This week the only broad market index ETFs on our Market Summary to finish higher were the Russell 2000 (IWM) and the S&P 600 (IJR). A look at IJR's chart and we can see a few bullish features, but mostly the picture is bearish.

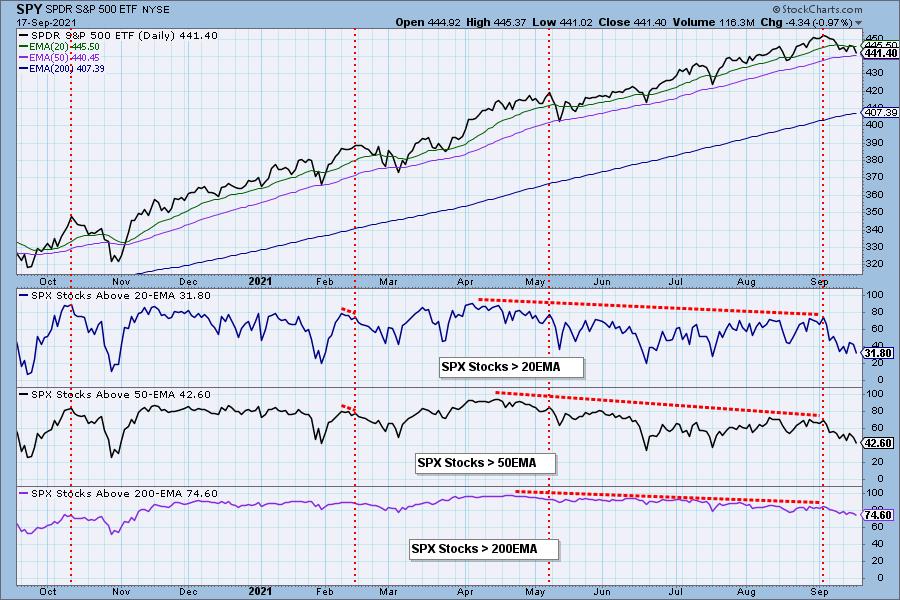

For bulls, there is a short-term rising trend channel and oversold indicators. Past that, there isn't much to write home about. Right now price is showing a rounded top. The SCI and GCI are still in decline. Participation, while oversold, isn't that oversold when you compare the readings to prior lows. Additionally, there is a slight bearish bias in both the short and intermediate terms given participation readings for %Stocks > 20/50-EMAs are lower than the SCI reading.

The mega-cap stocks that have been holding the market up are now weakening. We need small-caps to participate to ensure a broad market rally can happen. Based on the participation percentages, small-caps need more work.

The DecisionPoint Alert Weekly Wrap presents an end-of-week assessment of the trend and condition of the Stock Market, the U.S. Dollar, Gold, Crude Oil, and Bonds. The DecisionPoint Alert daily report (Monday through Thursday) is abbreviated and gives updates on the Weekly Wrap assessments.

Watch the latest episode of DecisionPoint on StockCharts TV's YouTube channel here!

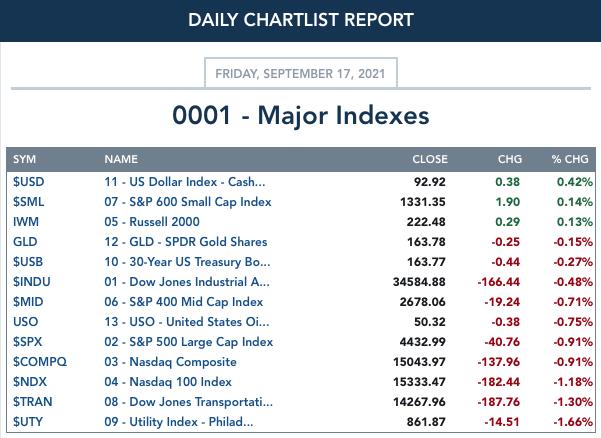

MAJOR MARKET INDEXES

For Friday:

For the week:

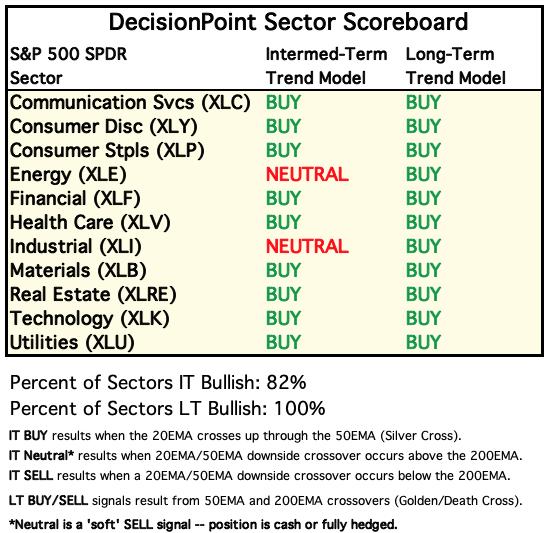

SECTORS

Each S&P 500 Index component stock is assigned to one, and only one, of 11 major sectors. This is a snapshot of the Intermediate-Term (Silver Cross) and Long-Term (Golden Cross) Trend Model signal status for those sectors.

For Today:

For the Week:

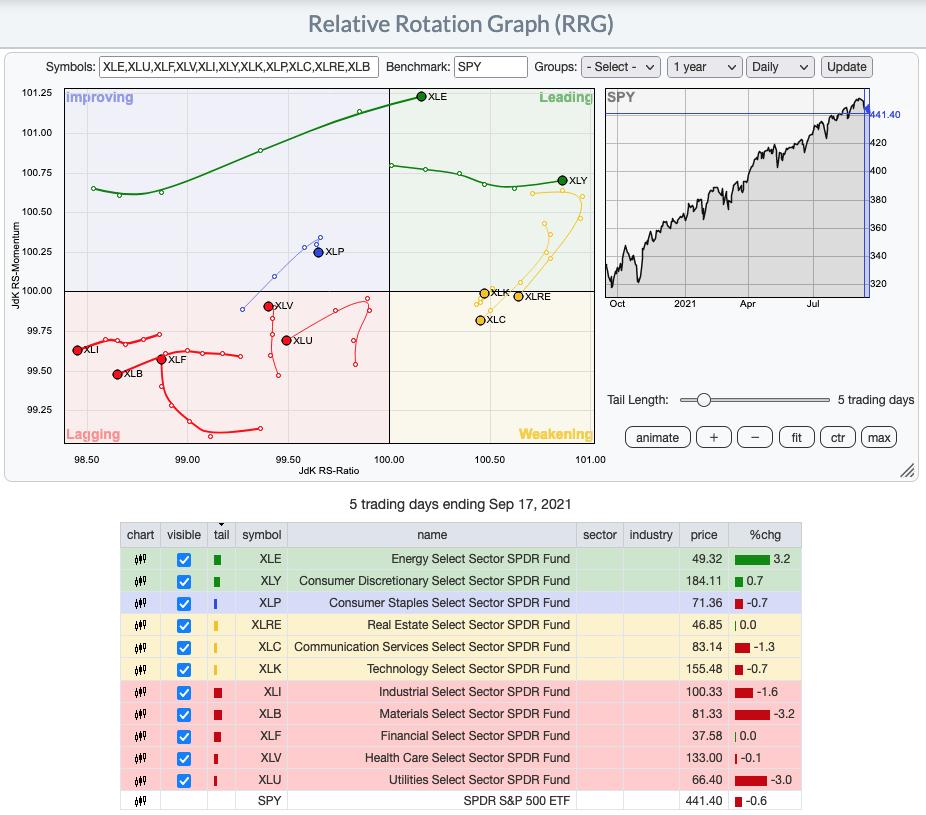

RRG® Chart: XLE and XLY are showing the strongest relative rotation. Interestingly, these are the only two sectors with positive PMO configurations and the only two in the Leading category. XLK also looks interesting given it is already attempting to recapture a spot in Leading after briefly foraying into the Weakening quadrant.

CLICK HERE for an animated version of the RRG chart.

CLICK HERE for Carl's annotated Sector charts.

THE MARKET (S&P 500)

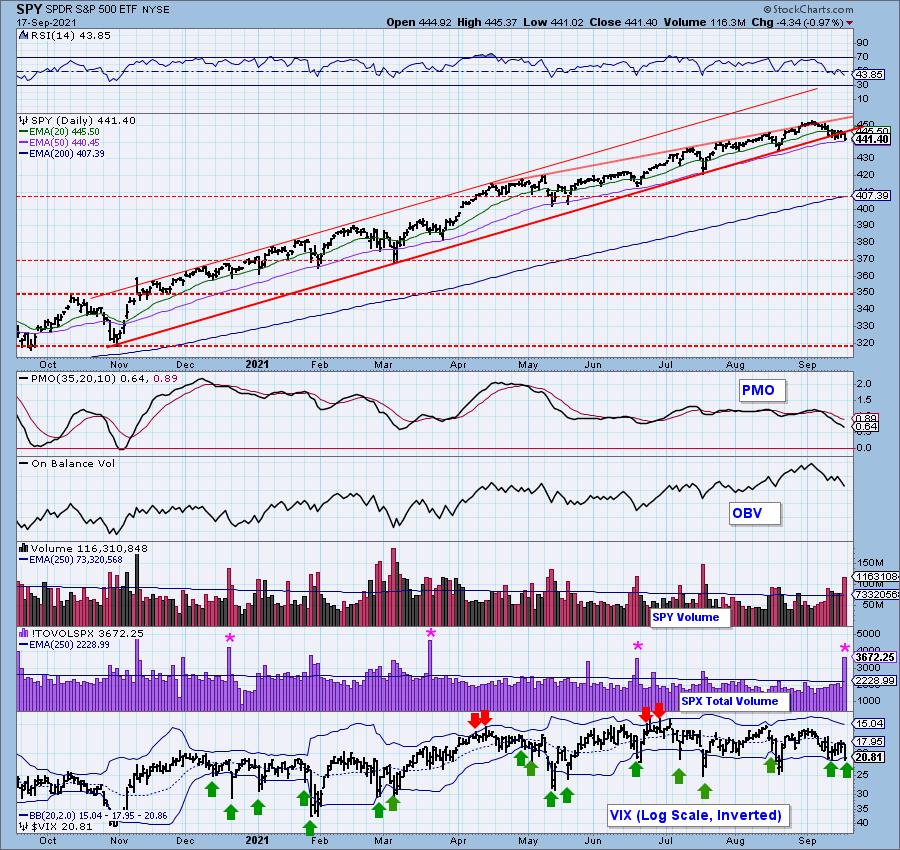

IT Trend Model: BUY as of 5/8/2020

LT Trend Model: BUY as of 6/8/2020

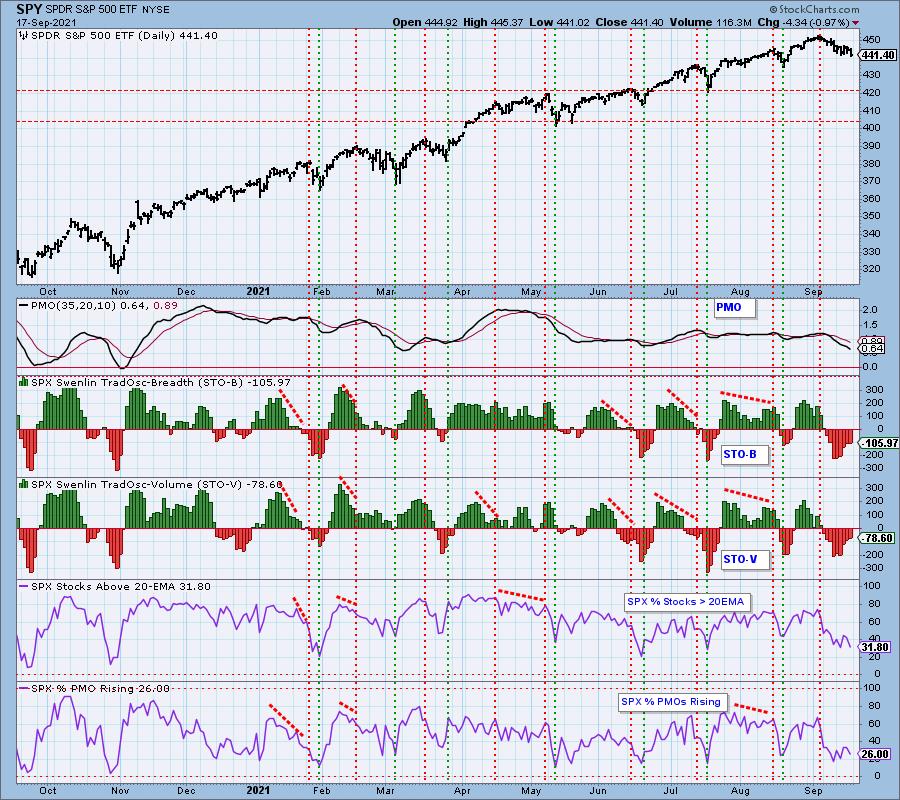

SPY Daily Chart: Today was Quadruple-Witching Options Expiration, so the high volume should not be mistaken as confirmation of, or a prediction of anything in particular. Note that volatility toward the end of the week was low, as we normally expect it to be for this end-of-quarter event. Price is holding above the 50-EMA, but the short-term rising trend was compromised. The slightly longer-term rising bottoms trendline is holding up.

The rising bottoms trendline drawn from the October low has been breached. The PMO is in decline and the RSI is in negative territory. For bulls, the VIX penetrated the lower Bollinger Band on the inverted scale. That typically leads to an upside reversal, but it didn't work out so well on last week's test of the lower Band. Remember that the market is vulnerable when the VIX oscillates below its moving average.

SPY Weekly Chart: The weekly PMO has topped, and has started to accelerate downward. This should make us somewhat nervous.

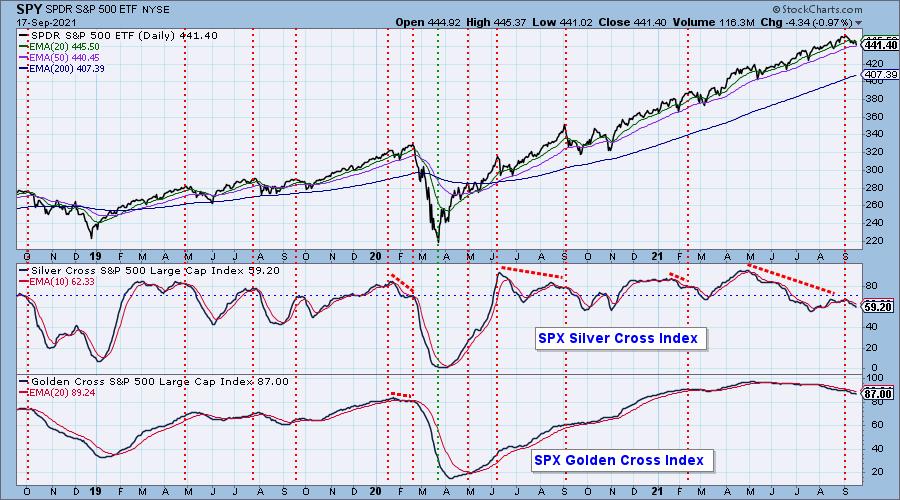

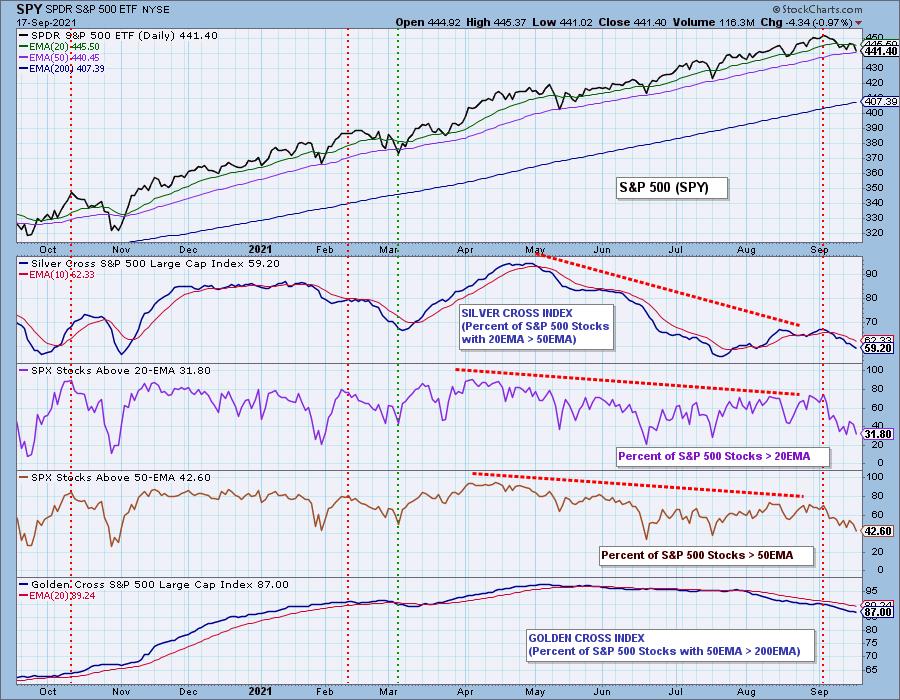

PARTICIPATION: The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA).

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA).

Both the SCI and GCI continue lower. The SCI is oversold, but the GCI is not.

Participation deteriorated somewhat this week. Readings are oversold, but there is plenty of room for them to move lower before reaching oversold extremes.

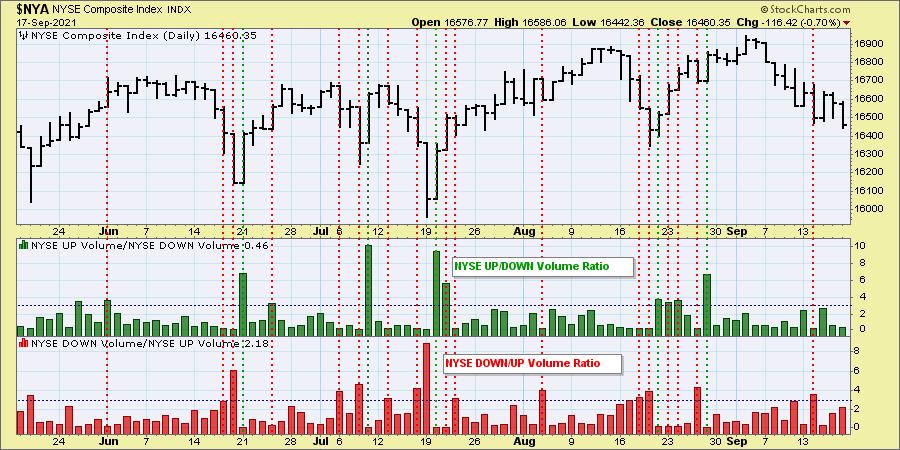

Climax Analysis: As we stated above, today's very high SPX Total Volume is associated with options expiration, and should not be considered climactic; nevertheless, there were climactic Net A-D, Net A-D Volume, and the SPX DOWN/UP Volume Ratio (See below.). These numbers may have been affected somewhat by the options expirations, but we have to take them at face value. On Wednesday we had an upside initiation climax, followed by a churn day. We think that today is a downside initiation climax, so we look for at least some more churning with a probable decline to follow.

NYSE Up/Down and Down/Up volume ratios are also climax detectors. The 9:1 ratio suggested by the late Dr. Martin Zweig in his book, Winning on Wall Street, is especially significant, but we primarily look for spikes outside the normal range to clarify a particular event. We have an NYSE and S&P 500 version of the ratios, and normally they will only be published when there is a notable reading.

We didn't see a climax on the NYSE Volume Ratio chart.

The S&P 500 version can get different results than the NYSE version because: (a) there are only 500 stocks versus a few thousand; and (b) those 500 stocks are all large-cap stocks that tend to move with more uniformity.

However, we did see a climactic reading on the SPX Down/Up Ratio. That confirms our thesis that this is a possible downside initiation climax.

Short-Term Market Indicators: The short-term market trend is DOWN and the condition is SOMEWHAT OVERSOLD.

The STOs rose slightly. They spent the last half of the week rising, but price did not follow suit. Only one-quarter of the SPX is demonstrating rising momentum.

Intermediate-Term Market Indicators: The intermediate-term market trend is UP and the condition is NEUTRAL to SOMEWHAT OVERSOLD.

The intermediate-term rising bottoms trendline was breached this week. All of our IT indicators are still declining. %PMO BUY signals is oversold, but again, we've seen lower readings.

Bias Assessment: The SCI continues to drop. On Wednesday we had a bullish bias, but that quickly disintegrated when the upside initiation climax failed.

CONCLUSION: The downside initiation climax implies a continuation of the decline; however, the market is oversold, enough so that it allows for an advance. The VIX is an excellent example. Nevertheless, the Silver Cross Index (SCI) shows that the market has had dismal participation for about three months. To clarify, its not as though the SCI has declined and built up tremendous 'rally-fuel' compression, rather is has been moving listlessly sideways. Finally, the upside initiation climax on Wednesday failed to trigger a rally. Continued caution seems advisable.

Calendar Notes: There is an FOMC meeting next week with the usual post-meeting announcement on Wednesday. These always have the potential to move the market, although no major changes in FOMC policy are expected.

Economic reports next week:

Monday: National Association of Home Builders Index

Tuesday: Housing starts (SAAR) and Building Permits (SAAR)

Wednesday: Existing home sales (SAAR) and FOMC Statement

Thursday: Jobs Reports

Friday: New Home Sales

Have you subscribed the DecisionPoint Diamonds yet? DP does the work for you by providing handpicked stocks/ETFs from exclusive DP scans! Add it with a discount! Contact support@decisionpoint.com for more information!

BITCOIN

Bitcoin rallied this week, but it is already cooling. The PMO is mostly flat and the RSI is mostly neutral, providing no clues. The 20-EMA is currently holding up as support. There is a positive OBV divergence, but the rally already appears to be waning.

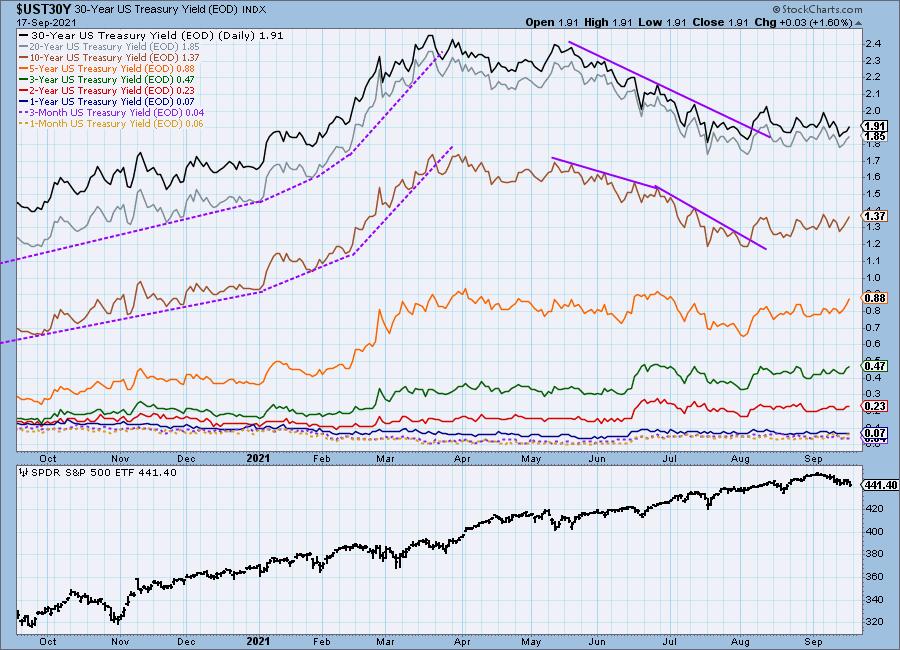

INTEREST RATES

After breaking their declining trend, yields have been moving sideways overall.

10-YEAR T-BOND YIELD

The 10-Year Bond Yield is making a fourth attempt to penetrate overhead resistance. Is the fourth time charmed? There is a bullish ascending triangle that would suggest so.

DOLLAR (UUP)

IT Trend Model: BUY as of 6/22/2021

LT Trend Model: BUY as of 8/19/2021

UUP Daily Chart: The Dollar rallied into the end of the week. The PMO is nearing a crossover BUY signal and the RSI is firmly planted in positive territory suggesting the Dollar will continue to rise next week.

UUP Weekly Chart: There is a major obstacle for the dollar arriving in the form of overhead resistance at the March high. We do have a double-bottom pattern, but price failed to confirm the pattern on the last test of the confirmation line at the March top. The weekly PMO has just entered positive territory and the weekly RSI remains positive suggesting a breakout is likely.

GOLD

IT Trend Model: NEUTRAL as of 6/24/2021

LT Trend Model: SELL as of 8/9/2021

GOLD Daily Chart: Gold fell out of bed this week after making a valiant attempt at overcoming resistance at the 200-EMA. Goldbugs can hold onto the fact that support is currently holding at the June low...but just barely. The PMO and RSI do not inspire confidence.

We see discounts moved into oversold territory, but like the market, we've seen readings much lower readings. If Gold can make the turn, we'll be watching for a reverse head and shoulders. Right now the chart is very bearish.

GOLD Weekly Chart: The weekly chart shows many failed breakout attempts. We're now seeing the formation of a bearish descending triangle coming alongside a now negative PMO and an RSI that was already weak.

GOLD MINERS Golden and Silver Cross Indexes: Gold Miners (GDX) closed at its low for the year. The group appeared to be improving, but the downside pressure applied by Gold's correction prevented an upside breakout. Price is oscillating within a bullish falling wedge. Unfortunately, it appears price will be testing the bottom of the wedge before making its way back up again.

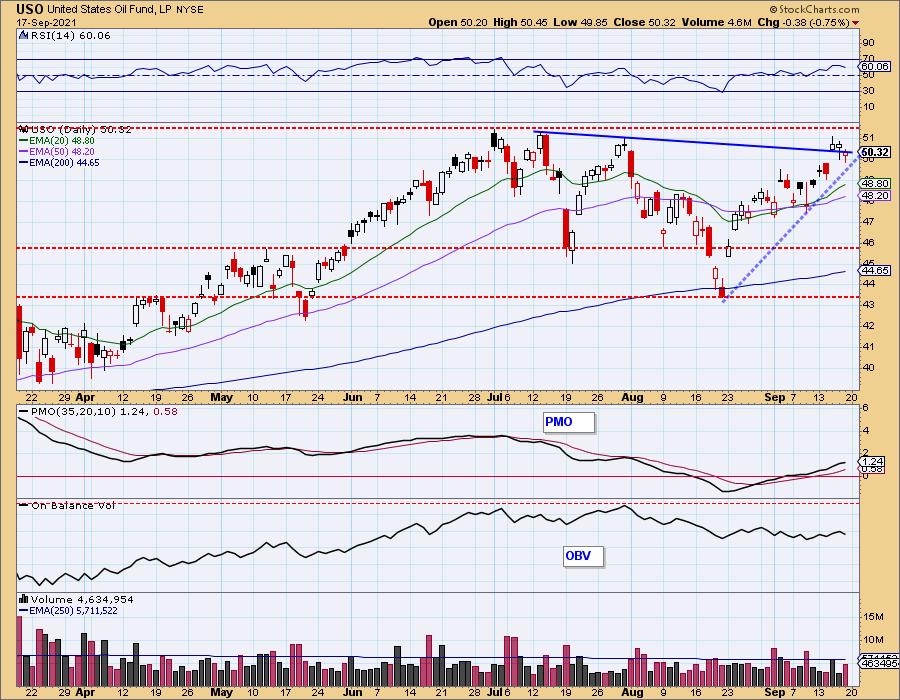

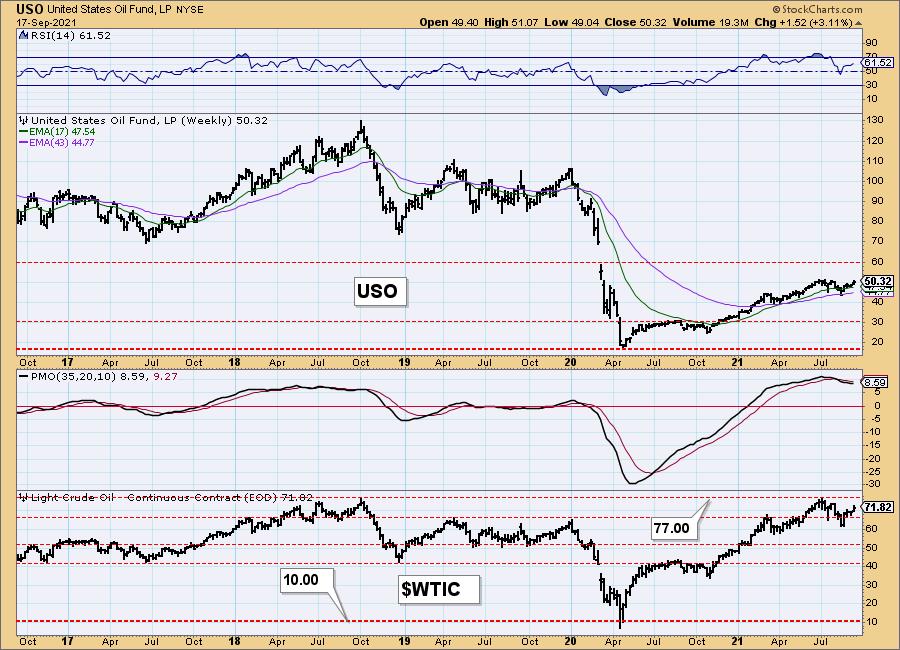

CRUDE OIL (USO)

IT Trend Model: BUY as of 9/3/2021

LT Trend Model: BUY as of 3/9/2021

USO Daily Chart: Crude Oil rallied strongly this week. Today price did break back down below the short-term declining tops trendline. The RSI and PMO are configured positively and the short-term rising trend is intact, but could be tested next week.

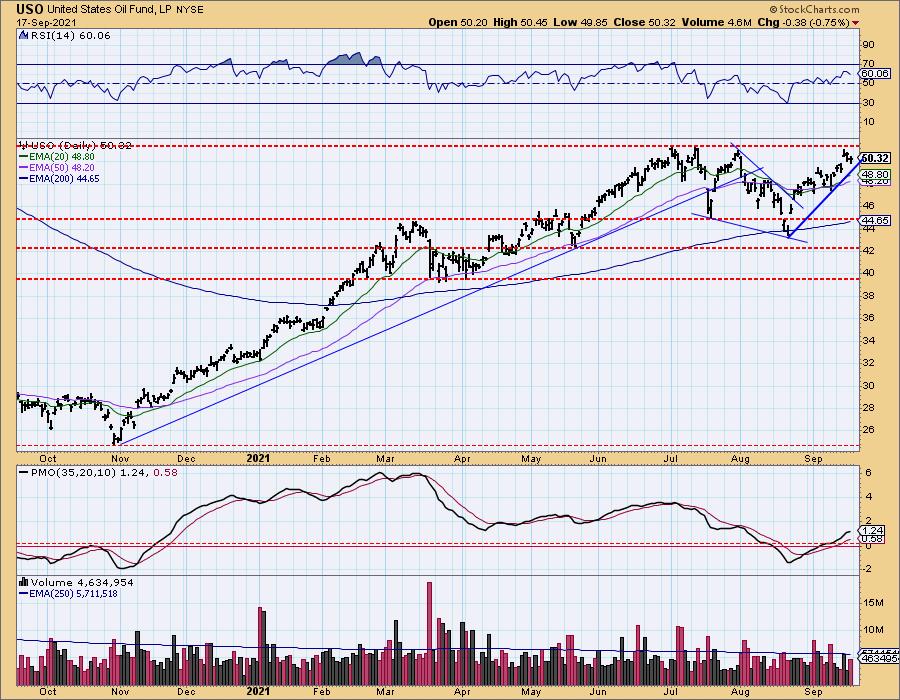

USO/$WTIC Weekly Chart: The weekly chart is mixed. The weekly RSI is positive, but the weekly PMO is on an overbought crossover SELL signal. The PMO is decelerating, but given $WTIC is about to test strong overhead resistance at multi-year highs, we could see it stumble or consolidate in the coming weeks.

BONDS (TLT)

IT Trend Model: BUY as of 6/10/2021

LT Trend Model: SELL as of 1/8/2021

TLT Daily Chart: TLT broke out earlier in the week as yields tumbled, but they are now gaining strength again and thus putting downside pressure on Bonds. The PMO attempted a crossover this week but was thwarted.

It is still holding support at the January low and you could make a case for a cup with handle pattern which is bullish.

TLT Weekly Chart: The cup with handle pattern is visible on the weekly chart as well. The weekly RSI is positive and the weekly PMO is rising. You could also make a case for a bull flag. However, we are seeing the weekly PMO decelerating and we know yields are configured somewhat bullishly. More than likely we'll see more sideways movement.

Technical Analysis is a windsock, not a crystal ball.

-- Carl Swenlin

(c) Copyright 2021 DecisionPoint.com

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.

NOTE: The signal status reported herein is based upon mechanical trading model signals, specifically, the DecisionPoint Trend Model. They define the implied bias of the price index based upon moving average relationships, but they do not necessarily call for a specific action. They are information flags that should prompt chart review. Further, they do not call for continuous buying or selling during the life of the signal. For example, a BUY signal will probably (but not necessarily) return the best results if action is taken soon after the signal is generated. Additional opportunities for buying may be found as price zigzags higher, but the trader must look for optimum entry points. Conversely, exit points to preserve gains (or minimize losses) may be evident before the model mechanically closes the signal.

Helpful DecisionPoint Links:

DecisionPoint Alert Chart List

DecisionPoint Golden Cross/Silver Cross Index Chart List

DecisionPoint Sector Chart List

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

DecisionPoint is not a registered investment advisor. Investment and trading decisions are solely your responsibility. DecisionPoint newsletters, blogs or website materials should NOT be interpreted as a recommendation or solicitation to buy or sell any security or to take any specific action.