Big sell-off today and that hit many of this week's Diamonds hard, but we'll talk about that tomorrow in the recap and during the Diamond Mine trading room. Thank you to George, Brandon, Cotton and Olivia for your Reader Requests. They were similarly damaged, but there are bright spots and this is definitely a teachable moment. Today's "Chartwise Women" show was all about exiting positions and what our strategies are. I will discuss this further during tomorrow's Diamond Mine so be sure to register. The recording and registrations links will always be available in the Diamond Reports.

My Diamond today is from the Real Estate sector. I've not been too hot on this sector and looking at the chart below, you can see why. It has basically been in a boring trading range for some time. Yesterday we finally saw a breakout and today much of that gain was erased. I like that despite today's sell-off, XLRE traded above and closed above its 20-EMA. The RSI remains positive. While the PMO did top, it was only a tick lower so it could shift back to the upside quickly if need be. A few things I like in particular...The Silver Cross Index (measures the percent stocks with their 20-EMA > 50-EMA, or a "silver cross") is trending higher to confirm the rally. The BPI is also rising. There aren't any real negative divergences as far as price tops and indicator tops. And finally, the participation is rising. On a sell-off day in the market, notice that XLRE didn't really take out price on the majority of stocks. Healthy participation that is rising suggests internal strength and likely higher prices for this sector.

Diamond Mine Information:

Diamond Mine Information:

Recording from 8/28 is at this link. The password to view the recording is: $LeoDog24

Register in advance for the "DecisionPoint Diamond Mine" Friday (9/4) 12:00p EST:

Here is this week's registration link. Password: dpdmine

Please do not share links! They are for Diamonds subscribers ONLY!

Click here to register in advance for the recurring free DecisionPoint Trading Room (Next one is 9/14)! Did you miss the 8/31 trading room? Here is a link to the recording (password: V#^P89Yv).

Welcome to DecisionPoint Daily Diamonds, wherein I highlight five "diamonds in the rough." These are selected from the results of my DecisionPoint scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

Peabody Energy Corp (BTU)

EARNINGS: 10/27/2020 (BMO)

Peabody Energy Corp. engages in the business of coal mining. It operates through the following segments: Powder River Basin Mining, Midwestern U.S. Mining, Western U.S. Mining, Seaborne Metallurgical Mining, Seaborne Thermal Mining, and Corporate and Other. The Powder River Basin Mining segment consists of its mines in Wyoming. The Midwestern U.S. Mining segment includes Illinois and Indiana mining operations. The Western U.S. Mining segment reflects the aggregation of its New Mexico, Arizona, and Colorado mining operations. The Seaborne Metallurgical Mining segment covers mines in Queensland, Australia. The Seaborne Thermal Mining segment handles operations in New South Wales, Australia. The Corporate and Other segment includes selling and administrative expenses, results from equity affiliates, corporate hedging activities, and trading and brokerage activities. The company was founded by Francis S. Peabody in 1883 and is headquartered in St. Louis, MO.

Up 1.90% so far in after hours trading, BTU is a Coal stock. I think I've mentioned quite a few times that I am keeping an eye on the Energy sector as I believe there will be some great bargains to take advantage of when money finally begins to rotate to that sector. I have to say I like this chart. The PMO has just generated a crossover BUY signal. Volume has certainly been coming in which is usually bullish. The RSI is negative and flat which isn't encouraging, but I do note that the SCTR may be coming out of the basement, but we have seen it react similarly and ultimately stay flat. Do understand that this stock is below $10 and therefore could be a very volatile ride. I personally don't have the stomach for it.

This reminds me of the Natural Gas (UNG) weekly chart that I stared out for weeks waiting for some action. Price did hit an all-time low last week, but that doesn't mean it is the final low. The PMO on the weekly chart does look great and because this stock is so beat down, the upside potential is staggering, I'd just be careful given the low price point.

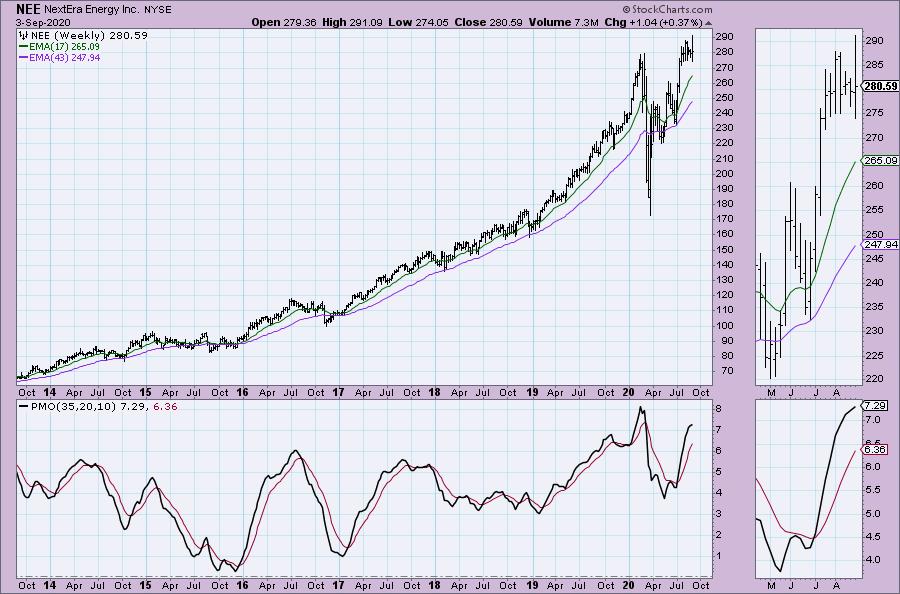

NextEra Energy Inc (NEE)

EARNINGS: 10/22/2020 (BMO)

NextEra Energy, Inc. is an electric power and energy infrastructure company. It operates through the following segments: FPL & NEER. The FPL segment engages primarily in the generation, transmission, distribution and sale of electric energy in Florida. The NEER segment produces electricity from clean and renewable sources, including wind and solar. It provides full energy and capacity requirements services; engages in power and gas marketing and trading activities; participates in natural gas production and pipeline infrastructure development; and owns a retail electricity provider. The company was founded in 1984 and is headquartered in Juno Beach, FL.

NEE had a nice breakout yesterday but like many others, it gave back much of that gain. Overall, it's not horrible, but deterioration is happening under the surface that does bother me--particularly the SCTR and OBV which are displaying negative divergences. I like that you don't have to put in a deep stop. Honestly watching to see if the current support holds and then opting in might be best. If I owned it, I wouldn't be too concerned yet. The PMO did top below its signal line, but as I have said above, deep declines or pullbacks will generally swing the PMO downward.

The weekly chart still looks positive with a rising PMO and a healthy consolidation period after the giant rallies in July.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

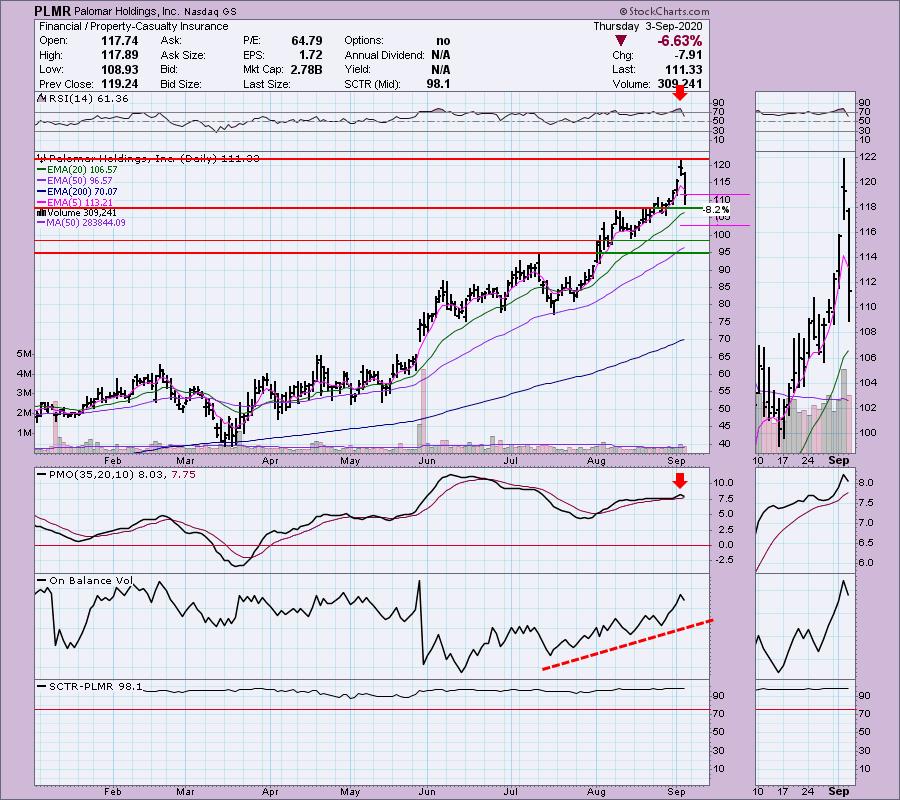

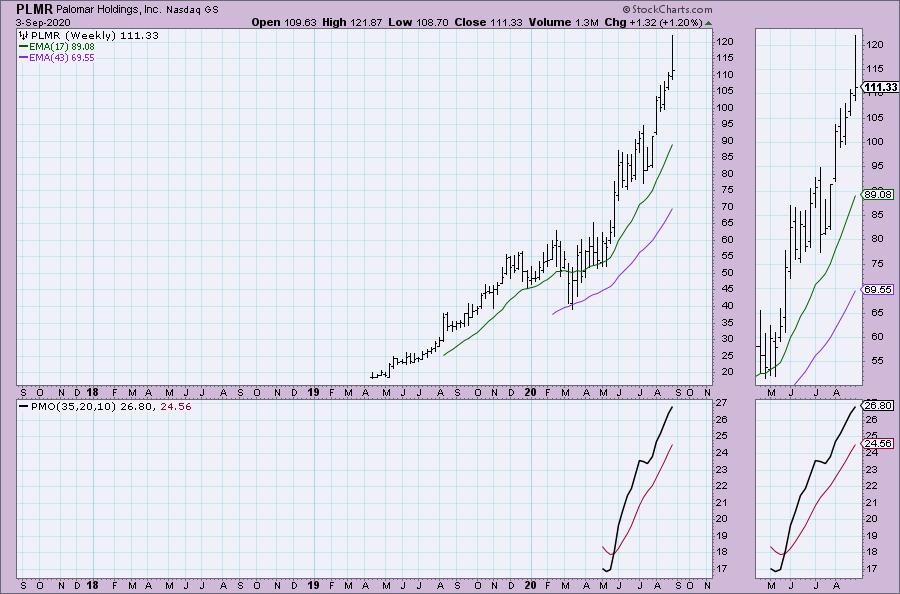

Palomar Holdings Inc (PLMR)

EARNINGS: 11/2/2020 (AMC)

Palomar Holdings, Inc. operates as an insurance holding company. It focuses on the residential and commercial earthquake markets in earthquake-exposed states such as California, Oregon, Washington, and states with exposure to the New Madrid Seismic Zone. The firm offers property and casualty insurance. The company was founded on October 4, 2013 and is headquartered in La Jolla, CA.

PLMR was a Diamond in the March 24th Diamond Report at a price of $50.99. I think most stocks rocked on the way out of the March lows, but this one certainly outperformed the SPX. Today's drop was harsh on PLMR, but it did stop on support at the early August top. Additionally it continues to hold onto the 20-EMA. This decline was actually a good thing for PLMR, it pulled the RSI out of overbought territory without damaging the OBV and SCTR. The PMO did top, but it was a tick lower and understandable. Overall, this one could still turn out well and offer a lower price point on a pullback.

We don't have a lot of data here, but the PMO is rising and confirming the rally out of the March lows.

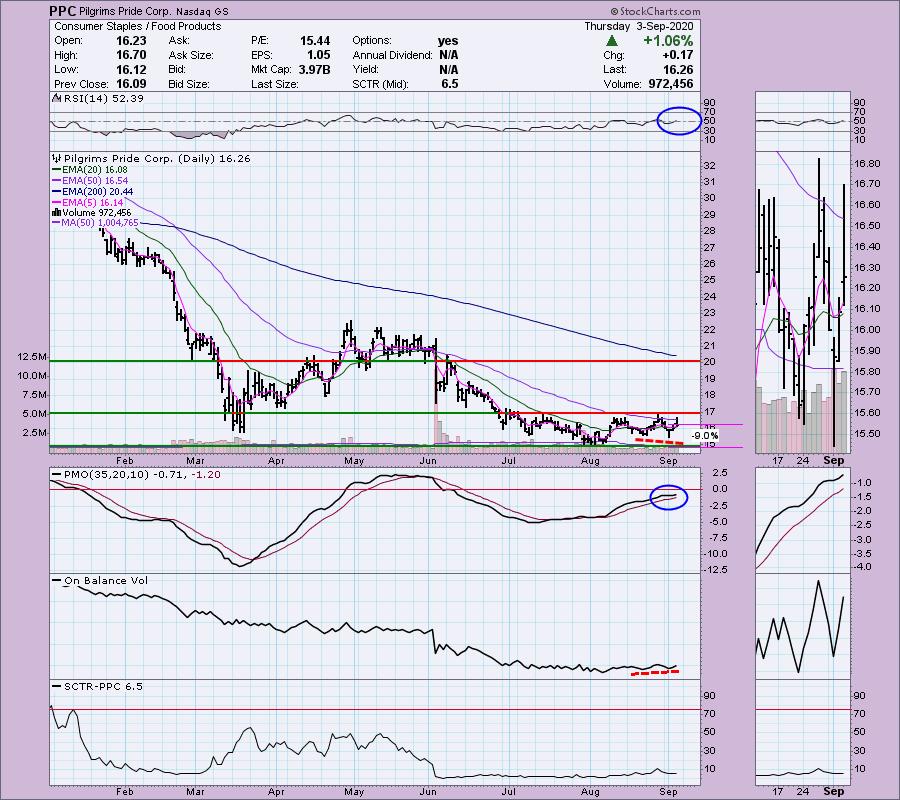

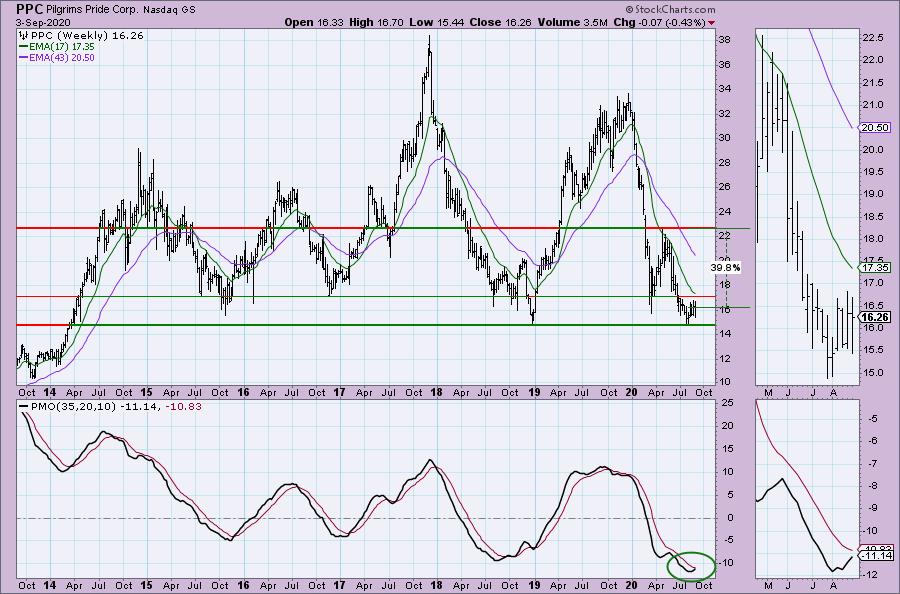

Pilgrims Pride Corp (PPC)

EARNINGS: 10/28/2020 (AMC)

Pilgrim's Pride Corp. is engaged in the production, processing, marketing and distribution of fresh, frozen, and value-added chicken products to retailers, distributors and foodservice operators. It operates through the following segments: U.S., U.K. & Europe and Mexico. The company was founded by Lonnie A. Pilgrim and Aubrey Pilgrim on October 2, 1946 and is headquartered in Greeley, CO.

This one really grabbed my attention as it has all the earmarks of a Diamond selection! The only deficiency is the SCTR, but I don't mind given this one has really been beat down. What are the earmarks? The RSI has just moved into positive territory. The PMO is accelerating higher and should hit positive territory soon. The OBV has a positive divergence--rising OBV bottoms matched to falling price bottoms. The stop level is reasonable-ish at 9%. I think you could even make a case for a complex bullish reverse head and shoulders within the trading range.

The weekly PMO has just turned up in oversold territory. Notice how this trades overall sideways. This is what many of the Consumer Staples stocks do. They aren't sexy technology or exciting biotech, but they are usually great for trading range plays and this one is set up nicely on its low.

Regency Realty Corp (REG)

EARNINGS: 10/28/2020 (AMC)

Regency Centers Corp. operates as a real estate investment trust, which engages in the ownership, operation, and development of retail shopping centers. Its portfolio includes thriving properties merchandised with highly productive grocers, restaurants, service providers, and best-in-class retailers that connect to its neighborhoods, communities, and customers. The company was founded by Martin Edward Stein, Sr. and Joan Wellhouse Newton in 1963 and is headquartered in Jacksonville, FL.

Alright, this is my Diamond pick today. As I noted in the opening, Real Estate has perked up and since it is generally considered part of the 'defensive' area of the market, this could do well if the market continues lower. If the market rebounds, the setup is pretty good and you'll also have a reasonable stop in place. The PMO has turned up and the RSI just moved into positive territory. Volume is coming in on REG and we could be looking at a double-bottom coming off the correction experienced in June/July. I don't like that SCTR, but price is well below the 200-EMA, so not a surprise. Sometimes that is the price you pay for a beat down candidate.

I was pleasantly surprised when I saw the weekly chart had a rising PMO that was making a move toward positive territory. I've made a conservative upside target based on the 2018 low; however, the 2020 high is certainly attainable if REG starts to rally big time.

Full Disclosure: I'm about 60% invested right now and 40% is in 'cash', meaning in money markets and readily available to trade with. I do not own any of the stocks presented today and don't plan on buying any either.

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

erin@decisionpoint.com

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com!