It shouldn't surprise my readers that the Communication Services sector, the Internet industry group in particular, continues to heat up. In my Recap last week, I suggested we watch that area closely. Three of them came up in my Bullish EMA/Mid-Range SCTR scan that I'm going to present. I also wanted to take you on a trip down memory lane. While going through the 68 results today, four came up that I have presented recently. Take a look at these four charts. They have had successful runs and according to my scan, they should continue to show good results.

Today's "Diamonds in the Rough": CDLX, IAC, LH, SONO, and SPOT

Diamond Mine Information:

Diamond Mine Information:

Recording from Today's (10/23/2020) is at this link. Access Passcode: 3F36ts=$

Register in advance for the next "DecisionPoint Diamond Mine" trading room on Friday 12:00p ET:

Here is the registration link for Friday, 10/30/2020. Password: diamond

Please do not share these links! They are for Diamonds subscribers ONLY!

It's Free!

***Click here to register for this recurring free DecisionPoint Trading Room on Mondays at Noon ET!***

Did you miss the 10/27 trading room? Here is a link to the recording (access code: X+2gJfpd). For best results, copy and paste the access code to avoid typos.

** Please note there will NOT be a free Trading Room on November 2nd! **

Welcome to DecisionPoint Daily Diamonds, wherein I highlight five "diamonds in the rough." These are selected from the results of my DecisionPoint scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

Cardlytics, Inc. (CDLX)

EARNINGS: 11/2/2020 (AMC)

Cardlytics, Inc. engages in the development of marketing solutions through its purchase intelligence platform. It operates through the Cardlytics Direct and Other Platform Solutions segments. The Cardlytics Direct segment represents its proprietary native bank advertising channel. The Other Platform Solutions segment includes solutions that enable marketers and marketing service providers to leverage the power of purchase intelligence outside the banking channel. The company was founded by Scott D. Grimes, Lynne M. Laube, and Hans Theisen on June 26, 2008 and is headquartered in Atlanta, GA.

Here is our first Internet diamond in the rough. The RSI is positive and the PMO is rising. The OBV does have a negative divergence in the short term which could be a problem. Overhead resistance is still holding, but with the PMO and the RSI not overbought as well as a strong SCTR, I expect a breakout. The stop at the current price is 8% away, so you could wait for the breakout and then lengthen the stop.

The weekly PMO is trying very hard to turn back up. The RSI on the weekly chart is also positive, but we can see how important this overhead resistance is.

InterActiveCorp (IAC)

EARNINGS: 11/5/2020 (AMC)

IAC Holdings, Inc. engages in media and Internet business. It operates through the following segments: ANGI Homeservices, Vimeo, Dotdash, Applications, Ask Media Group, and Emerging and Other. The ANGI Homeservices segment offers repairing, remodeling, cleaning, and landscaping through category-transforming products under HomeAdvisor, Angie's List, Handy, and Fixd Repair brands. The Vimeo segment operates a global video platform for creative professionals, small and medium businesses, organizations, and enterprises to connect with their audiences, customers, and employees. The Dotdash segment includes a portfolio of digital brands that provide information and inspiration in select vertical content categories. The Applications segment consists of direct-to-consumer downloadable desktop applications and the business-to-business partnership operations as well as global subscription mobile applications through Apalon, iTranslate, and TelTech. The Ask Media Group segment is a collection of websites that provide general search services and information. The Emerging and Other segment comprises of platforms Care.com, Bluecrew, and NurseFly. The company was founded on November 19, 2019 and is headquartered in New York, NY.

Here is Internet diamond in the rough #2. We have a nice breakout from the short-term declining trend. The PMO didn't quite bottom above its signal line, but I still find it very positive as the bottom did occur above the zero line. Volume is steady, but you can see in the thumbnail that we had rising bottoms on the OBV while price bottoms were declining last week. The RSI is positive and not overbought. I set the stop below support at last week's bottom and about halfway down toward the September low.

There is a huge bull flag on the chart and we have a positive RSI. The PMO is not good as it did just give us a crossover SELL signal. Consider this a short-term investment until the weekly PMO improves.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Laboratory Corporation of America Holdings (LH)

EARNINGS: 10/27/2020 (BMO)

Laboratory Corp. of America Holdings is a clinical laboratory company. The firm engages in the provision of clinical laboratory and end-to-end drug development services. It operates through the following segments: LabCorp Diagnostics and Covance Drug Development. The LabCorp Diagnostics segment includes core testing as well as genomic and esoteric testing. The Covance Drug Development segment provides drug development solutions to companies in the pharmaceutical and biotechnology industries. The company was founded in 1971 and is headquartered in Burlington, NC.

This one was up quite a bit today. I looked quickly at the 5-min candlestick chart and saw that it spiked on the open today and then pulled back to the low and then spent the rest of the day in the closing price range.

Price finished right on overhead resistance at the July top, but it is trying to break out. The RSI and PMO are both positive and not overbought. The rising trend is intact and the SCTR is very good. The stop at 9% would put you just under the April top.

Positive RSI and rising PMO are good. Would prefer PMO to not be so overbought, but a bottom above the signal line is usually a very bullish sign.

Sonos Inc. (SONO)

EARNINGS: 11/18/2020 (AMC)

Sonos, Inc. provides multi-room wireless smart home sound systems. It supports streaming services around the world, providing customers with access to music, Internet radio, podcasts, and audiobooks, with control from Android smartphones, iPhone, or iPad. The company was founded by Mai Trung, John MacFarlane, Craig A. Shelburne and Thomas S. Cullen in 2002 and is headquartered in Santa Barbara, CA.

Down -0.12% in after hours trading, SONO was presented as a reader requested Diamond (and was a Diamond of the Week, I believe, as I remember presenting it in "Your Daily Five") in the June 18th Diamonds Report so it is up +30.4% since then. It has broken a declining trend. The PMO is positive and rising strongly. The RSI is positive and not overbought. I picked the stop area to line up with the mid-August top.

Excellent weekly chart. It's hard to say whether the PMO is extremely overbought since we don't have that much data to base it on. First battle will be at $18, but after that it could run much higher.

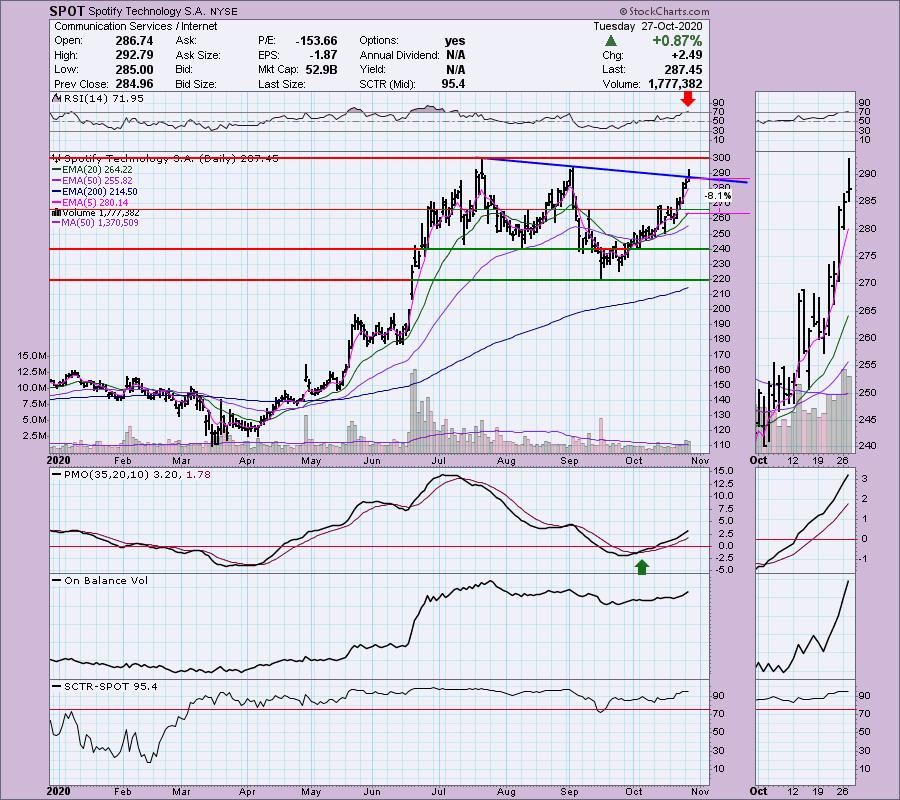

Spotify Technology S.A. (SPOT)

EARNINGS: 10/29/2020 (BMO)

Spotify Technology SA is a digital music service offering music fans instant access to a world of music. The company operates through the following segments: Premium and Ad-Supported. The Premium segment provides subscribers with unlimited online and offline high-quality streaming access of music and podcasts on computers, tablets, and mobile devices, users can connect through speakers, receivers, televisions, cars, game consoles, and smart watches. It also offers a music listening experience without commercial breaks. The Ad-Supported segment provides users with limited on-demand online access of music and unlimited online access of podcasts on their computers, tablets, and compatible mobile devices. It also serves both premium subscriber acquisition channel and a robust option for users who are unable or unwilling to pay a monthly subscription fee but still want to enjoy access to a wide variety of high-quality audio content. The company was founded by Daniel Ek and Martin Lorentzon in April, 2006 and is headquartered in Luxembourg.

Down -0.47% in after hours trading, I covered SPOT almost 2 weeks ago in the October 14th Diamonds Report. Since then it is up 11.6% and I believe it has more to go. The only thing I don't like is that the RSI is overbought. Price will be moving in on overhead resistance soon at $300, but the PMO isn't overbought and it is rising nicely. OBV is confirming the rally and we have a very strong SCTR. I set an 8.1% stop which is just below that Sept/October tops I have annotated.

Positive weekly chart. The RSI is positive and strong. The PMO has bottomed and is moving in for a BUY signal.

Full Disclosure: I'm about 35% invested and 65% is in 'cash', meaning in money markets and readily available to trade with.

Current Market Outlook:

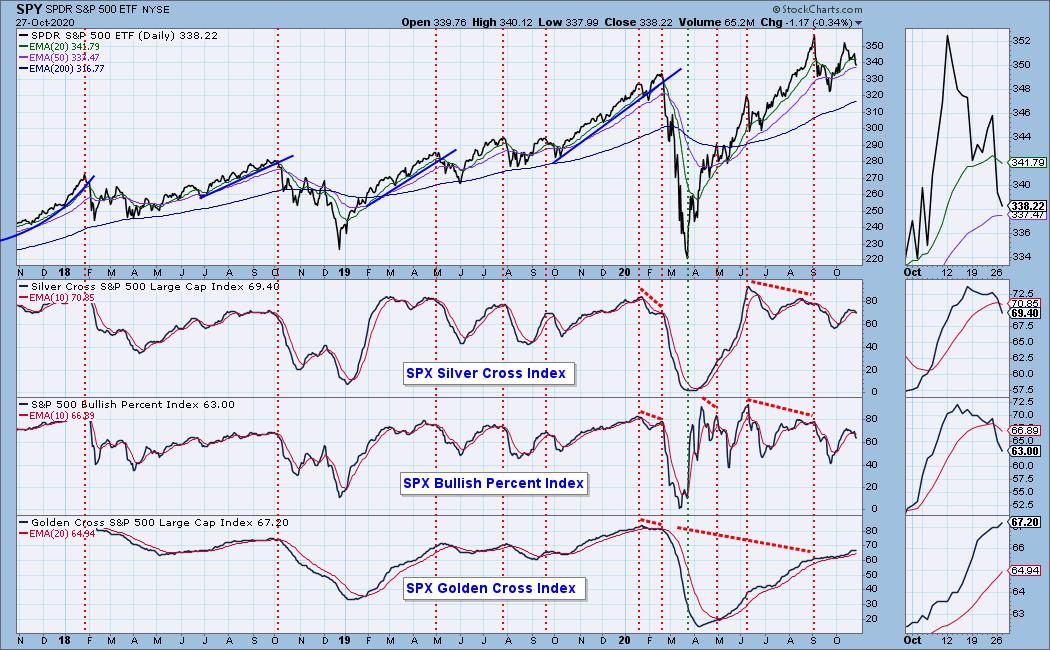

Market Environment: It is important to consider the odds for success by assessing the market tides. The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA)

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA)

- The Bullish Percent Index (BPI) shows the percentage of SPX stocks on Point & Figure BUY signals.

Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page.

Here is the current chart:

Diamond Index 10/13:

- Diamond Scan Results: 1

- Diamond Dog Scan Results: 53

- Diamond Bull/Bear Ratio: 0.02

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

erin@decisionpoint.com

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com!