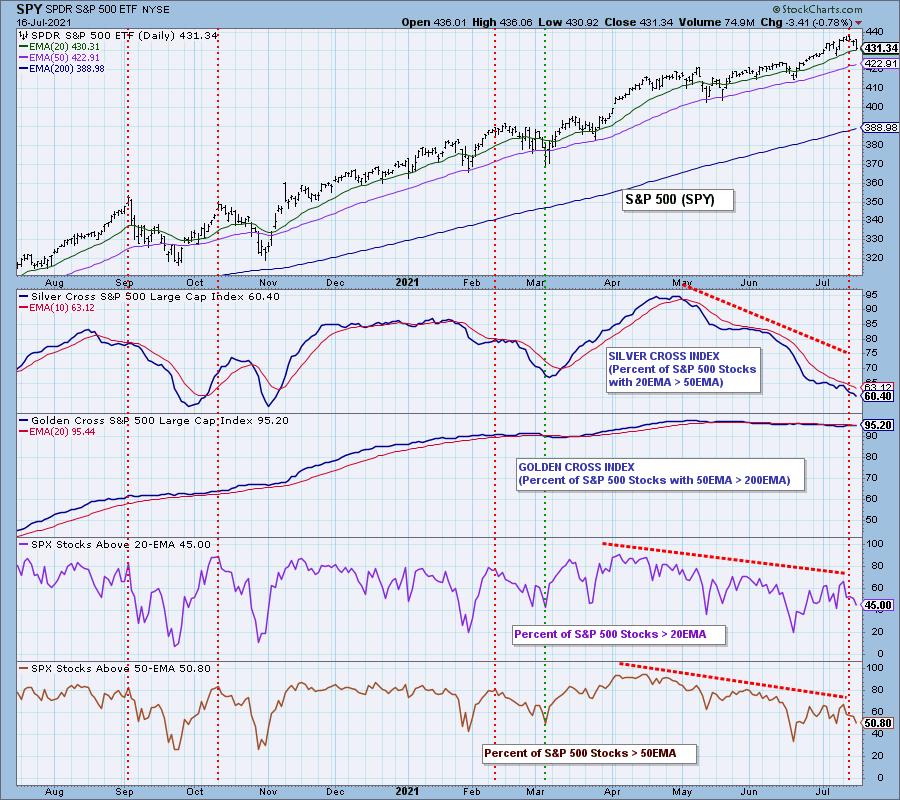

In spite of the market making new, all-time highs this week, participation continued to deteriorate. Our focus is usually on the S&P 500 Large-Cap Index, so we'll begin with that, but mid- and small-cap stocks are really looking bad as well. The Silver Cross Index for the S&P 500 has dropped to 60%, meaning that 60% of SPX stocks have the 20EMA above the 50EMA. Obviously, the largest component stocks are holding the index aloft. This is entirely possible because there are some giant stocks in the index; however, 60% is really starting to push the envelope. To make matters worse, only 50% of SPX stocks are above their 50EMA, meaning that there is the potential for an additional 10% of stocks to lose their Silver Cross status, which would leave only 50% of stocks supporting the index.

S&P 400 Mid-Cap stocks are much worse than the large-caps. Only 43% of them have the 20/50EMA Silver Cross, and only 29% are above their 50EMAs. That leaves an additional 16% of mid-cap stocks with the potential for 20/50EMA negative crossovers. We will assert that there is no way for this index to avoid a bear market under those circumstances.

As could be expected, the S&P 600 Small-Cap Index is in the worst shape of the three indexes. Only 41% have a Silver Cross, and only 21% are above their 50EMA, meaning that the Silver Cross percentage could drop to 21% or lower. We think it is safe to say that this index may already be in a bear market, it just doesn't know it yet.

CONCLUSION: As the market has relentlessly moved to record highs, we can clearly see that the foundation has been steadily crumbling beneath it. This condition could be turned around with renewed buying interest, but at present the internals are very weak and getting worse. Extreme caution is indicated.

Click here to register in advance for the recurring free DecisionPoint Trading Room! Recordings are available.

Technical Analysis is a windsock, not a crystal ball.

--Carl Swenlin

(c) Copyright 2021 DecisionPoint.com

Helpful DecisionPoint Links:

DecisionPoint Alert Chart List

DecisionPoint Golden Cross/Silver Cross Index Chart List

DecisionPoint Sector Chart List

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

DecisionPoint is not a registered investment advisor. Investment and trading decisions are solely your responsibility. DecisionPoint newsletters, blogs or website materials should NOT be interpreted as a recommendation or solicitation to buy or sell any security or to take any specific action.