SPY 10-Minute Chart: The election hangover has begun. Price is now in a declining trend channel on the 10-minute bar chart. Price actually dipped out of the channel briefly today which is very bearish. The decline definitely damaged some of our indicators as you will soon see.

The DecisionPoint Alert Weekly Wrap presents an end-of-week assessment of the trend and condition of the Stock Market, the U.S. Dollar, Gold, Crude Oil, and Bonds. The DecisionPoint Alert daily report (Monday through Thursday) is abbreviated and gives updates on the Weekly Wrap assessments.

Watch the latest episode of DecisionPoint on our YouTube channel here!

MARKET/INDUSTRY GROUP/SECTOR INDEXES

CLICK HERE for Carl's annotated Market Index, Sector, and Industry Group charts.

THE MARKET (S&P 500)

IT Trend Model: BUY as of 8/14/2024

LT Trend Model: BUY as of 3/29/2023

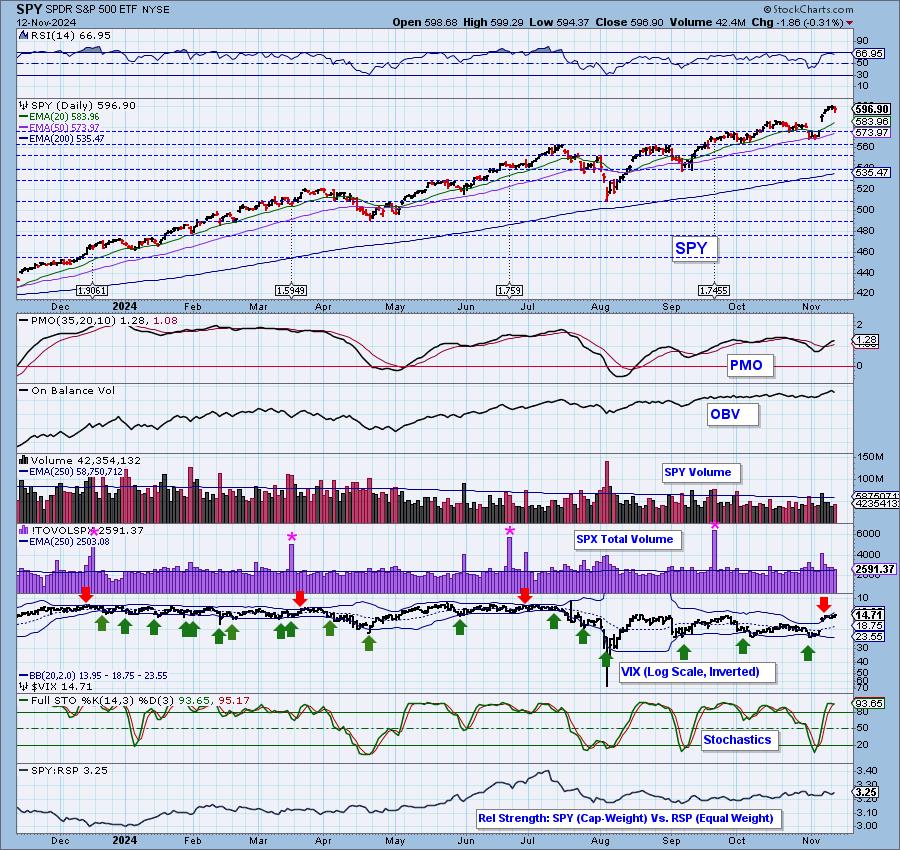

SPY Daily Chart: The PMO managed to escape unscathed by today's decline. It wasn't a big one so we're not surprised. The RSI has moved out of overbought territory on the decline which is a good result.

The VIX is still reading on the complacency side as it remains up against the upper Bollinger Band on the inverted scale. Stochastics did top today, but do remain above 80 so we aren't seeing any strong deterioration of internal price strength yet.

Here is the latest recording from 11/11. Click HERE to get to our video list.:

S&P 500 New 52-Week Highs/Lows: New Highs were still prevalent, but what we noticed was the increase in New Lows. They are hitting near-term oversold territory, but we are looking for them to expand further from here. The High-Low Differential decelerated today but is still rising.

Climax* Analysis: There were two climax readings today on the four relevant indicators, so we have a downside initiation climax. We think that the election euphoria is over. Since the SPY just came off an all-time high, downside followthrough seems likely. Total Volume confirmed the climax as it was just above the annual average.

*A climax is a one-day event when market action generates very high readings in, primarily, breadth and volume indicators. We also include the VIX, watching for it to penetrate outside the Bollinger Band envelope. The vertical dotted lines mark climax days -- red for downside climaxes, and green for upside. Climaxes are at their core exhaustion events; however, at price pivots they may be initiating a change of trend.

Short-Term Market Indicators: The short-term market trend is UP and the condition is OVERBOUGHT.

Swenlin Trading Oscillators (STOs) topped today and are now moving out of overbought territory. Participation shrank as we would expect. Rising momentum is now being bled away from the index.

Intermediate-Term Market Indicators: The intermediate-term market trend is UP and the condition is NEUTRAL.

The ITBM did manage a slight advance, but the ITVM topped to confirm topping short-term indicators. We saw a top on %PMO Xover BUY Signals. They are still above our bullish 50% threshold so damage is so far limited.

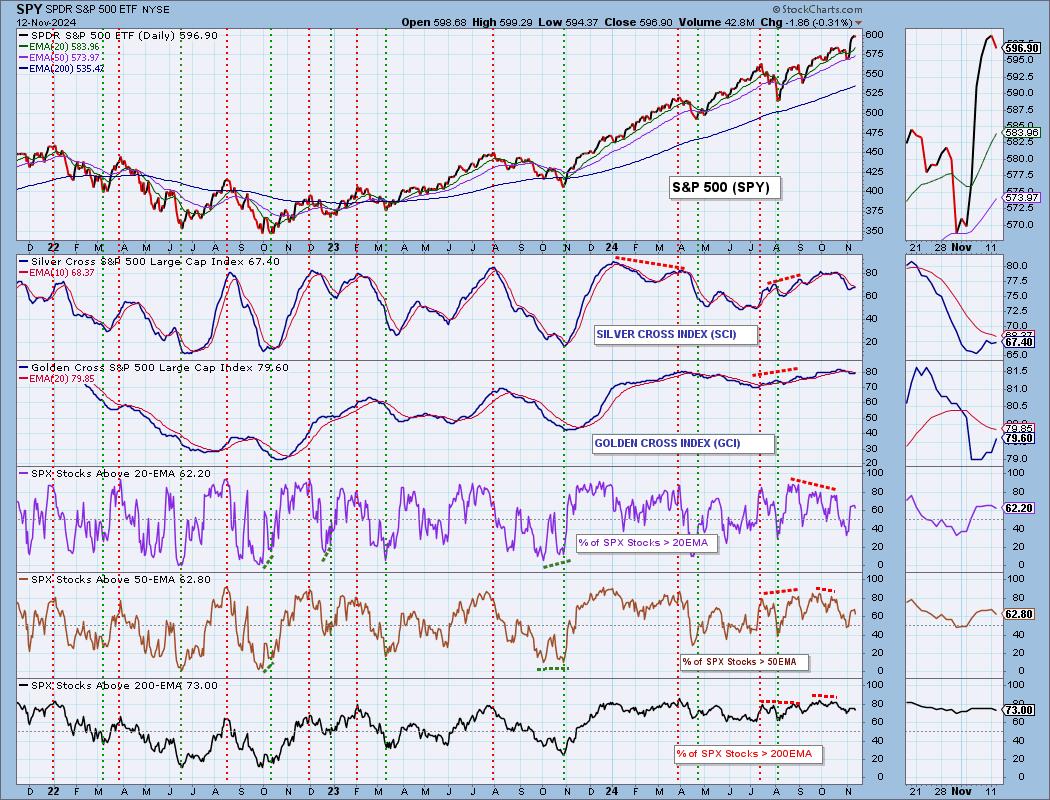

PARTICIPATION CHART (S&P 500): The following chart objectively shows the depth and trend of participation for the SPX in two time frames.

- Intermediate-Term - the Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA). The opposite of the Silver Cross is a "Dark Cross" -- those stocks are, at the very least, in a correction.

- Long-Term - the Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA). The opposite of a Golden Cross is the "Death Cross" -- those stocks are in a bear market.

The market bias is BEARISH in the intermediate and long terms.

The negative divergences on %Stocks indicators are a problem and it seems price is starting to react. The Silver Cross Index did manage to inch higher as well as the Golden Cross Index, but given participation readings are so close to the Silver/Golden Cross Indexes' readings, they aren't likely to rise much further. We expect them to stay beneath their signal lines keeping the BEARISH Bias intact in both the intermediate and long terms.

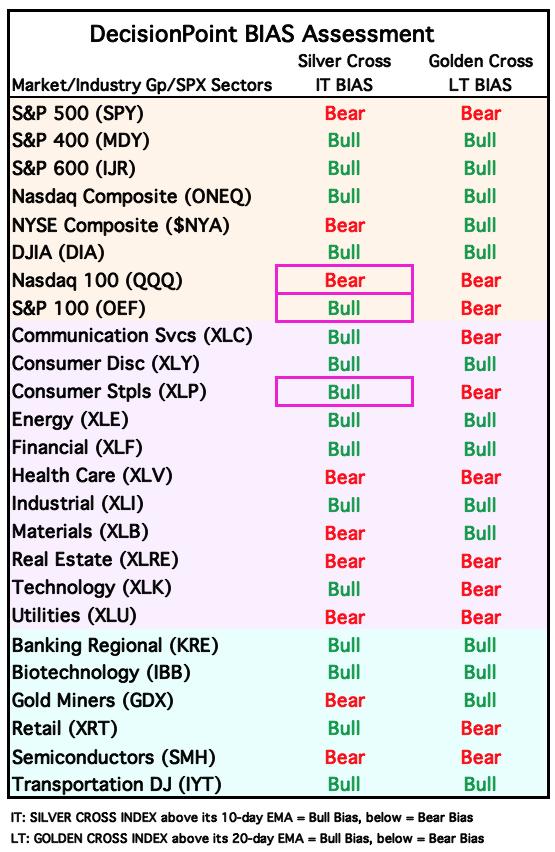

BIAS Assessment: The following table expresses the current BIAS of various price indexes based upon the relationship of the Silver Cross Index to its 10-day EMA (intermediate-term), and of the Golden Cross Index to its 20-day EMA (long-term). When the Index is above the EMA it is bullish, and it is bearish when the Index is below the EMA. The BIAS does not imply that any particular action should be taken. It is information to be used in the decision process.

The items with highlighted borders indicate that the BIAS changed today.

*****************************************************************************************************

CONCLUSION: The election rally hangover appears to be beginning as price is slowly losing ground and topping. It only took a small decline to turn many of our indicators south and that suggests internal weakness is a problem. That seems quite obvious when we look at the negative divergences on the participation of stocks above key moving averages. Today's downside initiation climax alongside topping STOs suggests we will see more downside ahead. Portfolios are likely to feel the pinch.

Erin is 75% long, 0% short. (This is intended as information, not a recommendation.)

*****************************************************************************************************

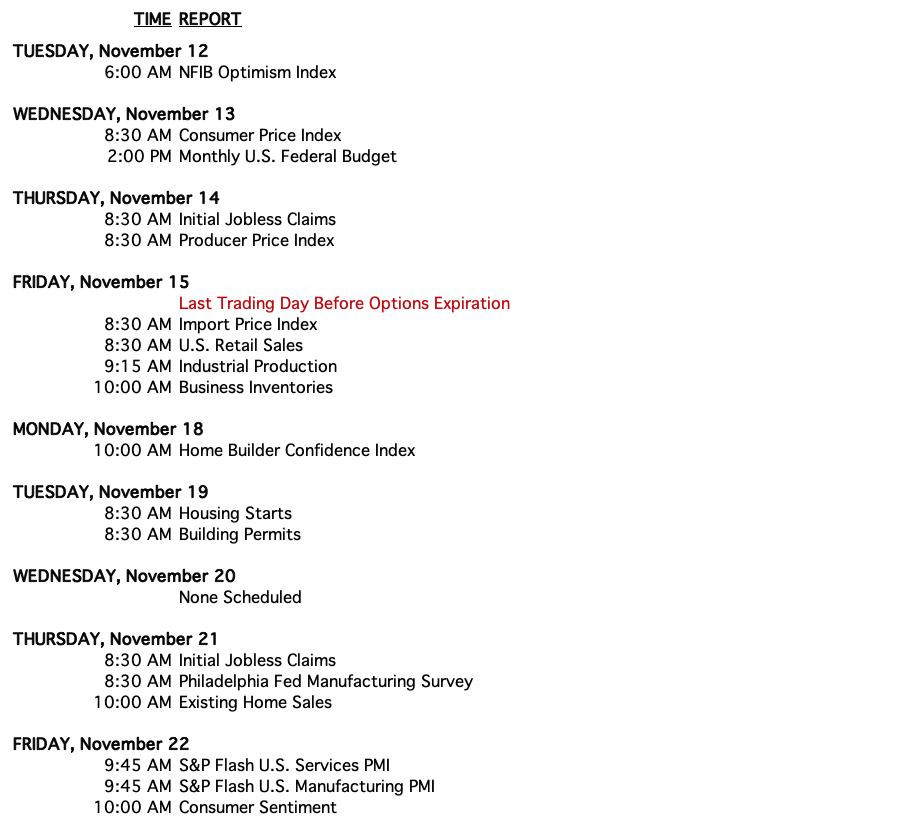

CALENDAR

Have you subscribed the DecisionPoint Diamonds yet? DP does the work for you by providing handpicked stocks/ETFs from exclusive DP scans! Add it with a discount! Contact support@decisionpoint.com for more information!

BITCOIN

Bitcoin also took a breather today. We still see much more upside ahead for Bitcoin despite seriously overbought conditions on the RSI. We could see some more consolidation to bring the RSI back down, but ultimately given the strongly rising PMO and Stochastics camped out above 80, the rally should continue.

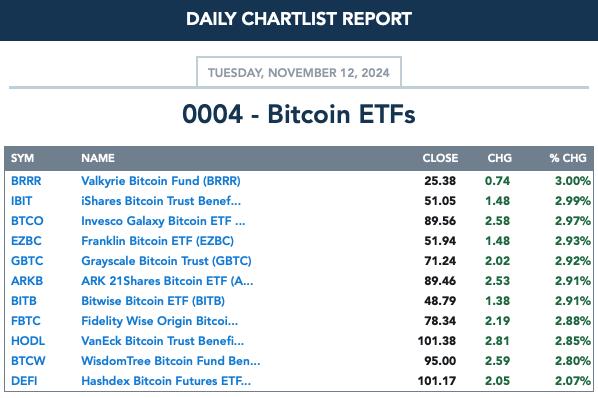

BITCOIN ETFs

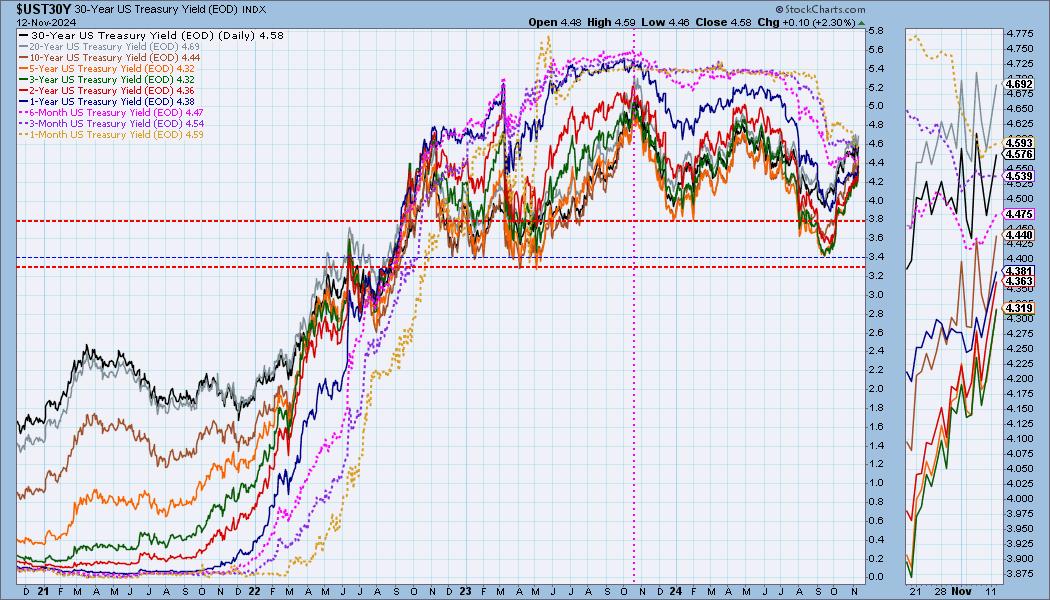

INTEREST RATES

We were looking for a pause in rising yields, but today they spiked higher suggesting the advance is not over. The inversions are slowly clearing as extremely short-term yields begin dropping beneath the longer-term yields.

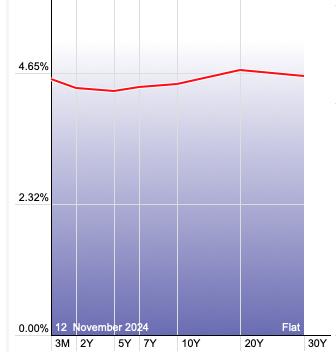

The Yield Curve Chart from StockCharts.com shows us the inversions taking place. The red line should move higher from left to right. Inversions are occurring where it moves downward.

10-YEAR T-BOND YIELD

We have redrawn the prior rising wedge formation into a rising trend channel using the yesterday's low. It really looked like we would see $TNX cool, but instead we now have a PMO Surge (bottom) above the signal line. Stochastics have also tipped upward. We also see a Golden Cross nearing for the 50/200-day EMAs. We will look for the yield to rise further, but a break in the rising trend will have us reevaluate.

BONDS (TLT)

IT Trend Model: NEUTRAL as of 11/10/2024

LT Trend Model: BUY as of 7/17/2024

TLT Daily Chart: As mentioned earlier, we were looking for yields to calm down, but today they rocketed higher. This put downside pressure on the Bond funds like TLT. Resistance was never overcome and now the PMO has topped and is crossing below its signal line. Stochastics also topped. At best we could see some more sideways movement, but the declining trend is likely to remain intact.

DOLLAR (UUP)

IT Trend Model: BUY as of 10/9/2024

LT Trend Model: BUY as of 5/25/2023

UUP Daily Chart: The Dollar continues to soar higher. The RSI is now overbought so it may be time for some consolidation of the current move. We are looking for the rising trend to remain as Stochastics are back above 80 and the PMO is rising well above the zero line on a Crossover BUY Signal.

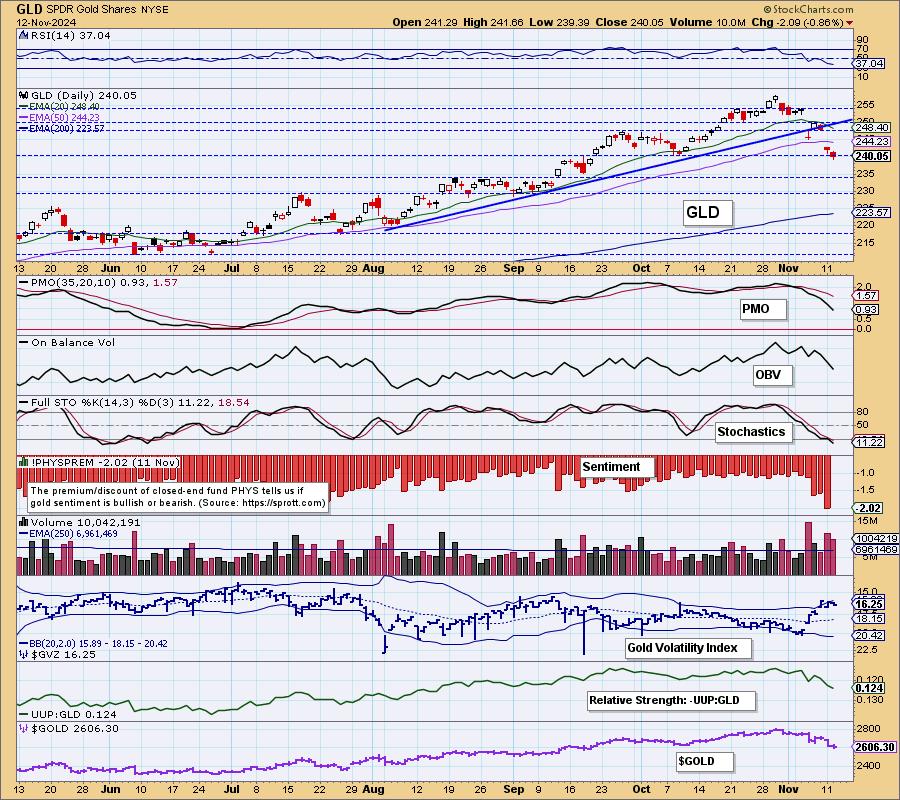

GOLD

IT Trend Model: BUY as of 10/23/2023

LT Trend Model: BUY as of 10/20/2023

GLD Daily Chart: The rising Dollar has put serious downside pressure on Gold and given its bullish outlook, we suspect that Gold is on its way to a more serious correction. The rising trend was broken and while price is currently sitting on some support, the negative PMO tells us that level of support isn't likely to hold. Stochastics are below 20 suggesting internal weakness. $GVZ is at the upper Bollinger Band on our inverted scale and that can also portend lower prices ahead.

GLD Weekly Chart: Yesterday's comments still apply:

"For weeks we have been concerned about the parabolic nature of GLD's advance from the 2022 low. The parabolic arc was broken last week, and the decline accelerated today. We think the weekly chart gives the best context for estimating the likely downside target for the current decline. The first obvious support is at 225 (-13%) and the next is at 210 (-18%). Beyond that is 195 (-25%), which is painful to contemplate."

GOLD MINERS (GDX) Daily Chart: GDX lost support at the 200-day EMA and is currently testing horizontal support. It isn't likely to hold. Gold Miners are likely in for much more decline given the very bearish outlook for Gold right now. We are looking for a test of 32.00.

CRUDE OIL (USO)

IT Trend Model: SELL as of 10/17/2024

LT Trend Model: SELL as of 9/10/2024

USO Daily Chart: Crude formed a bearish engulfing candlestick today suggesting we will see a decline tomorrow. Price is essentially moving in a sideways trading range and at this point it seems likely that the bottom of the range will be tested. There is a new PMO Crossover SELL signal and the PMO dropped beneath the zero line. Stochastics are diving lower.

There is some horizontal support on the one year chart at this level, but indicators seem far too bearish to expect it to hold.

Good Luck & Good Trading!

Erin Swenlin and Carl Swenlin

Technical Analysis is a windsock, not a crystal ball. --Carl Swenlin

(c) Copyright 2024 DecisionPoint.com

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.

DecisionPoint is not a registered investment advisor. Investment and trading decisions are solely your responsibility. DecisionPoint newsletters, blogs or website materials should NOT be interpreted as a recommendation or solicitation to buy or sell any security or to take any specific action.

NOTE: The signal status reported herein is based upon mechanical trading model signals, specifically, the DecisionPoint Trend Model. They define the implied bias of the price index based upon moving average relationships, but they do not necessarily call for a specific action. They are information flags that should prompt chart review. Further, they do not call for continuous buying or selling during the life of the signal. For example, a BUY signal will probably (but not necessarily) return the best results if action is taken soon after the signal is generated. Additional opportunities for buying may be found as price zigzags higher, but the trader must look for optimum entry points. Conversely, exit points to preserve gains (or minimize losses) may be evident before the model mechanically closes the signal.

Helpful DecisionPoint Links:

DecisionPoint Alert Chart List

DecisionPoint Golden Cross/Silver Cross Index Chart List

DecisionPoint Sector Chart List

Price Momentum Oscillator (PMO)