I've made it to Texas! We are in Big Spring TX and I'm thankful to have your reader requests today to save me a little time as I'm definitely ready for some rest. Two of the Diamonds below are probably more like lumps of coal and I suspect those who requested them may be rethinking them as possible Diamonds. Thanks to Richard, George, Olivia and Carla for today's requests!

** Announcements **

I am traveling July 1 - July 15. I will be writing on the road, but broadcasting will be suspended during that time. It's going to be an adventurous road trip for me and my husband. We will be taking a train from Los Angeles to New Orleans, visiting family, checking out retirement areas and then renting a car and making our way back to California with various stops along the way. I'll be sure to post a picture or two and I'm sure I'll have funny stories to share along the way. It'll be interesting to see the various stages of the reopening of America.

A heads up to Bundle subscribers, the LIVE Trading Room will be going on hiatus as Mary Ellen will also be out of pocket in the upcoming month. We hope to reopen in late-July. Please direct questions to erin@decisionpoint.com.

Welcome to DecisionPoint Daily Diamonds, wherein I highlight five "diamonds in the rough." These are selected from the results of my DecisionPoint scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

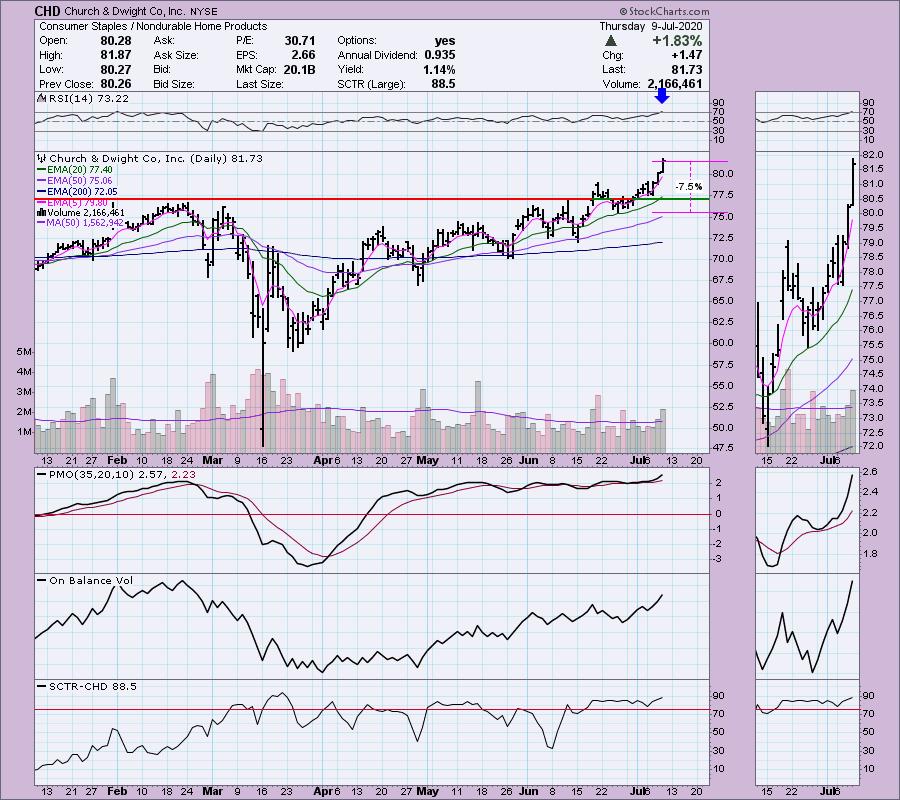

Church & Dwight Co Inc (CHD) - Earnings: 7/31/2020 (BMO)

Church & Dwight Co., Inc. engages in the development, manufacture, and market of household, personal care, and specialty products. It operates through the following segments: Consumer Domestic, Consumer International, and Specialty Products. The Consumer Domestic segment offers household products, such as laundry detergents, fabric softener sheets, cat litter, and household cleaning products; and personal care products including antiperspirants, oral care products, depilatories, reproductive health products, oral analgesics, nasal saline moisturizers, and dietary supplements. The Consumer International segment offers personal care products, household and over-the counter products in Canada, France, Australia, China, the United Kingdom, Mexico, and Brazil. The Specialty Products segment consists of sales to businesses which participated in different product areas, namely animal productivity, specialty chemicals, and specialty cleaners.

This one took off today and still looks pretty good, although I'd probably like to see a pullback if I were to enter as the RSI is now overbought. OBV is confirming and SCTR is in the "hot zone" above 75. You could set a stop just below support at the February top.

Great looking weekly chart as it is making new all-time highs and the PMO is shooting straight up and isn't overbought.

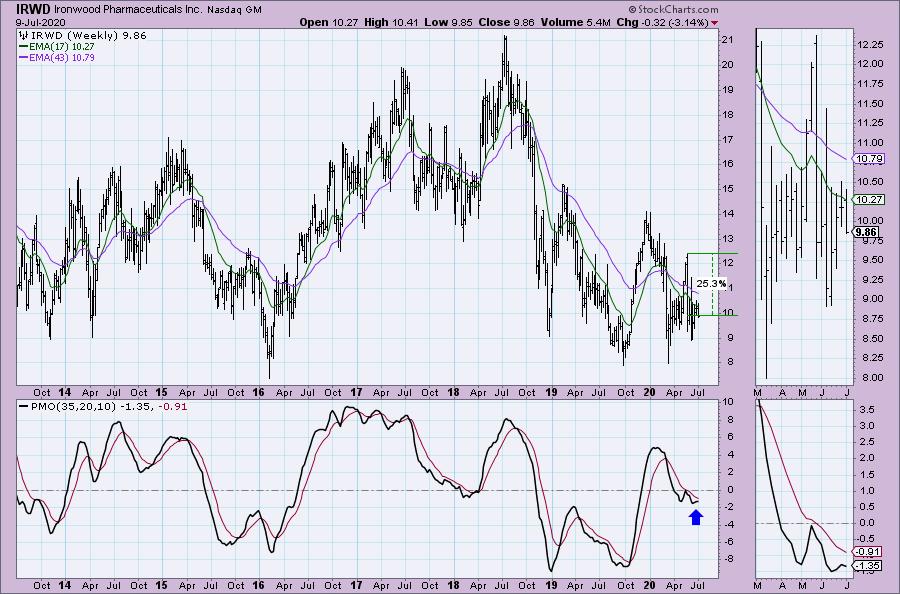

Ironwood Pharmaceuticals Inc (IRWD) - Earnings: 7/30/2020 (AMC)

Ironwood Pharmaceuticals, Inc. is a commercial biotechnology company, which engages in the discovery, commercialization, and development of medicines. Its products include linaclotide, a guanylate cyclase type-C agonists which treats patients irritable bowel syndrome with constipation and chronic constipation.

I presented this one back in June and a subscriber asked if I still liked it. That's easy...no. We have a negative divergence on the OBV. Price hit overhead resistance and is turning lower. The RSI is negative as it is below net neutral (50). I really don't like the PMO turning down beneath the zero line. The SCTR is rising, but is well below 75.

While there is upside potential if it can turn itself around, I wouldn't count on it based on the weekly PMO turning down below its signal line.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Momo Inc (MOMO) Earnings: 8/25/2020 (BMO)

Momo, Inc. operates as a mobile-based social networking platform. The platform includes Momo mobile application and related features, functionalities, tools and services that are provided to users, customers and platform partners. It offerings includes live video, value added and mobile game services.

This one looks pretty good. I like it on today's pullback. The RSI and PMO are very positive, but there is a negative divergence with the OBV that I would be concerned about. The SCTR has now turned down. The breakout is impressive though so if you did want to give it a try, I'd keep it on a short leash (tight stop).

The weekly chart looks pretty good. It tells me that I really want price to stay above resistance at the 2017/18 lows. The weekly PMO has turned up and upside potential is tempting.

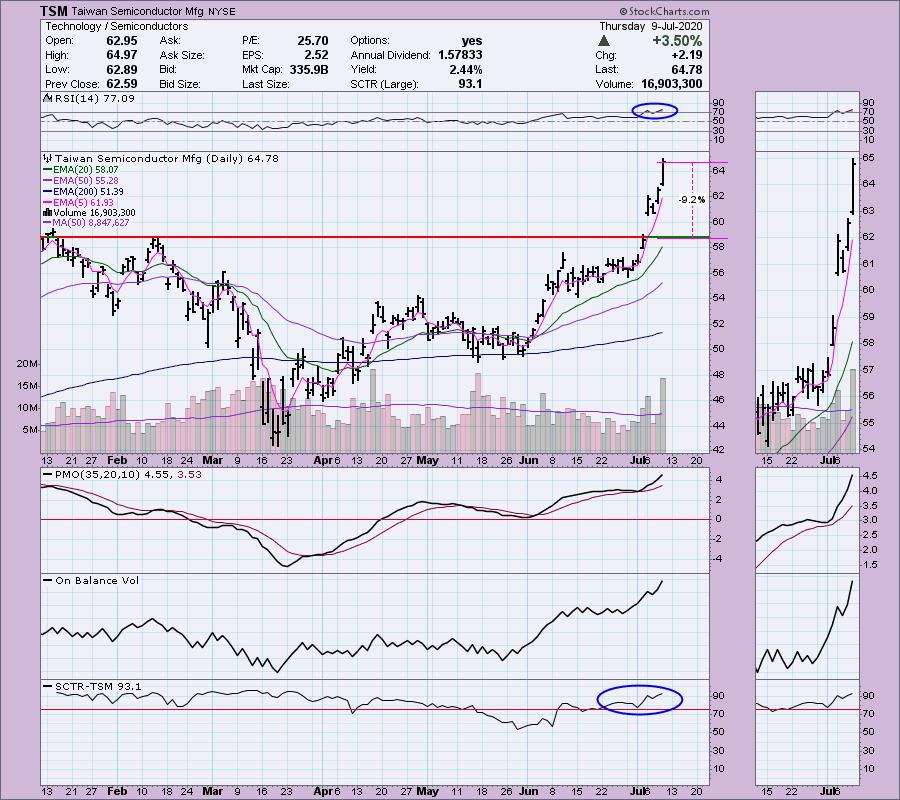

Taiwan Semiconductor Mfg (TSM) - Earnings: 7/16/2020 (BMO)

Taiwan Semiconductor Manufacturing Co., Ltd. engages in the manufacture and sale of integrated circuits and wafer semiconductor devices. Its chips are used in personal computers and peripheral products; information applications; wired and wireless communications systems products; automotive and industrial equipment including consumer electronics such as digital video compact disc player, digital television, game consoles, and digital cameras.

We have a parabolic rise on a gap up for TSM. The RSI is very overbought. Other than that, it looks pretty good. Usually when you get a strong gap up like that, there will be follow-on rallies like we have now.

Nice looking PMO that rising strongly.

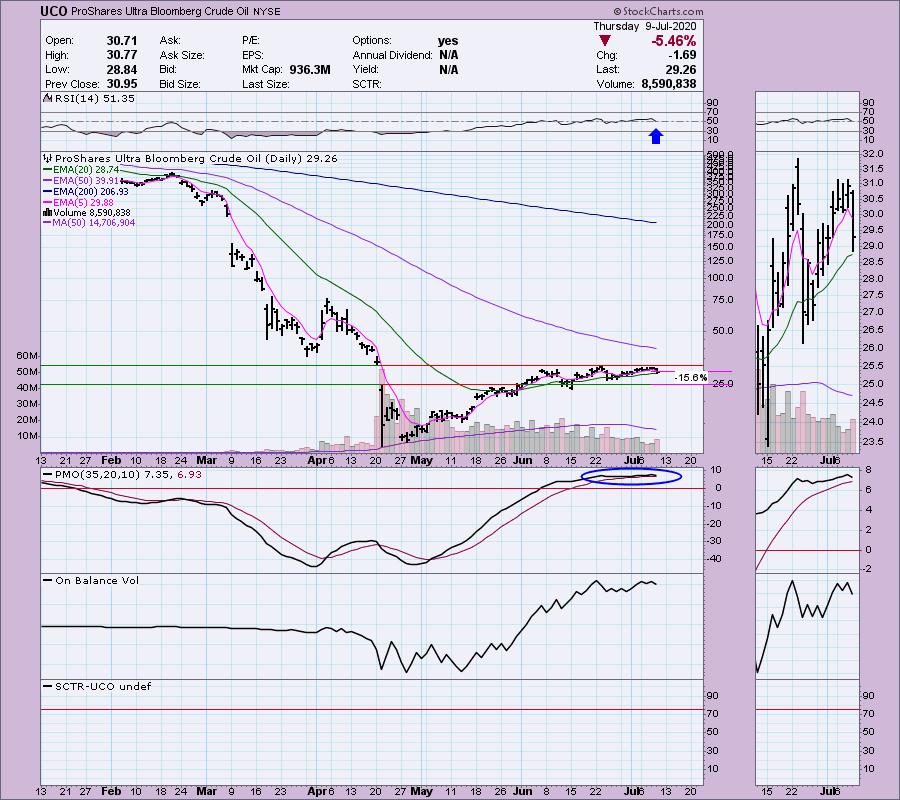

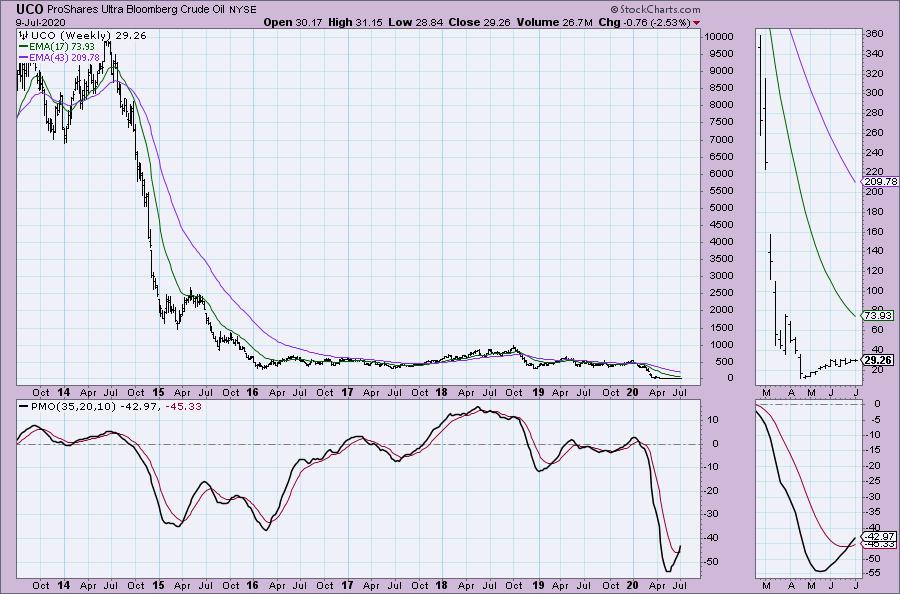

ProShares Ultra Crude Oil (UCO) -Earnings: 7/29/2020 (AMC)

UCO provides 2x the daily return of an index of futures contracts of WTI crude.

I am not a fan of Oil right now so I can't say I like this 'juiced' ETF for Oil. It is stuck within gap resistance. The PMO is turning lower and the RSI is dropping and could reach negative territory below net neutral soon. The 20-EMA held today which is positive.

As with all of the Oil related stocks, it has dropped significantly. This reminds me of Nat Gas (UNG) which I also do not like right now. On the positive side, the weekly PMO does look very bullish.

Current Market Outlook:

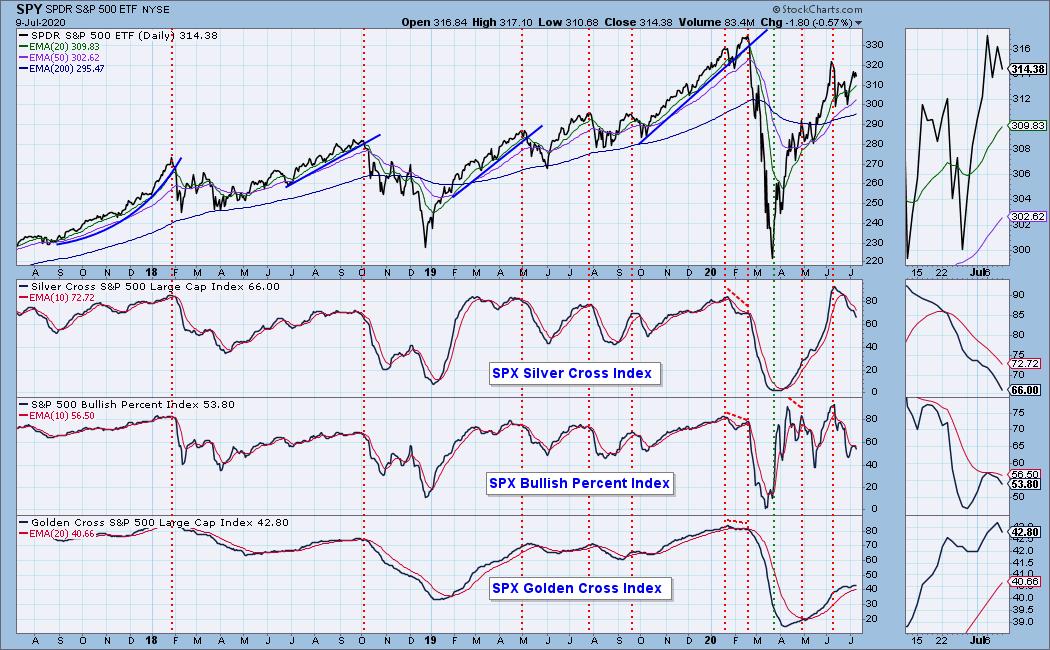

Market Environment: It is important to consider the odds for success. The Silver Cross Index measures the percentage of stocks on IT Trend Model BUY signals (20-EMA > 50-EMA), while the Golden Cross Index measures the percentage of stocks on LT Trend Model BUY signals (50-EMA > 200-EMA). Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page. Here are the current percentages on the Silver and Golden Cross Indexes:

Diamond Index:

- Diamond Scan Results: 24

- Diamond Dog Scan Results: 4

- Diamond Bull/Bear Ratio: 6.00

For a more comprehensive review of current market conditions as well as analysis of Dollar, Gold, Oil and Bonds, subscribe to the DecisionPoint Alert! For a LIMITED TIME you can get a coupon code that will give you a discount for bundling your Diamonds subscription with the DecisionPoint Alert! Contact support@decisionpoint.com for more details.

Full Disclosure: I'm about 50% invested right now.

Erin's Travel Log (Wednesday):

Today was a long drive from Florida to Alexandria, Louisiana. We had planned on stopping in Lafayette but decided to keep going so our trip tomorrow would be a little shorter as we head into Abilene TX. Last night we had steamed oysters and shrimp at the Old Bay Steamer in Ft. Walton Beach FL. As we left this morning, we stopped at one of my favorites that you can't get in California...Waffle House! I forgot how amazing their waffles and hash browns are. The scenery has been beautiful. I can't get over how lush and green the South is. We saw fields and fields of various agriculture...sugar cane, corn and soy beans. I didn't know there were so many shades of green! I noticed that Alabama and Florida were VERY vigilant as far as wearing masks, but Louisiana has been less so. Doesn't matter to me, I'm wearing mine diligently. Below are few highlights from last night in Ft Walton Beach and through today.

75 miles per hour! Wow!

Erin's Travel Log (Thursday):

Well, we started off in Louisiana today and crossed into Texas fairly early. Now it's going to be a whole lotta Texas! We made it to Big Springs today. Highlights today were seeing so many American flags as soon as we hit Texas. Countless flags...I wish I had started counting once we arrived. We saw some longhorn cattle and we lost all of the tree lined freeway as we progressed through Texas. The humidity dropped to almost nothing. I could almost feel the moisture being sucked out of my pores when I got out the first time. We also saw an increase in temperature in comparison to Louisiana and Alabama. The "dry heat" reminded me of my home in Southern California. Tomorrow we will be getting up early to head to Carlsbad Caverns. We're not sure we will get in yet, but if we can get there around 9a, we should be able to get a ticket. If anyone has a connection with the Park Service, let me know lol! I'm exhausted so signing off. Here are few pictures:

Erin Swenlin will be presenting at the The MoneyShow Las Vegas August 16 - 20 at Bally's/Paris Resort! You'll have an opportunity to meet Erin and discuss the latest DecisionPoint news and Diamond Scans. Claim your FREE pass here! You can watch online with this pass too!! There will be online events held in May and when I have more information I'll let you know.

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Thursdays 8:00a EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

erin@decisionpoint.com

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com!