As most of you know from Friday's Diamonds Recap, I said the "Sector to Watch" this week was Consumer Discretionary (XLY). My Mid-Range SCTR - Bullish EMAs Scan produced quite a few Discretionary results and I have picked my favorites.

If you missed my article yesterday about the "Diamond of the Week", Amazon (AMZN), you'll want to read it. Julius de Kempenaer "Mr. RRG" joined me in the free trading room yesterday and using RRG and my Diamond PMO Crossover Scan, we both decided that AMZN looked best. I also added the 5-minute candlestick chart with notice of a near immediate entry for this morning. It turned out to be a good one. AMZN was up +1.68% today. Here is a direct link to the article, but remember, you can access all of our articles (paid and free) from the DecisionPoint.com website "Blogs and Links" page.

Today's "Diamonds in the Rough" are: HAS, JACK, POOL, SFIX and TJX.

Diamond Mine Information:

Diamond Mine Information:

Here is Friday's (11/20) recording link. Use Access Passcode: @f#x+6qP

Register in advance for the next "DecisionPoint Diamond Mine" trading room on Friday (12/4/2020) 12:00p ET:

Here is the registration link for Friday, 12/4/2020. Password: turkey

Please do not share these links! They are for Diamonds subscribers ONLY!

It's Free!

***Click here to register for this recurring free DecisionPoint Trading Room on Mondays at Noon ET!***

Did you miss the 11/23 free trading room? Here is a link to the recording. Access Code: EE4Xi6Y$

For best results, copy and paste the access code to avoid typos.

Welcome to DecisionPoint Daily Diamonds, wherein I highlight five "diamonds in the rough." These are selected from the results of my DecisionPoint scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

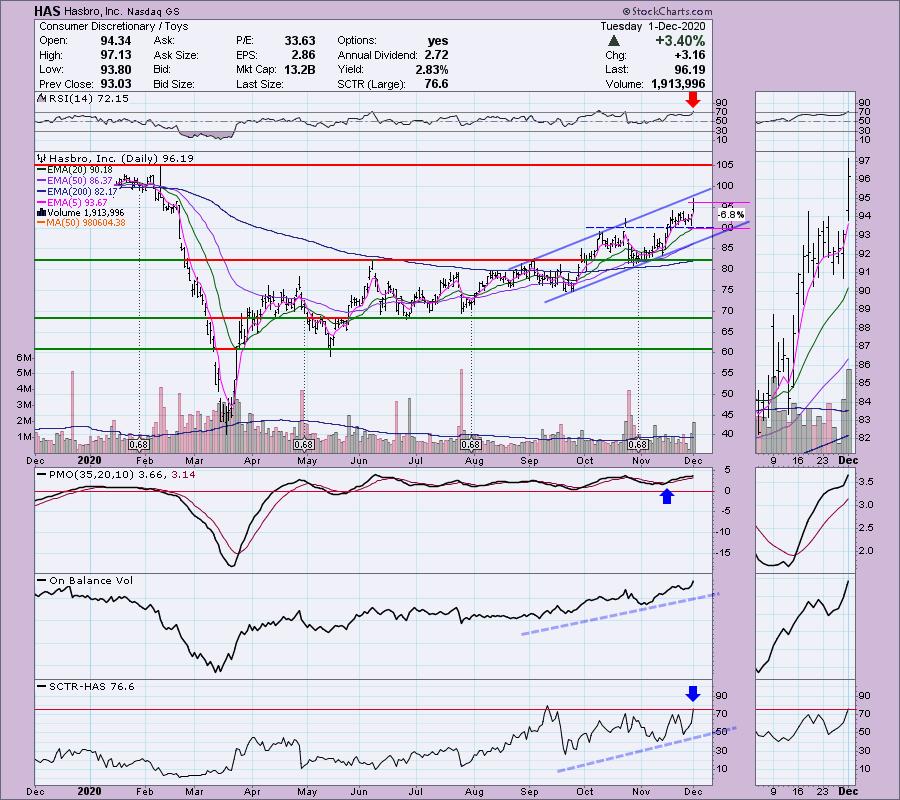

Hasbro, Inc. (HAS)

EARNINGS: 2/8/2021 (BMO)

Hasbro, Inc. engages in the provision of children and family leisure time products and services with a portfolio of brands and entertainment properties. The firm operates under the following brands: Littlest Pet Shop, Magic: The Gathering, Monopoly, My Little Pony, Nerf, Play-Doh, and Transformers. It operates through the following segments: United States and Canada, International, and Entertainment, Licensing and Digital. The United States and Canada segment refers to the marketing and sale of products in the United States and Canada which include the innovation and reinvention of toys and games. The International segment engages in the marketing and sale of product categories to retailers and wholesalers in Europe, Latin and South America, and the Asia Pacific region and through distributors in those countries where there is no direct presence. The Entertainment, Licensing and Digital segment conducts movie, television and digital gaming entertainment operations. The company was founded by Henry Hassenfeld and Hilal Hassenfeld in 1923 and is headquartered in Pawtucket, RI.

Last Monday I covered Mattel (MAT). I'm adding another toy company to Diamonds and that is Hasbro (HAS). Let me start off with my concerns as they are few. The RSI is overbought right now and I've added this after a healthy +3.4% gain. It is likely to pullback tomorrow as it is reaching the top of the rising trend channel. However, I think it's worth presenting given the breakout today and the ability to set a shallow stop. The PMO is on a BUY signal, the OBV is confirming the rising trend and the SCTR just reached the "hot zone" above 75.

The weekly chart looks fantastic so just because Christmas is over at the end of December, this one has the momentum to move higher. Volume has been stationary and is neutral.

Jack In The Box, Inc. (JACK)

EARNINGS: 2/17/2021 (AMC)

Jack in the Box, Inc. engages in operating and franchising a chain of quick-service and fast-casual restaurants. It operates through the Jack in the Box Restaurant segments. The Jack in the Box Restaurant segment offers a broad selection of distinctive products including burgers like Jumbo Jack burgers, and product lines such as Buttery Jack burgers including the Brunchfast menu. The company was founded by Robert Oscar Peterson in 1951 and is headquartered in San Diego, CA.

I was almost certain I'd presented this before. I may have, I began writing Diamond Reports before our website opened in January on StockCharts.com (those reports are included in the Diamonds archive on DecisionPoint.com) and I didn't start tracking them in a historical list until February. This chart popped up and I was very pleased with it. Restaurants and Bars industry stocks have mostly been moving sideways but JACK broke out of its trading range. I've added the "events" feature. This will show us when company's paid dividends like JACK did today. It will also reveal when stocks have splits. Carl recommended it. I'd completely forgotten about it.

The breakout today came alongside a positive, yet not quite overbought RSI, and an acceleration upward for the PMO. The OBV is confirming the move and the SCTR is just about in the "hot zone".

I was let down a little bit when I saw the weekly chart as overhead resistance at all-time highs is approaching. Still, if it can at least test that level, that would be about a 12% gain. The PMO has turned up and has whipsawed back into a BUY signal. The RSI is positive and not quite overbought on the weekly. I would've liked to have a seen an OBV breakout to accompany this one, however the week isn't over yet so it could definitely get there.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

SCP Pool Corp. (POOL)

EARNINGS: 2/11/2021 (BMO)

Pool Corp. engages in the wholesale distribution of swimming pool supplies, equipment and related leisure products. It also offers non-discretionary pool maintenance products such as chemicals and replacement parts; discretionary products like packaged pool kits, whole goods, irrigation, and landscape products, including a complete line of commercial and residential irrigation products and parts, power equipment for the professional landscape market; specialty products such as outdoor lighting, grills, and outdoor kitchen components; and golf irrigation and water management products. The company was founded in 1993 and is headquartered in Covington, LA.

Today price showed follow-through after breaking above the 20-EMA last week. The PMO has turned up and the RSI has just moved into positive territory above net neutral (50). The pop in volume on this breakout is also encouraging. The SCTR just hit the hot zone.

We have a steep rising trend channel. Those are difficult to maintain, but it has done so most of the year. The PMO is triggering a SELL signal, but the RSI is still positive and price is poised to rise after the recent test of the bottom of the channel. Volume has been stable and confirming.

Stitch Fix, Inc. (SFIX)

EARNINGS: 12/7/2020 (AMC)

Stitch Fix, Inc. is an online personal styling service that delivers personalized fixes of apparel and accessories to men, women and kids. The company was founded by Katrina Lake and Erin Morrison Flynn in February 2011 and is headquartered in San Francisco, CA.

If this one sounds familiar that's because I covered it in the October 15th Diamonds Report. Since then it is up +23.5%! It looks like there is another entry available for SFIX right now on this pullback. Support is holding at the October/November highs. The PMO gave us a BUY signal last week. The RSI is positive and the SCTR is in the "hot zone". The one thing I do not like is the negative OBV divergence, but given the bullishness on the rest of the chart, I'm picking it.

I was surprised to see that SFIX is not at all-time highs, but it did go parabolic in mid-2018. You can see the horrific results that followed when it broke down at the end of the 3rd quarter of 2018. We aren't looking at a parabola right now, we have a nice rising bottoms trendline. The OBV set up a strong positive divergence at the bear market low. since then price has taken off. I'm glad it isn't at all-time highs as that tells me we could reach that previous all-time high with a 32%+ upside move.

TJX Cos., Inc. (TJX)

EARNINGS: 2/24/2021 (BMO)

The TJX Cos., Inc. engages in the retail of off-price apparel and home fashion products. It operates through the following segments: Marmaxx, HomeGoods, TJX Canada, and TJX International. The Marmaxx segment sells family apparel including apparel, home fashions, and other merchandise. The HomeGoods segment offers assortment of home fashions, including furniture, rugs, lighting, soft home, decorative accessories, tabletop and cookware as well as expanded pet, kids, and gourmet food departments. The TJX Canada segment operates the Winners, Marshalls, and HomeSense chains in Canada. The TJX International segment comprises operations of T.K. Maxx and Homesense chains in Europe and the T.K. Maxx chain in Australia. The company was founded by Bernard Cammarata in 1976 and is headquartered in Framingham, MA.

I covered TJX in the February 19th Diamonds Report. This is only a +2.24% gain since then, but picking stocks at the beginning of a bear market is rough. I'm pleased that despite that it did recover and is at least in positive territory. I did have it set with a 7.9% stop which clearly would've been hit fairly quickly.

Right now I like the set up. We have a rising trend channel that has formed after the breakout from an intermediate-term trading channel. The PMO is on a BUY signal and the RSI is positive. The OBV is confirming the move, as is the SCTR. It's very easy to set a stop right on support at 8.7%, or you could simply get rid of it if it drops below the 20-EMA.

This is my favorite weekly chart today. TJX has a positive and rising RSI that is not overbought. The PMO is on a BUY signal and is not overbought. Icing on the cake? There is a PMO bottom above the signal line. Price is currently at an all-time closing high and it looks like it will give us a breakout here as the OBV is also confirming this rally.

Full Disclosure: I'm about 70% invested and 30% is in 'cash', meaning in money markets and readily available to trade with.

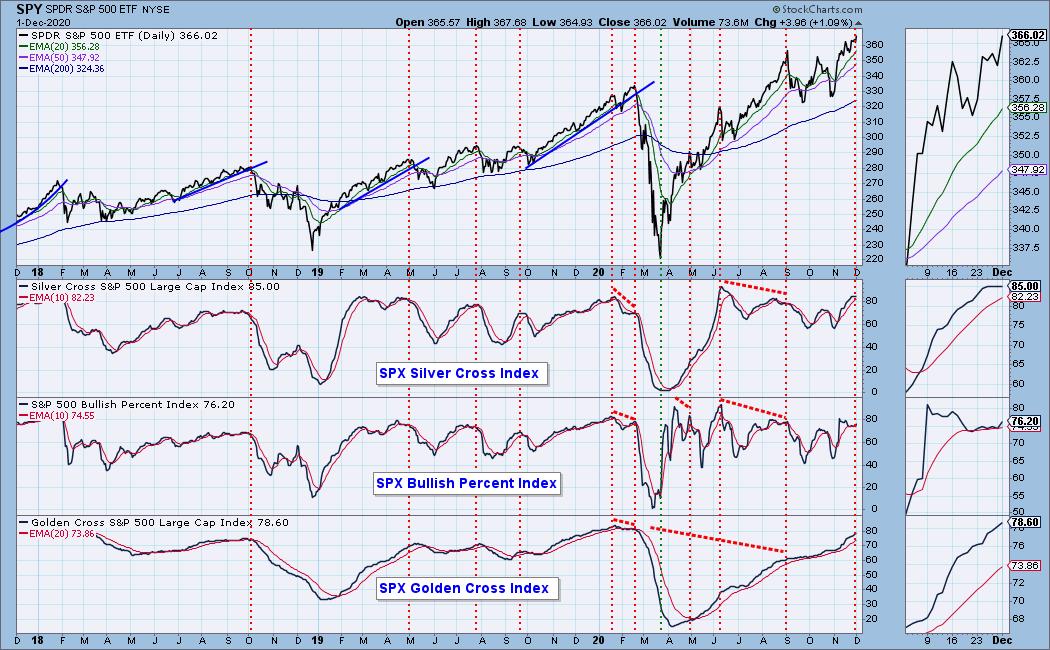

Current Market Outlook:

Market Environment: It is important to consider the odds for success by assessing the market tides. The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA)

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA)

- The Bullish Percent Index (BPI) shows the percentage of SPX stocks on Point & Figure BUY signals.

Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page.

Here is the current chart:

Diamond Index:

- Diamond Scan Results: 2

- Diamond Dog Scan Results: 1

- Diamond Bull/Bear Ratio: 2.00

I'm in the process of trying to plot the Diamond Index, but with time at a premium, it is on the back burner.

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

erin@decisionpoint.com

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com!