When I ran one of my EMA Crossover Scans, I found a large group of Materials sector stocks and ETFs. I have included two others not in that sector. Yesterday, I mentioned that my scans were suggesting that there was strength building in Gold and Gold Miners. Today, I chose the Sprott Silver Trust (PSLV), but a similar candidate SLV looks good too. I do want to point out that I have had far more Diamond Dog candidates that Diamond candidates right now. I was contemplating throwing some short positions out there so I will say that my confidence level on any "diamonds in the rough" is not as high as it normally is. Apparently Virgin Galactic (SPCE) would have been an excellent short. It was down over 11% today which triggered the stop I set on it yesterday for the Diamonds Report (I did not purchase it). This is the first time in awhile that I have had an instant loser trigger the stop the next day.

Today's "Diamonds in the Rough" and Reader Requests: JCI, PSLV, RVLV, SCCO and URA

Diamond Mine Information:

Diamond Mine Information:

Recording from 10/9/2020 is at this link. Access Passcode: .6O2G.E!

Register in advance for the next "DecisionPoint Diamond Mine" trading room on Friday (10/16/2020) 12:00p ET:

Here is the registration link for Friday, 10/16/2020. Password: outlook

Please do not share these links! They are for Diamonds subscribers ONLY!

It's Free!

***Click here to register for this recurring free DecisionPoint Trading Room on Mondays at Noon ET!***

Did you miss the 10/19 trading room? Here is a link to the recording (access code: Au6B.X*1). For best results, copy and paste the access code to avoid typos.

Welcome to DecisionPoint Daily Diamonds, wherein I highlight five "diamonds in the rough." These are selected from the results of my DecisionPoint scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

Johnson Controls Intl plc (JCI)

EARNINGS: 11/3/2020 (BMO)

Johnson Controls International Plc engages in the provision of buildings products, energy solutions, integrated infrastructure and next generation transportation systems. Its technology and service capabilities include fire, security, HVAC, power solutions and energy storage to serve various end markets including large institutions, commercial buildings, retail, industrial, small business and residential. The company was established in 1885 and is headquartered in Cork, Ireland.

Up +0.37% in after hours trading, JCI has broken out from its previous very short-term top. The PMO has just had a positive crossover and the RSI is positive and not overbought. OBV is confirming the short-term rising trend. I will say that we had a 'fake out breakout' on the last PMO BUY signal, so watch it carefully if you decide to enter.

The PMO is rising strongly albeit very overbought. The RSI is positive and not overbought. Notice the importance of this breakout. It puts JCI at a new all-time high.

Sprott Physical Silver Trust ETF (PSLV)

EARNINGS: N/A

Sprott Physical Silver Trust is a closed-end investment trust company, which investment objective is to provide a secure, convenient, and exchange-traded investment alternative for investors interested in holding physical silver bullion without the inconvenience that is typical of a direct investment in physical silver bullion. The Trust invests and intends to continue to invest primarily in long-term holdings of unencumbered, fully allocated, physical silver bullion, and does not speculate with regard to short-term changes in silver prices. The company was founded on June 30, 2010 and is headquartered in Toronto, Canada.

At this point, I see a rising trend channel and a new 5/20-EMA positive crossover. Additionally, we have a new PMO BUY signal arriving just as the RSI moved into positive territory above net neutral (50). Price gapped up and traded above both the 20/50-EMAs for the first time since the September breakdown.

Not thrilled with the weekly PMO right now, but the RSI remains positive and not overbought. Overhead resistance is nearing at around $9.00. Upside potential is almost 20% if it can return to its summer high.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

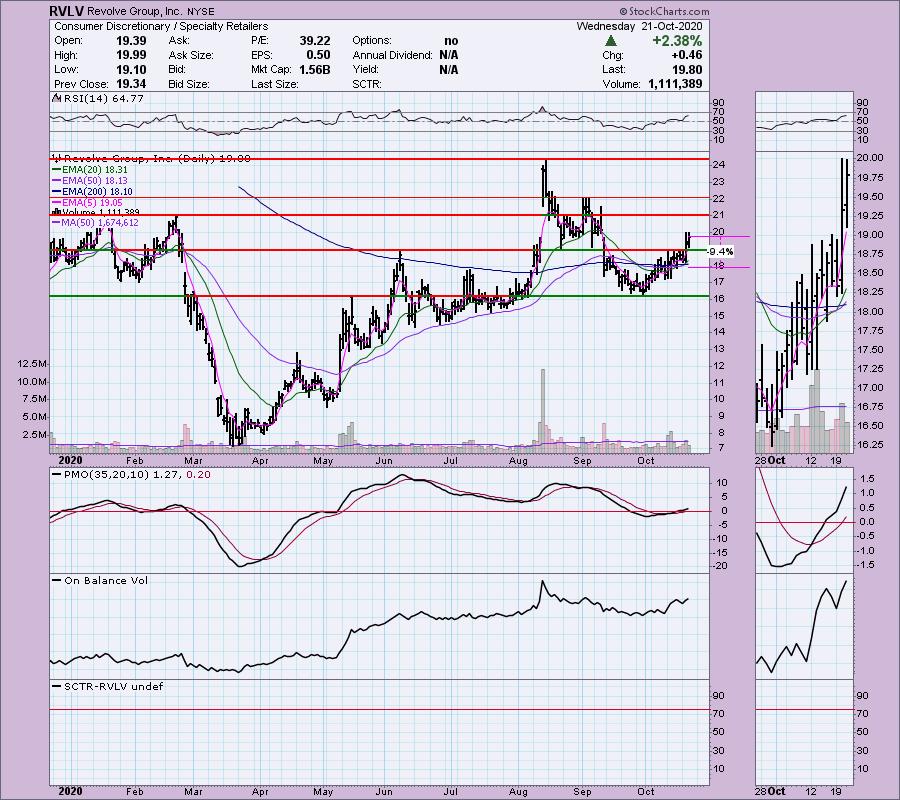

Revolve Group, Inc. (RVLV)

EARNINGS: 11/5/2020 (AMC)

Revolve Group, Inc. engages in the retail of next-generation fashion for millenial consumers. It operates through the following segments: Revolve and Forward. The Revolve segment offers assortment of apparel and footwear, accessories and beauty products from emerging, established and owned brands. The Forward segment provides luxury products. The company was founded by Michael Mente and Mike Karanikolas in 2003 and is headquartered in Cerritos, CA.

This one broke out yesterday and intraday it pulled back to that breakout point. My concern on this one up front would be that we could end up getting a "handle" on this "cup". However, the positives on the chart are many. The RSI is positive and not overbought. The PMO is on a BUY signal and recently reached positive territory again. The OBV bottoms are rising with price. The stop is set below the EMAs.

Sure looks like a reverse head and shoulders pattern. This bullish pattern would trigger if price can get above the upward sloping neckline. The PMO has bottomed above the signal line which is bullish. The RSI is positive and the OBV bottoms are rising with price. You'll note I've set the upside target below the neckline of the head and shoulders. It's a long way up there to the neckline and while I think it could materialize, a reasonable upside target of 25% is good to me. If it gets there it will be an excellent time to reevaluate.

Southern Copper Corp. (SCCO)

EARNINGS: 10/28/2020

Southern Copper Corp. engages in the development, production, and exploration of copper, molybdenum, zinc, and silver. It operates through the following segments: Peruvian Operations; Mexican Open-Pit Operations; and Mexican Underground Operations. The Peruvian Operations segment focuses on the Toquepala and Cuajone mine complexes and the smelting and refining plants, industrial railroad, and port facilities that service both mines. The Mexican Open-Pit Operations segment comprises La Caridad and Buenavista mine complexes, the smelting, and refining plants and support facilities, which service both mines. The Mexican Underground Mining Operations segment involves in the operation of five underground mines, a coal mine, and several industrial processing facilities. The company was founded on December 12, 1952 and is headquartered in Phoenix, AZ.

Down -0.44% in after hours trading, SCCO broke out today. A reverse head and shoulders is visible, but these are considered reversal patterns so rather than annotate it, I'm looking at it as a rounded bottom which is bullish anyway. The PMO is rising on a BUY signal and isn't overbought. The RSI is positive and OBV bottoms are rising with price.

Overhead resistance at the all-time high is less than 5% away and the PMO and RSI are getting overbought. However I like this bounce off the 17-week EMA and the flag shape of that last pullback.

Global X Uranium ETF (URA)

EARNINGS: N/A

URA tracks a market-cap-weighted index of uranium mining, exploration, and technology companies combined with nuclear component producers.

I may be early on this one. It reached overhead resistance and was stopped, but this is the first time in weeks that price has traded completely over the 20-EMA since the September decline. The RSI just entered positive territory as the PMO has generated a BUY signal. I do like that I don't have to set a very deep stop.

This is an element that has been in a trading range for years. Currently we are near the bottom of that range. If we can get a bounce right here, it is a sign of strength as it will have turned back up before testing the bottom of that trading range. Upside potential is about 27% based on a conservative top of that range.

Full Disclosure: I won't be adding to my positions for now. I had more trailing stops trigger so I'm about 40% invested and 60% is in 'cash', meaning in money markets and readily available to trade with.

Current Market Outlook:

Market Environment: It is important to consider the odds for success by assessing the market tides. The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA)

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA)

- The Bullish Percent Index (BPI) shows the percentage of SPX stocks on Point & Figure BUY signals.

Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page.

Here is the current chart:

Diamond Index 10/13:

- Diamond Scan Results: 2

- Diamond Dog Scan Results: 57

- Diamond Bull/Bear Ratio: 0.04

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

erin@decisionpoint.com

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com!