Before I begin, I want to remind everyone to register for Friday's subscriber-only "Diamond Mine" trading room at the registration link provided below or here.

I don't know if this industry group has necessarily made its move "quietly", but the many scan results that have been arriving have included quite a few members of this industry group. If you recall, yesterday I presented a "diamond in the rough" from the Home Builders industry group. Well, I had four more appear in my scans today! I decided to include two of them, but I suspect if you click through the charts from this group, you will see some of the same setups.

One of my subscribers wrote to tell me that I should consider tracking Diamonds in the Rough for a longer period of time. He remarked that apparently my picks since November 3rd have done very well, but no one knows. I need a personal assistant before I can even consider this. Thank you though for the update on my picks!

Today's "Diamonds in the Rough" are: AMSC, DOOR, IBP, KBH, and PHM.

Diamond Mine Information:

Diamond Mine Information:

Here is Friday November 6th's recording link. I apologize, but I forgot to hit the record button for last Friday's Diamond Mine. I have left the recording link available from 11/6 available using the Access Passcode: #g8G^J&3

Register in advance for the next "DecisionPoint Diamond Mine" trading room on Friday (11/20/2020) 12:00p ET:

Here is the registration link for Friday, 11/20/2020. Password: resource

Please do not share these links! They are for Diamonds subscribers ONLY!

It's Free!

***Click here to register for this recurring free DecisionPoint Trading Room on Mondays at Noon ET!***

Did you miss the 11/16 free trading room? Here is a link to the recording. Access Code: =8STr92*

For best results, copy and paste the access code to avoid typos.

Welcome to DecisionPoint Daily Diamonds, wherein I highlight five "diamonds in the rough." These are selected from the results of my DecisionPoint scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

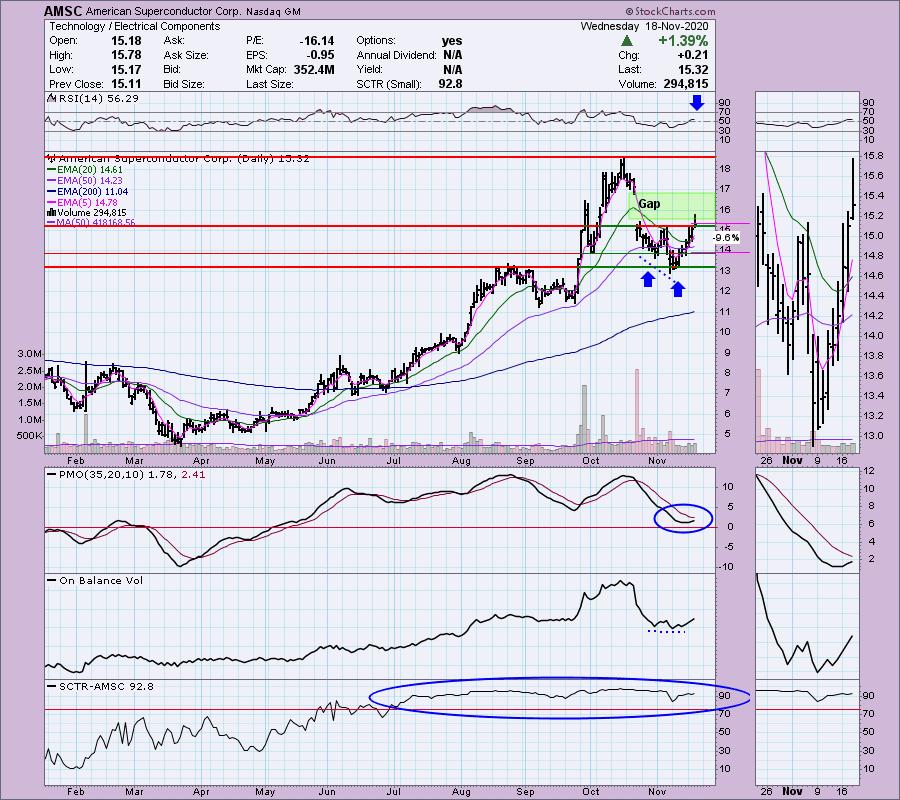

American Superconductor Corp. (AMSC)

EARNINGS: 2/3/2021 (AMC)

American Superconductor Corp. engages in provision of megawatt-scale power solutions which improve the performance of the power grid and lower the cost of wind power. It operates through Grid and Wind segments. The Grid segment enables electric utilities and renewable energy project developers to connect, transmit, and distribute power with efficiency, reliability, security, and affordability. The Wind segment permits the manufacturers to field wind turbines with power output, reliability, and affordability. The company was founded by Yet-Ming Chiang, David A. Rudman, John B. Vander Sande, and Gregory J. Yurek on April 9, 1987 and is headquartered in Ayer, MA.

Up +1.18% in after hours trading, AMSC is a semiconductor. Technology is not showing leadership right now, but small-caps are and the setup is pretty sweet. Many of the charts these days have double-bottoms and of course not all of them will execute, but if they are accompanied by positive indicators, their chances of resolving upward are high. The double-bottom on AMSC executed today. Price popped above the confirmation line and then pulled back during the day but held support. There is strong gap resistance to muddle through, but the RSI is positive and rising and the PMO is bottoming above the zero line. This is a small-cap and we are seeing them outperforming so that is a plus too. While we don't have a perfect OBV positive divergence, I do note that the OBV bottoms are flat while the double-bottom has a sharply lower low. The SCTR is great too.

We had a topping PMO, but it is now decelerating and could turn back up. The RSI is positive and not overbought. Even if we can just retest the 2020 high, that's a 22% gain.

Masonite Intl Corp. (DOOR)

EARNINGS: 2/16/2021 (AMC)

Masonite International Corp. designs and manufactures of interior and exterior doors for the residential new construction; the residential repair, renovation and remodeling; and the non-residential building construction markets. The company markets and sells its products to remodeling contractors, builders, homeowners, retailers, dealers, lumberyards, commercial and general contractors and architects through well-established wholesale and retail distribution channels. Its reportable segments are organized and managed principally by geographic region: North America; Europe, Asia & Latin America; and Africa. The North America segment operates through three sub segments: Retail, Wholesale and Commercial. The Europe, Asia and Latin America segment includes operations in United Kingdom, France, Central Eastern Europe, Asia & South America and Israel. The company's business roots back to 1925 and was founded on April 16, 2009 and is headquartered in Tampa, FL.

I didn't mark this as a double-bottom, but I suppose you could say it is one. Price is rallying strongly and did overcome resistance at the 20/50-EMAs. Granted overhead resistance is again coming at $100, but given the positive and rising RSI as well as the new PMO crossover BUY signal, I'm good with it. The stop level is set to match the February top and lows at the bottom of the consolidation zone from mid-August to mid-September. The OBV positive divergence is setting the stage for this rally to continue.

We do have a PMO SELL signal on the weekly chart, but the RSI remained positive. Upside potential is under 14%, but if it can reach that level, we are likely looking at more to come.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Installed Building Products Inc. (IBP)

EARNINGS: 2/25/2021 (BMO)

Installed Building Products, Inc. engages in the business of installing insulation for the residential new construction market. Its products include garage doors, rain gutters, shower doors, closet shelving, and mirrors. The company was founded in 1977 and is headquartered in Columbus, OH.

I knew when I picked this one today that I remembered picking it before. I did. You'll find my first review of IBP in the September 15th Diamonds Report. Since then it us up +3.5%, but I suspect I would've booked more profit than that by simply using the RSI which moved negative at about the same time we got a PMO SELL signal. Getting out then would have given you about a +14% gain. It's not rocket science. Even beginners can follow these signals and likely improve their performance. We have another double-bottom, but it still hasn't executed the pattern with a break above the confirmation line. However, the nearing PMO BUY signal and an RSI that just hit positive territory, I believe this one will execute this pattern. Note also that price traded above the 20/50-EMAs today. The stop level is set along the top of the August consolidation zone as well as the bottoms that follow.

Another less than appetizing weekly chart with a PMO SELL signal. The RSI does remain positive and you can see how price tested support last week and is bouncing this week.

KB Home (KBH)

EARNINGS: 1/7/2021 (AMC)

KB Home engages in selling and building a variety of new homes. It builds various types of homes, including attached and detached single-family homes, townhomes and condominiums. It operates through the following segments: West Coast, Southwest, Central and Southeast. It offer homes in development communities, at urban in-fill locations and as part of mixed-use projects. The company was founded in 1957 and is headquartered in Los Angeles, CA.

I hope you're not bored with double-bottoms because here is another one. This one also has not executed yet. Price is struggling with the 50-EMA, but if it can get above it, this stock's personality suggests a rally continuation. The RSI has just moved into positive territory today and the PMO triggered a BUY signal. When these signals come in concert with a newly positive RSI, I am bullish and find these to be excellent buy points. They don't all work out, but it definitely gives you an advantage is most cases. I'm not seeing much as far as the SCTR or OBV.

The weekly chart has a PMO in decline and on a SELL signal. However, I like the bounce off the 43-week EMA as well as a positive RSI.

PulteGroup, Inc. (PHM)

EARNINGS: 1/26/2021 (BMO)

PulteGroup, Inc. engages in the homebuilding business. It is also involved in the mortgage banking, and title and insurance brokerage operations. It operates through the Homebuilding and Financial services business segments. The Homebuilding segment comprises of operations from the Connecticut, Maryland, Massachusetts, New Jersey, New York, Pennsylvania, Rhode Island, Virginia, Georgia, North Carolina, South Carolina, Tennessee, Florida, Illinois, Indiana, Kentucky, Michigan, Minnesota, Missouri, Ohio, Texas, Arizona, California, Nevada, New Mexico, and Washington. The Financial Services segment consists of mortgage banking and title operations. The company was founded by William J. Pulte in 1950 and is headquartered in Atlanta, GA.

Last Homebuilder for the day is Pulte (PHM). This is a large-cap homebuilder with a very nice double-bottom. The struggle is with the 50-EMA right now, but it did trade above it today. The PMO is nearing a BUY signal and the RSI is only a few tenths of a point away from moving into positive territory. The OBV is confirming the rally. The SCTR isn't much to look at, but it isn't in the basement.

Another ugly weekly chart that is displaying yet another PMO SELL signal; however, the RSI is positive. When you have a beautiful daily chart paired with an ugly weekly chart, it tells you to consider the investment short-term until the weekly chart improves. For me, I like knowing what is happening on the weekly chart so I can gauge a time horizon and I can be aware that I need to be true to my stops.

Full Disclosure: I'm about 45% invested and 55% is in 'cash', meaning in money markets and readily available to trade with.

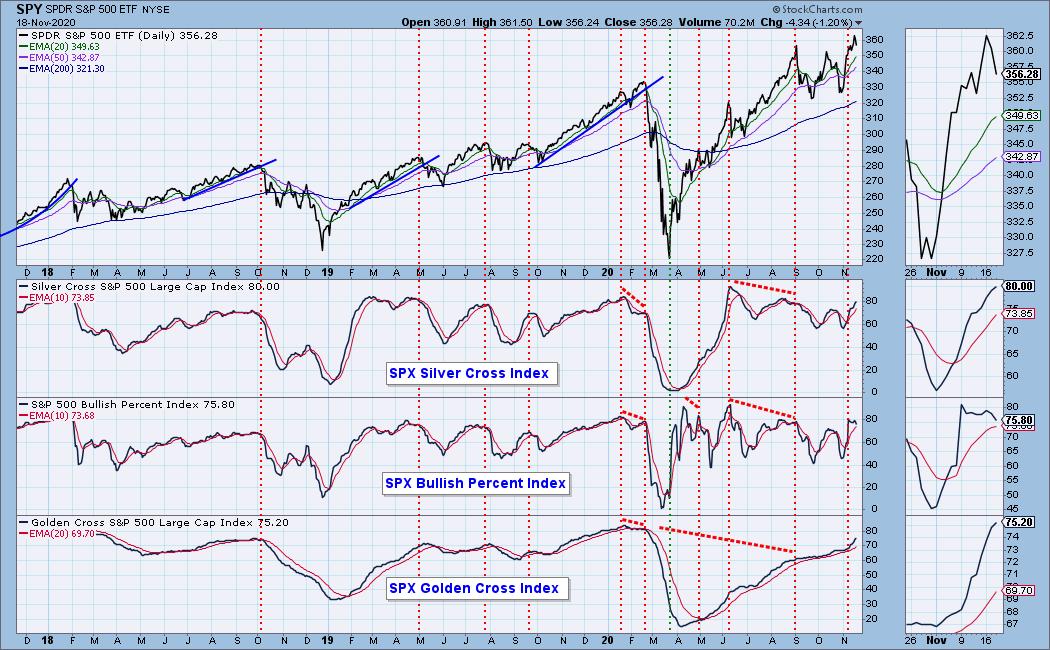

Current Market Outlook:

Market Environment: It is important to consider the odds for success by assessing the market tides. The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA)

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA)

- The Bullish Percent Index (BPI) shows the percentage of SPX stocks on Point & Figure BUY signals.

Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page.

Here is the current chart:

Diamond Index:

- Diamond Scan Results: 9

- Diamond Dog Scan Results: 5

- Diamond Bull/Bear Ratio: 1.80

I'm in the process of trying to plot the Diamond Index, but with time at a premium, it is on the back burner.

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

erin@decisionpoint.com

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com!I