Exciting day in the market! Only one problem, it does make it hard to find stock picks that haven't already had a huge gain on the day. I found that my scans were heavy Health Care, especially pharmaceuticals. On a day when Moderna (MRNA) was up almost 20% on news of a possible fast track vaccine, it isn't surprising. It took along with it many of its companions in the Pharmaceutical industry group. Today I'm looking at the Pharmaceuticals ETF (XPH) and three members of that industry group that I'm eyeing. Finally, I'll finish up with a stock that hit all-time highs today and looks ready to continue that winning streak.

Welcome to DecisionPoint Daily Diamonds, wherein I highlight five "diamonds in the rough." These are selected from the results of my DecisionPoint scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

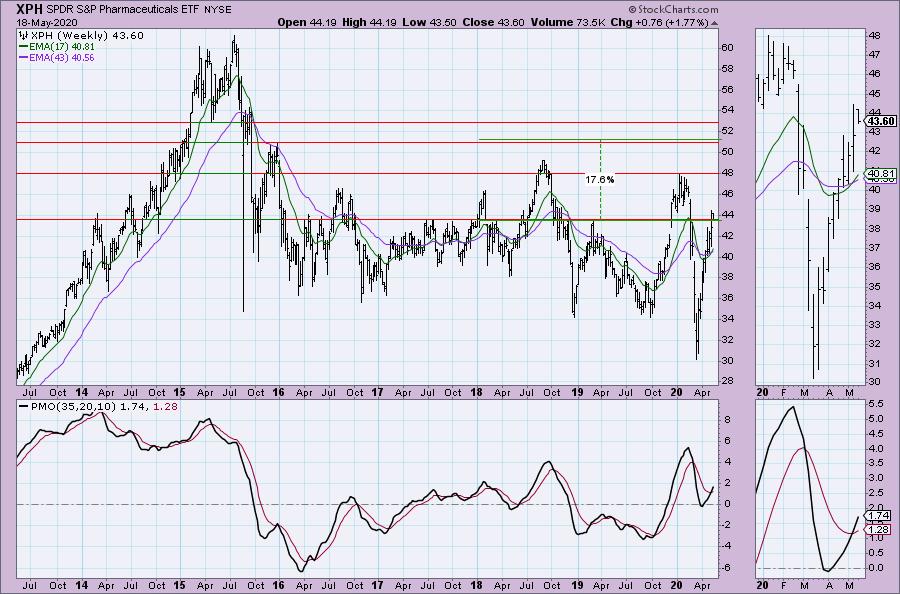

SPDR S&P Pharmaceuticals ETF (XPH) - Earnings: N/A

XPH tracks an equal-weighted index of US pharmaceutical companies.

XPH reached overhead resistance and was turned back. It still gapped up and finished 1.77% higher on the day. The PMO has now turned up and the RSI has remained above 50 since early April. The SCTR is healthy and notice that the 50-EMA just crossed above the 200-EMA (golden cross) and that gives XPH a Long-Term Trend Model BUY signal.

The PMO just had a crossover BUY signal and we can see the 17-week EMA crossed above the 43-week EMA. While overhead resistance appears to be a problem on the daily chart, I like that resistance at the early 2019 top and at the top of the consolidation zone from 2017. The upside potential isn't as exciting as some of the others, but this area should continue to be a strong performer as we muddle through the coronavirus.

Remember DecisionPoint Bundle Subscribers Get the

LIVE Trading Room for FREE ($49.95 Value)! Upgrade Today!

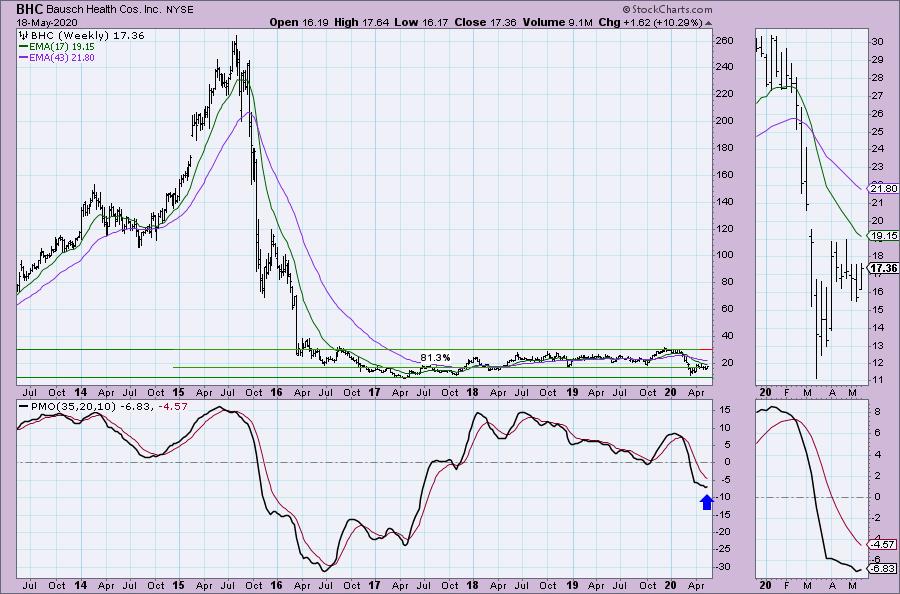

Bausch Health Cos Inc (BHC) - Earnings: 8/4/2020 (AMC)

I haven't like this stock as it is underperforming its brethren in the pharma space, but it came up on my scan today based on the new PMO crossover BUY signal. Granted it is a whipsaw signal, but I like the breakout from the declining tops trendline. It is actually breaking more than just the short-term declining trend, it is also breaking above the longer-term declining trend. The RSI is just now breaking above 50. I also spy a positive divergence with the OBV.

The PMO has managed to turn up. While this "basing pattern" on the weekly chart looks fairly tame, that trading range is between $10 - $30. In fact, if price can get back up to the top of the range, that would be a more than 80% gain!

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

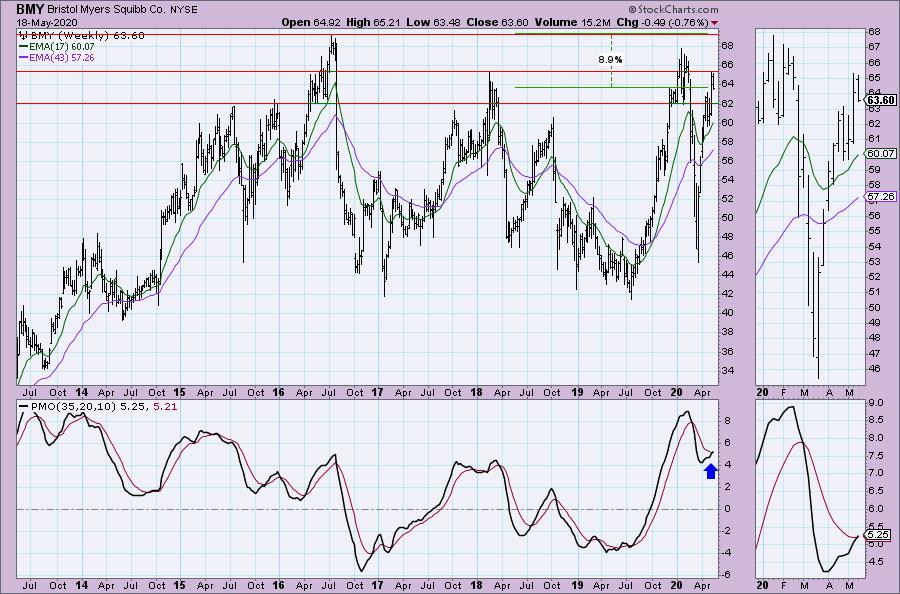

Bristol Myers Squibb Co (BMY) - Earnings: 7/23/2020 (BMO)

Bristol-Myers Squibb Co. engages in the discovery, development, licensing, manufacture, marketing, distribution, and sale of biopharmaceutical products. The firm offers chemically-synthesized drugs or small molecules and products produced from biological processes called biologics.

Interestingly on a day when most pharmas enjoyed rallies, BMY did not. Honestly, I like it more for it. It remains in a solid rising trend channel and today's drop brought it to the bottom of the channel. The PMO is rising again and it is not overbought. The RSI remains above 50.

The upside potential may not be as exciting as BHC, but it is likely to move higher than that. The PMO is scheduled to log a BUY signal after the close on Friday when the signal goes "final" on the weekly chart.

Intra-Cellular Therapies Inc (ITCI) - Earnings: 8/5/2020 (BMO)

Intra-Cellular Therapies, Inc. is a biopharmaceutical company, which focuses on the discovery and clinical development of innovative, small molecule drugs that address underserved medical needs in neuropsychiatric and neurological disorders by targeting intracellular signaling mechanisms within the central nervous system, or CNS. Its lead product candidate, ITI-007, is in clinical development as a first-in-class treatment for schizophrenia. The company also includes pre-clinical programs that are focused on advancing drug candidates for the treatment of cognitive dysfunction, in both schizophrenia and Alzheimer's disease, and for disease modification and the treatment of neurodegenerative disorders, including Alzheimer's disease.

A big gain on ITCI will likely need a pullback. Price is accelerating off the original rising trend. That can be dangerous if it goes parabolic, but it is also a show of momentum and internal strength. I don't think this one is going parabolic, but I do see quite a bit of upside potential if it can break above overhead resistance at $25. The RSI is becoming overbought. I would watch for a pullback, but if it begins to run, it may be worth entry.

That $25 level is going to be tough if you look at the weekly chart, but once that area is cleared, resistance isn't a problem until $37.50 or $45. The PMO has turned up.

Home Depot Inc (HD) - Earnings: 5/19/2020 (BMO)

The Home Depot, Inc. engages in the sale of building materials and home improvement products. Its products include building materials, home improvement products, lawn and garden products, and decor products. It offers home improvement installation services,and tool and equipment rental.

This is a company that has managed to get through the virus quite well. It has kept most of its stores open throughout March and became one of the exciting shopping destinations (at least in my house) that sold something other than groceries. Today it broke out to a new all-time high. The RSI is getting overbought, but the PMO has room to move higher. It had a "golden cross" last week when the 50-EMA crossed above the 200-EMA. Volume is certainly coming in. My one caveat is that they report earnings before the market opens so either set a limit entry tonight or watch carefully for a better entrance in the morning based on the 5 to 30-minute charts.

The weekly PMO is on a BUY signal. HD was in a very solid rising trend before the bear market crash.

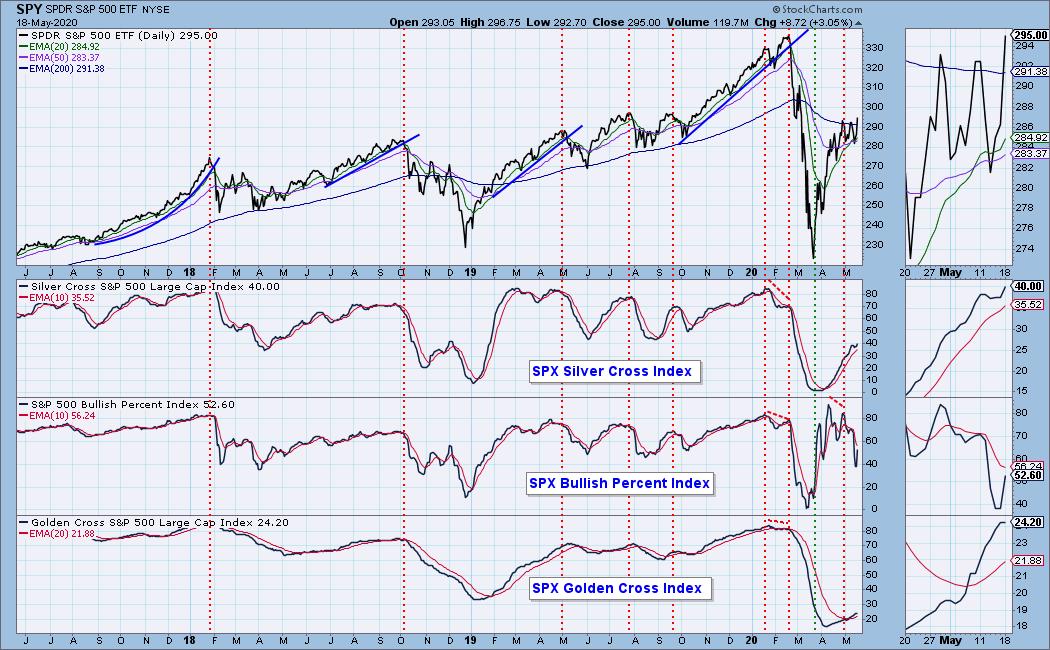

Current Market Outlook:

Market Environment: It is important to consider the odds for success. The Silver Cross Index measures the percentage of stocks on IT Trend Model BUY signals (20-EMA > 50-EMA), while the Golden Cross Index measures the percentage of stocks on LT Trend Model BUY signals (50-EMA > 200-EMA). Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page. Here are the current percentages on the Silver and Golden Cross Indexes:

Diamond Index:

- Diamond Scan Results: 1

- Diamond Dog Scan Results: 9

- Diamond Bull/Bear Ratio: 0.11

For a more comprehensive review of current market conditions as well as analysis of Dollar, Gold, Oil and Bonds, subscribe to the DecisionPoint Alert! For a LIMITED TIME you can get a coupon code that will give you a discount for bundling your Diamonds subscription with the DecisionPoint Alert! Contact support@decisionpoint.com for more details.

Full Disclosure: I don't own any of the stocks above but I will be trying to get in on HD and BHC this week. I'm currently 20% in cash. My trading timeframe has moved from intermediate-term to short-term and therefore I'm investing more.

Erin Swenlin will be presenting at the The MoneyShow Las Vegas August 16 - 20 at Bally's/Paris Resort! You'll have an opportunity to meet Erin and discuss the latest DecisionPoint news and Diamond Scans. Claim your FREE pass here! You can watch online with this pass too!! There will be online events held in May and when I have more information I'll let you know.

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Thursdays 8:00a EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

erin@decisionpoint.com

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com!