I knew well ahead of the 2006-2007 real estate crash that problems were coming, but I didn't really understand the cause. I thought that the price of houses was going to deter buyers, but buyers didn't care about the price of a home, they only cared about "how much a month?" And that, of course, is a function of interest rates -- as rates go down, a fixed monthly payment can buy a more expensive house (and vice versa). It's the 'vice versa' with which we are currently concerned.

Since January 2021, the 30-Year Fixed Mortgage Rate has gone from 2.65% to 6.29% today. Looking at this chart, one has to wonder if the term 'criminal ineptitude' is an appropriate appellation for the Fed. It would seem that the Fed thinks their mission is to prevent anyone from ever feeling any pain. Unfortunately, the Fed's actions simply delay the pain and, in doing so, potentially make it worse.

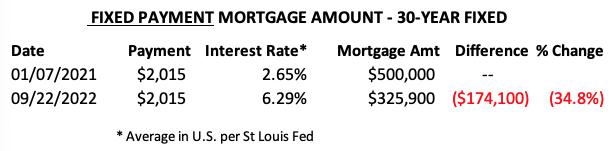

For most people, the price of the home is irrelevant. They only care about the monthly payment they can afford. The following table assumes a monthly payment of $2015 (principal and interest) and a mortgage amount in 2021 of $500,000. Note that, at the current rate of 6.29%, the the fixed payment can only cover a loan of $325,900 -- 34.8% smaller than in 2021.

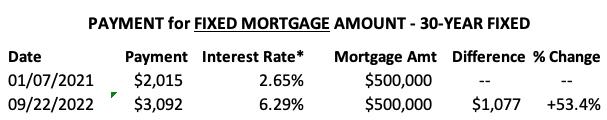

There are some people who can afford a higher payment, but they are still going to feel the pinch as rates go higher. This table shows that the current payment is over 50% higher than at the 2021 starting rate. Surely, many of these people are going to postpone their purchase.

Conclusion: Real estate is in a bubble thanks to interest rates being kept unrealistically low for years. Rising rates will put the squeeze on home buyers and, in many cases, they will have to forego their purchase. The result will be that the reduced demand will cause prices to drop. Real estate cheerleaders say that prices won't suffer because "people have to live somewhere." This is true, but they are already living somewhere, aren't they?

Technical Analysis is a windsock, not a crystal ball. --Carl Swenlin

(c) Copyright 2022 DecisionPoint.com

Helpful DecisionPoint Links:

DecisionPoint Alert Chart List

DecisionPoint Golden Cross/Silver Cross Index Chart List

DecisionPoint Sector Chart List

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

DecisionPoint is not a registered investment advisor. Investment and trading decisions are solely your responsibility. DecisionPoint newsletters, blogs or website materials should NOT be interpreted as a recommendation or solicitation to buy or sell any security or to take any specific action.