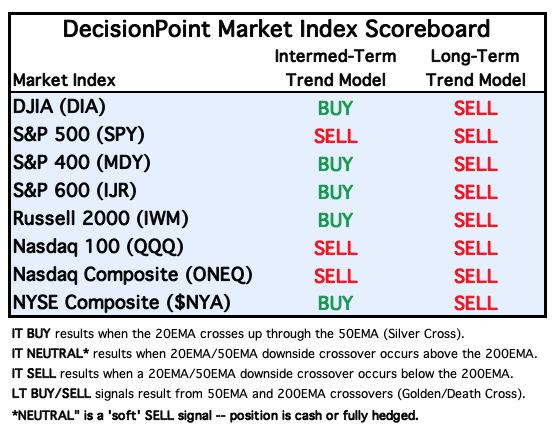

As of today, five of the eight major indexes we track have IT Trend Model BUY signals. This is determined by the 20EMA being above the 50EMA (Silver Cross). This is a good start toward broad market recovery, but unfortunately, all eight indexes have LT Trend Model SELL signals, which means that the 50EMAs are below the 200EMAs (Death Cross), and that condition will take a lot more positive action to correct. The three IT recalcitrant indexes (still on IT Trend Model SELL signals) are the S&P 500 (SPY), Nasdaq 100 (QQQ), and the Nasdaq Composite (ONEQ), indexes which normally lead the market.

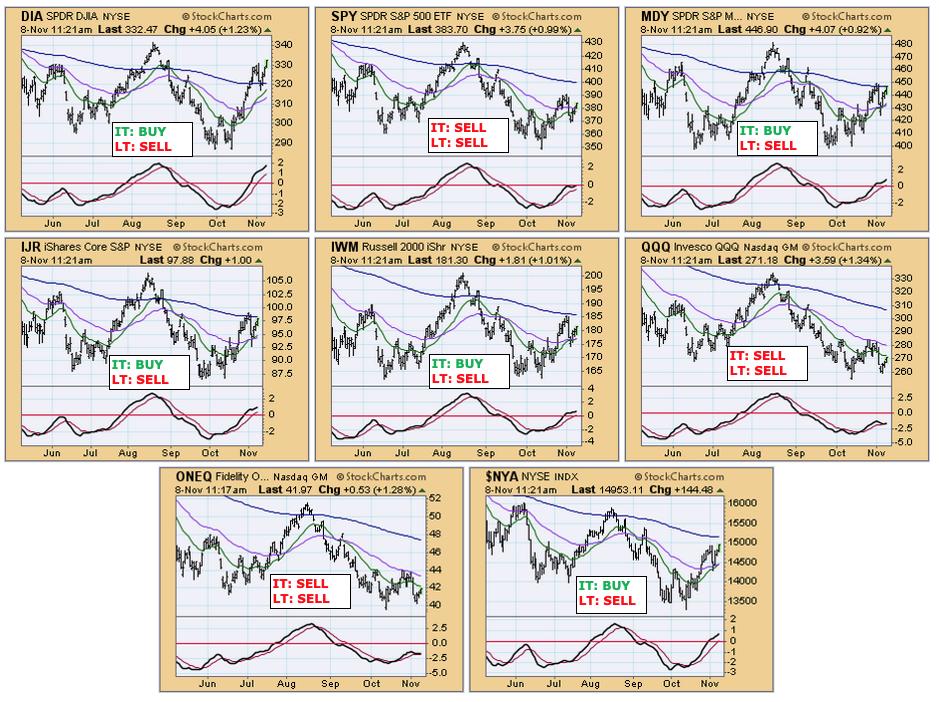

Looking at the charts (snapshot taken today at about 11:20 ET) we see that the chart patterns are very similar, but that the Nasdaq 100 and Nasdaq Composite are not even above their 20EMA. They will have to get above their 20EMA and 50EMA before an IT BUY signal has any chance of being generated. The question is why are those three indexes lagging?

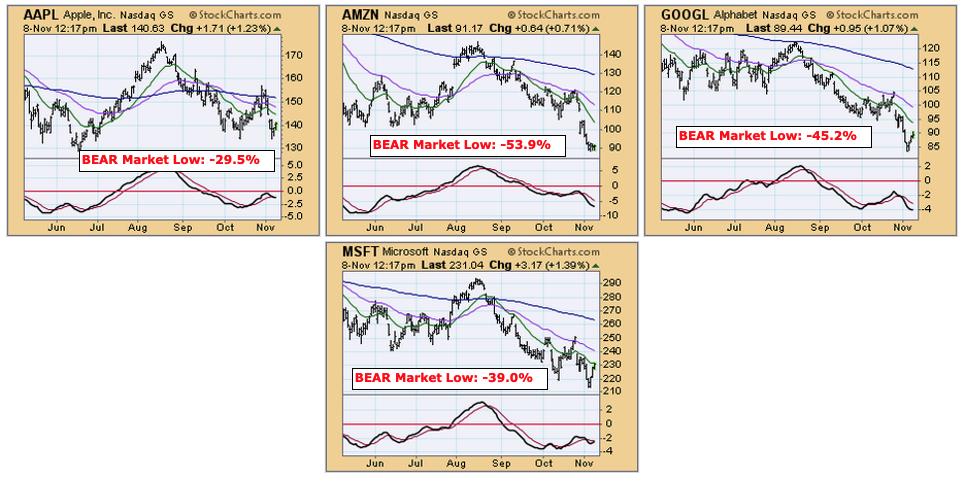

The shortfall is not a big mystery. Four super-large-cap tech stocks, which usually support the market are in dire straits. They all carry heavy weight in the three cap-weighted market indexes that are in trouble. The charts below show the extent of their bear market drawdowns so far. Note that all four stocks are below their 20/50/200EMAs, and no turn around is going to get started until that changes.

Conclusion: Five of the major market indexes we track are improving, but the extent to which all indexes will improve will be in question as long as the large-cap tech stocks are dragging behind.

Technical Analysis is a windsock, not a crystal ball. --Carl Swenlin

(c) Copyright 2022 DecisionPoint.com

Helpful DecisionPoint Links:

DecisionPoint Alert Chart List

DecisionPoint Golden Cross/Silver Cross Index Chart List

DecisionPoint Sector Chart List

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

DecisionPoint is not a registered investment advisor. Investment and trading decisions are solely your responsibility. DecisionPoint newsletters, blogs or website materials should NOT be interpreted as a recommendation or solicitation to buy or sell any security or to take any specific action.