Reader Request Thursday! Let's just say today's market action was unexpectedly bad. I was looking for further decline in the market today, but I didn't expect a deep 6% decline in one day. The good news is that when prices move swiftly down, it offers excellent entries when the market begins to turn back up. We had some interesting requests. Subscriber George and I have been going back and forth on more possible "virus" plays. First was needle making companies. Our thought is that when a vaccine is available they will need the supplies to give them. Second was 'road trip' stocks as people travel but maybe aren't excited about getting on an airplane yet (that's me!). Olivia asked me about Natural Gas which has been severely beaten down. Carla suggested an interesting medical equipment stock.

** Announcements **

I will be traveling July 1 - July 15. I will be writing on the road, but broadcasting will be suspended during that time. It's going to be an adventurous road trip for me and my husband. We will be taking a train from Los Angeles to New Orleans, visiting family, checking out retirement areas and then renting a car and making our way back to California with various stops along the way. I'll be sure to post a picture or two and I'm sure I'll have funny stories to share along the way. It'll be interesting to see the various stages of the reopening of America.

A heads up to Bundle subscribers, the LIVE Trading Room will be going on hiatus as Mary Ellen will also be out of pocket in the upcoming month. We hope to reopen in late-July. Please direct questions to erin@decisionpoint.com.

Welcome to DecisionPoint Daily Diamonds, wherein I highlight five "diamonds in the rough." These are selected from the results of my DecisionPoint scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

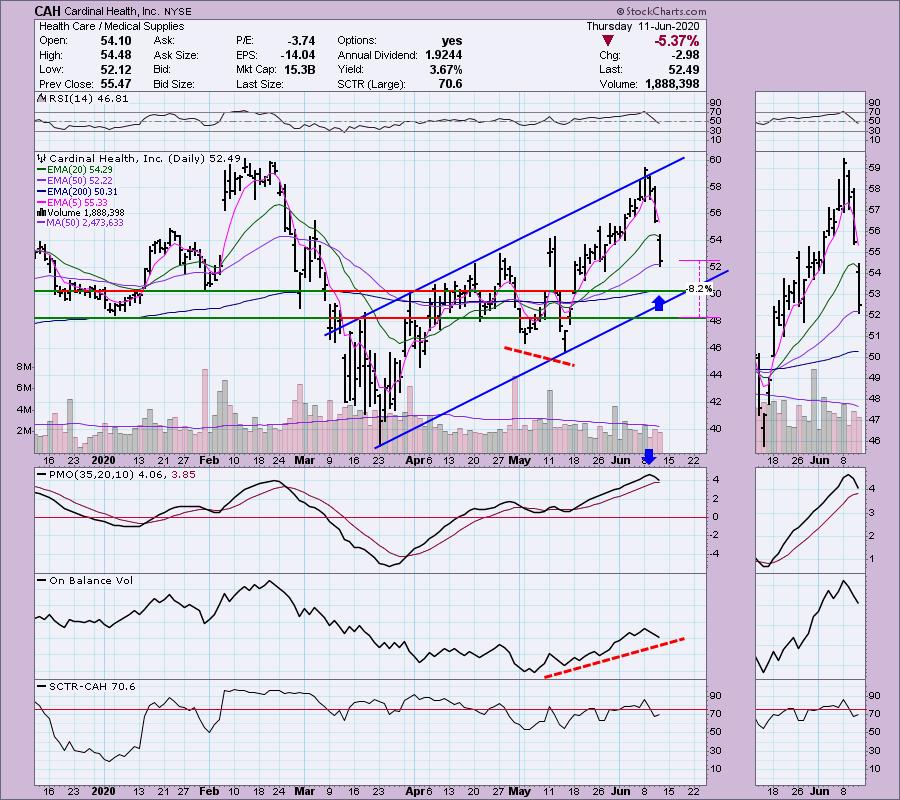

Cardinal Health Inc (CAH) - Earnings: 8/6/2020 (BMO)

Cardinal Health, Inc. is a healthcare services and products company, which engages in the provision of customized solutions for hospitals, healthcare systems, pharmacies, ambulatory surgery centers, clinical laboratories and physician offices. It also provides medical products and pharmaceuticals and cost-effective solutions that enhance supply chain efficiency. The company operates through the following segments: Pharmaceutical and Medical. The Pharmaceutical segment distributes branded and generic pharmaceutical, specialty pharmaceutical and over-the-counter healthcare and consumer products. The Medical segment manufactures, sources and distributes cardinal health branded medical, surgical and laboratory products.

This one has been trading in a wide rising trend channel and is on its way back to test the bottom of the channel. I do believe it has some downside left in it given the RSI moving below 50 and the overbought PMO top. I still like this stock's volume pattern on the OBV. We still have rising bottoms. I annotated the positive divergence that happened back in May. The SCTR is healthy enough. This one is dealing with as Tom Bowley often says, "throwing the baby out with the bathwater". The broad markets dropped slightly more than CAH today. After yesterday's deep decline, this is follow-through. I've listed a stop area that is actually lower than I would want. I would be watching the 200-EMA closely as that would be my stop. I wouldn't want this is it dropped below the 200-EMA and the rising bottoms trendline.

This is another sign that despite the big decline so far this week, the weekly PMO is still pointed upward. That tells me there is internal strength. With this week's pullback, it adds to its upside potential which I have at around 23%. I would want to take a 'relook' at $60 though to make sure it is still behaving.

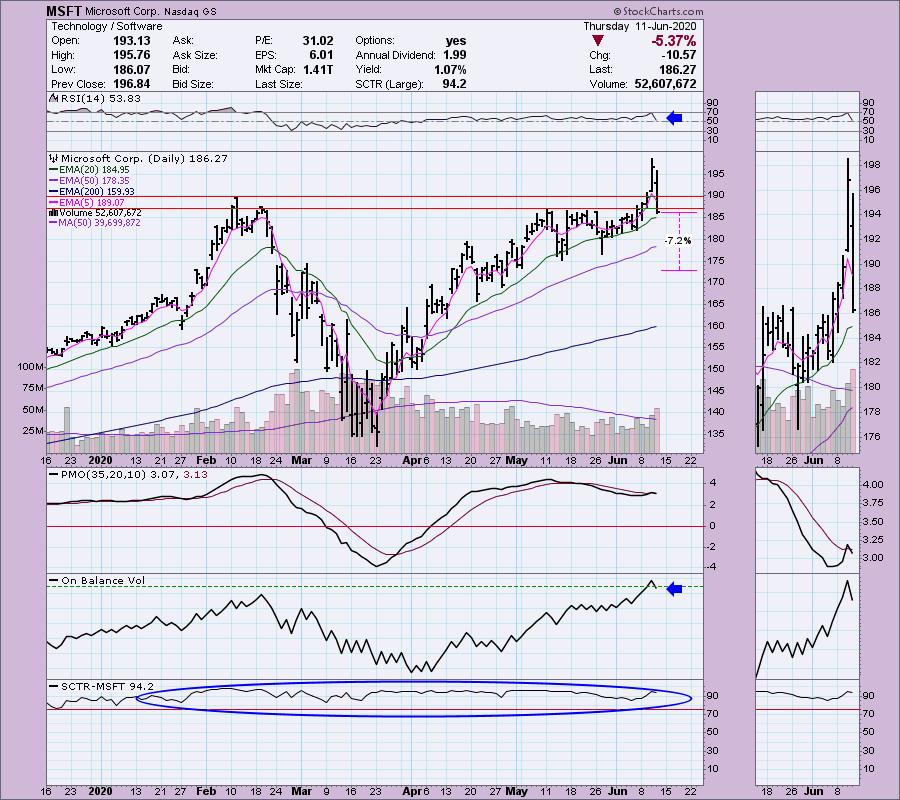

Microsoft Corp (MSFT) - Earnings: 7/16/2020 (AMC)

Microsoft Corp. engages in the development and support of software, services, devices, and solutions. It operates through the following business segments: Productivity and Business Processes; Intelligent Cloud; and More Personal Computing. The Productivity and Business Processes segment comprises products and services in the portfolio of productivity, communication, and information services of the company spanning a variety of devices and platform. The Intelligent Cloud segment refers to the public, private, and hybrid serve products and cloud services of the company which can power modern business. The More Personal Computing segment encompasses products and services geared towards the interests of end users, developers, and IT professionals across all devices. The firm also offers operating systems; cross-device productivity applications; server applications; business solution applications; desktop and server management tools; software development tools; video games; personal computers, tablets; gaming and entertainment consoles; other intelligent devices; and related accessories.

Microsoft broke out to new all-time highs yesterday, but took it all back and then some today. Despite this deep decline, MSFT is still showing some internal strength. Volume on today's move was substantial, but in the context of the past four days, it isn't climactic, only a tick downward. The RSI remains above 50 and it remains in the top 6% of large-cap stocks based on the 94.2 SCTR rank. The PMO is not particularly overbought and today's yank downward is expected on a move of this degree. I didn't include the weekly chart, but the weekly PMO is still rising strongly and isn't particularly overbought.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Resmed Inc (RMD) - Earnings: 7/23/2020 (AMC)

ResMed, Inc. engages in the development, manufacturing, distribution, and marketing of medical equipment and software solutions. The company operates through the following segments: Sleep and Respiratory Care, and SaaS. The Sleep and Respiratory Care segment engages in the sleep and respiratory disorders sector of the medical device industry. The SaaS segment engages in the supply of business management software as a service to out-of-hospital health providers. Its product portfolio includes devices, diagnostic products, mask systems, headgear and other accessories, and dental devices.

RMD has been stuck in a trading channel between $150 and $170. It appears ready to test the bottom of that channel. However, it is sitting on possible short-term support and the OBV continues to have rising bottoms. The PMO isn't good and the RSI just moved below 50. The SCTR isn't that horrible though. If you want to dive in now, you could set a pretty tight stop or you may want to wait to see if you'll get an even better entry point at the bottom of the trading channel.

Ugly weekly chart with a declining PMO on a SELL signal. Upside potential isn't as good as others. I'm fairly neutral on this stock. I need to know more information before I would enter.

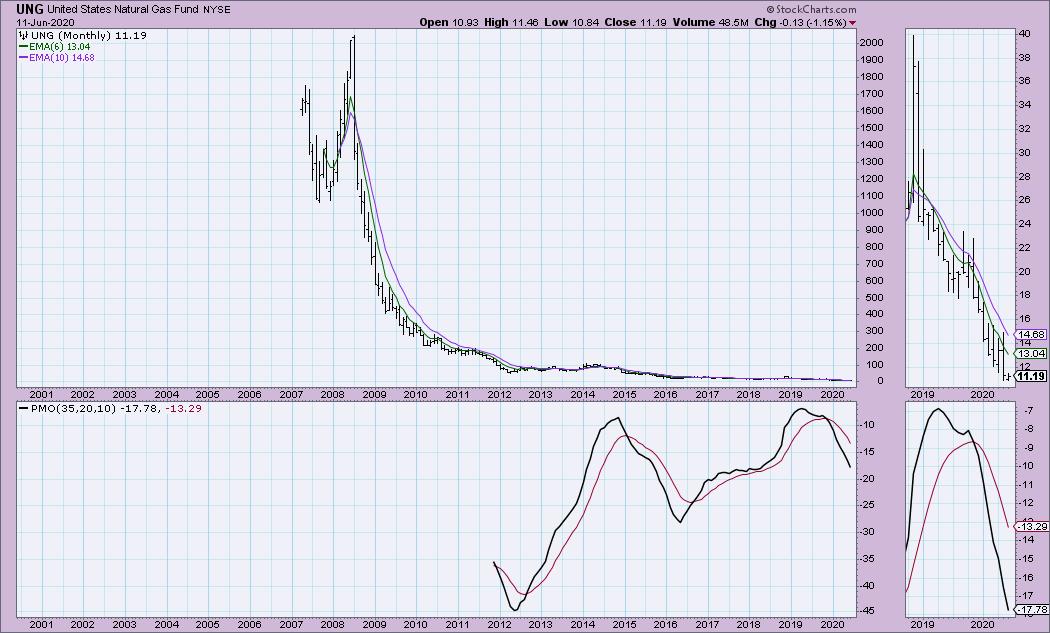

United States Natural Gas Fund (UNG) - Earnings: N/A

UNG holds near-month futures contracts in natural gas and swaps on natural gas.

Admittedly, UNG has burned my butt (figuratively of course lol) more times than I'd like to say. Right now, UNG is trading at an all-time low...talk about beat down. The PMO is turning gently up and I do see a positive OBV divergence. Keep in mind that the RSI is still negative (less than 50) and the SCTR tells you that as far as ETFs go it is in the bottom 1%. This could be a speculative play--trading not investing. I might take a chance here with a tight stop.

I went back on a monthly chart (below) to see if price was sitting on historical support. Well, no, it's not, it is at an all-time low with a monthly PMO on a SELL signal.

The weekly chart is not great, but we are seeing the weekly PMO decelerating somewhat. Just remember that even if price is at an all-time low, it can definitely move lower still.

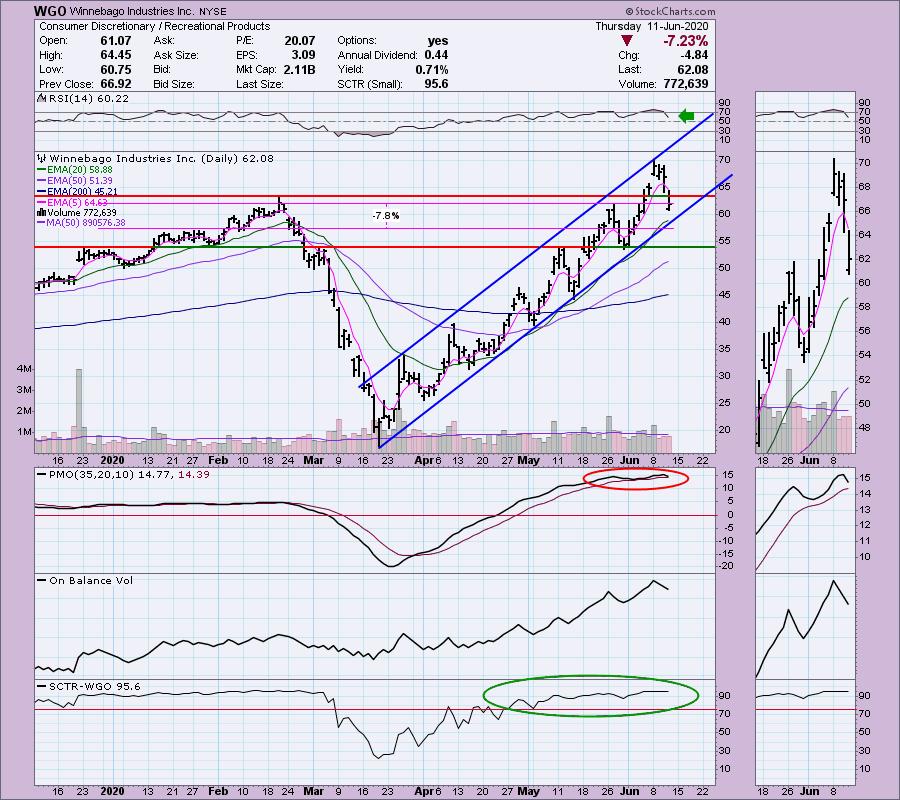

Winnebago Industries Inc (WGO) - Earnings: 6/24/2020 (BMO)

Winnebago Industries, Inc. engages in the design, development, manufacture, and sale of motorized and towable recreation products. It operates through the following segments: Grand Design towables, Winnebago towables, Chris-Craft marine, Winnebago motorhomes and Winnebago specialty vehicles.

After looking at a few 'road trip' stocks, I decided I like WGO best. Unlike its peers, it has been in a strong rising trend channel since the bear market low. It's 'personality' as Mary Ellen and I like to call it, has been touches to the top of the channel followed by tests of the bottom of the channel. It's taking that test right now. This is good, the RSI is no longer overbought and support at the 20-EMA is close. The SCTR is strong so this is part of the cream of the crop of small-caps.

The weekly PMO is very strong, although slightly overbought. This week's pullback definitely offers a nice entry.

Current Market Outlook:

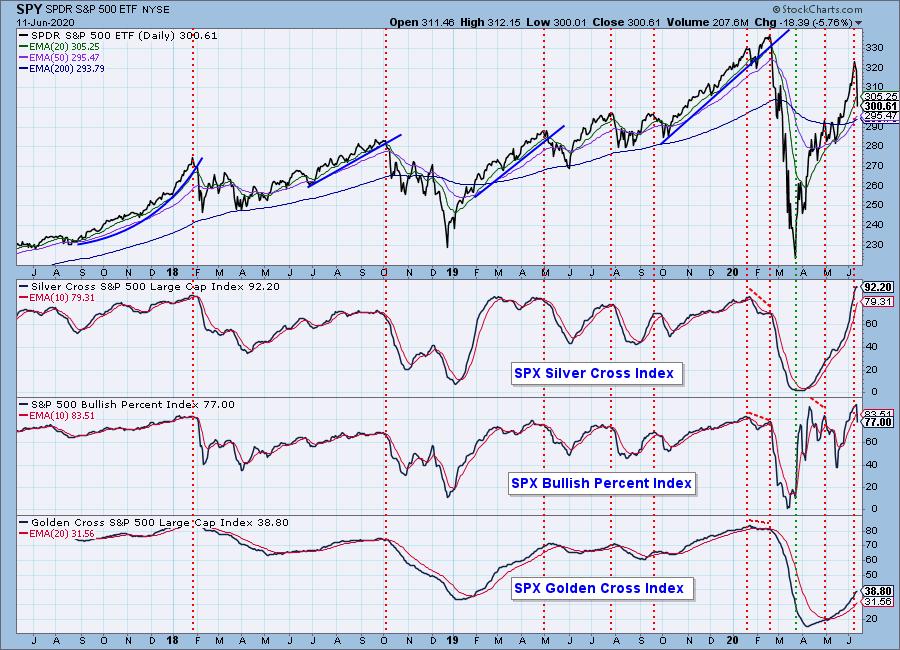

Market Environment: It is important to consider the odds for success. The Silver Cross Index measures the percentage of stocks on IT Trend Model BUY signals (20-EMA > 50-EMA), while the Golden Cross Index measures the percentage of stocks on LT Trend Model BUY signals (50-EMA > 200-EMA). Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page. Here are the current percentages on the Silver and Golden Cross Indexes:

Diamond Index:

- Diamond Scan Results: 2

- Diamond Dog Scan Results: 47

- Diamond Bull/Bear Ratio: 0.04

For a more comprehensive review of current market conditions as well as analysis of Dollar, Gold, Oil and Bonds, subscribe to the DecisionPoint Alert! For a LIMITED TIME you can get a coupon code that will give you a discount for bundling your Diamonds subscription with the DecisionPoint Alert! Contact support@decisionpoint.com for more details.

Full Disclosure: Terrible day. I was stopped out of HD, but I'd made a tidy profit and had tightened the stop. Diamonds from Monday and Tuesday might be up for a relook as today's decimation could be offering better entries, Microsoft is high on that list. I am currently about 40% in cash.

Erin Swenlin will be presenting at the The MoneyShow Las Vegas August 16 - 20 at Bally's/Paris Resort! You'll have an opportunity to meet Erin and discuss the latest DecisionPoint news and Diamond Scans. Claim your FREE pass here! You can watch online with this pass too!! There will be online events held in May and when I have more information I'll let you know.

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Thursdays 8:00a EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

erin@decisionpoint.com

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com!f