I wrote in today's DP Alert that I am cautious about the market in general. When I feel cautious, I generally do not enter new positions. However, if I were, I would be looking for investments that would give me the opportunity to set a tighter stop should the market (or the stock) turn on me. For me, I want a stock that has bounced off important intermediate- to long-term support so I can use that support level to set my stop. If major support is broken, there is no reason why I would keep it so it makes it easier to take if I do get stopped out. We don't like to be stopped out, but as I said, if major support is broken, I certainly wouldn't want to be holding and using 'hope' as an investment strategy.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all! Your insight helps me to tailor my commentary to what my readers and viewers want to hear about.

Welcome to DecisionPoint Daily Diamonds, wherein I highlight five "diamonds in the rough." These are selected from the results of my DecisionPoint scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

Current Market Outlook:

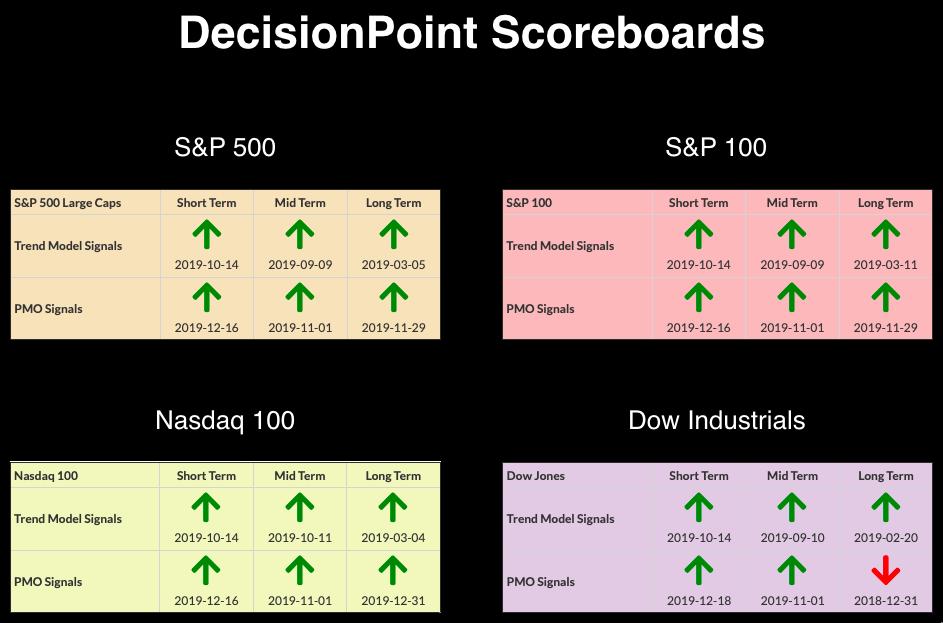

Market Trend: Currently, we have Trend Model BUY signals in all three timeframes on the DP Scoreboard Indexes.

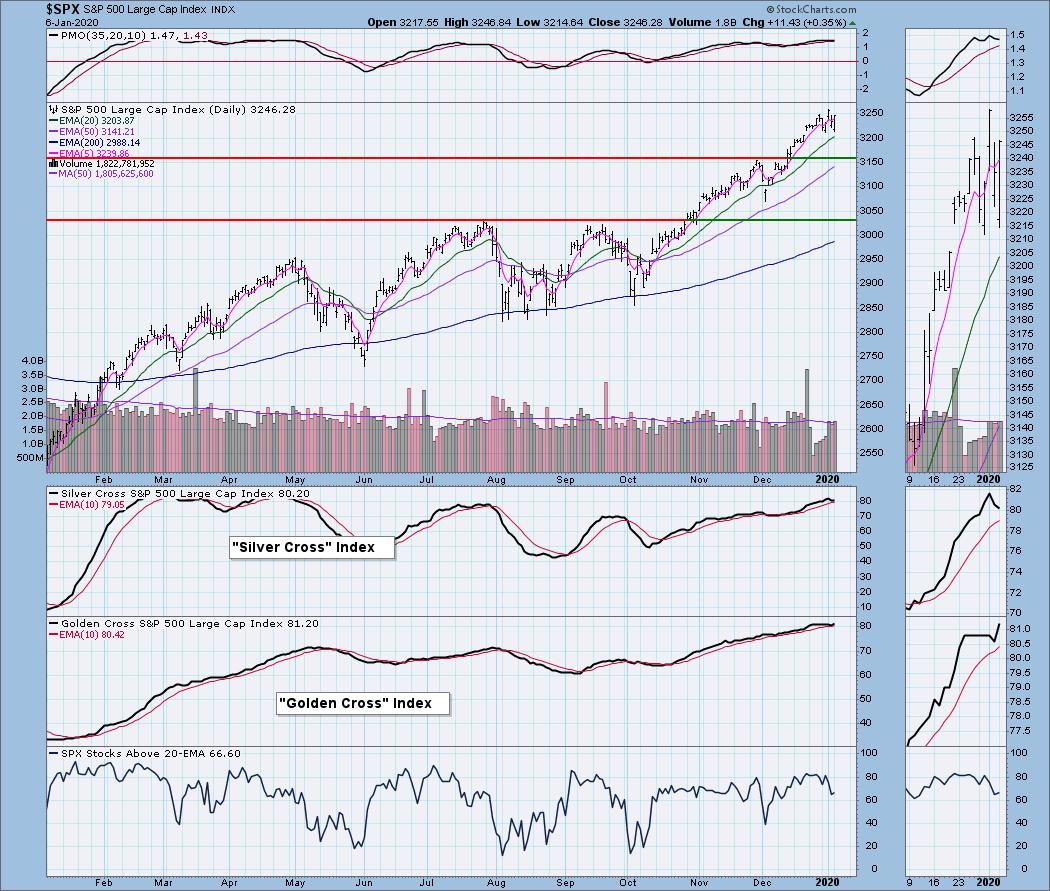

Market Condition: The market is still choppy and acting 'toppy' so I would likely hold off on any higher risk investment unless you can have a tight stop. The market remains overbought, but we must remember that in a bull market, overbought conditions can persist.

Market Environment: It is important to consider the odds for success. The Silver Cross Index measures the percentage of stocks on IT Trend Model BUY signals (20-EMA > 50-EMA), while the Golden Cross Index measures the percentage of stocks on LT Trend Model BUY signals (50-EMA > 200-EMA). Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side. Here are the current percentages on the Silver and Golden Cross Indexes:

Diamond Index:

- Diamond Scan Results: 3

- Diamond Dog Scan Results: 19

- Diamond Bull/Bear Ratio: .16

BCE Inc (BCE) - Earnings: N/A

This is a great example of a stock that has bounced off major support and honestly could be at the bottom of a trading range. A stop here would be fairly easy to set near that support area. If the 200-EMA is lost, that would be it for me. However, there is some possibility here. The PMO has turned up and the OBV has broken a declining trend. The SCTR isn't great, so relative strength is not good. Yield of 5.13% isn't too shabby.

Here is the risk. It looks like this could be setting the table for a very large decline off a double-top. The good news is that price did bounce off the confirmation line. The PMO is ugly, no denying so look at this as a shorter-term investment. Remember you don't want to be holding this if that major support level is broken.

First American Corp (FAF) - Earnings: 2/13/2020

FAF looks a bit like BCE above. Price has bounced off major support and the 200-EMA. There is a positive divergence between the OBV lows and price lows. The PMO has turned up, but it isn't particularly committed to moving higher at this point as with today's drop it flattened quickly. I'm not thrilled with overhead resistance being somewhat close at $60, but the rounded price bottom is suggesting a continuation of the rally off that support at $57. Today's decline actually makes this better for entry than yesterday for sure. A stop at $57 or below would make sense to me.

Note that overhead resistance at $60 is probably stronger than it appears on the daily chart because we can see that it lines up with the 2018 high. Just be aware of that going in. A $57 stop seems reasonable here as well.

Lennar Corp (LEN) - Earnings: 1/8/2020

Earnings are tomorrow so consider that if you enter. This one showed up in my scans yesterday and I decided not to pick it because of the large breakout it had made and I was concerned about a possible pullback. Glad I saw that as today it did as I expected and pulled back much of yesterday's profits. Price did close above the 20-EMA and the PMO is about to trigger a BUY signal. There is small double-bottom and technically it reached its target with yesterday's big breakout, but the targets calculated for chart patterns tell you the "minimum" upside or downside target. LEN still has some work to do given that the declining tops trendline wasn't really tested before price turned back. I am still encouraged especially since it came up for a second day on my scan.

I think you could make a case for a flag with the flagpole starting at the July low. The PMO isn't pretty, but the bounce did come off long-term support which could be an area to set a stop. Note that it aligns with the 2015 top.

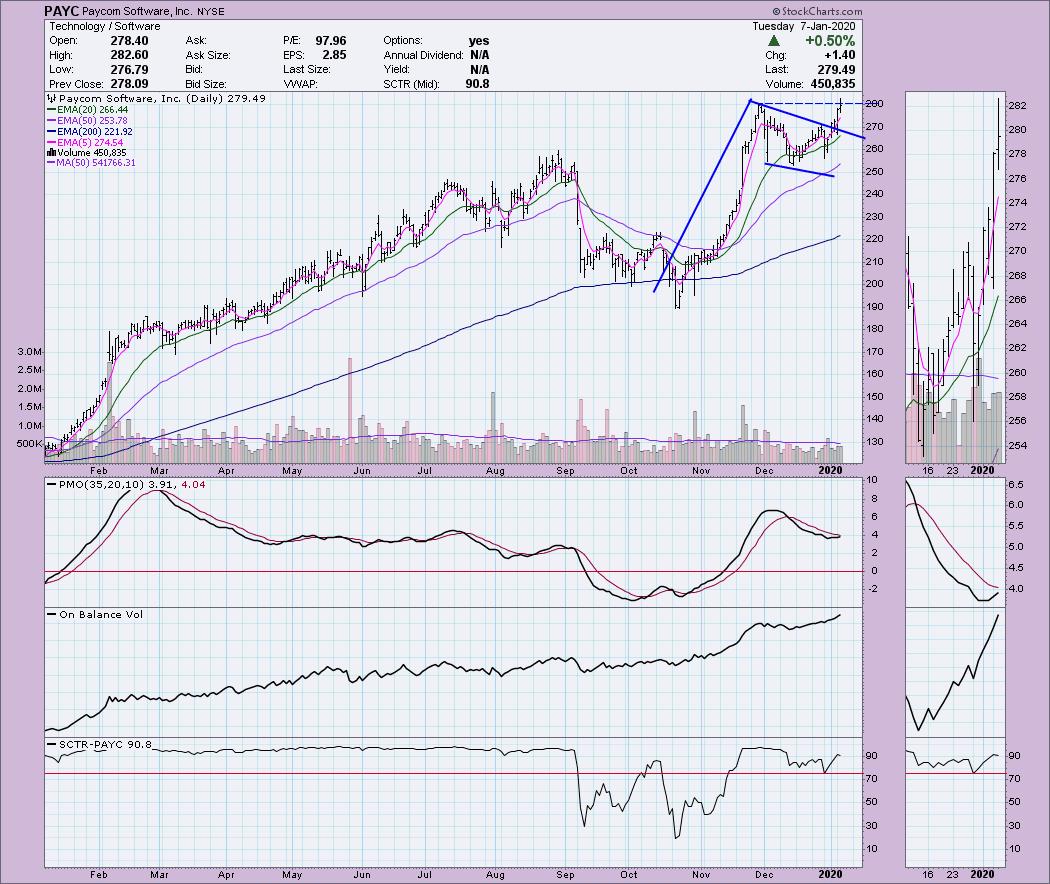

Paycom Software Inc (PAYC) - Earnings: 2/3 - 2/7/2020

I only had three results from my "Diamond PMO Scan" and two of the stocks looked very enticing. This one and the next (TROW) are the two. We saw a breakout that executed a flag formation and today price broke to a new all-time high. The OBV tells us that volume is behind this move. The PMO is nearing a BUY signal and the SCTR is very strong.

The weekly PMO is on a BUY signal and as I noted above PAYC is at all-time highs. Yes, if you look closely you can spot a parabolic ascent, that is why setting a stop will be very important should it run quickly to the upside. I prefer trailing stops when you start to see parabolic moves on the daily chart. $260 could be a possible area for a stop as well depending on your risk appetite.

T. Rowe Price Associates Inc (TROW) - Earnings: 1/28 - 2/3/2020

This is the second stock that came up as a Diamond. Beautiful breakout on a rally that came off a positive divergence between OBV bottoms and price bottoms. The SCTR has just entered the "hot zone" above 75.

The 2018 top is the make or break support for any investment in TROW. Right now price is holding above that 2018 top and the PMO is rising nicely and is not overbought.

Full Disclosure: I do not own any of the stocks presented. I would like to see the market resolve the current consolidation and show me it is ready to rally again. I am 60% cash.

Erin Swenlin will be presenting at the The MoneyShow Las Vegas on May 11-13, 2020! You'll have an opportunity to meet Erin and discuss the latest DecisionPoint news and Diamond Scans. The conference is free to attend or view online!

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin LIVE on Mondays 5:00p EST or on the StockCharts TV YouTube channel here!

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

erinh@stockcharts.com

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

**Don't miss DecisionPoint Commentary! Add your email below to be notified of new updates"**