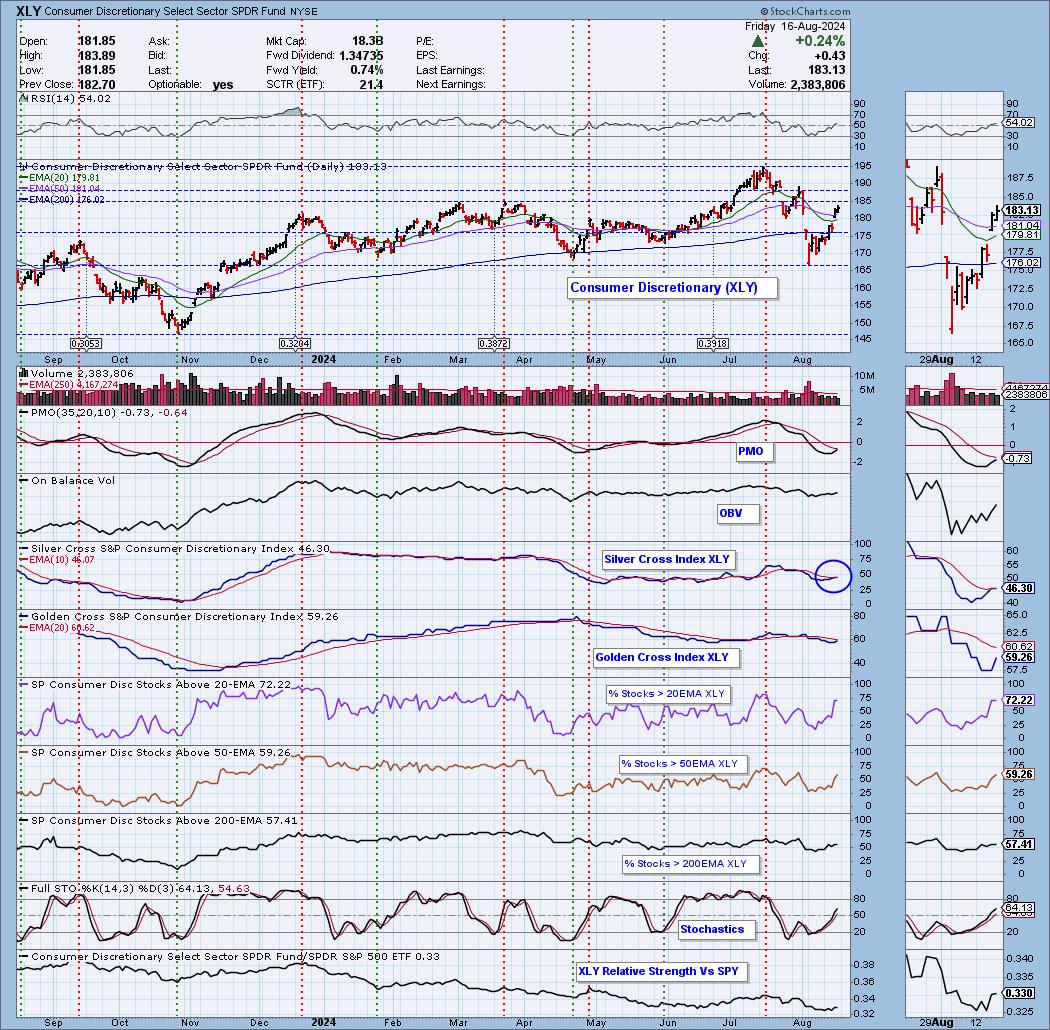

We wrote a free article on Consumer Discretionary (XLY), but here is a synopsis. XLY is a strong growth sector and with the latest retail data coming in positively, this is likely going to be a sector to watch moving forward. Looking under the hood we can see why. First and foremost, the Silver Cross Index moved above its signal line for a Bullish Shift that moves the IT Bias to BULLISH for the sector.

Participation is also coming in strong as the sector is renewing its strength and building upon it. The PMO is nearing a Crossover BUY Signal and Stochastics are rising. It is beginning to outperform the market as well.

Technology (XLK) would be the other sector to watch. With the market reversing strongly, XLK has been leading the charge, and it is likely to continue to. Overhead resistance has been hit, but under the hood it is showing excellent strength. The Silver Cross Index is about to have a Bullish Shift across the signal line. Participation of stocks above their 20-day EMAs has jumped above 92% with more and more finding their way above their 50-day EMAs as well. Stochastics are strongly rising and relative strength shows us that this is truly a leadership sector right now.

The DecisionPoint Alert Weekly Wrap presents an end-of-week assessment of the trend and condition of the Stock Market, the U.S. Dollar, Gold, Crude Oil, and Bonds. The DecisionPoint Alert daily report (Monday through Thursday) is abbreviated and gives updates on the Weekly Wrap assessments.

Watch the latest episode of DecisionPoint on our YouTube channel here!

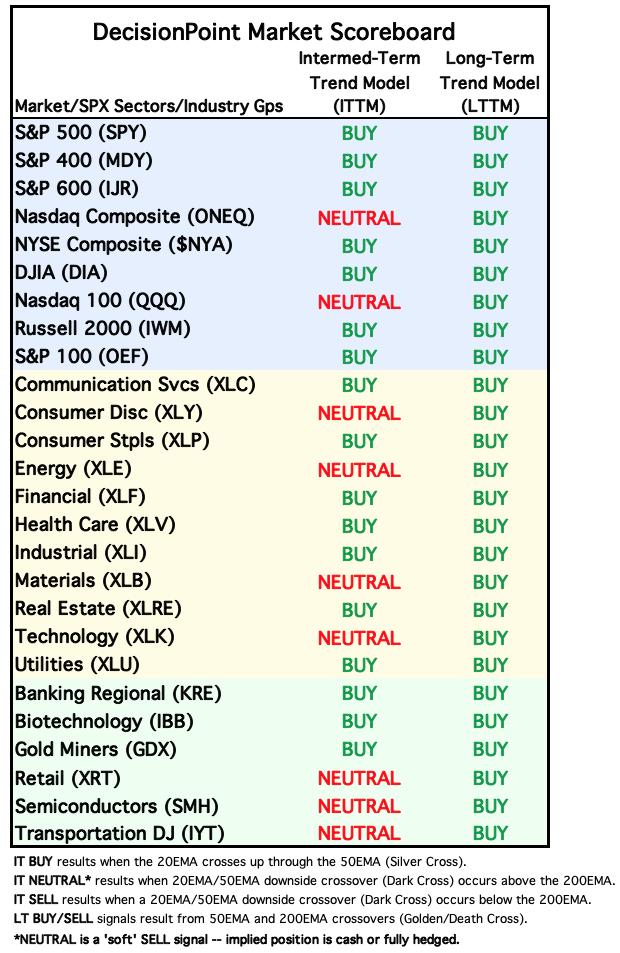

MARKET/SPX SECTOR/INDUSTRY GROUP INDEXES

Change Today:

Change for the Week:

CLICK HERE for Carl's annotated Market Index, Sector, and Industry Group charts.

THE MARKET (S&P 500)

IT Trend Model: BUY as of 8/14/2024

LT Trend Model: BUY as of 3/29/2023

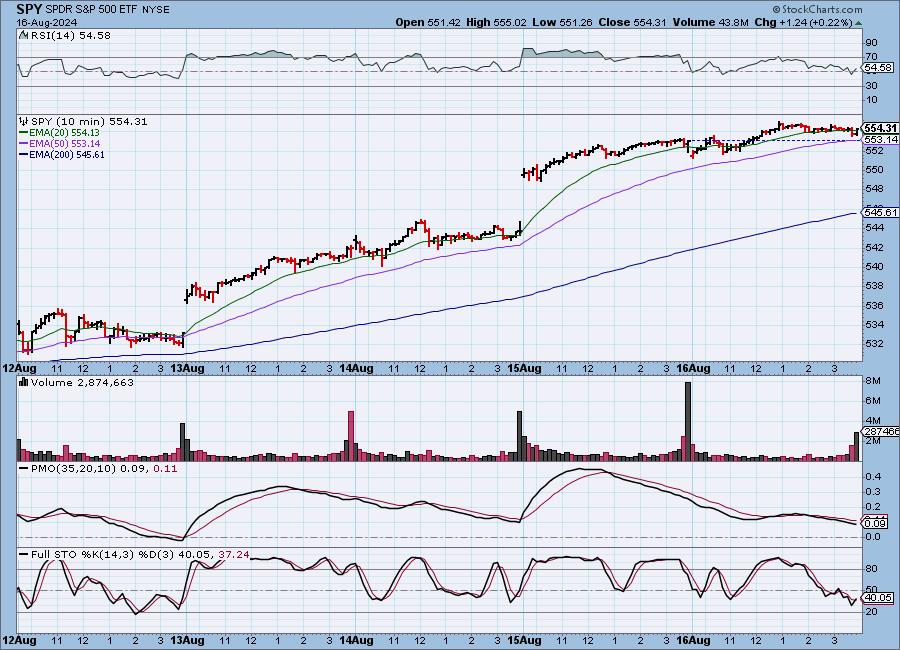

SPY 10-Minute Chart: On the last trading day before options expiration prices were quiet. This was probably because of yesterday's upside exhaustion climax, after which we expect some consolidation.

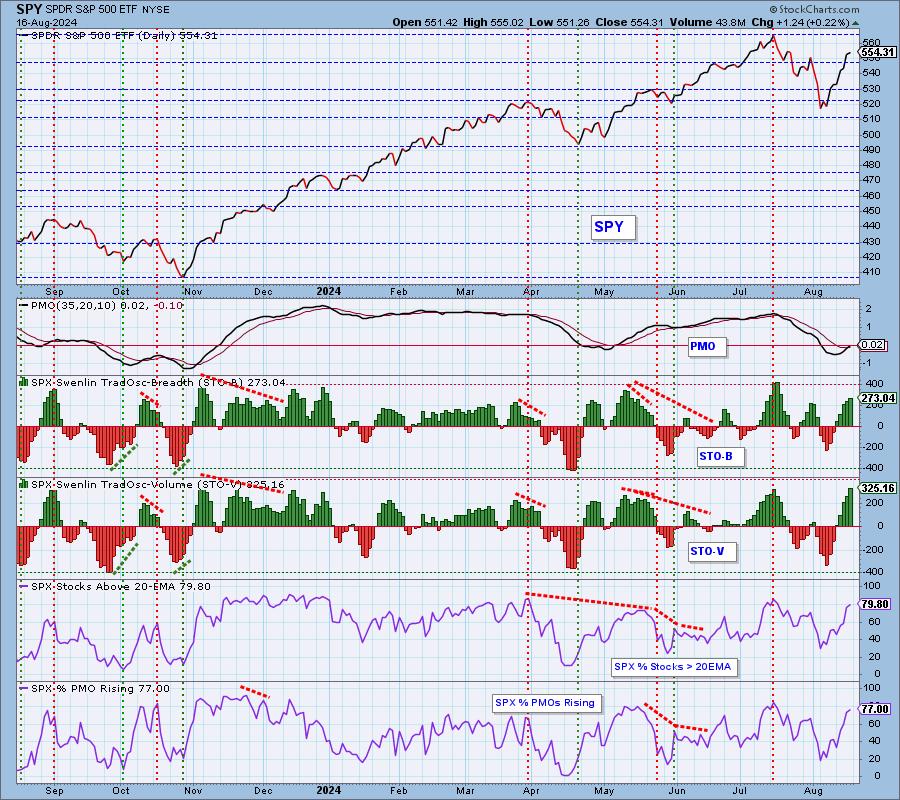

SPY Daily Chart: Price broke out above the declining tops trendline yesterday essentially taking it out of the bearish rising wedge that formed a pennant on a flagpole. This portended lower prices, but the market had other ideas and the rally stuck. We do have some overhead resistance, but ultimately indicators are very positive and suggest higher prices ahead, possibly after some consolidation.

Investors have dropped the fear based on the VIX rising on our inverted scale. It is comfortably above its moving average and is not at all overbought. Stochastics have reached above 80 suggesting internal strength. Volume was a little low on options expiration.

Below is the latest free DecisionPoint Trading Room recording from 8/12. You'll find these recordings posted on Mondays to our DP YouTube Channel HERE. Be sure and subscribe HERE.

SPY Weekly Chart: We saw a bounce off the 43-week EMA that continued this week. Price is now back above the rising bottoms trendline. The weekly PMO flattened in response. It appears ready to reverse higher from here. The very steep rising trend is softened by the prior low.

New 52-Week Highs/Lows: New Highs pared back on today's rally, we would've preferred to see them stay at the same level at a minimum. The High-Low Differential is still declining, but has reached oversold territory.

Climax Analysis: There were no climax readings today, but this week saw two upside exhaustion climaxes. The first didn't lead to a decline and neither did yesterday's which is bullish. We still see some likely consolidation or churn ahead.

*A climax is a one-day event when market action generates very high readings in, primarily, breadth and volume indicators. We also include the VIX, watching for it to penetrate outside the Bollinger Band envelope. The vertical dotted lines mark climax days -- red for downside climaxes, and green for upside. Climaxes are at their core exhaustion events; however, at price pivots they may be initiating a change of trend.

Short-Term Market Indicators: The short-term market trend is UP and the condition is OVERBOUGHT.

We listed the Swenlin Trading Oscillators (STOs) as overbought this week, but admittedly they can accommodate more upside based on prior readings, but it does have us on alert. Participation really expanded this week and is now at a very healthy 80% above their 20-day EMAs. Rising PMOs are also expanding as the broad market gets on board this rally.

Intermediate-Term Market Indicators: The intermediate-term market trend is UP and the condition is NEUTRAL.

The ITBM and ITVM reversed higher this week confirming already rising short-term indicators. The ITVM hit positive territory today. We now have over half the index holding PMO Crossover BUY Signals.

_______

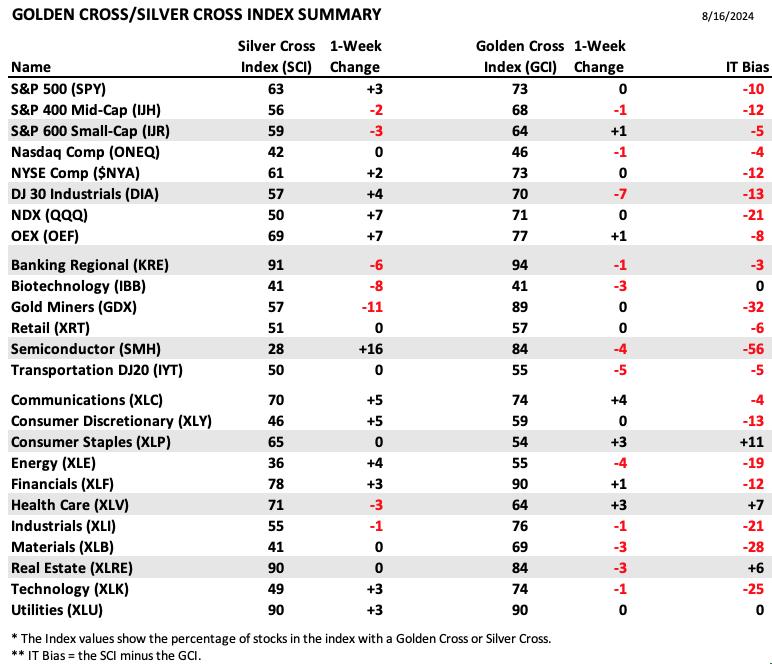

PARTICIPATION TABLES: The following tables summarize participation for the major market indexes and sectors. The 1-Week Change columns inject a dynamic aspect to the presentation. There are three groups: Major Market Indexes, Miscellaneous Industry Groups, and the 11 S&P 500 Sectors.

Consumer Staples (XLP) hold the highest IT Bias as the Silver Cross Index is reading higher than the Golden Cross Index. That suggests strength in the intermediate term.

Semiconductors (SMH) hold the lowest IT Bias after being beat down on the recent decline. The group is on the rise right now as the Silver Cross Index gained a strong 16 points. It holds such a negative bias because the Golden Cross Index is still very high in comparison to the Silver Cross Index.

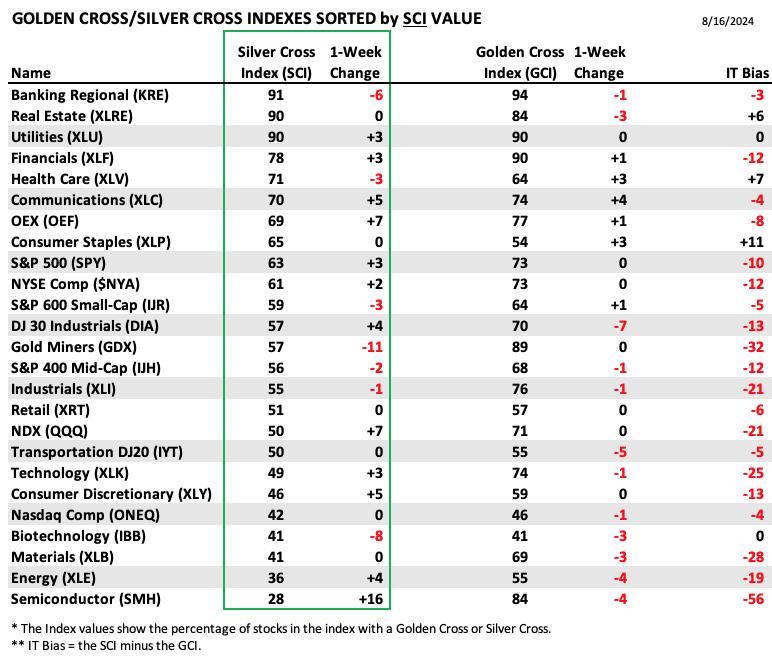

This table is sorted by SCI values. This gives a clear picture of strongest to weakest index/sector in terms of intermediate-term participation.

Regional Banks (KRE) hold the highest SCI value but we note that it lost ground this week on both the SCI and GCI.

Semiconductors (SMH) hold the lowest SCI value however that is changing quickly. We like SMH moving forward despite the low SCI reading. Next week it is likely to be much higher.

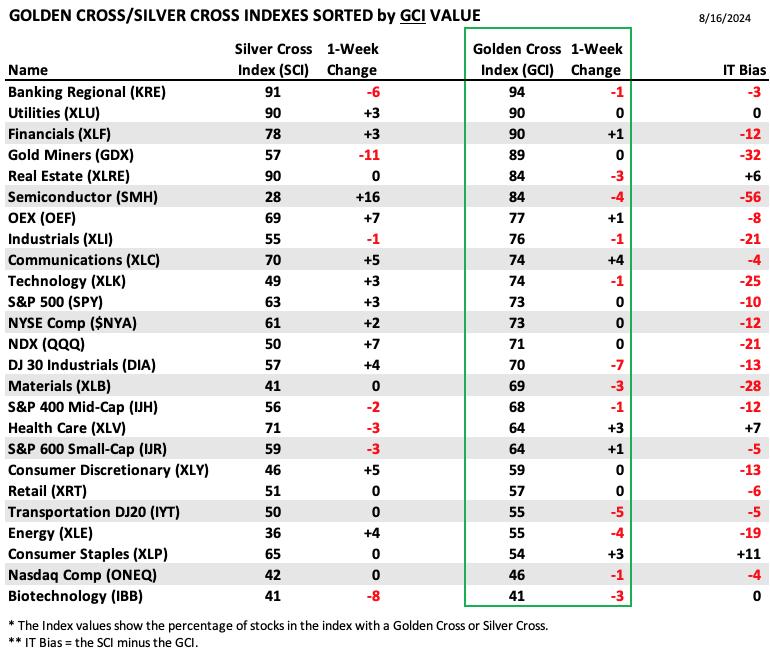

This table is sorted by GCI values. This gives a clear picture of strongest to weakest index/sector in terms of long-term participation.

Interestingly the biggest GCI gainer was Communication Services (XLC). It also saw a nice gain on the SCI. This is a growth sector that will be worth a watch next week.

Biotechnology (IBB) holds the lowest GCI percentage and it lost some ground this week. The SCI also lost ground so we would be careful of this industry group next week.

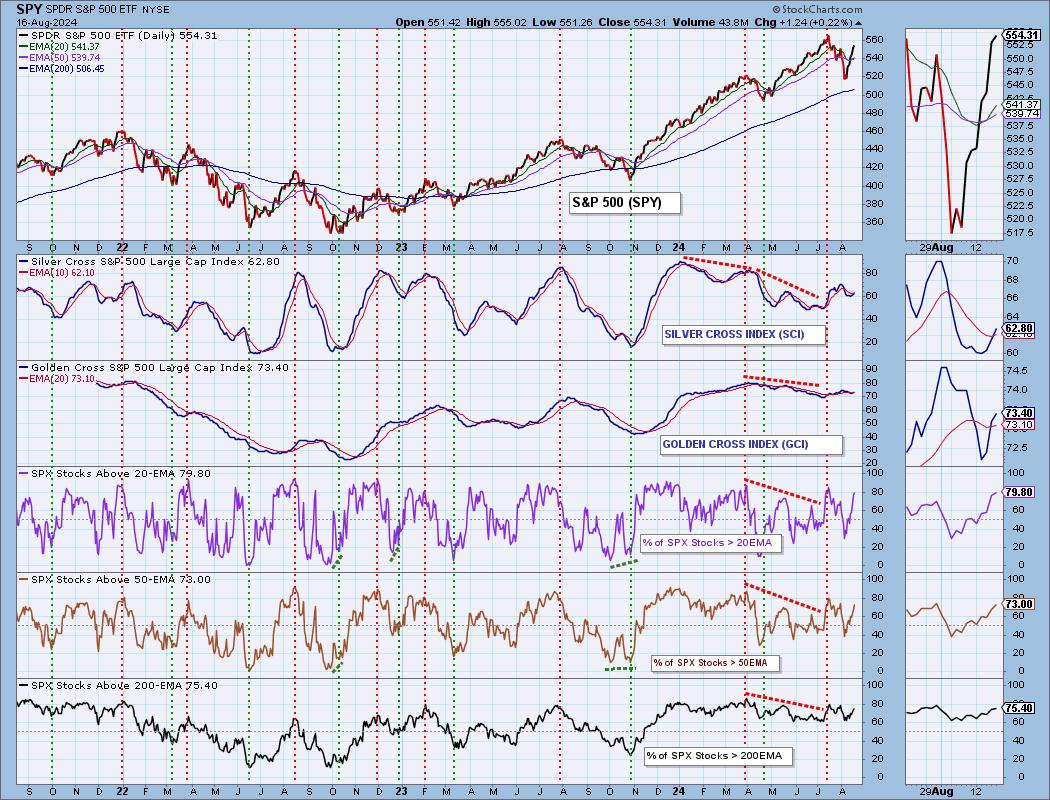

PARTICIPATION CHART (S&P 500): The following chart objectively shows the depth and trend of participation for the SPX in two time frames.

- Intermediate-Term - the Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA). The opposite of the Silver Cross is a "Dark Cross" -- those stocks are, at the very least, in a correction.

- Long-Term - the Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA). The opposite of a Golden Cross is the "Death Cross" -- those stocks are in a bear market.

The market bias is BULLISH in the intermediate and long terms.

The Silver Cross Index crossed above its signal line for a Bullish Shift that moved the IT Bias to BULLISH. The Golden Cross Index is also above its signal line and that gives us a BULLISH Bias in the long term. Participation in general has really beefed up and certainly suggests the broad market is participating in the current rally.

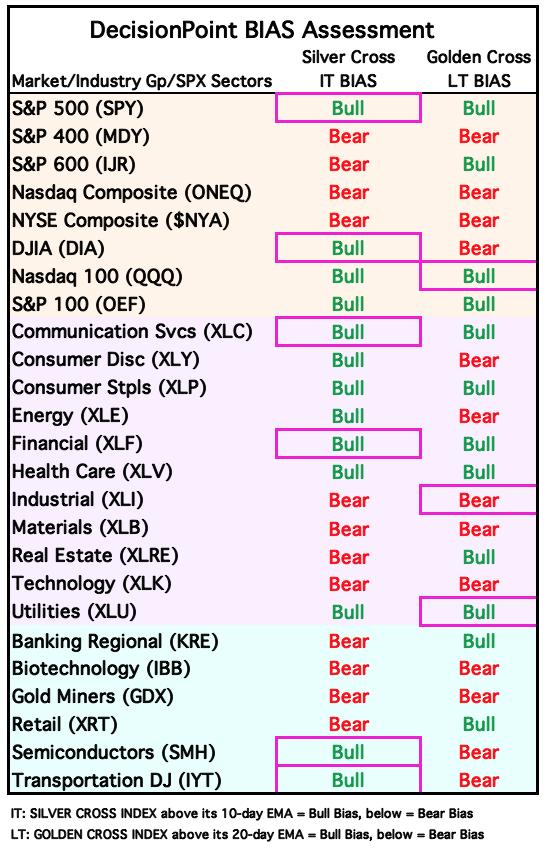

BIAS Assessment: The following table expresses the current BIAS of various price indexes based upon the relationship of the Silver Cross Index to its 10-day EMA (intermediate-term), and of the Golden Cross Index to its 20-day EMA (long-term). When the Index is above the EMA it is bullish, and it is bearish when the Index is below the EMA. The BIAS does not imply that any particular action should be taken. It is information to be used in the decision process.

The items with highlighted borders indicate that the BIAS changed today.

****************************************************************************************************

CONCLUSION: We had to reverse our bearish stance this week as new Buy Signals arrived or were arriving on our DP Signal Table. In response, the Silver Cross Index has given us a Bullish Shift. Participation has expanded greatly and it tells us this is rally lifting all boats not just mega-caps. The market is due for a digestion phase so next week may bring some turbulence to this new bull market move. STOs are confirmed by rising ITBM and ITVM so the market is set up for a rally continuation after whatever shake out we might encounter in the coming week. At this point expanding exposure is fine but we would suggest using stops and let the market take you out. Tight stops don't seem warranted at this time.

Erin is 40% long, 0% short.

****************************************************************************************************

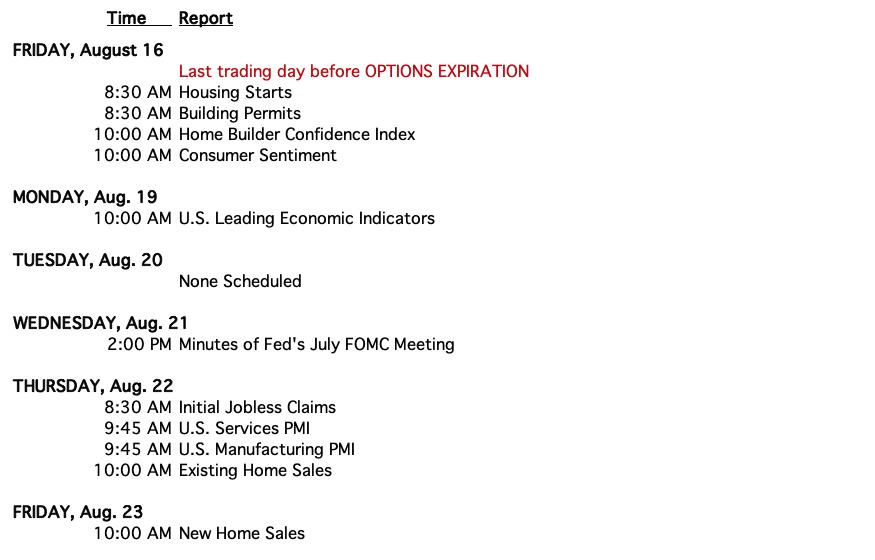

CALENDAR

Have you subscribed the DecisionPoint Diamonds yet? DP does the work for you by providing handpicked stocks/ETFs from exclusive DP scans! Add it with a discount! Contact support@decisionpoint.com for more information!

BITCOIN

Bitcoin Daily Chart: Bitcoin has formed a bull flag and with Stochastics rising, we see a possible breakout ahead. The PMO has not reversed higher yet, but price has settled onto support at the May low. The flag could continue to be built with more decline, but this is a good place to look for an upside reversal. If this support level is lost over weekend, we would likely see a test of support at the July/August lows.

Bitcoin Weekly Chart: There is a giant bull flag on the weekly chart that suggests Bitcoin will eventually break out of the large consolidation of the parabolic rally. The weekly PMO isn't on board with this outlook yet so caution is still warranted.

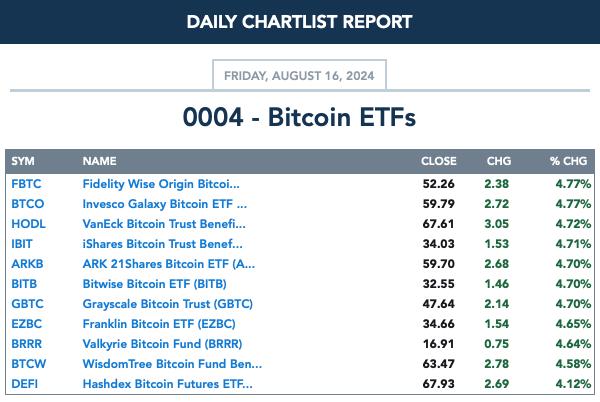

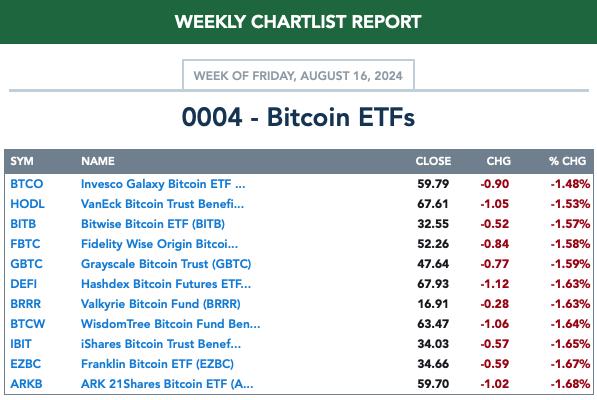

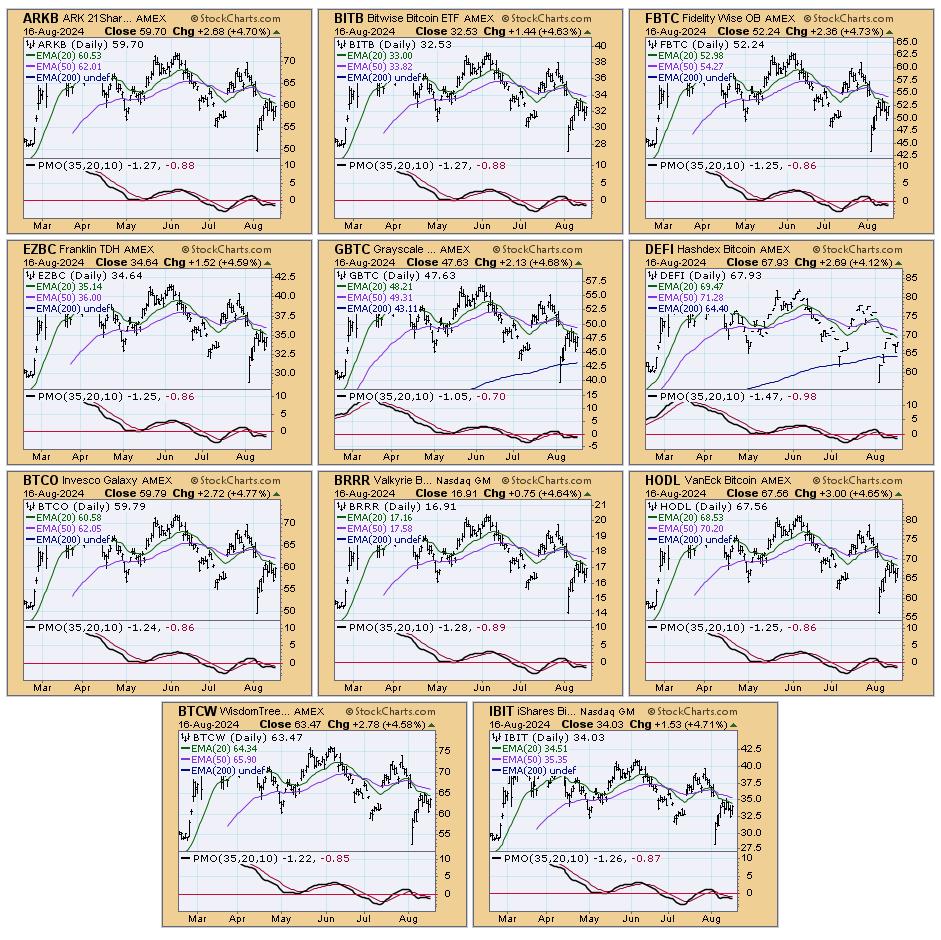

BITCOIN ETFs

Today:

This Week:

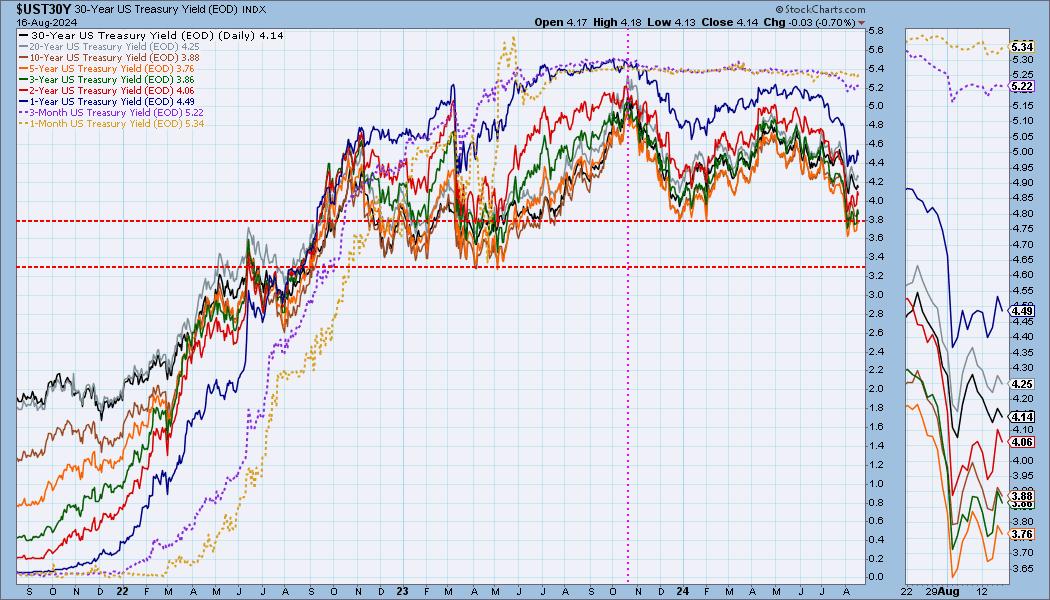

INTEREST RATES

Yields ticked lower but this week set up new short-term rising bottoms trendlines. We expect yields will see more upside off this level of support, but Fed rate cuts in September would likely have them reversing again.

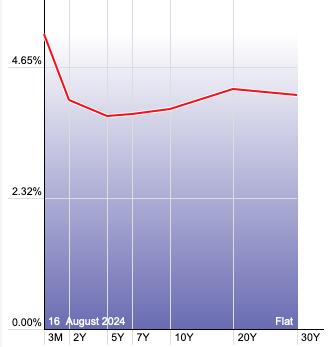

The Yield Curve Chart from StockCharts.com shows us the inversions taking place. The red line should move higher from left to right. Inversions are occurring where it moves downward.

10-YEAR T-BOND YIELD

We actually see a possible bullish double bottom in the very short term. While the first bottom is extended, it closed at the top of that bar so a double bottom is plausible. The PMO has turned back up and Stochastics are rising.

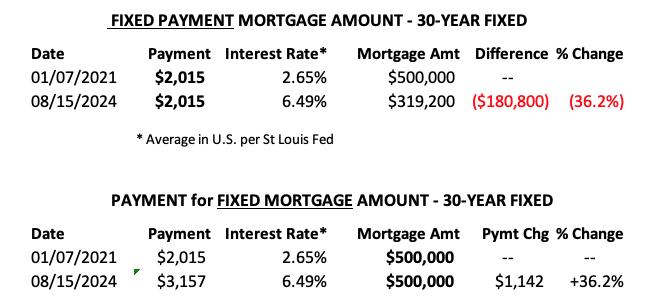

MORTGAGE INTEREST RATES (30-Yr)**

**We watch the 30-Year Fixed Mortgage Interest Rate, because, for the most part, people buy homes based upon the maximum monthly payment they can afford. As rates rise, a fixed monthly payment will carry a smaller mortgage amount, which shuts many buyers out of the market, and potential sellers will experience pressure to lower prices (to no effect so far).

--

This week the 30-Year Fixed Rate changed from 6.47 to 6.49.

Here is a 50-year chart for better perspective.

BONDS (TLT)

IT Trend Model: BUY as of 6/5/2024

LT Trend Model: BUY as of 7/17/2024

TLT Daily Chart: We have a symmetrical triangle on TLT. These are continuation patterns so an upside breakout is what the pattern calls for. We are somewhat bullish on interest rates so we aren't so sure that an upside breakout will occur here. Stochastics have topped, but the PMO is still rising so we will look for more sideways chop and churn.

It isn't surprising that the rally hit a wall given overhead resistance was strong at the December high.

TLT Weekly Chart: We see a reverse head and shoulders on the weekly chart which is long-term bullish so ultimately we should look for Bonds to continue higher in the intermediate term. Rate cuts in September could boost TLT a great deal.

DOLLAR (UUP)

IT Trend Model: NEUTRAL as of 8/5/2024

LT Trend Model: BUY as of 5/25/2023

UUP Daily Chart: We noted a bullish double bottom developing on the Dollar. While the pattern hasn't been busted with a drop below the prior lows, neither was it confirmed with a break above the confirmation line. The majority of candlesticks are bearish so we still detect weakness here. The PMO is in decline and the RSI is negative. Stochastics are flat in negative territory. Not much bullish activity under the surface.

UUP Weekly Chart: This is a decision point for the Dollar. It is traveling in a bearish rising wedge and is now testing the bottom of it. It seems highly likely that it will execute the pattern with a decline. The weekly PMO is in decline so the weekly chart is officially bearish.

GOLD

IT Trend Model: BUY as of 10/23/2023

LT Trend Model: BUY as of 10/20/2023

GLD Daily Chart: Gold made a new all-time high rallying strongly above the prior three tops. The bullish ascending triangle won out with its rising bottoms and flat top. The possible triple top formation has officially been busted. The PMO is rising again on a Crossover BUY Signal and Stochastics turned up while above 80.

Discounts are paring back somewhat suggesting investors are warming to Gold. Relative strength against the Dollar is rising. The correlation is weak between the Dollar and Gold right now so even if the Dollar rebounds, there is still a chance that Gold would rise too.

GLD Weekly Chart: The breakout looks great on the weekly chart as trading this week took place above new support. The weekly PMO is rising so we would expect upside follow through on this breakout move.

GOLD MINERS (GDX): Gold Miners are off to the races on the back of rising Gold prices and a market rally. The wind is clearly at their back. There is a new PMO Crossover BUY Signal and participation is very strong. The Silver Cross Index isn't rising yet, but with so many stocks above their 20/50-day EMAs, it should reverse higher soon. Stochastics have just moved above 80 and the RSI is positive. We expect price to overtake the July top.

CRUDE OIL (USO)

IT Trend Model: BUY as of 6/21/2024

LT Trend Model: BUY as of 2/27/2024

USO Daily Chart: Crude Oil is full of mixed messages. On the bullish side we have a rising PMO and a bull flag formation. Yet on the bearish side we have dropping Stochastics and a negative RSI. Today saw a bullish hollow red candlestick so we are partial to the bull flag and will look for an upside reversal. If the PMO turns down and we lose support at the 200-day EMA we will have to reevaluate.

USO/$WTIC Weekly Chart: We like the weekly chart as it shows a bullish ascending triangle formation. Additionally, the weekly PMO is rising toward a Crossover BUY Signal. The expectation here would be an upside breakout.

Good Luck & Good Trading!

Erin Swenlin and Carl Swenlin

Technical Analysis is a windsock, not a crystal ball. --Carl Swenlin

(c) Copyright 2024 DecisionPoint.com

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.

DecisionPoint is not a registered investment advisor. Investment and trading decisions are solely your responsibility. DecisionPoint newsletters, blogs or website materials should NOT be interpreted as a recommendation or solicitation to buy or sell any security or to take any specific action.

NOTE: The signal status reported herein is based upon mechanical trading model signals, specifically, the DecisionPoint Trend Model. They define the implied bias of the price index based upon moving average relationships, but they do not necessarily call for a specific action. They are information flags that should prompt chart review. Further, they do not call for continuous buying or selling during the life of the signal. For example, a BUY signal will probably (but not necessarily) return the best results if action is taken soon after the signal is generated. Additional opportunities for buying may be found as price zigzags higher, but the trader must look for optimum entry points. Conversely, exit points to preserve gains (or minimize losses) may be evident before the model mechanically closes the signal.

Helpful DecisionPoint Links:

DecisionPoint Alert Chart List

DecisionPoint Golden Cross/Silver Cross Index Chart List

DecisionPoint Sector Chart List

Price Momentum Oscillator (PMO)