The Fed left rates unchanged, as was expected, but the market was already rallying strongly since the release of a well-received CPI report earlier in the day. Then Chairman Powell made his comments later in the day, and "the crowd went wild."

The DecisionPoint Alert Weekly Wrap presents an end-of-week assessment of the trend and condition of the Stock Market, the U.S. Dollar, Gold, Crude Oil, and Bonds. The DecisionPoint Alert daily report (Monday through Thursday) is abbreviated and gives updates on the Weekly Wrap assessments.

Watch the latest episode of DecisionPoint on our YouTube channel here!

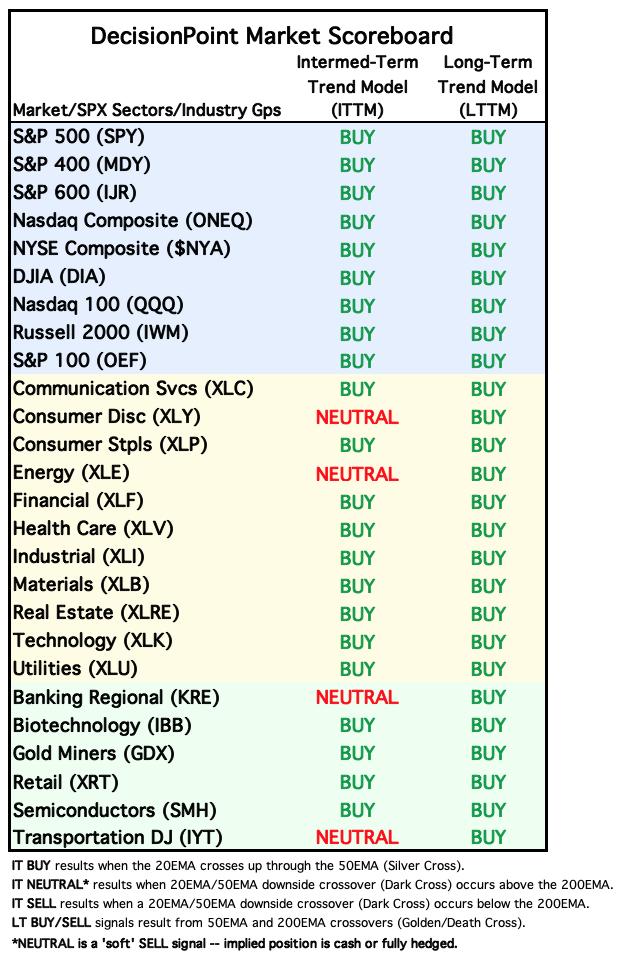

MARKET/INDUSTRY GROUP/SECTOR INDEXES

CLICK HERE for Carl's annotated Market Index, Sector, and Industry Group charts.

THE MARKET (S&P 500)

IT Trend Model: BUY as of 11/14/2023

LT Trend Model: BUY as of 3/29/2023

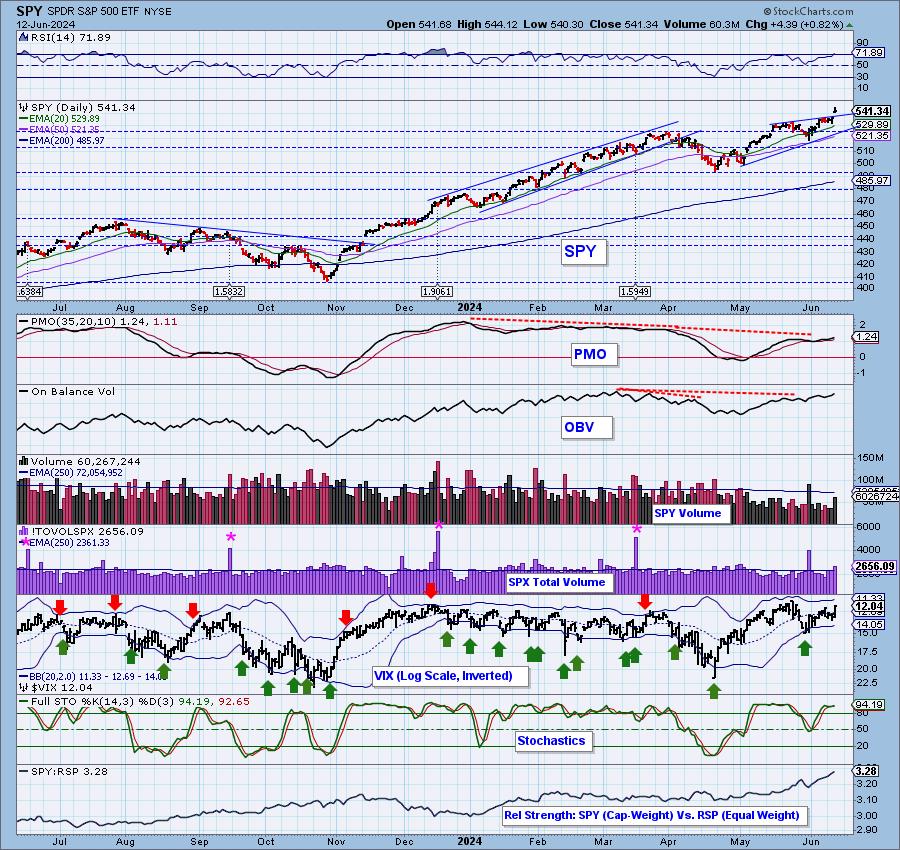

SPY Daily Chart: For such a strong breakout we thought volume was a little light. The rally is still a bit narrow, with only 90 net advances in the S&P 500. The candlestick is doji-like and implies indecision among investors.

Price broke out of the bearish rising wedge pattern. Bullish conclusions to bearish chart patterns are especially bullish. Stochastics are strong and the VIX saw a spike higher on our inverted scale so we do see internal price strength.

Here is the latest recording from 6/10:

S&P 500 New 52-Week Highs/Lows: The High-Low Differential its move higher. We saw a good amount of New Highs, but we still think there should be more given we hit another all-time high.

Climax* Analysis: There were no climax readings today, which we think is strange for a day that should have generated an upside initiation climax.

*A climax is a one-day event when market action generates very high readings in, primarily, breadth and volume indicators. We also include the VIX, watching for it to penetrate outside the Bollinger Band envelope. The vertical dotted lines mark climax days -- red for downside climaxes, and green for upside. Climaxes are at their core exhaustion events; however, at price pivots they may be initiating a change of trend.

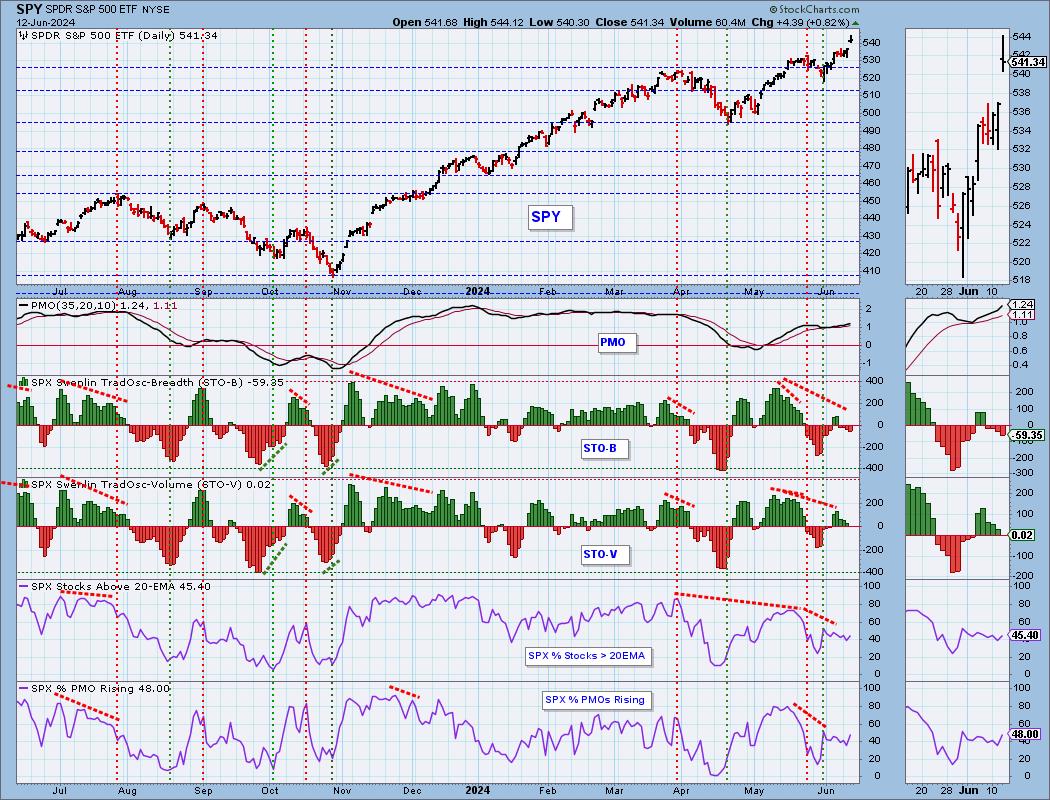

Short-Term Market Indicators: The short-term market trend is UP and the condition is NEUTRAL.

We were definitely surprised that the Swenlin Trading Oscillators (STOs) continued lower despite today's gap up move to all-time highs. This is concerning. We didn't see much movement in participation. %Stocks > 20EMA and %PMOs Rising are both below our 50% bullish threshold.

Intermediate-Term Market Indicators: The intermediate-term market trend is UP and the condition is NEUTRAL.

Both the ITBM and ITVM continue lower setting up a negative divergence with price. There was no movement in the number of PMO BUY Signals which isn't entirely surprising given we didn't see much expansion in the number of rising PMOs.

PARTICIPATION: The following chart objectively shows the depth and trend of participation in two time frames.

- Intermediate-Term - the Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA). The opposite of the Silver Cross is a "Dark Cross" -- those stocks are, at the very least, in a correction.

- Long-Term - the Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA). The opposite of a Golden Cross is the "Death Cross" -- those stocks are in a bear market.

Yesterday's comments still apply:

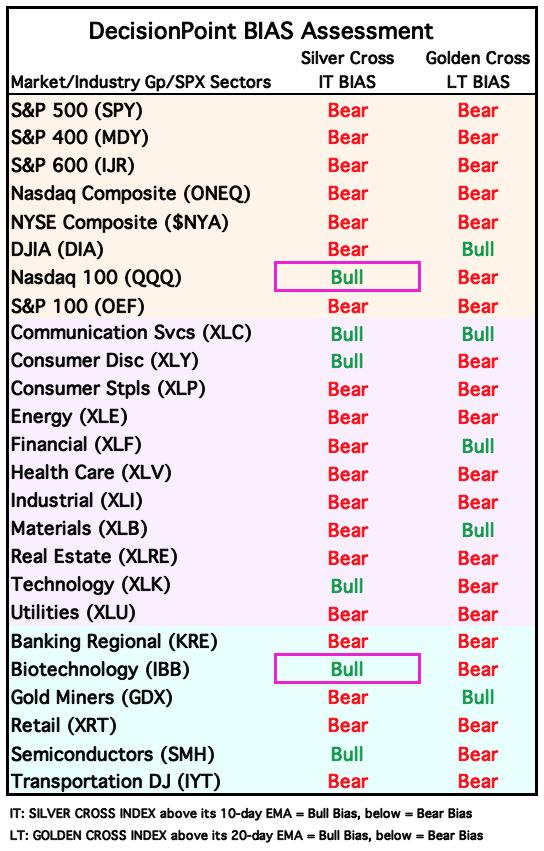

"The market bias is BEARISH in all three timeframes.

We now have only 50% of stocks holding a Silver Cross. That means that half of the index is likely experiencing a correction. We have less than 50% above the 20/50-day EMAs so we have a ST Bias that is BEARISH. The Silver Cross Index is in decline and will continue to decline if we don't see more stocks above their 50-day EMA. It is below its signal line so the IT Bias is BEARISH. The Golden Cross Index is also falling and given less stocks are above their 200-day EMAs, it should continue to fall toward that percentage of 63%. It is below its signal line so the LT Bias is also BEARISH. Participation should not be thinning as we keep reaching all-time highs."

BIAS Assessment: The following table expresses the current BIAS of various price indexes based upon the relationship of the Silver Cross Index to its 10-day EMA (intermediate-term), and of the Golden Cross Index to its 20-day EMA (long-term). When the Index is above the EMA it is bullish, and it is bearish when the Index is below the EMA. The BIAS does not imply that any particular action should be taken. It is information to be used in the decision process.

The items with highlighted borders indicate that the BIAS changed today.

**************************************************************************************

CONCLUSION: The market cheered and prices leapt higher, but this gap up move didn't result in much expansion of participation under the hood. Most concerning is that STOs are continuing to move lower in spite of new all-time highs being reached. In general participation is thin overall suggesting the broader markets aren't on board yet. With small-caps gaining today, that could change, but it isn't showing up on %Stocks > 20/50EMAs. Negative divergences continue to plague our charts and with both STOs and the ITBM/ITVM declining, that is a near-term negative divergence. We can't throw caution to the wind. We still have some inflationary reports to be released and if they go the wrong way, the market will likely do so too.

Erin is 45% long, 0% short.

Calendar:

Thursday - Initial Jobless Claims and PPI

Friday - Consumer Sentiment

**************************************************************************************

Have you subscribed the DecisionPoint Diamonds yet? DP does the work for you by providing handpicked stocks/ETFs from exclusive DP scans! Add it with a discount! Contact support@decisionpoint.com for more information!

BITCOIN

Bitcoin broke its rising trend yesterday and in spite of the rally, that trend was not recaptured. The PMO is declining and so are Stochastics. Price hasn't left its tight trading range near-term and it is still within a range in the intermediate term. The short-term trading range is vulnerable, but for now we don't see the larger range being lost.

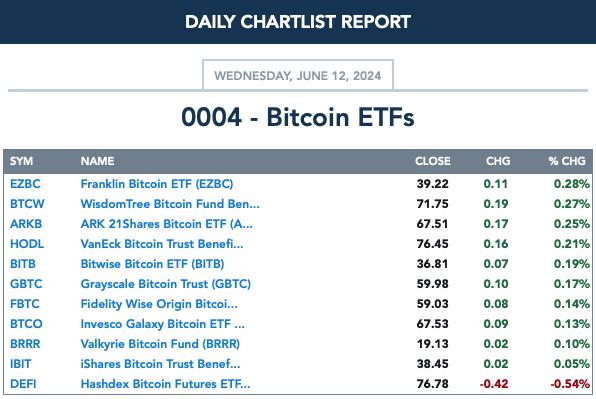

BITCOIN ETFs

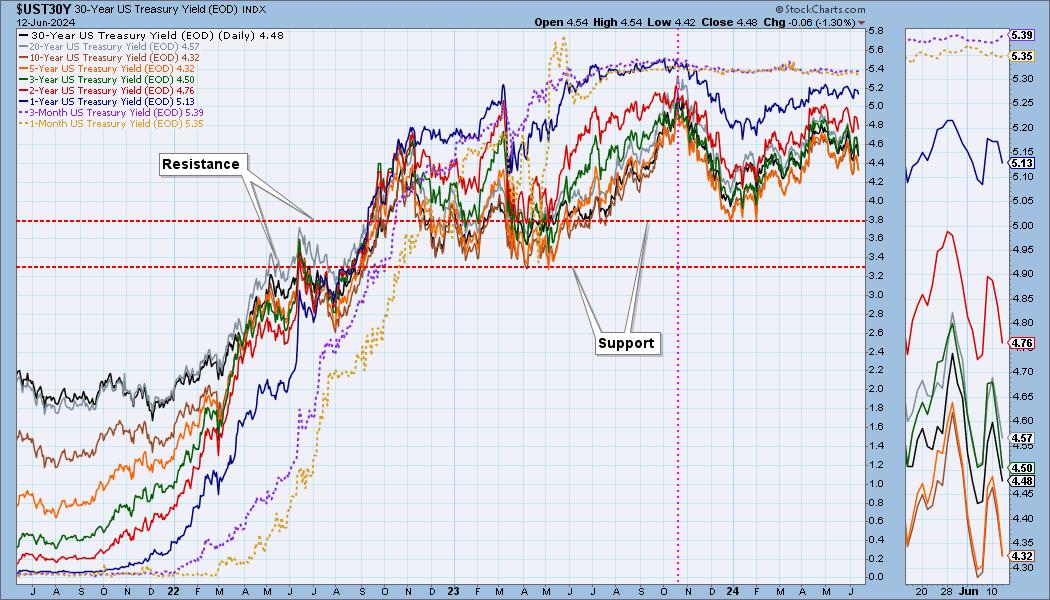

INTEREST RATES

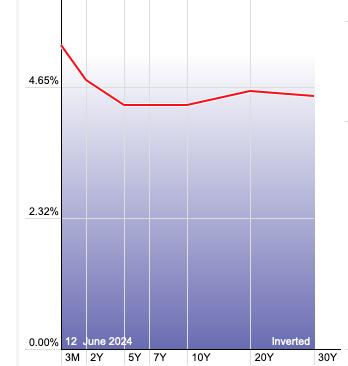

Yields dropped on today's CPI report and Fed announcement. The declining trends are intact suggesting they will continue lower, but much rests on whether the PPI and jobless claims as well as consumer sentiment go the right way for the Fed to lower rates.

The Yield Curve Chart from StockCharts.com shows us the inversions taking place. The red line should move higher from left to right. Inversions are occurring where it moves downward.

10-YEAR T-BOND YIELD

The 10-year yield fell perilously today on the positive news regarding inflation and that could continue to be a problem depending on how the rest of the reports go this week. Ultimately we have a bullish falling wedge that implies a breakout. If we get another breakdown, the pattern will essentially be busted. We have a PMO top beneath the zero line which does suggest a breakdown ahead.

BONDS (TLT)

IT Trend Model: SELL as of 3/20/2024

LT Trend Model: SELL as of 1/19/2022

TLT Daily Chart: Bonds rallied on the decline in yields and TLT was no exception. It did form a bearish filled black candlestick so we could see a decline tomorrow. As with yields much will be revealed with more inflation reporting. For now the indicators are leaning bullish so we will too.

DOLLAR (UUP)

IT Trend Model: BUY as of 1/23/2024

LT Trend Model: BUY as of 5/25/2023

UUP Daily Chart: The Dollar tumbled today bringing price back inside the declining trend channel. The PMO is clinging to a Crossover BUY Signal. Stochastics could warn of more decline ahead though. We are expecting near-term support to hold given the PMO BUY Signal.

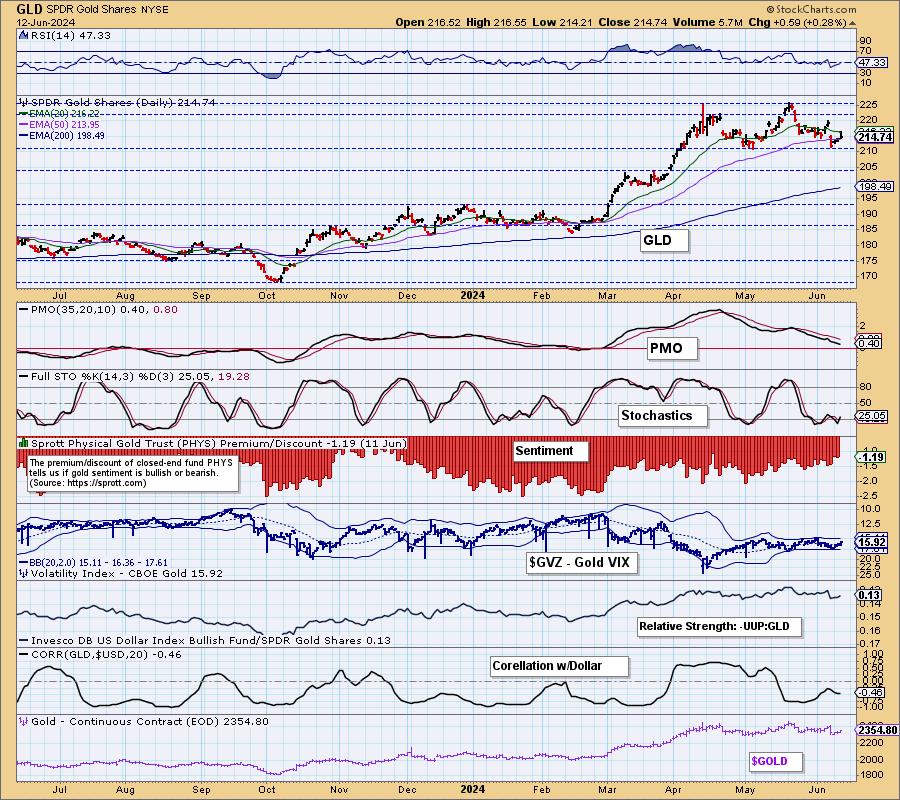

GOLD

IT Trend Model: BUY as of 10/23/2023

LT Trend Model: BUY as of 10/20/2023

GLD Daily Chart: Gold took advantage of the falling Dollar, but the reverse correlation didn't completely hold as Gold was not up the percentage the Dollar was down. This tells us there is still some weakness here. The RSI is negative and the PMO is in decline. Today's filled black candlestick implies a down day tomorrow.

Yesterday's comments still apply:

"Interestingly we are seeing discounts on PHYS fading which means investors aren't quite so bearish on Gold. They are not exceedingly low so it isn't likely time to look for an upside reversal on sentiment. We'll be watching for discounts to get down to where they were back in November. Then we can look for a lasting rally."

GOLD MINERS (GDX): GDX managed a rally today, but it closed well short of the day's highs. We saw almost no movement in participation. With %Stocks > 20/50EMAs reading so low, the Silver Cross Index will begin declining more aggressively. The declining trend is intact so we are looking for Miners to continue to angle lower.

CRUDE OIL (USO)

IT Trend Model: NEUTRAL as of 5/20/2024

LT Trend Model: BUY as of 2/27/2024

USO Daily Chart: We got a breakout from the declining trend, but it happened on a bearish filled black candlestick that implies we'll see a decline tomorrow. This rally does look good and it should open up some positions in Energy. The RSI is positive again and the PMO is on a Crossover BUY Signal. Stochastics are also rising so while it may stumble tomorrow, we expect the rising trend to continue.

Good Luck & Good Trading!

Erin Swenlin and Carl Swenlin

Technical Analysis is a windsock, not a crystal ball. --Carl Swenlin

(c) Copyright 2024 DecisionPoint.com

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.

DecisionPoint is not a registered investment advisor. Investment and trading decisions are solely your responsibility. DecisionPoint newsletters, blogs or website materials should NOT be interpreted as a recommendation or solicitation to buy or sell any security or to take any specific action.

NOTE: The signal status reported herein is based upon mechanical trading model signals, specifically, the DecisionPoint Trend Model. They define the implied bias of the price index based upon moving average relationships, but they do not necessarily call for a specific action. They are information flags that should prompt chart review. Further, they do not call for continuous buying or selling during the life of the signal. For example, a BUY signal will probably (but not necessarily) return the best results if action is taken soon after the signal is generated. Additional opportunities for buying may be found as price zigzags higher, but the trader must look for optimum entry points. Conversely, exit points to preserve gains (or minimize losses) may be evident before the model mechanically closes the signal.

Helpful DecisionPoint Links:

DecisionPoint Alert Chart List

DecisionPoint Golden Cross/Silver Cross Index Chart List

DecisionPoint Sector Chart List

Price Momentum Oscillator (PMO)