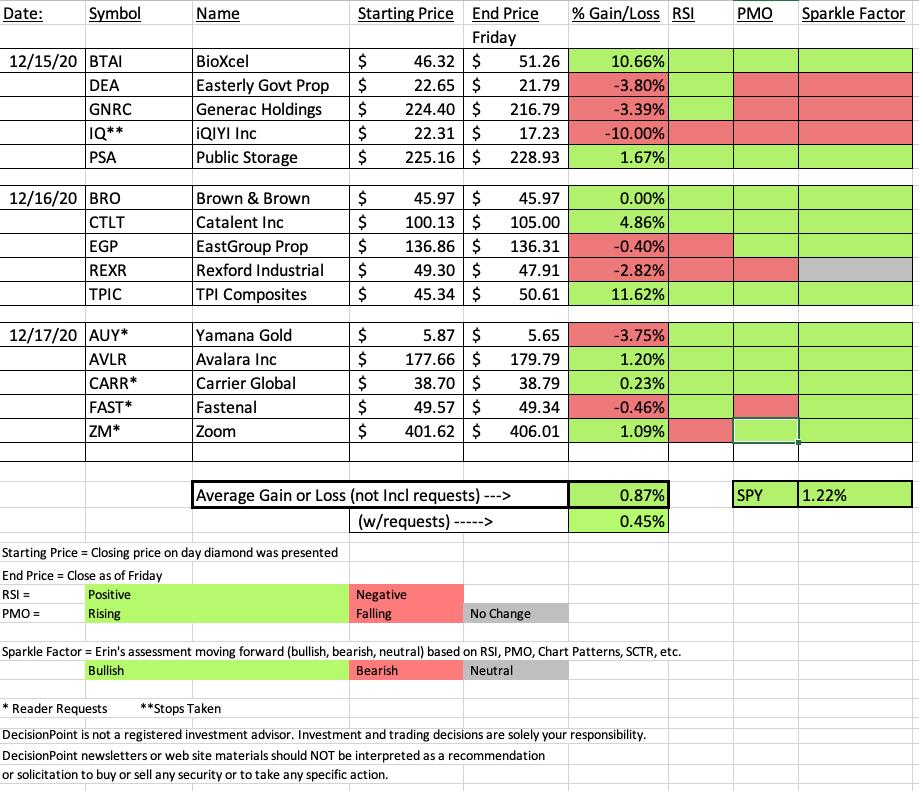

A few items about the spreadsheet: I decided it only fair to denote "reader requests" as I shouldn't get to take credit if they turn out great! I've put on the spreadsheet whether the RSI is positive (green) or negative (red). The PMO column tells you if it is rising (green) or falling (red). Finally I've added my own "Sparkle Factor" that gives you my assessment going forward, bullish (green), bearish (red) or neutral (gray). The Sparkle Factor is basically my thoughts on whether I expect it to rise or fall. A neutral means it could really go either way so it could be added to a watch list. If you're in a stock I consider "neutral" going forward, the ball is in your court.

It's FREE!

***Click here to register for this recurring free DecisionPoint Trading Room!***

Did you miss the 12/14 DP Trading Room! Here's a link to the recording with Passcode: 7dJNVe6+

For best results, copy and paste the password to avoid typos.

Darling:

BioXcel Therapeutics, Inc. (BTAI)

EARNINGS: 3/9/2021 (BMO)

BioXcel Therapeutics, Inc. is a clinical stage biopharmaceutical company, which focuses on drug development. The firm's two clinical development programs are BXCL501, a sublingual thin film formulation designed for acute treatment of agitation resulting from neurological and psychiatric disorders, and BXCL701, an immuno-oncology agent designed for treatment of a rare form of prostate cancer and for treatment of pancreatic cancer. The company was founded by Vimal D. Mehta on March 29, 2017 and is headquartered in New Haven, CT.

Below is the chart and commentary from Tuesday:

"I covered this one in the April 28th Diamond Report (up 39.9% since). It is lined up nicely again. The PMO has turned up but hasn't actually given us the BUY signal, so we may be getting in early on this one. Indeed, the RSI is just now getting close to moving back into positive territory. We have a positive OBV divergence on the double-bottom pattern. The SCTR is terrible so it hasn't been the best performer in relation to other small-caps, but it should improve quickly if this breakout occurs. The upside target of the double-bottom pattern is right at the November top. I've set the stop just below the October low. If you wish to move it down to the 200-EMA, it's deeper than I like, but that is the next area of strong support. "

Here is today's chart:

Unlike IQ which had a similar set-up, BTAI followed through exactly as expected with the double-bottom pattern confirming on the breakout above the confirmation line. The minimum upside target of that pattern would take price at least to overhead resistance at the November top. The RSI remains positive and isn't overbought and the PMO triggered its BUY signal and is now in positive territory above the zero line. I like it going forward.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Dud:

Easterly Government Properties, Inc. (DEA)

EARNINGS: 2/23/2021 (BMO)

Easterly Government Properties, Inc. operates as a real estate investment trust, which engages in the acquisition, development, and management of commercial properties that are leased to U.S. Government agencies. The company was founded on October 10, 2014 and is headquartered in Washington, DC.

Below is the chart and commentary from Tuesday:

"This is a great example of a "momentum sleeper" that woke up today. It is likely you'll see a pullback tomorrow for a better entry if you want this one. I see a reverse head and shoulders that executed with today's forceful rally. It helped the PMO avoid a crossover SELL signal by forming a very bullish bottom above the signal line. The RSI popped into positive territory but isn't overbought yet. I set the stop level just below the right shoulder."

Below is today's chart:

Rather than a simple pullback to the breakout point on the reverse head and shoulders, price whipped WAY back down, failing to hold support at all three of the EMAs and the July lows. The PMO has topped at the RSI went negative. When you look at the top chart, you can see why it was enticing. The only possible hint we had that this was going to happen was the declining tops on the OBV and lack of an OBV breakout on the price breakout. We did have a very low SCTR which suggests internal and relative weakness, but it was rising at the time.

THIS WEEK's Sector Performance:

Click Here to view Carl's annotated Sector ChartList!

CONCLUSION:

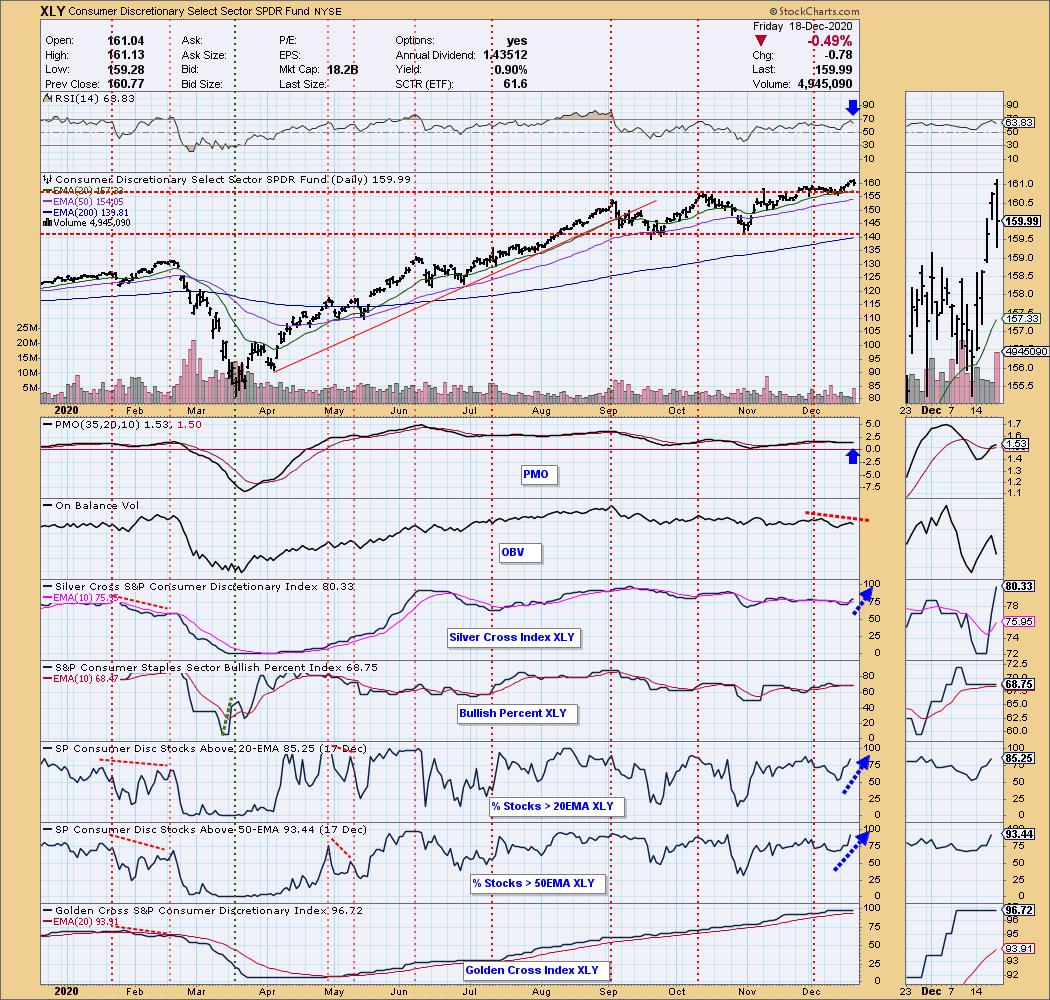

My current favorite going into next week would be the Consumer Discretionary sector. The indicators are turning up and this tends to be a good time of year for this sector. Industry group to watch will likely be

Sector to Watch: Consumer Discretionary (XLY)

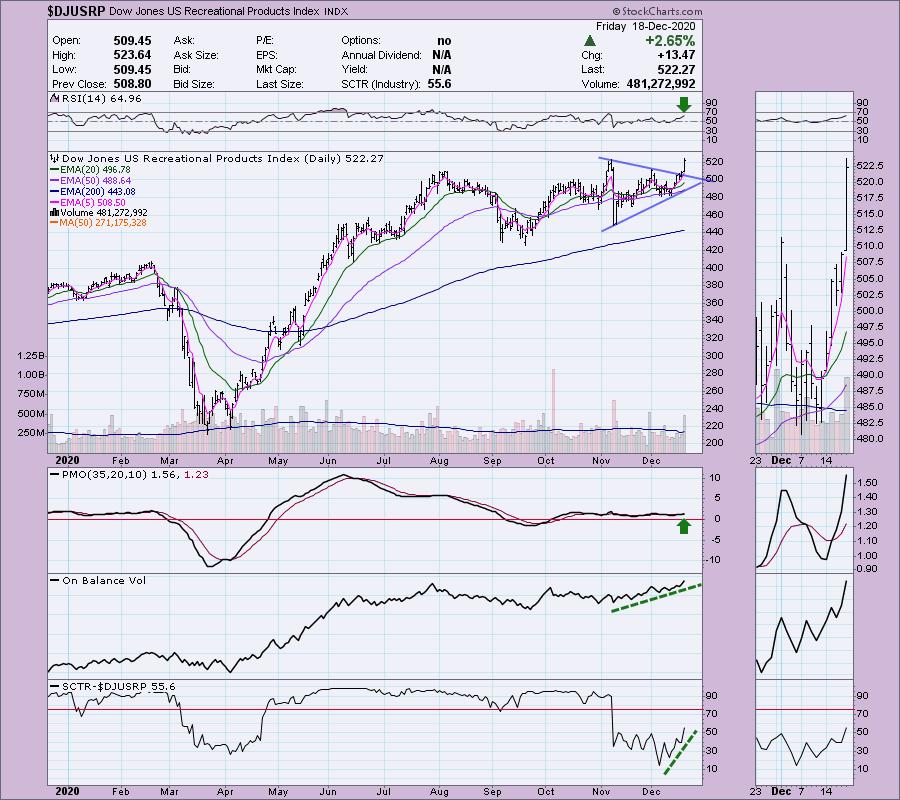

Industry Group to Watch: Recreational Products ($DJUSRP)

Go to our Sector ChartList on DecisionPoint.com to get an in depth view of all the sectors.

Have a great weekend! Happy Charting!

- Erin

erin@decisionpoint.com

Full Disclosure: I'm about 50% invested right now and 50% is in 'cash', meaning in money markets and readily available to trade with. I've lightened my exposure to the market as it is acting "toppy". I'm not planning on selling any more positions this coming week. However, I'm not planning on adding either (unless it's a Gold Miner).

Technical Analysis is a windsock, not a crystal ball.

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com!