With the coronavirus running amok, it isn't surprising to see one area of the market showing strength. Healthcare is the one area that most agree could actually benefit from the coronavirus. I noticed that I had quite a few biotechs and pharmaceuticals hitting the scans. I picked out five that I think have promise. As an aside, INO which I recommended last week is up over 101% (probably my best pick ever and one I am crying I didn't get into). The biotech space is volatile and I don't think that will stop, but the profits could be worth the rocky ride. And, let's face it, the entire market is a rocky ride right now. I am considering some small positions in a few of these stocks right now. Don't forget! Tomorrow is Reader Request Thursday! Send in any symbol you'd like me to analyze for you!

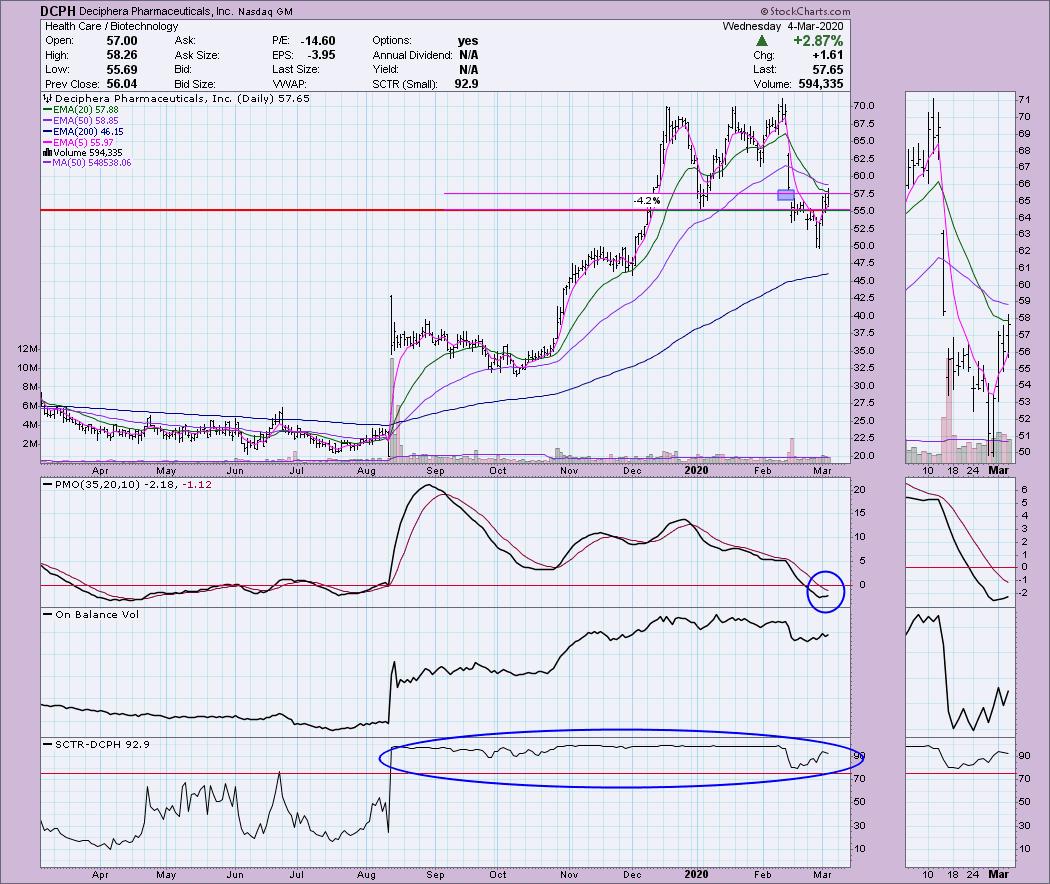

Deciphera Pharmaceuticals Inc (DCPH) - Earnings: 3/9/2020 (AMC)

This biotech has formed a bullish "V" bottom (like most of the market actually). I like that it just closed the earlier gap and traded above the 20-EMA. The PMO is favorable as it turns back up just below the zero line in near-term oversold territory. The SCTR has been great since last August, suggesting it should make a move toward $70. I show a tight stop around the January low, but stops are a personal thing. I like to add a range for subscribers to consider.

The weekly chart isn't that favorable. We have a PMO SELL signal and price hasn't quite moved back into the intermediate-term rising trend. However it is a steep rising trend and we could be looking at the formation to remedy that.

Welcome to DecisionPoint Daily Diamonds, wherein I highlight five "diamonds in the rough." These are selected from the results of my DecisionPoint scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

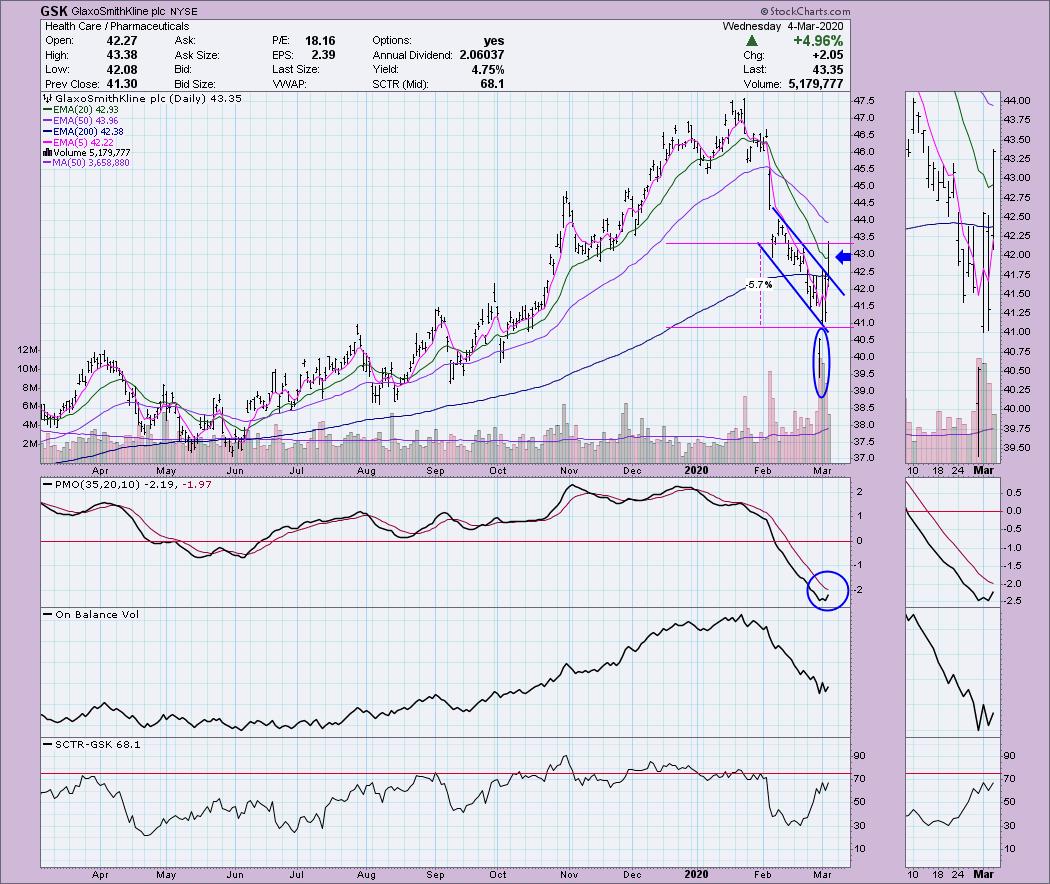

GlaxoSmithKline plc (GSK) - Earnings: 4/29/2020

I almost missed the OHLC bar from the crash site. The good news is that it has recovered nicely, even closing above the 20-EMA. The PMO is turning back up in oversold territory. I am looking for a move back to test the highs.

Another one with a not so rosy weekly chart based on the PMO. The rising wedge is a bearish formation, but price shot up instead of down. Of course that changed a few weeks ago. I'd like to see the $41 level hold, but given the bearish PMO, it is hard to bank on a bullish conclusion again.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

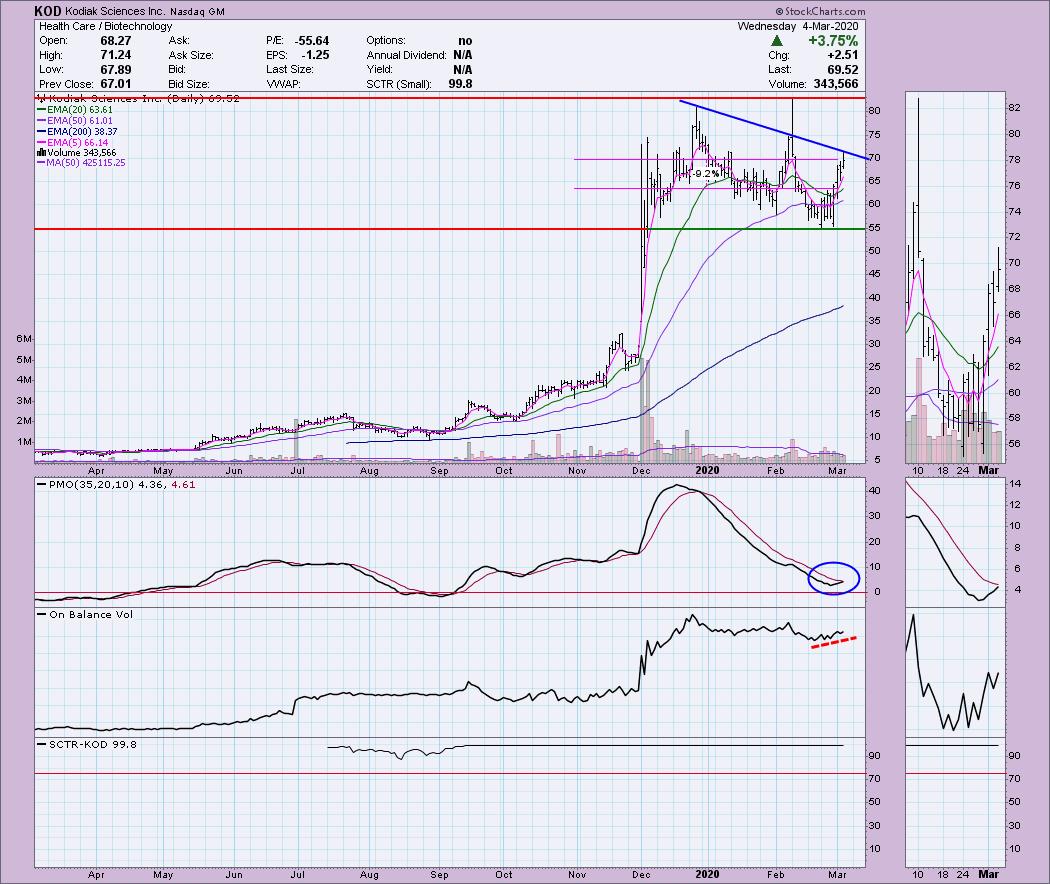

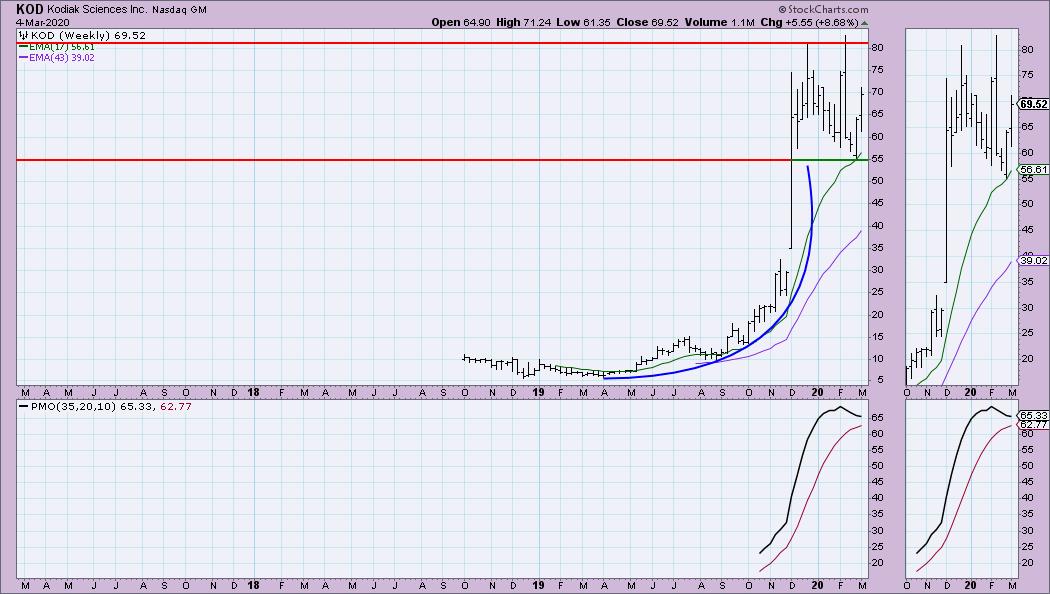

Kodiak Sciences Inc (KOD) - Earnings: 3/26/2020

This stock has a great looking PMO and I like the steady rise of the OBV. Hard to argue with a SCTR of 99.8. I've annotated a declining tops trendline but opted not to include the "pinocchio" bar from February since price closed near the low that day. A breakout seems likely. Setting a stop here is tricky as support and resistance levels aren't quite that obvious. I chose a stop that lines up with the tops at the end of February.

This one had a parabolic move but it broke down constructively and appears to have set a new trading range. It's a wide range which is one reason setting a stop is not easy on this one. I do see a bull flag formation here. The PMO topped, but it is already decelerating before a negative crossover.

Madrigal Pharmaceuticals Inc (MDGL) - Earnings: 5/6/2020 (BMO)

I am partial to this pharma. I like the double-bottom pattern and that price has bounced back up above the 20/50-EMAs. We even have a ST Trend Model BUY signal as the 5-EMA just crossed above the 20-EMA. The PMO has triggered a BUY signal. The OBV has rising bottoms in line with price bottoms and the SCTR is showing great improvement. I'm looking for the double-bottom to execute and a move to test overhead resistance at the June/July tops in 2019.

The weekly chart on MDGL looks great. We have a bullish falling wedge and a new PMO BUY signal. Doesn't get much better than that. Just watch your stop.

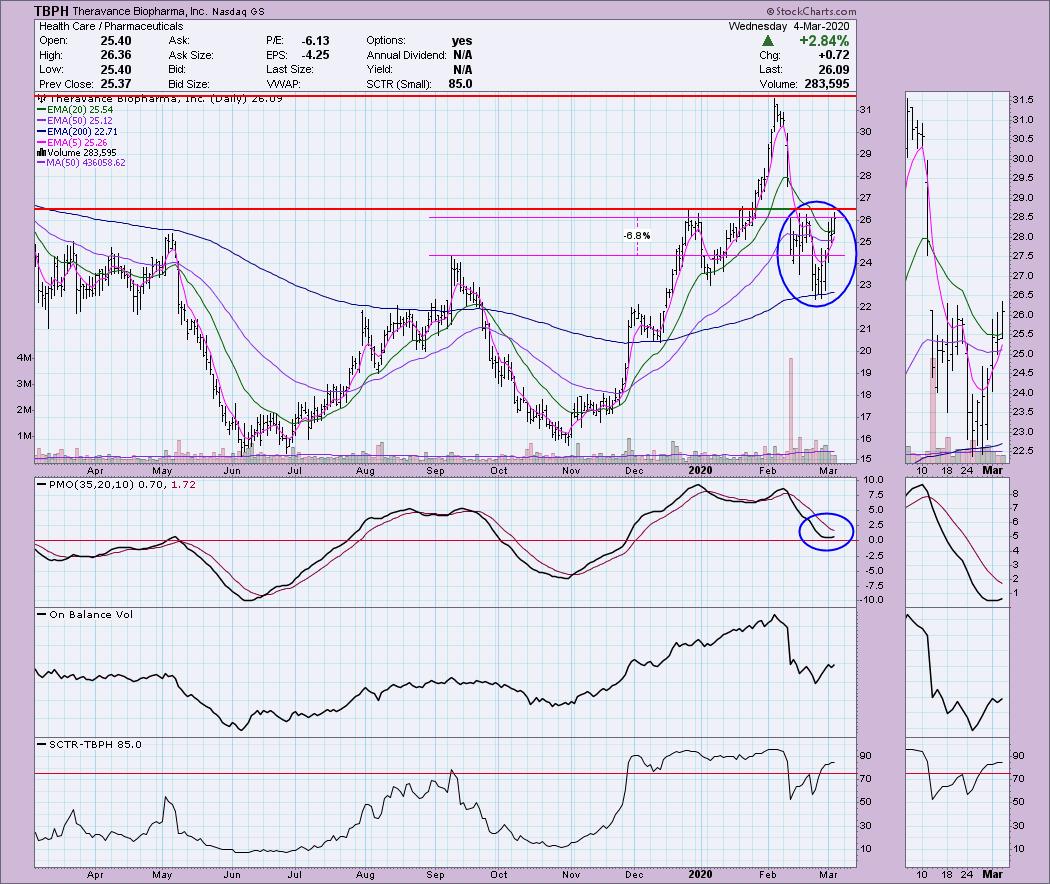

Thervance Biopharma Inc (TBPH) - Earnings: 5/5/2020 (AMC)

I've annotated a price group. Price is ready to break from that island type formation and close the gap that appeared on its correction. Right now overhead resistance is holding at the December top, but we saw a break above the 20-EMA and close near its highs for the day. The SCTR is healthy.

I've annotated a double-bottom. It executed but didn't quite reach its upside target. Instead it corrected with the rest of the market. $24 level is important support. The PMO is moving back up and is not overbought.

Current Market Outlook:

Market Environment: It is important to consider the odds for success. The Silver Cross Index measures the percentage of stocks on IT Trend Model BUY signals (20-EMA > 50-EMA), while the Golden Cross Index measures the percentage of stocks on LT Trend Model BUY signals (50-EMA > 200-EMA). Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page. Here are the current percentages on the Silver and Golden Cross Indexes:

Diamond Index:

- Diamond Scan Results: 11

- Diamond Dog Scan Results: 1

- Diamond Bull/Bear Ratio: 11.00

For a more comprehensive review of current market conditions as well as analysis of Dollar, Gold, Oil and Bonds, subscribe to the DecisionPoint Alert! For a LIMITED TIME you can get a coupon code that will give you a discount for bundling your Diamonds subscription with the DecisionPoint Alert! Contact support@decisionpoint.com for more details.

Full Disclosure: I do not own any of the stocks above, but am considering a few small positions. I'm currently 60% in cash.

Erin Swenlin will be presenting at the The MoneyShow Las Vegas on May 11-13, 2020! You'll have an opportunity to meet Erin and discuss the latest DecisionPoint news and Diamond Scans. The conference is free to attend or view online!

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin LIVE on Mondays 5:00p EST or on the StockCharts TV YouTube channel here!

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

erinh@stockcharts.com

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com!