Typically the "diamonds in the rough" are short-term (days to a week or two). Today, I ran into a few with new IT Trend Model BUY signals on the daily chart and/or they had very positive weekly charts. I think you'll find today's selections interesting. I am presenting six today since I usually present 11 of my own picks each week.

Tomorrow is the "Diamond Mine" trading room. Be sure to register using the link within this report. It could be an even smaller group than usual, so I will likely open mics for participants who wish to ask their questions or give me background on a symbol request before I look at it. I look forward to talking to you!

Update on SLV "Diamond of the Week":

Silver pulled back into its previous trading range. The RSI is falling from overbought territory, but remains above net neutral (50). The PMO decelerated but is still rising.

This is a great example of why I prefer to trade during the day off the 5-minute bar charts. The RSI kept me out. Every time the PMO gave us a crossover BUY signal, the RSI was still negative. I do see a triple-bottom going into tomorrow's trading which could offer an opportunity to get in if the daily chart still shows a rising PMO.

Today's "Diamonds in the Rough" are: ALT, AXNX, CRM, NIU, SWBI and WB.

** HOLIDAY SCHEDULE 12/21/2020 - 1/4/2021 **

Diamonds:

Monday & Tuesday --Eleven Diamonds in the Rough (no reader requests).

Wednesday: Diamonds Recap & LIVE Diamond Mine Trading Room at 9:00a PT

DecisionPoint Alert:

Publishing Monday - Wednesday

** There will be no reports sent on 12/24 and 12/25. Additionally no reports will be sent 12/31 and 1/1 **

Diamond Mine Information:

Diamond Mine Information:

Here is the last Friday's (12/18) recording link. Use Access Passcode: 6?i8uv&f

Register in advance for the THIS WEDNESDAY's "DecisionPoint Diamond Mine" trading room (12/23/2020) 12:00p ET:

Here is the registration link for Wednesday (12/23) Password: merry

Please do not share these links! They are for Diamonds subscribers ONLY!

It's Free!

***Click here to register for this recurring free DecisionPoint Trading Room on Mondays at Noon ET!***

Did you miss the 12/21 free trading room? Here is a link to the recording. Access Code: fg#n^HF7

For best results, copy and paste the access code to avoid typos.

Welcome to DecisionPoint Daily Diamonds, wherein I highlight five "diamonds in the rough." These are selected from the results of my DecisionPoint scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

Altimmune, Inc. (ALT)

EARNINGS: 3/26/2021 (AMC)

Altimmune, Inc. is a clinical stage immunotherapeutic biotechnology company. It focuses on the discovery and development of products to stimulate robust and durable immune responses for the prevention and treatment of diseases. The company's portfolio includes RespirVec and Densigen that targets to stimulate the elements of the human immune system to treat respiratory diseases, chronic infections, and cancer. Altimmune was founded in 1997 and is headquartered in Gaithersburg, MD.

ALT is currently down -0.52% in after hours trading. Here is the first stock with a brand new IT Trend Model BUY signal. These are triggered when the 20-EMA crosses above the 50-EMA. The PMO has begun to accelerate higher out of oversold territory. The RSI is positive and not overbought. We could be looking at a reverse head and shoulders-type reversal pattern. I would mainly consider it a nice basing pattern. We don't actually have a breakout yet, but this is honestly another reason I like it. I want to enter beforehand if possible. This chart's bullish characteristics suggest I could.

We may have an IT Trend Model BUY signal on the daily chart, but we aren't there on the weekly yet. The PMO is decelerating somewhat. The long-term cup and handle pattern is very interesting, as is the possible breakout from the handle's declining trend. The RSI has just reached positive territory. Note that I am using a log scale chart so that we can see the actual price movement. The 2020 top is 175% away. It is possible it could get back there and further, but this is a biotech. They don't always follow the rules.

Axonics Modulation Technologies Inc. (AXNX)

EARNINGS: 3/4/2021 (AMC)

Axonics Modulation Technologies, Inc. operates as a medical technology company, which engages in the design, development, and commercialization of sacral neuromodulation solutions. The firm focuses on the treatment of patients with overactive bladder (OAB), fecal incontinence (FI), and urinary retention (UR). It offers rechargeable SNM system, which delivers mild electrical pulses to the targeted sacral nerve in order to restore normal communication to and from the brain to reduce the symptoms of OAB, FI, and UR. The company was founded by Guang Qiang Jiang, Danny L. Dearen, Timothy Deer, and Michael V. Williamson in March 2012 and is headquartered in Irvine, CA.

AXNX is up +1.02% in after hours trading. I covered AXNX in the September 17th Diamonds Report (up 15.7% since). AXNX has been in a declining trend channel since topping back in October. Last week we saw a breakout from the trend channel, but price pulled back within the declining trend. Yesterday it closed again above declining channel and today we saw follow-through on the breakout. The IT Trend Model triggered a BUY signal today. The RSI is positive and the PMO is on a BUY signal. We having rising bottoms on the OBV which is confirming this new rally. The SCTR has improved greatly this week.

The PMO is decelerating and the RSI is staying in positive territory. You can see the breakout.

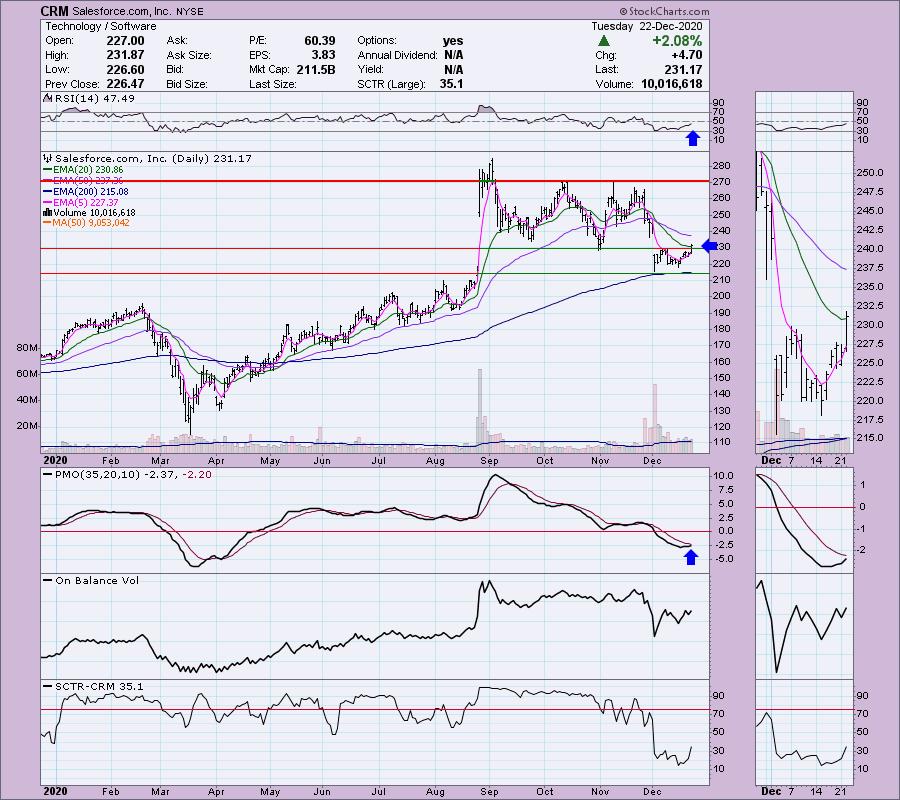

Salesforce.com, Inc. (CRM)

EARNINGS: 2/23/2021 (AMC)

Salesforce.com, Inc. engages in the design and development of cloud-based enterprise software for customer relationship management. Its solutions include sales force automation, customer service and support, marketing automation, digital commerce, community management, collaboration, industry-specific solutions, and salesforce platform. The firm also provides guidance, support, training, and advisory services. The company was founded by Marc Russell Benioff, Parker Harris, David Moellenhoff, and Frank Dominguez in February 1999 and is headquartered in San Francisco, CA.

CRM is down slightly -0.05% in after hours trading. This one is a bottom fish as the RSI is negative and the SCTR is only 35.1. I think we could be getting in early on this one. Today's rally broke the trading that was forming. It closed above the 20-EMA after successfully testing the 200-EMA. The RSI and SCTR are rising along with the PMO. The PMO is about to trigger a crossover BUY signal. It appears that price is preparing to cover the gap formed at the beginning of this month.

Not a stellar weekly chart, but then it is a bottom fish. The RSI did tick up before spending too much time in negative territory. The PMO could be decelerating a bit as well.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

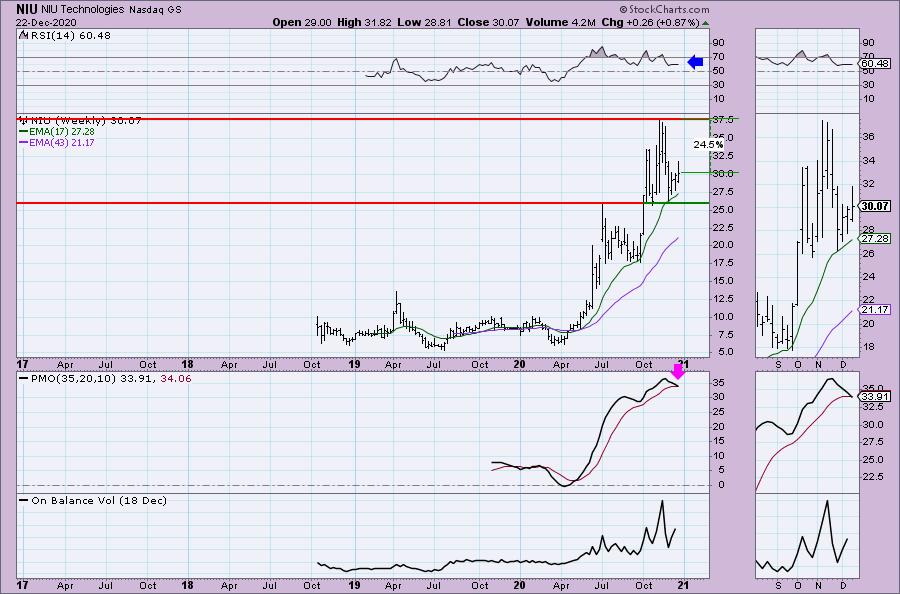

NIU Technologies (NIU)

EARNINGS: 3/15/2021 (BMO)

Niu Technologies is a holding company, which engages in the provision of urban mobility solutions. It involves in the design, manufacture, and sale of lithium-ion battery-powered e-scooters. The company was founded in September 2014 and is headquartered in Beijing, China.

Be sure and watch the 5-minute candlestick chart before entering this one as I note that it is down -1.2% in after hours trading. The breakout may not quite be here given that after hours decline. However, I still like the chart. The RSI is just rising above net neutral. The PMO has decelerated and is about to turn up. We see that a ST Trend Model BUY signal was triggered today as the 5-EMA crossed above the 20-EMA.

The RSI is positive on the weekly chart, but we are seeing a PMO crossover SELL signal in the making so plan on babysitting this one.

Smith & Wesson Brands, Inc. (SWBI)

EARNINGS: 3/4/2021 (AMC)

Smith & Wesson Brands, Inc. is a holding company, which engages in the manufacture, design, and provision of firearms. It operates through the Firearms and Outdoor Products & Accessories segments. The Firearms segment comprises the manufacture of handguns, long guns, handcuffs, suppressors, and other firearm-related products for sale to a wide variety of customers. The Outdoor Products & Accessories segment engages in the distribution, manufacture, and design of reloading, gunsmithing, and gun cleaning supplies; stainless-steel cutting tools and accessories; flashlights; tree saws and related trimming accessories; shooting supplies, rests, and other related accessories; apparel; vault accessories; laser grips and laser sights; and a full range of products for survival and emergency preparedness. The company was founded by Michell A. Saltz on June 17, 1991 and is headquartered in Springfield, MA.

SWBI is down slightly at -0.06% in after hours trading. I covered SWBI (formerly AOBC) in the March 17th Diamonds Report (up +104.5% since). We have a possible double-bottom breakout today. This comes alongside a new IT Trend Model BUY signal as the 20-EMA crossed above the 50-EMA today. The PMO had a recent BUY signal in oversold territory and is now above the zero line. The RSI is positive. Notice that we have rising bottoms on the OBV and flat bottoms on price. I consider that a positive divergence. The SCTR is improving quickly.

The double-bottom is even more clear on the weekly chart. The RSI is positive and the PMO is just beginning to turn up. This is probably my favorite today as everything seems to be lined up on both the daily and weekly charts.

Weibo Corp. (WB)

EARNINGS: 12/28/2020 (BMO)

Weibo Corp. engages in the creation, distribution, and discovery of Chinese-language content. It operates through the Advertising and Marketing Services, and Other Services segments. Its products and services include Self-Expression, such as Feed, Individual page, and Enterprise page; Social Products, such as Follow, Repost, Comment, Favorite, like, Mention, Messenger, and Group Chat; Discovery Products, such as Information Feed, Search, Object Page, Trends, and Discovery Channel; Notifications; Weibo Games; VIP Membership; and Weibo Apps. The company was founded in August 2009 and is headquartered in Beijing, China.

Currently WB is unchanged in after hours trading. Price has rallied strongly from the December low, but I think there is more to go. Note that the RSI was about to move overbought after the initial rally pop. Since then price has been consolidating forming a bull flag (best seen in the thumbnail). The PMO has just recently generated a BUY signal. I set the stop at the 50-EMA.

There is a prominent cup and handle pattern on the weekly chart with the past two weeks showing a breakout from the handle. The RSI is positive. The PMO looks especially bullish with a recent bottom above the signal line.

Full Disclosure: I'm about 50% invested and 50% is in 'cash', meaning in money markets and readily available to trade with. I'm holding off adding any positions right now.

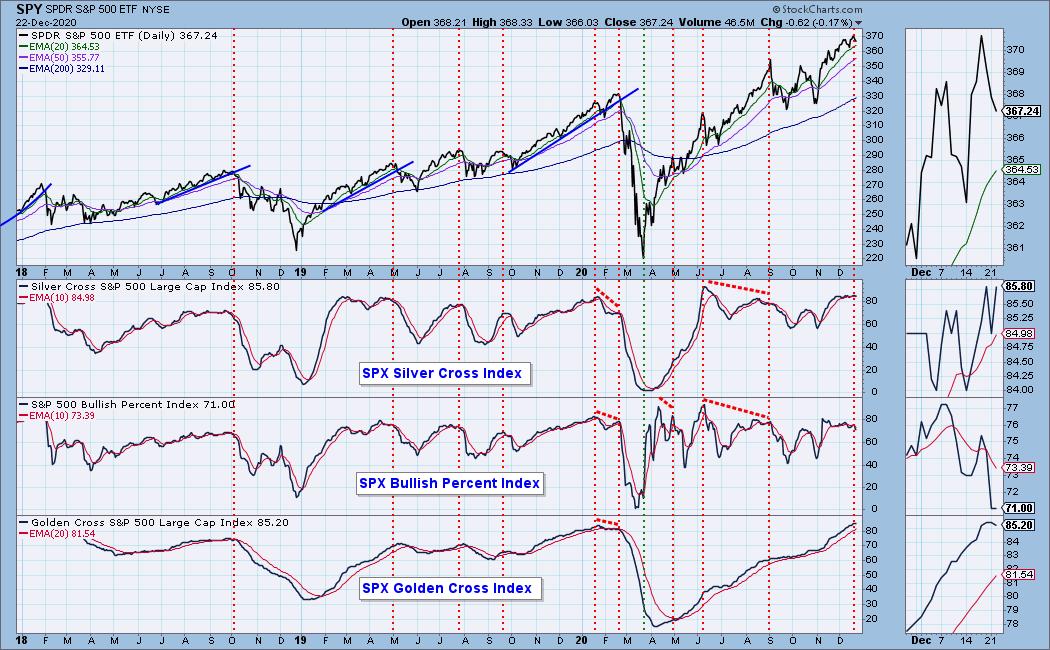

Current Market Outlook:

Market Environment: It is important to consider the odds for success by assessing the market tides. The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA)

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA)

- The Bullish Percent Index (BPI) shows the percentage of SPX stocks on Point & Figure BUY signals.

Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page.

Here is the current chart:

Diamond Index:

- Diamond Scan Results: 8

- Diamond Dog Scan Results: 2

- Diamond Bull/Bear Ratio: 4.00

I'm in the process of trying to plot the Diamond Index, but with time at a premium, it is on the back burner.

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

erin@decisionpoint.com

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com!