Thank goodness it is Reader Request Thursday as there continues to be slim pickin's coming out of DecisionPoint scans. In the past four days, the bullish Diamond Scan has had only ONE result total. The good news (I think) is that the number of results from the Diamond 'Dog' Scan is seeing fewer results. The last two days that scan produced 35 and today 16 results. Given we had a continuation of this dastardly correction, it is good see bearish scan results more than halve. I did find two Healthcare stocks that actually look pretty good now and are piquing my interest.

Quest Diagnostics (DGX) - Earnings: 4/21/2020 (BMO)

This is one of the Healthcare stocks that I will be adding to my watchlist. Despite the market correction, DGX is holding its own. If anything the pullback has made it more desirable. The PMO needs to improve and really all of these stocks have ugly short-term PMOs. At this point, support is holding at both the December top and 50-EMA (it closed above it). Healthcare could end up being one the places that rights the market given that one of the triggers to this decline was the coronavirus. The SCTR shot up as it is clearly outperforming even though it did lose some ground.

The weekly chart is positive in my opinion. I would watch to make sure that the support level at the 2017 top holds, but a mostly rising PMO is bullish. It ticked lower today, but this chart doesn't go 'final' until after the close on Friday.

Welcome to DecisionPoint Daily Diamonds, wherein I highlight five "diamonds in the rough." These are selected from the results of my DecisionPoint scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

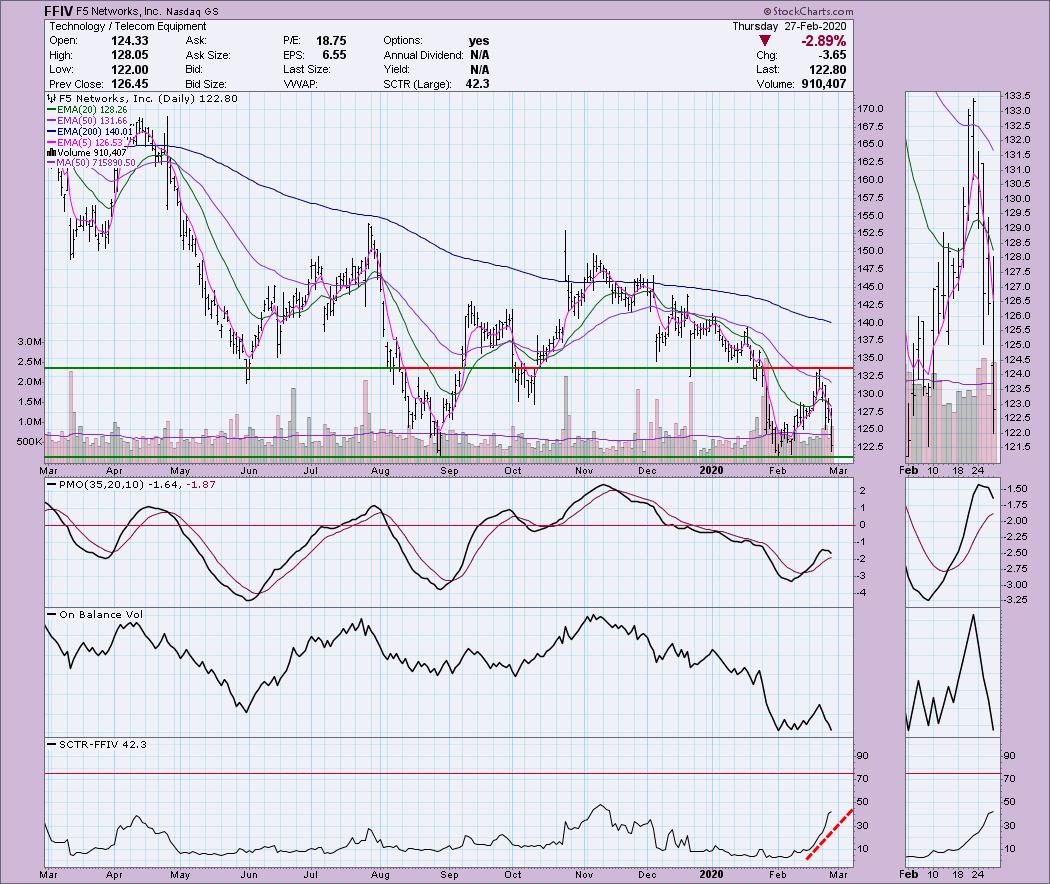

F5 Networks Inc (FFIV) - Earnings: 4/22/2020 (AMC)

This was a reader request. When it was requested, it didn't look quite so weak. Still, major support is being reached. Adding this to a watchlist makes sense as I am not enamored of the Technology sector in general. The PMO did top below its signal line and OBV is now reaching past its previous lows. Stopping on major support and a hot SCTR could make this one interesting, but overall I believe there are better stocks out there.

We see a long-term declining trend channel and despite the positivity of price on an annual low, we see that real support likely is around $115.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

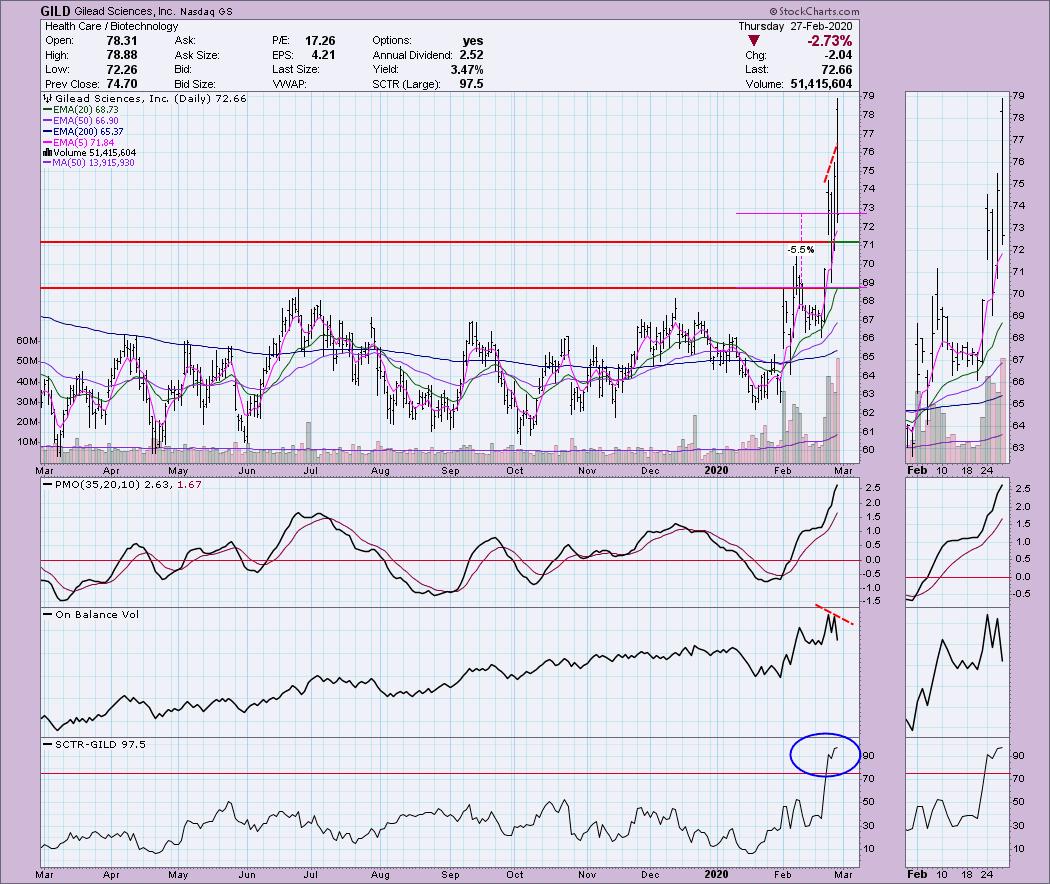

Gilead Sciences Inc (GILD) - Earnings: 4/30/2020 (AMC)

Also a reader request. Nice job on this pick! It certainly outperformed this week. Today was a heavy hit, but now we can possibly look for support to hold at $69. If price gets down there, depending on the market environment, this could be a good pick up. I don't believe it is right now. I don't like the negative OBV divergence that seems to be playing out right now.

This is an impressive breakout, especially given what the overall market has been up to. So far this week it is up 4.25%. $80 could be an issue if it wants to continue to buck the trend. Mainly I would watch the $68 level and possibly consider picking it up there.

Inspire Medical Systems Inc (INSP) - Earnings: 5/12/2020 (AMC)

I'm fairly certain this one was a Diamond at one point. I'm starting to keep historical records of what Diamonds I give out each day so I will know! As much as I'd love to curate a Diamonds portfolio, I simply don't have the time to send out buy/sell signals. I'm contemplating an 'institutional' product that might do that or give subscribers the opportunity to purchase 'mentoring time' with me. Anyway, back to INSP. We had a lovely breakout from a symmetrical triangle. This is pretty impressive given the current markets. The OBV is confirming the breakout. The PMO generated a BUY signal today and the SCTR has been holding up for some time.

In all honesty, I don't like to see an upside breakout from a rising trend channel. It gives me the impression that price is getting overbought and could be leading to a vertical rally which can never be sustained. The PMO looks good though and it is hard to complain about an upside breakout, especially this week!

Natera Inc (NTRA) - Earnings: 5/7/2020 (AMC)

This is my second candidate. I don't usually use candlestick charts, but it really is an excellent example of a bullish engulfing candle. Price has been basically holding support at the bottom of the trading range. We did see price drop below intraday, but the recovery was good. The PMO has a new BUY signal and the SCTR is healthy. The OBV certainly could be better, but I do like today's volume bar on a 7%+ move.

The weekly PMO is decelerating and I see a possible flagpole with pennant. The expectation is an upside breakout. I would really prefer to wait for the PMO to turn back up before entering.

Current Market Outlook:

Market Environment: It is important to consider the odds for success. The Silver Cross Index measures the percentage of stocks on IT Trend Model BUY signals (20-EMA > 50-EMA), while the Golden Cross Index measures the percentage of stocks on LT Trend Model BUY signals (50-EMA > 200-EMA). Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page. Here are the current percentages on the Silver and Golden Cross Indexes:

Diamond Index:

- Diamond Scan Results: 0

- Diamond Dog Scan Results: 16

- Diamond Bull/Bear Ratio: 0.00

For a more comprehensive review of current market conditions as well as analysis of Dollar, Gold, Oil and Bonds, subscribe to the DecisionPoint Alert! For a LIMITED TIME you can get a coupon code that will give you a discount for bundling your Diamonds subscription with the DecisionPoint Alert! Contact support@decisionpoint.com for more details.

Full Disclosure: I do not own any of the stocks above. I'm currently 50% in cash.

Erin Swenlin will be presenting at the The MoneyShow Las Vegas on May 11-13, 2020! You'll have an opportunity to meet Erin and discuss the latest DecisionPoint news and Diamond Scans. The conference is free to attend or view online!

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin LIVE on Mondays 5:00p EST or on the StockCharts TV YouTube channel here!

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

erinh@stockcharts.com

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com!