The market had a necessary pullback today and I suspect we will see it continue lower. Today's Diamonds aren't sure things, but they are in areas that usually hold up during pullbacks in this market. Consumer Staples Food Products industry group is defensive and of course with the virus, I have included selections from Health Care. I've been staying away from the Financial sector as it is showing strain from the small business loans that are ballooning at an unanticipated rate. However, an insurance company arrived in the scan results and I do like the charts for it. Tomorrow is the Live Trading Room! Here is the link to register. I'll be resending it tonight to all of our DecisionPoint email lists.

Live Trading Room - Tuesdays/Thursdays

I'm teaming up with Mary Ellen McGonagle (MEMInvestmentResearch.com) to do regular "LIVE Trading Room" sessions for FREE at 11:00a EST. We've had excellent reviews on our new LIVE Trading Rooms so far and plan on continuing them Tuesdays/Thursdays 11:00a EST. The link will be sent out the day before the event, so watch your email and tell your colleagues to sign up for our free email list on DecisionPoint.com to be notified!

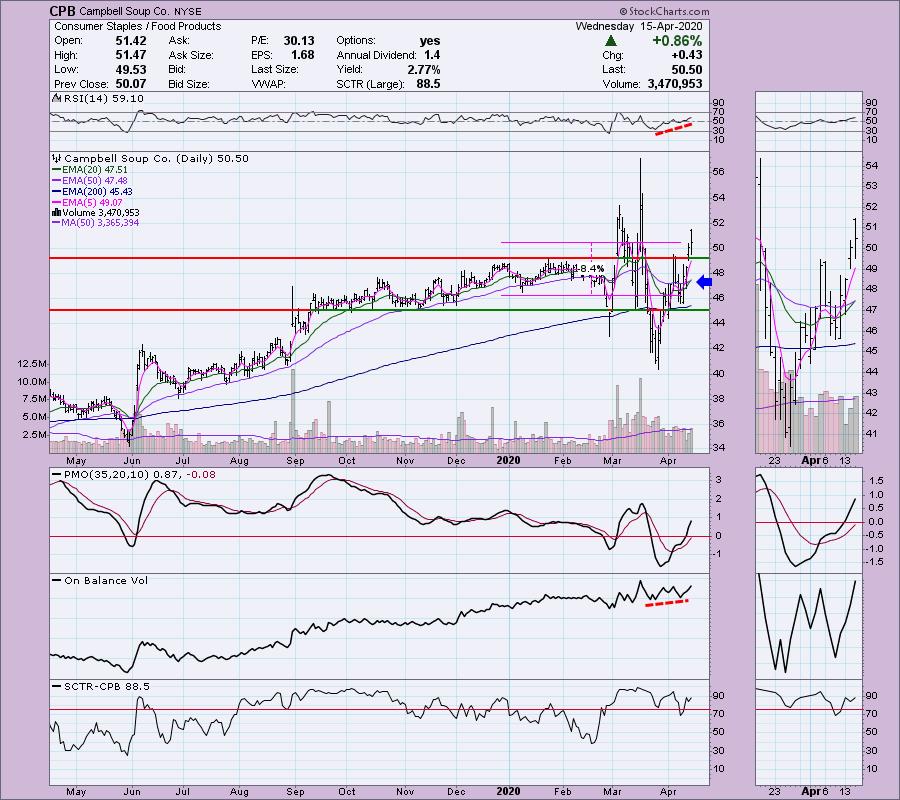

Campbell Soup Co (CPB) - Earnings: 5/22/2020 (BMO)

I covered Campbell Soup on March 11th as a watchlist candidate. It was at $50.09 at the time. I like the entry now that the volatility seems to have ironed itself out somewhat. There is a Silver Cross IT Trend Model BUY signal that triggered today. The PMO is rising and is not overbought. I like the way the RSI is gently rising and is not overbought. A possible stop level might be at the January low. I like this one, it's on my watchlist for tomorrow's Live Trading Room.

The weekly PMO is slightly overbought, but it is rising. I set the upside target at the 2017 top as a place for reevaluation.

Welcome to DecisionPoint Daily Diamonds, wherein I highlight five "diamonds in the rough." These are selected from the results of my DecisionPoint scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

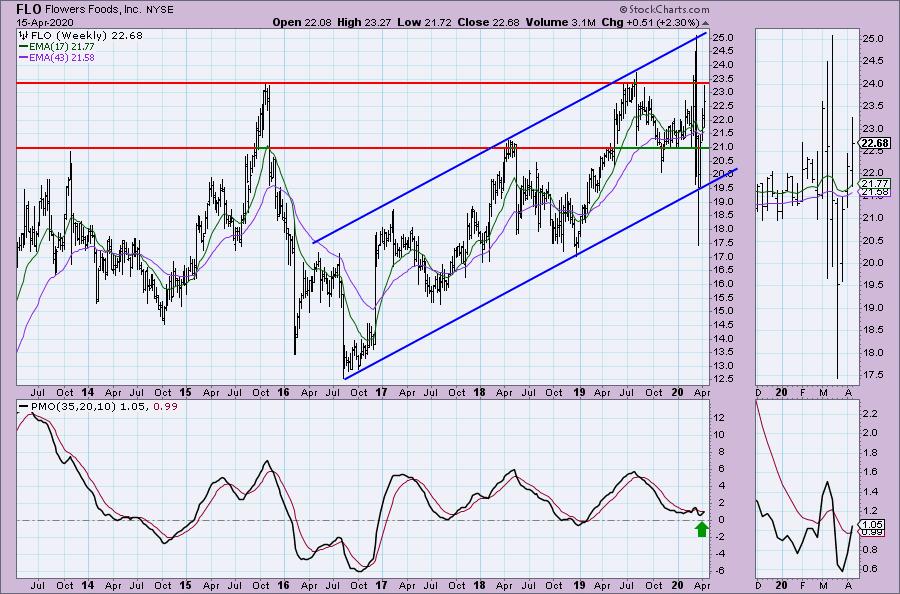

Flowers Foods Inc (FLO) - Earnings: 5/13/2020 (AMC)

This is on my watch list for tomorrow as well. The RSI is trending higher, the PMO is moving straight up and the OBV is confirming the price move. The SCTR is in the "hot zone" above 75. It had a nice pullback today that didn't break below support at the February top. We've had both a Silver Cross IT Trend Model BUY signal and a Golden Cross LT Trend Model BUY signal.

AMD has been traveling along steeper and steeper rising bottoms trendlines. I am okay with that. The bear market low for AMD didn't ruin its rising trend in the least. The PMO has turned up suggesting higher prices. We only are about 7.5% from the all-time high, but for the reasons I outlined above, I believe it will continue higher.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Eli Lilly & Co (LLY) - Earnings: 4/23/2020 (AMC)

I am little unsure of the Health Care Provider industry group. I preparing to sell my Cigna (CI) stock soon. I can tell you that it hasn't performed nearly as well as AMED. Today AMED broke out. It did close beneath resistance, but this might be an opportunity to take advantage of what looks like a strong rally. I note a new Silver Cross IT Trend Model BUY signal. The PMO is not overbought. The RSI tells us that price itself isn't overbought and the OBV is confirming. We even saw an OBV breakout on the price breakout which is bullish.

The PMO on the weekly chart has turned up and is about ready to trigger a new BUY signal. This is another stock whose rising trend wasn't broken on the bear market low. It actually became a springboard. There certainly is the possibility of a pullback since it didn't hold above resistance, but the indicators look pretty good in the short and intermediate terms.

Progressive Corp (PGR) - Earnings: 4/15/2020 (BMO)

Here's a big name Biotech. Today it broke out from a volatile consolidation zone. The PMO and RSI are rising and not overbought. We have a recent Silver Cross IT Trend Model BUY signal. The OBV is confirming the move. I like that you can set a reasonable stop.

The weekly PMO has turned up before triggering a SELL signal. I always like to see bottoms above the signal line. It is near-term overbought based on the previous three years, but we have seen it stretch higher during strong run-ups. My upside target would be the 2018 top. I think it could challenge all-time highs, but 17% profit level would be a great time to reevaluate and possibly take partial profits.

Rite Aid Corp (RAD) - Earnings: 4/16/2020 (BMO)

This one has appeared the last three days on my scans and given today's gain, I am sorry I didn't present it earlier. The PMO is about ready to trigger a BUY signal. Price broke out strongly from the declining trend and it has quite a bit of upside potential. OBV bottoms have remained fairly even while price bottoms are rising. That would be considered a positive reverse divergence. It tells us that price has been able to move higher even with lower volume. That suggests internal strength. I like the stop area at about 8.6%. You could set it deeper given the volatility to avoid stopping out, but that is a solid area of new support.

PMO continues to bottom above the signal line which is good. You have to like that upside target. Additionally we know that it has been much much higher which leaves us with some great upside potential in the intermediate to long term.

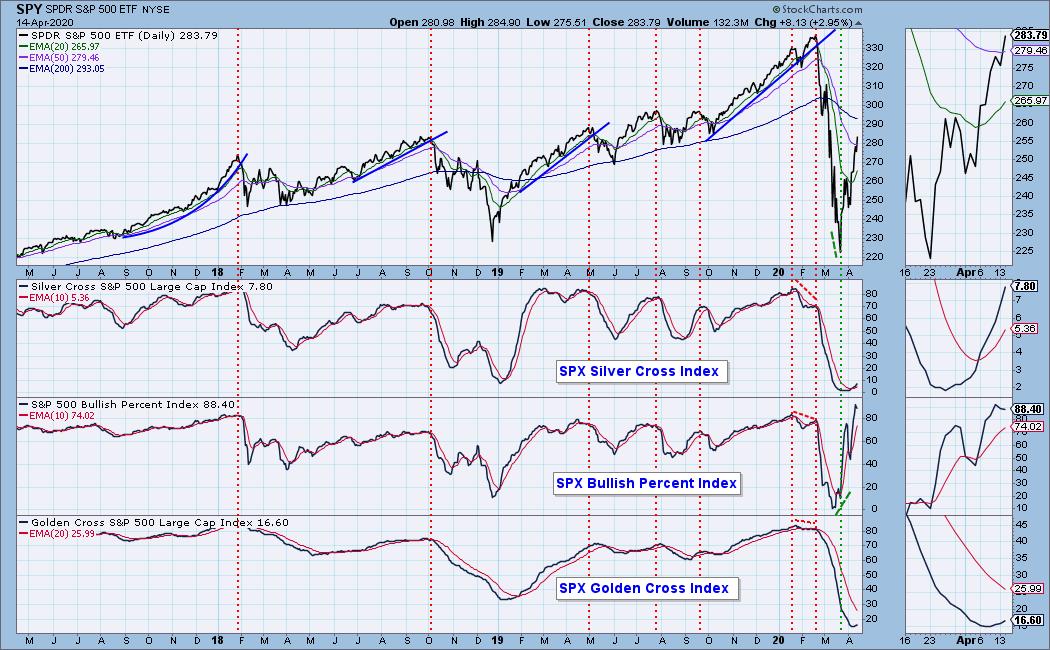

Current Market Outlook:

Market Environment: It is important to consider the odds for success. The Silver Cross Index measures the percentage of stocks on IT Trend Model BUY signals (20-EMA > 50-EMA), while the Golden Cross Index measures the percentage of stocks on LT Trend Model BUY signals (50-EMA > 200-EMA). Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page. Here are the current percentages on the Silver and Golden Cross Indexes:

Diamond Index:

- Diamond Scan Results: 1

- Diamond Dog Scan Results: 0

- Diamond Bull/Bear Ratio: 1.00

For a more comprehensive review of current market conditions as well as analysis of Dollar, Gold, Oil and Bonds, subscribe to the DecisionPoint Alert! For a LIMITED TIME you can get a coupon code that will give you a discount for bundling your Diamonds subscription with the DecisionPoint Alert! Contact support@decisionpoint.com for more details.

Full Disclosure: I do not own any of the stocks above. I'm currently 60% in cash.

Erin Swenlin will be presenting at the The MoneyShow Las Vegas August 16 - 20 at Bally's/Paris Resort! You'll have an opportunity to meet Erin and discuss the latest DecisionPoint news and Diamond Scans. Claim your FREE pass here! You can watch online with this pass too!! There will be online events held in May and when I have more information I'll let you know.

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin LIVE on Mondays 5:00p EST or on the StockCharts TV YouTube channel here!

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

erinh@stockcharts.com

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com!