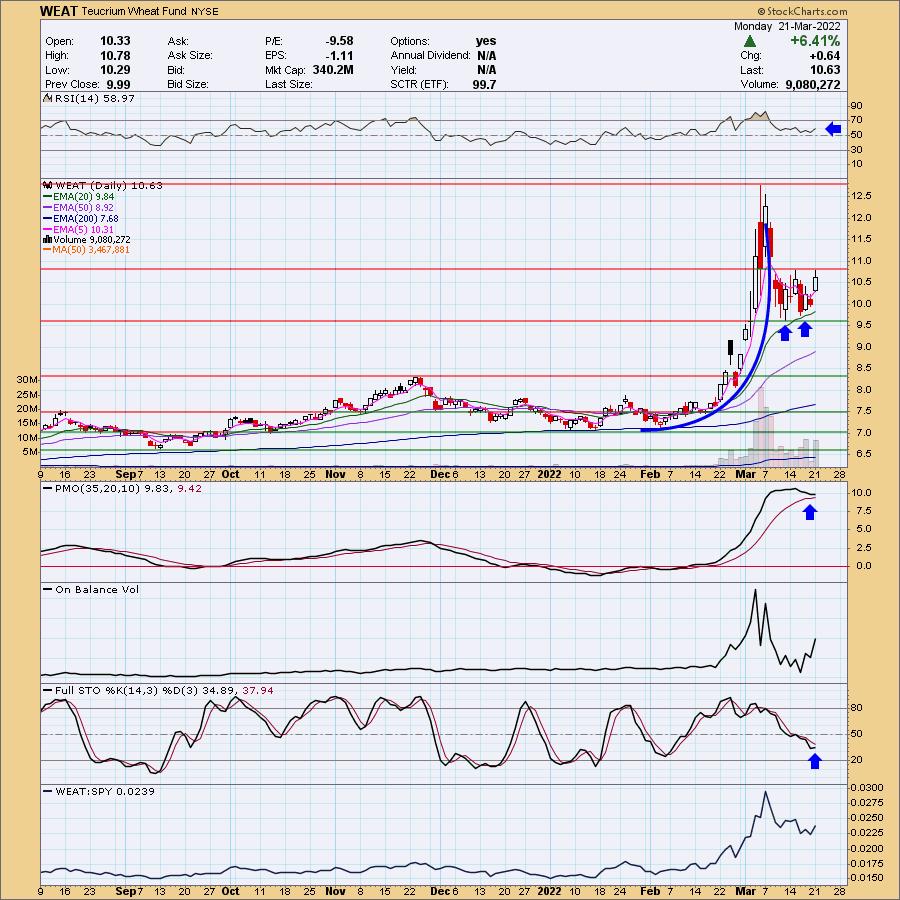

After rising parabolically, Wheat (WEAT) collapsed as all parabolic formations do--quickly and painfully. However, since then it has been consolidating on top of the 20-day EMA. This pullback was needed to alleviate extremely overbought conditions.

While consolidating, WEAT has formed a small bullish double-bottom formation. If we get a breakout here that would confirm this pattern and imply a minimum upside target that is around $12. The PMO topped ominously, but it is already flattening and could turn back up soon. Like Crude Oil, I expect to see it continue higher given global instability in commodities. If it fails here before executing the double-bottom, then we will likely want to wait it out a bit longer. It looks pretty interesting right now.

The DecisionPoint Alert Weekly Wrap presents an end-of-week assessment of the trend and condition of the Stock Market, the U.S. Dollar, Gold, Crude Oil, and Bonds. The DecisionPoint Alert daily report (Monday through Thursday) is abbreviated and gives updates on the Weekly Wrap assessments.

Watch the latest episode of DecisionPoint on StockCharts TV's YouTube channel here!

MAJOR MARKET INDEXES

SECTORS

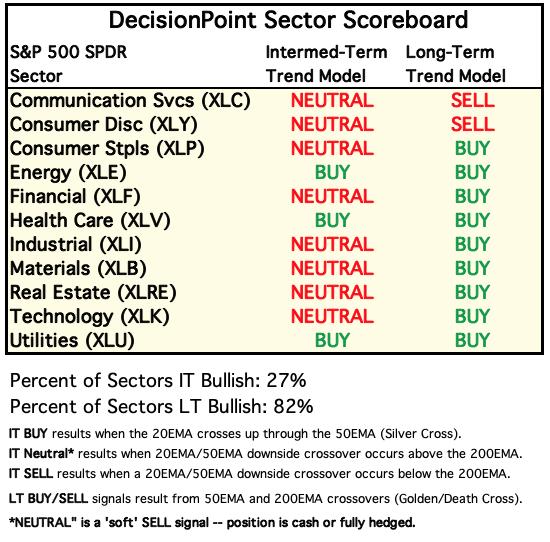

Each S&P 500 Index component stock is assigned to one, and only one, of 11 major sectors. This is a snapshot of the Intermediate-Term (Silver Cross) and Long-Term (Golden Cross) Trend Model signal status for those sectors.

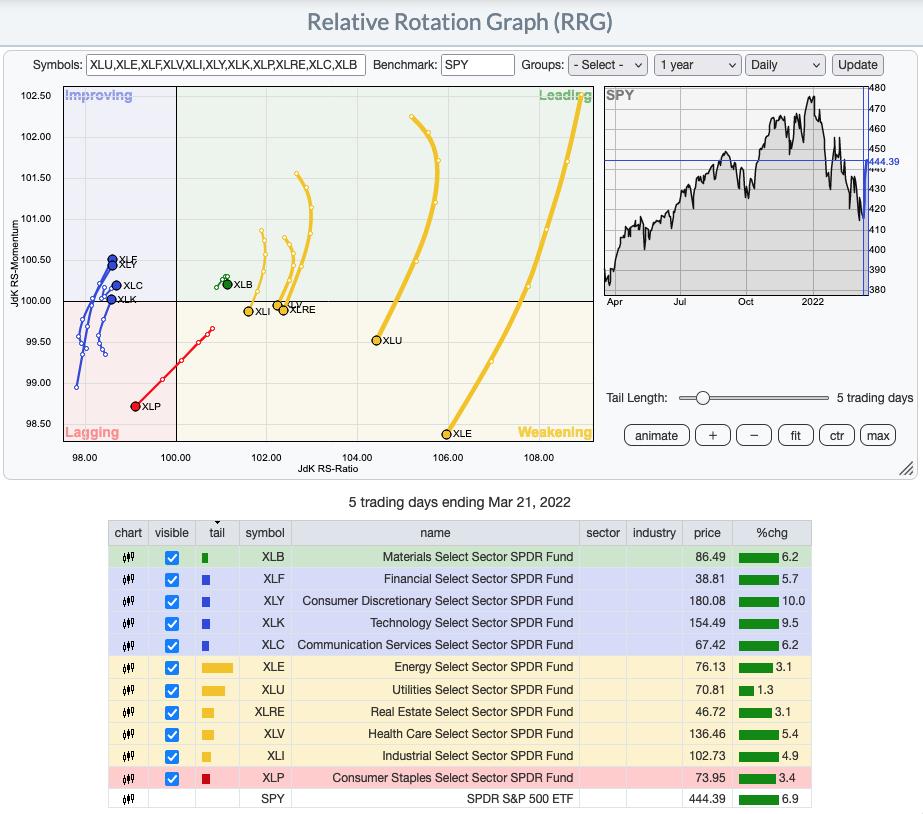

RRG® Chart: Where did all the Leading sectors go? They have tumbled into the Weakening quadrant quickly. This is likely due to the recent rally in more of the growth-y areas of the market like Technology and Discretionary.

All sectors that have fallen into the Weakening quadrant have bearish southwest headings. We will want to see if they hook back around while in this quadrant as that would be very bullish.

XLP continues to be the weakest of all the sectors. It is headed in a near perfectly bearish southwest heading within Lagging.

XLC, XLK, XLY and XLF actually have the most bullish configuration as they move in the bullish northeast direction and head toward the Leading quadrant.

This leaves XLB. It is still in the Leading quadrant, but has hooked around and is moving toward Weakening quadrant. It isn't moving as quickly, so it could reverse itself to remain in the strongest quadrant of Leading.

RRG® charts show you the relative strength and momentum for a group of stocks. Stocks with strong relative strength and momentum appear in the green Leading quadrant. As relative momentum fades, they typically move into the yellow Weakening quadrant. If relative strength then fades, they move into the red Lagging quadrant. Finally, when momentum starts to pick up again, they shift into the blue Improving quadrant.

CLICK HERE for an animated version of the RRG chart.

CLICK HERE for Carl's annotated Sector charts.

THE MARKET (S&P 500)

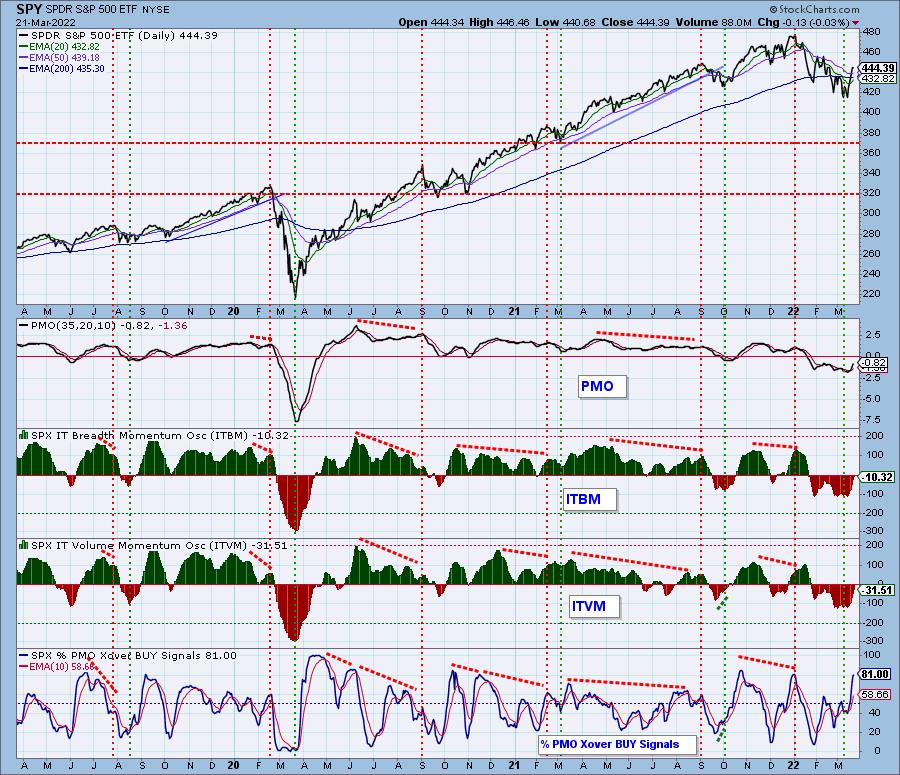

IT Trend Model: NEUTRAL as of 1/21/2022

LT Trend Model: BUY as of 6/8/2020

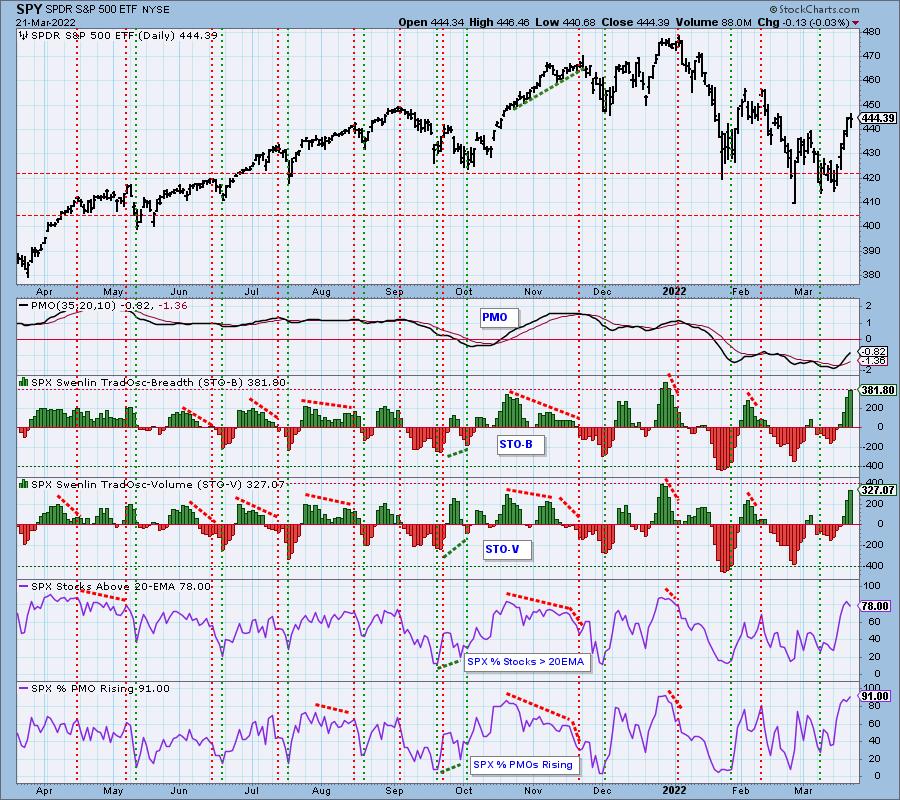

SPY Daily Chart: Carl noted in today's DecisionPoint Show that while we had a negative close, it is actually quite encouraging that we didn't see price fall off a cliff and instead hold its ground above the 50-day EMA.

Indicators are bullish with the RSI in positive territory and the PMO rising quickly on a crossover BUY signal. You'll note that the VIX has moved well outside the upper Bollinger Band on our inverted scale. We should be prepared for a downside reversal, but that isn't always a given particularly since the VIX is still reading above 20.

Here is the latest recording:

Topic: DecisionPoint Trading Room

Start Time: Mar 21, 2022 09:00 AM

Meeting Recording Link.

Access Passcode: March@21

S&P 500 New 52-Week Highs/Lows: New Highs expanded, but not above the previous high this month so currently there is a negative divergence.

Climax* Analysis: Not a climax day. We find it positive that we haven't seen a breakdown based on the last two upside exhaustion climaxes (identified with green vertical lines last week).

*A climax is a one-day event when market action generates very high readings in, primarily, breadth and volume indicators. We also include the VIX, watching for it to penetrate outside the Bollinger Band envelope. The vertical dotted lines mark climax days -- red for downside climaxes, and green for upside. Climaxes indicate either initiation or exhaustion.

Short-Term Market Indicators: The short-term market trend is UP and the condition is EXTREMELY OVERBOUGHT.

STOs have now reached extremely overbought territory. They are still rising so until they top, we expect to see a bit more upside or possibly consolidation to move them out of overbought territory. Participation indicators (%Stocks > 20-day EMA and %PMOs Rising) are also overbought. Overbought conditions in a bear market are dangerous.

Intermediate-Term Market Indicators: The intermediate-term market trend is DOWN and the condition is NEUTRAL.

Carl pointed out today that since the top at the beginning of the year, the ITBM/ITVM have been "overbought" when they close in on the zero line. We also have very overbought readings on %PMO BUY signals.

PARTICIPATION and BIAS Assessment: The following chart objectively shows the depth and trend of participation in two time frames.

- Intermediate-Term - the Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA). The opposite of the Silver Cross is a "Dark Cross" -- those stocks are, at the very least, in a correction.

- Long-Term - the Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA). The opposite of a Golden Cross is the "Death Cross" -- those stocks are in a bear market.

The market bias in the short term is bullish given %Stocks > 20/50-day EMAs are much higher than the SCI.

The intermediate term shows a bearish bias as the SCI is reading well below 70%. However, it is rising, so that tells us that the bearish bias is at least improving.

The long-term bias is neutral to bearish. We have nearly the same percentage of stocks > 50/200-day EMAs as the GCI so we can't expect to see too much improvement on the GCI. The GCI is at a bearish reading of 55% and is mostly flat.

CONCLUSION: There is a strong bullish bias in the short term, but indicators in that timeframe are very overbought for a bull market or a bear market. We'd like to think this is going to be a longer-term rally, but none of the concerns investors had before this rally have not cleared up. The ITBM/ITVM are "neutral" for a bull market, but are not for a bear market, they are overbought. Be prepared for more volatility and churn.

Given my vacation that starts Wednesday, I've opted to keep my exposure at 15% because I can't manage them in the short term. I will continue to publish the DP Alert while I'm gone, but comments will be brief or carried over from the day before if there are no big changes. There will not necessarily be a "lead" story, I'll be referring to the 10-minute candlestick chart to go over market movement for the day. If you have any questions or concerns, email me at erin@decisionpoint.com.

Have you subscribed the DecisionPoint Diamonds yet? DP does the work for you by providing handpicked stocks/ETFs from exclusive DP scans! Add it with a discount! Contact support@decisionpoint.com for more information!

BITCOIN

The volume bar isn't correct, so ignore it. Bitcoin is in consolidation mode as it weaves above and below the 20/50-day EMAs. Indicators are softening. The RSI is still positive but it moving back toward negative territory below net neutral (50). The PMO is still rising but has flattened and Stochastics while reading above 80 have topped and could drop below tomorrow. I don't expect to see much more than continued consolidation.

INTEREST RATES

Yields spiked higher. We expect them to move even higher.

10-YEAR T-BOND YIELD

$TNX was up almost 8 basis points today. There is nothing on this chart that suggests they will lose this rising trend.

DOLLAR (UUP)

IT Trend Model: BUY as of 6/22/2021

LT Trend Model: BUY as of 8/19/2021

UUP Daily Chart: The Dollar isn't sure what it wants to do. After forming a short-term bearish double-top, it is now consolidating above the confirmation line and the 20-day EMA. Indicators are mixed with a positive RSI accompanied by a now flat PMO and Stochastics. Stochastics are staying above net neutral (50) for now.

GOLD

IT Trend Model: BUY as of 12/29/2021

LT Trend Model: BUY as of 1/12/2022

GLD Daily Chart: Gold pulled back after it went parabolic. It did find purchase on the 50-day EMA. The RSI is the only positive indicator right now given the PMO is on an overbought SELL signal and Stochastics are still falling in negative territory. I expect to see both the Dollar and Gold move mostly sideways this week.

GOLD Daily Chart: Carl mentioned today that he wouldn't be surprised if we see more decline in Gold. Fortunately price has three levels of support, the 50-day EMA, May top and November top. Discounts are trending lower which suggests investors are getting more bullish on Gold.

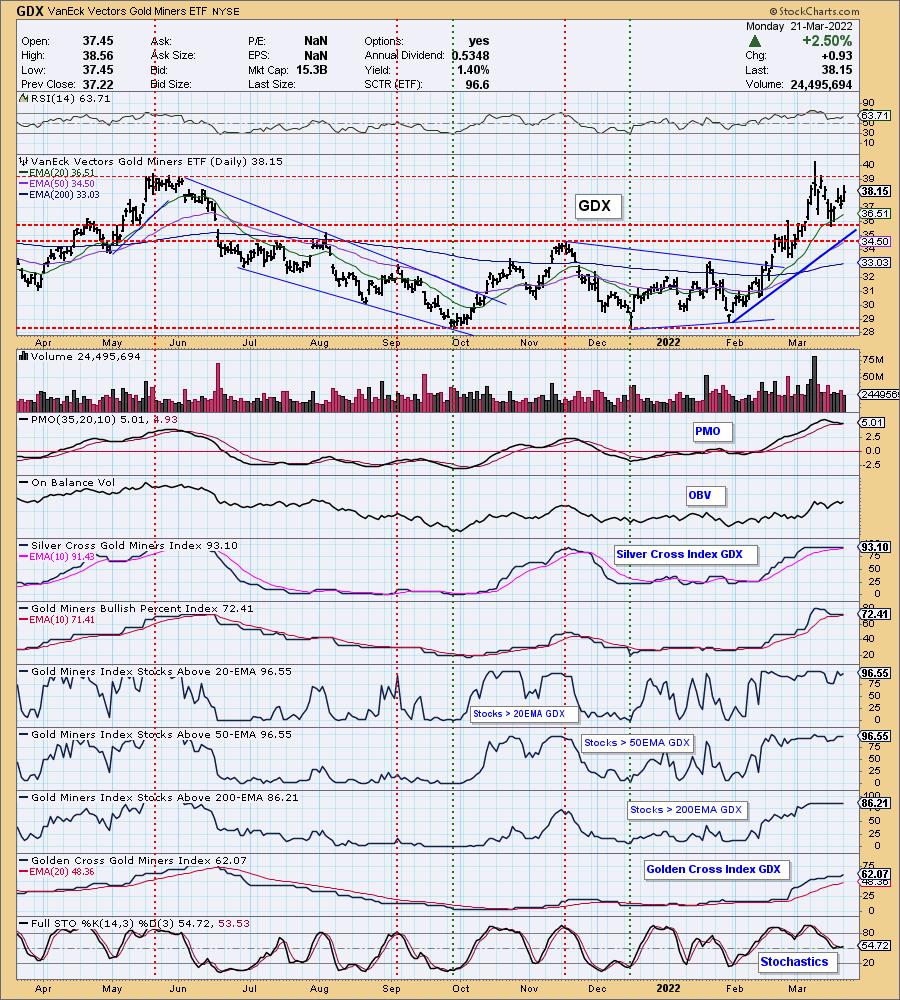

GOLD MINERS Golden and Silver Cross Indexes: Many of the prior winners found themselves losing the last week and half. GDX was no exception. Participation is strong and the RSI is positive. However, we could see a PMO crossover SELL signal if it declines. Overhead resistance does appear strong at $39. I like Miners right now, but be aware it has some strong resistance to break through which could take a bit more time to happen.

CRUDE OIL (USO)

IT Trend Model: BUY as of 1/3/2022

LT Trend Model: BUY as of 3/9/2021

USO Daily Chart: I mentioned last Thursday and Friday that USO looked ripe on the reversal off the 50-day EMA. The indicators have reversed and look bullish. I expect to see Crude breakout above the March high.

BONDS (TLT)

IT Trend Model: NEUTRALas of 1/5/2022

LT Trend Model: SELL as of 1/19/2022

TLT Daily Chart: With yields rising so quickly, TLT has gotten caught in the crossfire. It moved below $130 today.

The RSI is negative, the PMO is falling on a SELL signal and Stochastics have topped beneath 20. All of these are indications that we will see Bonds fall even further.

Good Luck & Good Trading!

Erin Swenlin

Technical Analysis is a windsock, not a crystal ball. --Carl Swenlin

(c) Copyright 2022 DecisionPoint.com

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.

NOTE: The signal status reported herein is based upon mechanical trading model signals, specifically, the DecisionPoint Trend Model. They define the implied bias of the price index based upon moving average relationships, but they do not necessarily call for a specific action. They are information flags that should prompt chart review. Further, they do not call for continuous buying or selling during the life of the signal. For example, a BUY signal will probably (but not necessarily) return the best results if action is taken soon after the signal is generated. Additional opportunities for buying may be found as price zigzags higher, but the trader must look for optimum entry points. Conversely, exit points to preserve gains (or minimize losses) may be evident before the model mechanically closes the signal.

Helpful DecisionPoint Links:

DecisionPoint Alert Chart List

DecisionPoint Golden Cross/Silver Cross Index Chart List

DecisionPoint Sector Chart List

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

DecisionPoint is not a registered investment advisor. Investment and trading decisions are solely your responsibility. DecisionPoint newsletters, blogs or website materials should NOT be interpreted as a recommendation or solicitation to buy or sell any security or to take any specific action.