As we looked at yesterday's Discount for the Sprott Physical Gold Trust (PHYS) we realized it was one of the lowest readings on record since data started being collected in 2010.

Closed-end funds like PHYS can sell at a premium or discount to their net asset value (NAV) which is based on the price of physical Gold in the trust. We have about twelve years of premium/discount data on the closed-end fund Sprott Physical Gold Trust (PHYS). We use that data to gauge gold sentiment -- premium readings show bullish sentiment, and discount readings show bearish sentiment.

We are taught to think of sentiment as being a contrary indicator, but that is not always the case. It is only contrary within a certain context. For example, if gold is trending up, we should expect sentiment to be positive, and vice versa. It is when it becomes 'excessively' positive (or negative) that it becomes contrarian. Current conditions provide us with a good example.

This is a monthly chart going back to 2010 when we started tracking discounts and premiums on PHYS. It's a spreadsheet of over 3150 readings. We put the readings on a spreadsheet and yesterday's reading -2.27 was #24 on the list. Today's reading was -2.24 (#29 on the list). The highest discount on record is -3.58.

What does this all mean? Looking at the chart, it could mean an upside reversal is coming based on sentiment. The double-top on the monthly chart isn't encouraging, but price lows do seem to follow higher discounts over time.

The DecisionPoint Alert Weekly Wrap presents an end-of-week assessment of the trend and condition of the Stock Market, the U.S. Dollar, Gold, Crude Oil, and Bonds. The DecisionPoint Alert daily report (Monday through Thursday) is abbreviated and gives updates on the Weekly Wrap assessments.

Watch the latest episode of DecisionPoint on StockCharts TV's YouTube channel here!

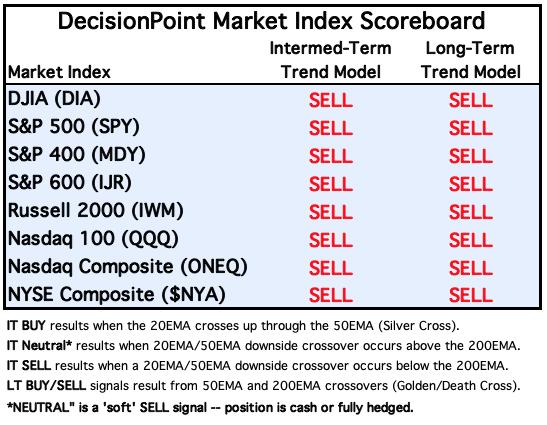

MAJOR MARKET INDEXES

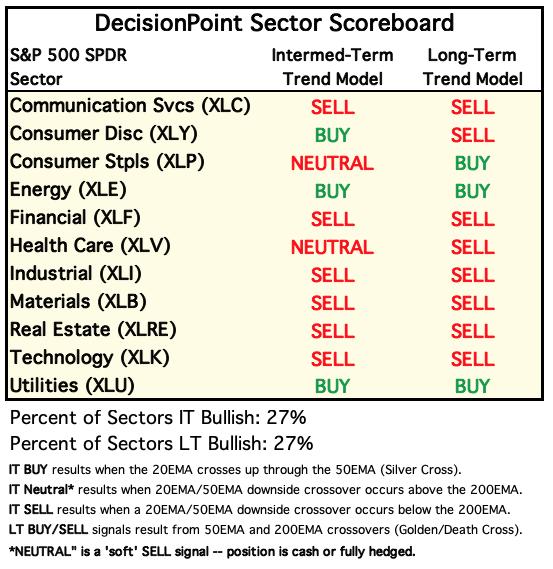

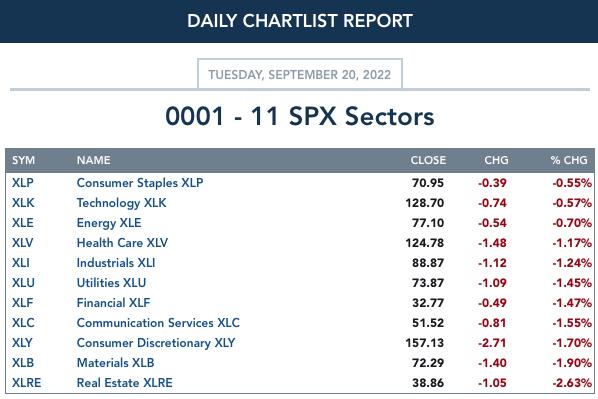

SECTORS

Each S&P 500 Index component stock is assigned to one of 11 major sectors. This is a snapshot of the Intermediate-Term (Silver Cross) and Long-Term (Golden Cross) Trend Model signal status for those sectors.

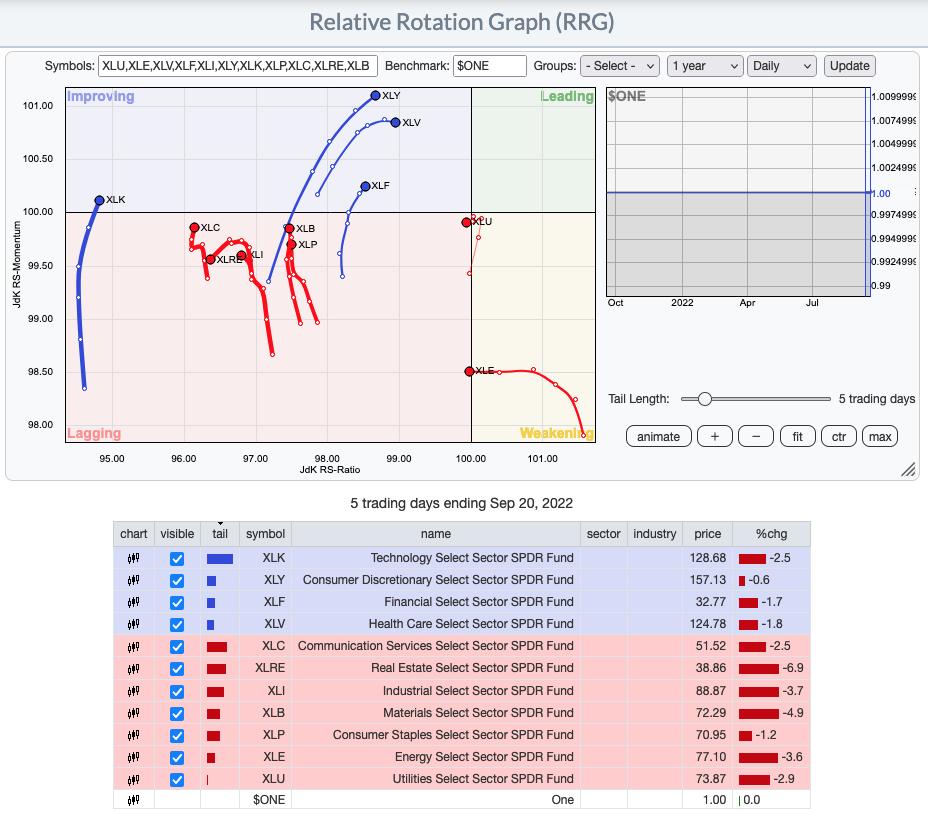

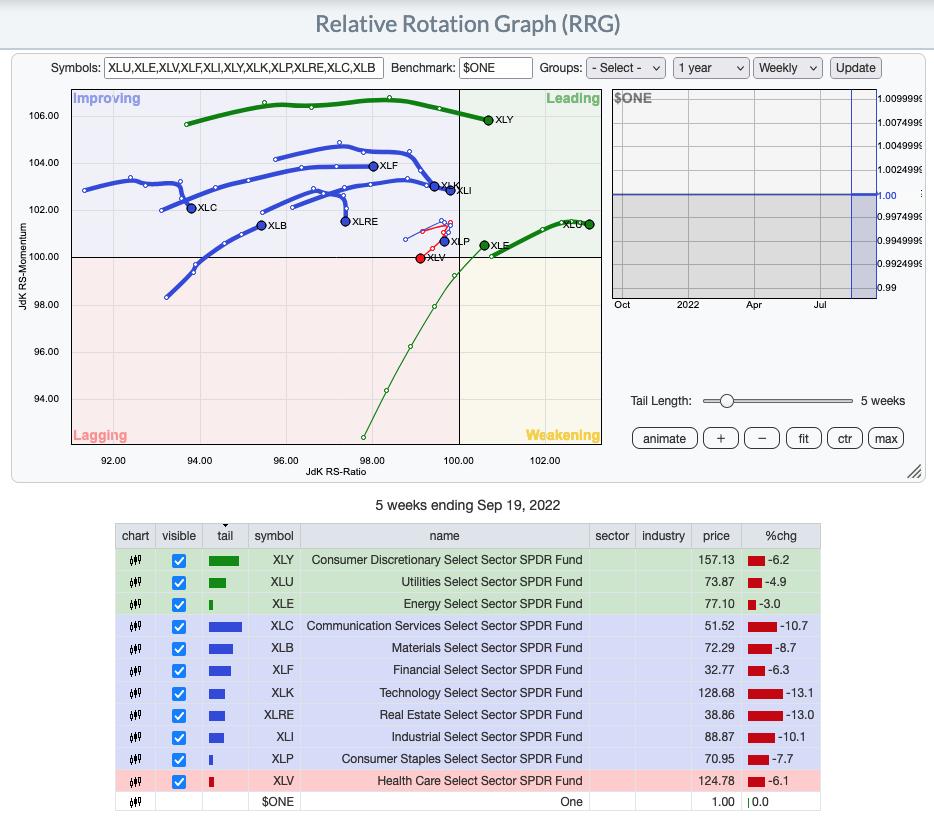

RRG® Charts ($ONE Benchmark)

Daily: The daily RRG is getting squirrelly. Most sectors are heading out or are out of the Lagging quadrant. Given the northerly headings, those in Lagging should reach Improving soon. XLE and XLU are newcomers . XLRE is most bearish given its bearish southwest heading within the Lagging quadrant, but newcomers to the Lagging quadrant, XLE and XLU also look very bearish.

The three strongest sectors are XLK, XLY, XLV and XLF which are in the Improving quadrant. They have bullish northeast headings.

Weekly: The longer-term RRG suggests that the most bearish sectors are XLV and XLP which have bearish southwest headings. XLV has hit the Lagging quadrant, but XLP isn't far behind.

As with the daily RRG, XLRE is looking particularly bearish as it makes its way toward the Lagging quadrant. All others with the exception of XLK and XLC should hit the Leading quadrant eventually; although a longer-term market decline would change everything.

RRG® charts show you the relative strength and momentum for a group of stocks. Stocks with strong relative strength and momentum appear in the green Leading quadrant. As relative momentum fades, they typically move into the yellow Weakening quadrant. If relative strength then fades, they move into the red Lagging quadrant. Finally, when momentum starts to pick up again, they shift into the blue Improving quadrant.

CLICK HERE for an animated version of the RRG chart.

CLICK HERE for Carl's annotated Sector charts.

THE MARKET (S&P 500)

IT Trend Model: BUY as of 8/2/2022

LT Trend Model: SELL as of 5/5/2022

SPY Daily Chart: Yesterday's bullish engulfing candlestick failed to produce a positive day. Today's candlestick is filled and red which is very bearish and suggests a continuation to the downside. On the bright side we have a bullish falling wedge.

Indicators aren't improving whatsoever. The RSI is negative and falling. The PMO is negative and falling and the VIX is oscillating below its MA on the inverted scale which implies internal weakness. We don't yet have a puncture of the lower Bollinger Band so sentiment isn't bearish enough to look for a short-term upside reversal.

Here is the latest recording:

S&P 500 New 52-Week Highs/Lows: New Lows are the highest we've seen since June/July. Making the comparison, currently New Lows are NOT oversold. The 10-DMA of the High-Low Differential is now accelerating lower.

Climax* Analysis: Yesterday there was an upside initiation climax. Today we got a downside initiation climax. This is confusing to be sure, but we think it is just churn ahead of the Fed announcement tomorrow.

*A climax is a one-day event when market action generates very high readings in, primarily, breadth and volume indicators. We also include the VIX, watching for it to penetrate outside the Bollinger Band envelope. The vertical dotted lines mark climax days -- red for downside climaxes, and green for upside. Climaxes are at their core exhaustion events; however, at price pivots they may be initiating a change of trend.

Short-Term Market Indicators: The short-term market trend is DOWN and the condition is NEUTRAL.

STOs continue to decline, but we don't see them as oversold yet. %Stocks indicators are oversold, although June saw even lower readings.

Intermediate-Term Market Indicators: The intermediate-term market trend is DOWN and the condition is NEUTRAL.

There was no eye test today. Both the ITBM/ITVM are traveling lower and they are not at all oversold. %PMO BUY signals is very low, but we had even lower readings earlier this month.

PARTICIPATION and BIAS Assessment: The following chart objectively shows the depth and trend of participation in two time frames.

- Intermediate-Term - the Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA). The opposite of the Silver Cross is a "Dark Cross" -- those stocks are, at the very least, in a correction.

- Long-Term - the Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA). The opposite of a Golden Cross is the "Death Cross" -- those stocks are in a bear market.

The bias remains bearish in all three timeframes.

Short term: We have a very low number of stocks above their 20/50-day EMAs. While the readings did tick up today, it wasn't enough to change the short-term bias.

Intermediate term: The SCI is at a low 39.4% which in and of itself is bearish, but we also see lower percentage of stocks above their 20/50-day EMAs. This implies that the SCI won't be able to move higher. A silver cross can only be generated if the 20-day EMA moves above the 50-day EMA. EMAs will move in the direction of price so price must be above both the 20/50-day EMAs in order to create a new silver cross.

Long term: The GCI is flat and reading only 37.4%. This means that over 2/3rds of the market is in the midst of a correction or bear market.

CONCLUSION: Yesterday's upside initiation climax and bullish engulfing candlestick failed to produce. Now we have a downside initiation climax. Indicators are all negative with the exception of today's climax. If the Fed surprises with a 100 basis point hike, the market will go into a tailspin. However, if they raise the Fed funds rate 75 points, we could see a small celebration rally. Weird to think that investors would celebrate a 75 point hike, but under the current context of inflation, it would relieve investors.

Erin is 20% exposed to the market, but plans to slim position sizes or shed GDX.

Key Earnings Tomorrow: General Mills (GIS), Lennar Homes (LEN) and KB Homes (KBH)

Click HERE for a complete Earnings list from Zacks.com.

Have you subscribed the DecisionPoint Diamonds yet? DP does the work for you by providing handpicked stocks/ETFs from exclusive DP scans! Add it with a discount! Contact support@decisionpoint.com for more information!

BITCOIN

Bitcoin continues to push against support at about $18,000. The OBV is actually showing a positive divergence with price lows which suggests a possible rally off this support level. However indicators don't see it the same way. There is a new PMO SELL signal accompanied by a negative RSI and falling Stochastics.

INTEREST RATES

Rates are breaking out to new multi-year highs. Given the FOMC's steps to curb inflation with raising the Fed Funds Rate, the rest seem to be following suit. We expect a rising rate environment to continue.

The Yield Curve Chart from StockCharts.com shows us the inversions taking place. The red line should move higher from left to right. Inversions are occurring where it moves downward.

10-YEAR T-BOND YIELD

$TNX is about to have an upside breakout from the bearish rising wedge. A bullish conclusion to a bearish chart pattern is especially bullish. This doesn't surprise us given the strongly positive indicators and the current economic environment.

DOLLAR (UUP)

IT Trend Model: BUY as of 6/22/2021

LT Trend Model: BUY as of 8/19/2021

UUP Daily Chart: The is indecisive to say the least. Indicators are positive enough, particularly a possible whipsaw PMO BUY signal in the works. The RSI and Stochastics are in positive territory, but we need Stochastics to get above 80. All of this is happening in the context of a bearish rising wedge. We believe our currency will continue to hold up, but we imagine there will be quite a bit of churn and chop.

GOLD

IT Trend Model: NEUTRAL as of 5/3/2022

LT Trend Model: SELL as of 6/30/2022

GLD Daily Chart: GLD is holding above lows from last week. Indicators are highly negative with the exception of discounts which we've already discussed. The RSI is negative and the PMO is falling on a SELL signal. Stochastics may be bottoming, but they aren't in a hurry to move higher.

GOLD Daily Chart: $Gold technically closed at a new low for the year, but it does seem to be clinging to support for now. $GVZ is oscillating below its moving average on our inverted scale which confirms the internal weakness we are seeing in price.

GOLD MINERS Golden and Silver Cross Indexes: GDX had a very bad day. Participation is pulling back once again. The double-bottom pattern in the short term hasn't busted yet, but price's inability to overcome the 20-day EMA after a rally like yesterday's is a problem. The RSI is negative, but the PMO is flat and unresponsive. There is a slight heartbeat here, but we'll need the paddles pretty quick before it flat lines across the board.

(Full disclosure: Erin owns GDX.)

CRUDE OIL (USO)

IT Trend Model: NEUTRAL as of 7/8/2022

LT Trend Model: BUY as of 3/9/2021

USO Daily Chart: After touching down on support at $67.50, USO rallied to finish the positively yesterday. We may've seen a decline today, but today's candlestick is a clear bullish hammer pattern. The RSI and PMO aren't helpful, but Stochastics are beginning to turn back up. The $OVZ is oscillating above its moving average so there is some internal strength. More than likely we will see a bounce here.

BONDS (TLT)

IT Trend Model: SELLas of 8/19/2022

LT Trend Model: SELL as of 1/19/2022

TLT Daily Chart: TLT lost support but at least formed a slightly bullish hollow red candlestick. However, that's about the only positive to the chart given support was lost. With rates rising quickly, downside pressure on TLT will continue to push price lower.

Good Luck & Good Trading!

Erin Swenlin and Carl Swenlin

Technical Analysis is a windsock, not a crystal ball. --Carl Swenlin

(c) Copyright 2022 DecisionPoint.com

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.

NOTE: The signal status reported herein is based upon mechanical trading model signals, specifically, the DecisionPoint Trend Model. They define the implied bias of the price index based upon moving average relationships, but they do not necessarily call for a specific action. They are information flags that should prompt chart review. Further, they do not call for continuous buying or selling during the life of the signal. For example, a BUY signal will probably (but not necessarily) return the best results if action is taken soon after the signal is generated. Additional opportunities for buying may be found as price zigzags higher, but the trader must look for optimum entry points. Conversely, exit points to preserve gains (or minimize losses) may be evident before the model mechanically closes the signal.

Helpful DecisionPoint Links:

DecisionPoint Alert Chart List

DecisionPoint Golden Cross/Silver Cross Index Chart List

DecisionPoint Sector Chart List

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

DecisionPoint is not a registered investment advisor. Investment and trading decisions are solely your responsibility. DecisionPoint newsletters, blogs or website materials should NOT be interpreted as a recommendation or solicitation to buy or sell any security or to take any specific action.