As you know, I love Reader Request day! It is clear to me that these dear readers use the DecisionPoint analysis process in making their selections and that gives you a definite leg up on the crowd. Three picks are from the Materials sector which has been heating up. It is up 6.4% for the past week. Technology on the other hand is down -1.66% over the past week. Thank you, Ralph, Carla, George and Olivia for your 'diamonds in the rough'! I welcome all of you to submit your requests any day of the week for a Thursday review.

Welcome to DecisionPoint Daily Diamonds, wherein I highlight five "diamonds in the rough." These are selected from the results of my DecisionPoint scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

CF Industries Holdings Inc (CF) - Earnings: 7/29/2020 (AMC)

CF Industries Holdings, Inc. engages in the manufacture and distribution of nitrogen fertilizer. The firm owns and operates nitrogen plants and serves agricultural and industrial customers through its distribution system. It operates through following segments: Ammonia, Granular Urea, UAN, AN, and Other. The Ammonia segment produces anhydrous ammonia, which is company's most concentrated nitrogen fertilizer product as it contains 82% nitrogen. The Granular Urea segment produces granular urea, which contains 46% nitrogen. The UAN segment produces urea ammonium nitrate solution, which is a liquid fertilizer product with a nitrogen content from 28% to 32%, is produced by combining urea and ammonium nitrate. The AN segment produces ammonium nitrate, which is a nitrogen-based product with a nitrogen content between 29% and 35%. The Other segment includes diesel exhaust fluid, nitric acid, urea liquor and aqua ammonia.

Last I checked, CF was up over 1% in after hours trading which makes me feel better about this diamond in the rough. It certainly had a bad day, but it didn't breakdown in a technical way. The 5-EMA is still well below price and we just got a new PMO crossover BUY signal. I noticed a positive divergence with the OBV that kicked off this rally and a bullish falling wedge that executed this week. There are few issues. First, price is well below the 200-EMA, this gives CF a bearish bias. Second would be the very low SCTR. But as I've said often, if you're going to bottom fish you have to be prepared to ignore some of those technical problems. We also have a double-bottom that triggered on yesterday's breakout, but has fallen back down below the confirmation line.

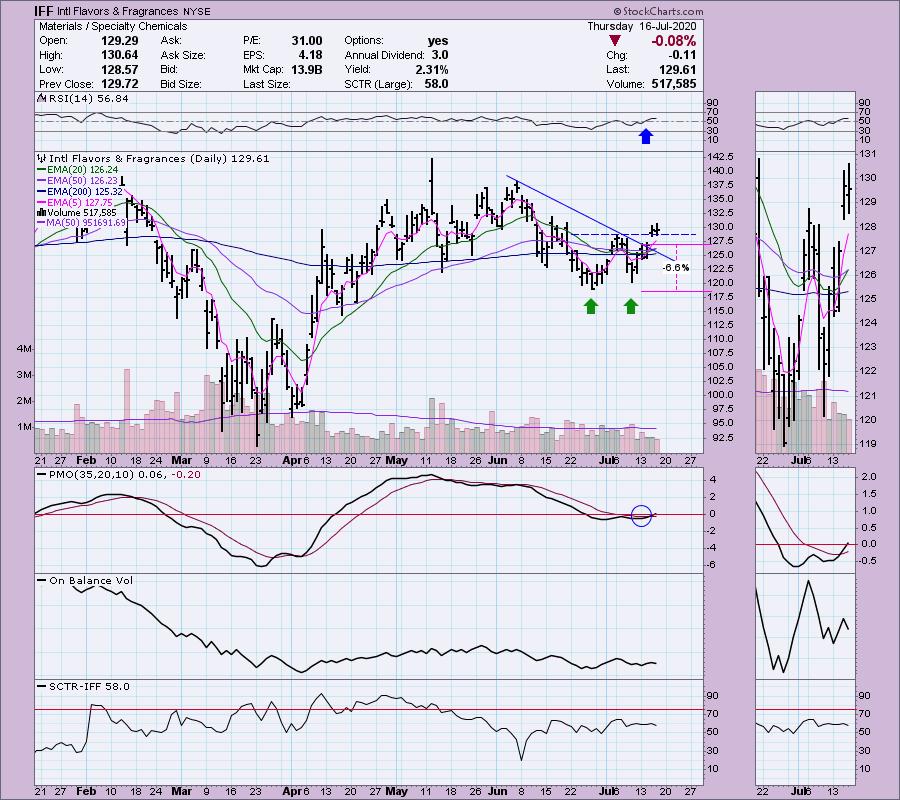

In this industry group, I prefer the Diamond I presented Tuesday, IFF. It was down only 0.08% today and it is still above the double-bottom confirmation line. Food for thought.

CF has great upside potential and the PMO is configured very nicely in oversold territory and rising.

Cleveland-Cliffs Inc (CLF) - Earnings: 7/30/2020 (BMO)

Cleveland-Cliffs, Inc. is an iron ore mining company. It supplies iron ore pellets to the North American steel industry from mines and pellet plants located in Michigan and Minnesota. It operates through the following segments: Mining & Pelletizing and Metallics. The Mining & Pelletizing segment owns operational iron ore mines plus and indefinitely idled mine. The Metallics segment constructs an HBI production plant in Toledo, Ohio.

Currently CLF is up 0.17% in after hours trading. I know my reader owns this one. I think you'll be okay, but be prepared for a pullback right now. If it bounces off the 20-EMA, I'd stick around. The PMO did move sideways today, but that is good given the over 3.3% decline. The RSI is falling but it is still above 50. Volume is petering out on this rally which is also something to watch before a pullback. The SCTR isn't looking so hot as it slips lower. If I got this one at the July low, I would not let it drop below the 20-EMA.

So upside potential is ridiculous here. Even if we could get it back above $7, that would be a sizable reward. The weekly PMO looks very healthy.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

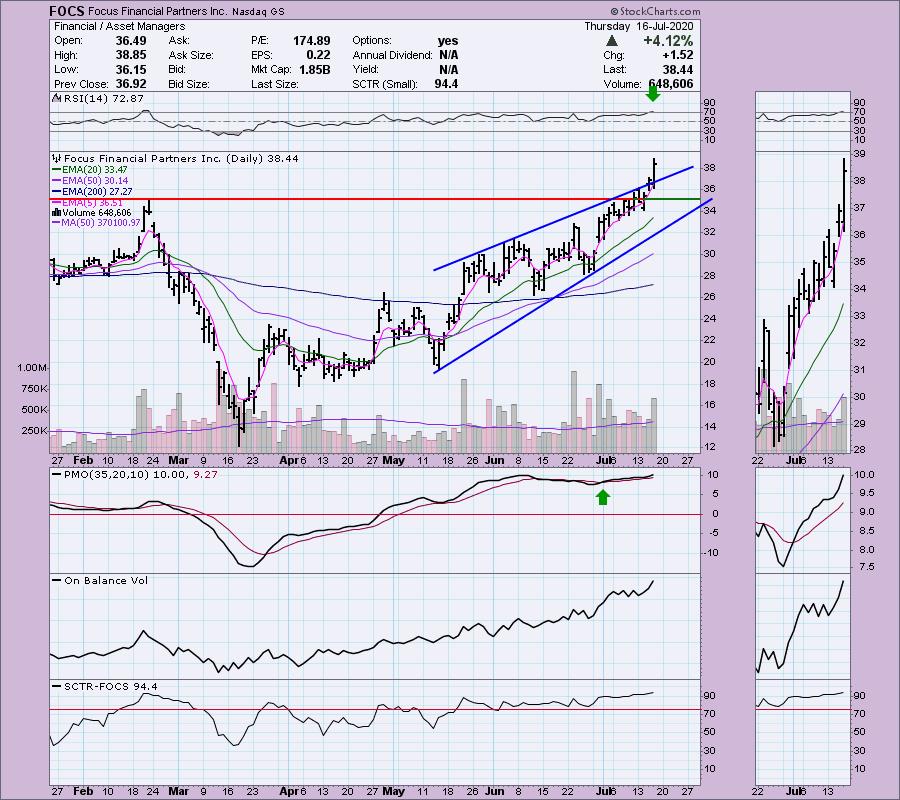

Focus Financial Partners Inc (FOCS) - Earnings: 8/6/2020 (BMO)

Focus Financial Partners, Inc. is a holding company, which engages in the provision of wealth management services. It also offers practices, resources, and continuity planning for its partner firms who serve individuals, families, employers, and institutions with comprehensive wealth management services.

Really nice breakout today! I hope you are in it, George! At first glance I had some issues with this one being too overbought based on the RSI and the PMO. However seeing a decisive breakout to the upside from a bearish rising wedge is impressive. This one likely will run higher, I would just keep an eye out for a pullback. I think a stop set around $35 would work as well. The SCTR is healthy and the OBV is confirming the move with its own upside breakout.

Upside potential is nice at 29%! We just saw a positive crossover of the 17/43-week EMAs. It's hard to say much about the PMO as far as overbought/oversold since it doesn't have much history, but we can deduce from the strong upward thrust that momentum is going the right way in the intermediate term.

Pan American Silver Corp (PAAS) - Earnings: 8/5/2020 (AMC)

Pan American Silver Corp. engages in the exploration, development, extraction, processing, refining, and reclamation of mineral properties. It owns and operates silver mines located in Peru, Mexico, Argentina, and Bolivia.

I've been a fan of Gold and the Gold Miners so I like this one! Despite a difficult 2.26% down day, the PMO only flattened, the RSI is still very positive. The OBV is mostly neutral and not telling us much. The SCTR is excellent. The PMO is on a BUY signal and isn't that overbought. I like that you can set a reasonable stop.

Excellent PMO configuration on the weekly chart!

US Concrete Inc (USCR) -Earnings: 8/6/2020 (BMO)

U.S. Concrete, Inc. engages in the production of ready-mixed concrete. It operates through Ready-mixed Concrete and Aggregate Products segments. The Ready-Mixed Concrete segment focuses on the formulation, preparation, and delivery of ready-mixed concrete to the job sites of customers. The Aggregate Products segment produces crushed stone, sand and gravel from aggregates facilities located in New Jersey and Texas, Oklahoma, United States, Virgin Islands, and British Columbia, Canada.

This one is down in after hours trading by over 1% right now so it may provide a nice entry. The RSI is rising and is positive. The OBV and SCTR are confirming the rising trend channel. Price just recently broke out from a symmetrical triangle. These triangles are continuation patterns so an upside breakout and follow-on rally are expected. On a side note, Home Builders have been picking up and could carry this one along with them.

Very nice PMO configuration and plenty of upside potential.

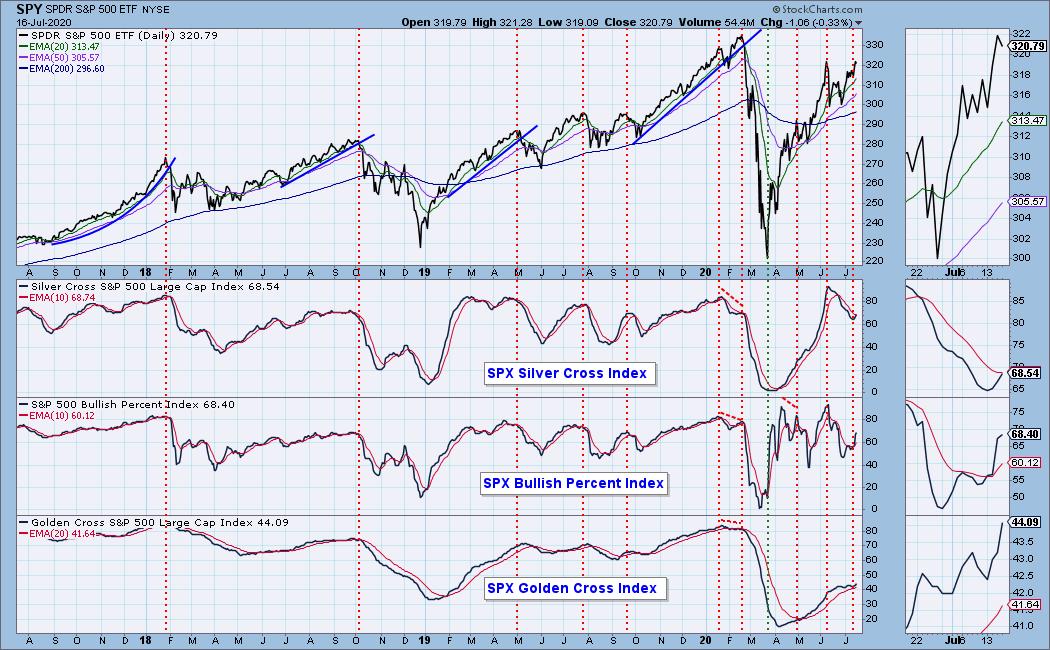

Current Market Outlook:

Market Environment: It is important to consider the odds for success. The Silver Cross Index measures the percentage of stocks on IT Trend Model BUY signals (20-EMA > 50-EMA), while the Golden Cross Index measures the percentage of stocks on LT Trend Model BUY signals (50-EMA > 200-EMA). Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page. Here are the current percentages on the Silver and Golden Cross Indexes:

Diamond Index:

- Diamond Scan Results: 30

- Diamond Dog Scan Results: 1

- Diamond Bull/Bear Ratio: 30.00

Full Disclosure: I'm about 50% invested right now.

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

erin@decisionpoint.com

Erin Swenlin will be presenting at the The MoneyShow Las Vegas August 16 - 20 at Bally's/Paris Resort! You'll have an opportunity to meet Erin and discuss the latest DecisionPoint news and Diamond Scans. Claim your FREE pass here! You can watch online with this pass too!! There will be online events held in May and when I have more information I'll let you know.

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Thursdays 8:00a EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com!