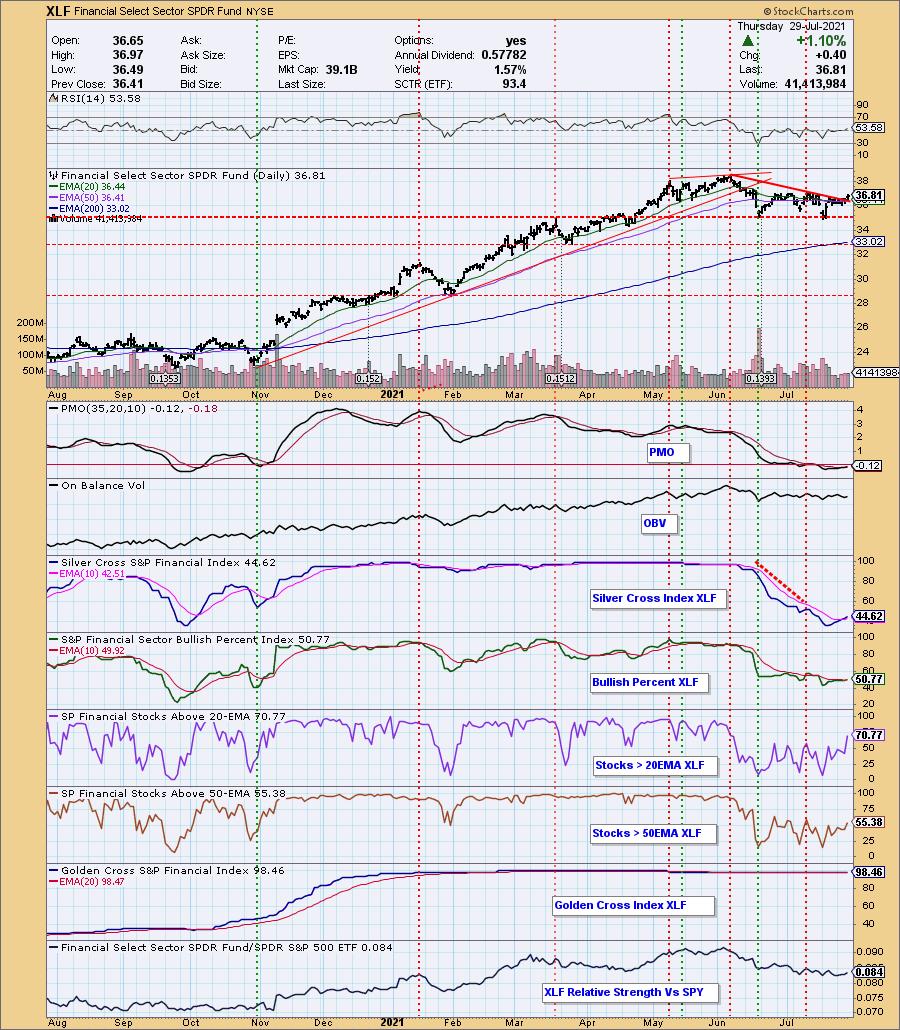

The PMO BUY signals continue to come in on the sector charts. Today Financials (XLF) joined the crowd with a PMO crossover BUY signal in oversold territory. We've seen this before and it didn't pan out but this time we have a new crossover by the Silver Cross Index (SCI) that implies strength is arriving. Participation numbers are strong and not overbought yet. Additionally, today saw a breakout from a bearish descending triangle. I quick peek at the industry groups within and I see continued strength in Specialty Finance ($DJUSSP), Consumer Finance ($DJUSSF) as well as new strength in among Insurance Brokers ($DJUSIB) and Mortgage Finance ($DJUSMF).

The DecisionPoint Alert Weekly Wrap presents an end-of-week assessment of the trend and condition of the Stock Market, the U.S. Dollar, Gold, Crude Oil, and Bonds. The DecisionPoint Alert daily report (Monday through Thursday) is abbreviated and gives updates on the Weekly Wrap assessments.

Watch the latest episode of DecisionPoint on StockCharts TV's YouTube channel here!

MAJOR MARKET INDEXES

SECTORS

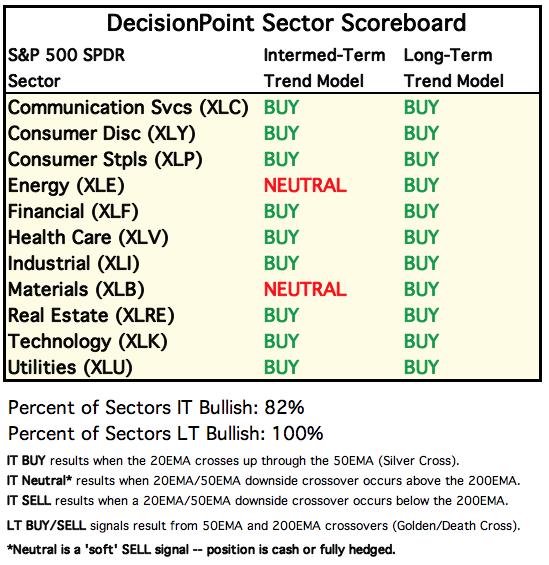

Each S&P 500 Index component stock is assigned to one, and only one, of 11 major sectors. This is a snapshot of the Intermediate-Term (Silver Cross) and Long-Term (Golden Cross) Trend Model signal status for those sectors.

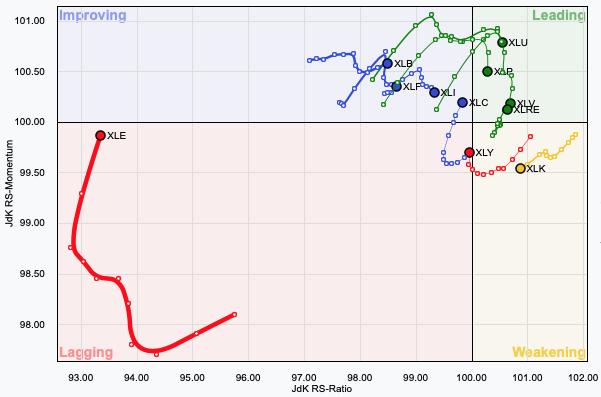

RRG® Chart: XLE is finally moving with a bullish northeast heading toward Improving. This sector has been a laggard among the sectors but appears to be recovering based on the RRG.

CLICK HERE for an animated version of the RRG chart.

CLICK HERE for Carl's annotated Sector charts.

THE MARKET (S&P 500)

IT Trend Model: BUY as of 5/8/2020

LT Trend Model: BUY as of 6/8/2020

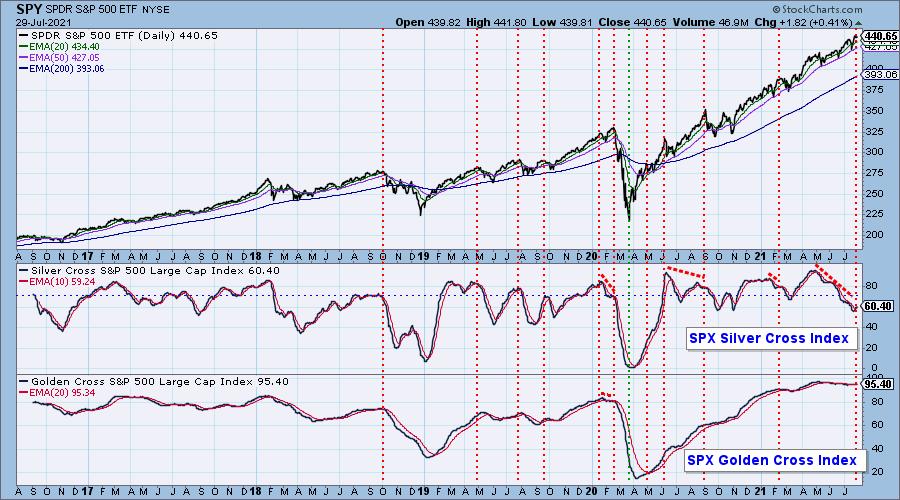

SPY Daily Chart: A new intraday all-time high was reached today, but price remains within a bearish rising wedge. I'm not fond of the possible bearish shooting star candlestick today.

The wedge is most clearly seen on the one-year daily chart, nestled within an intermediate-term rising trend channel. The RSI is positive and the PMO is rising after a relatively recent crossover BUY signal. Total Volume did dip a little today.

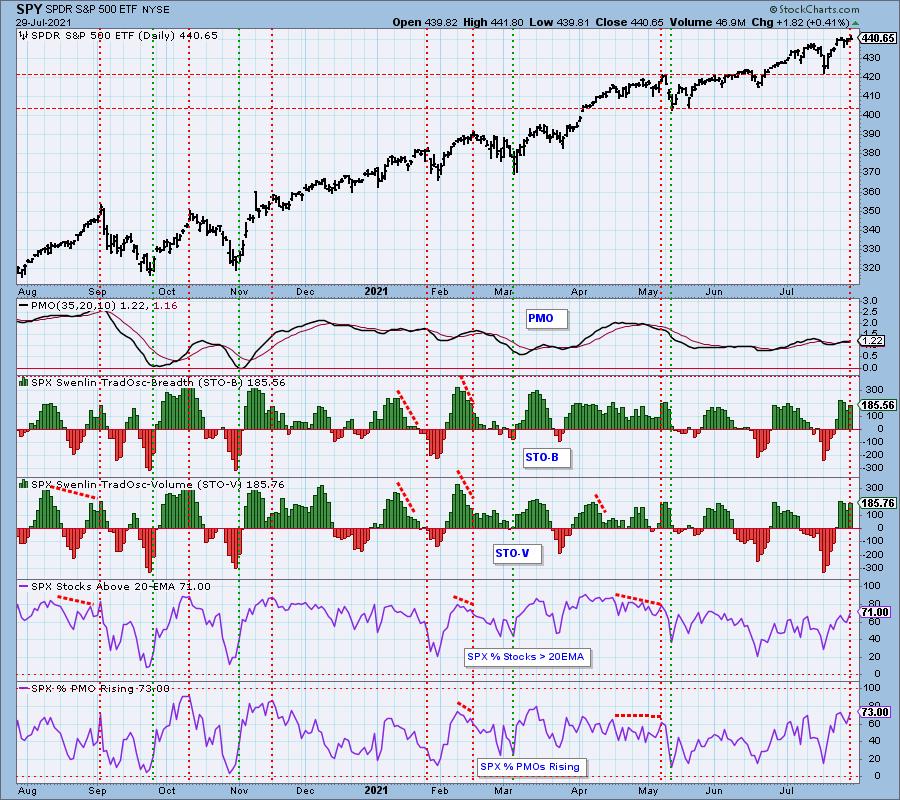

Participation: The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

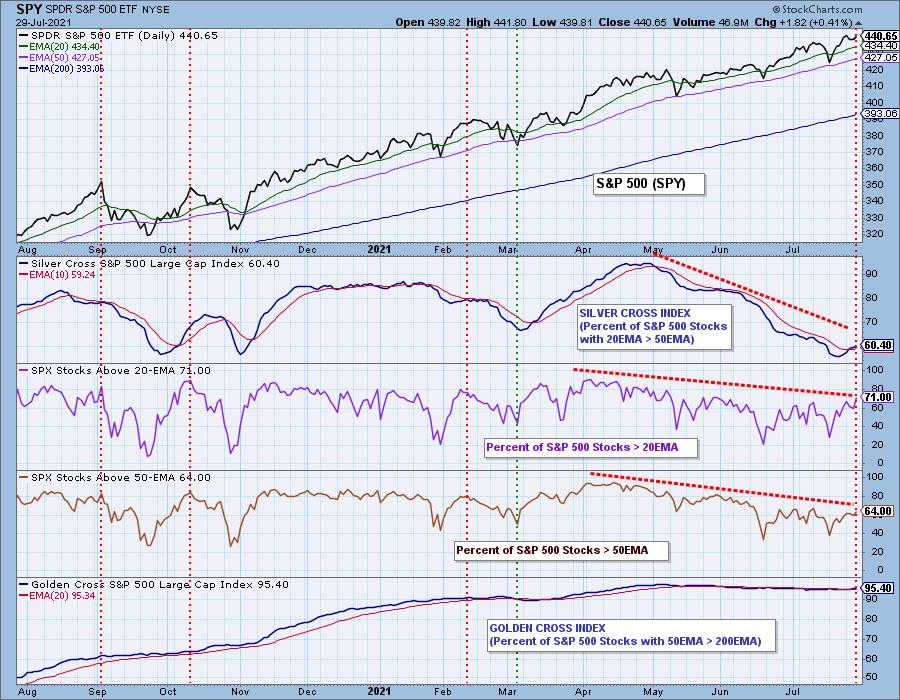

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA).

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA).

- The Bullish Percent Index (BPI) shows the percentage of SPX stocks on Point & Figure BUY signals.

The SCI continues to rise, albeit very slowly, out of near-term oversold territory. The GCI is staying about the same.

Participation in the short-term is speeding up with 71% of stocks > 20-EMA. There is a slight improvement in the intermediate term with 64% of stocks above their 50-EMA, but a negative divergence is still visible.

Climax Analysis: No climax today, although we did see an expansion of New Highs and Net A-D. I'm bothered by the VIX which is still oscillating below its EMA on the inverted scale. Typically this type of behavior indicates a market that is vulnerable to decline in the very short term.

Short-Term Market Indicators: The short-term market trend is UP and the condition is OVERBOUGHT.

The STOs popped back into overbought territory. The are rising which is generally a good sign and we are seeing nearly 3/4 of the SPX with rising momentum.

Intermediate-Term Market Indicators: The intermediate-term market trend is UP and the condition is NEUTRAL.

IT indicators are still on the rise, but remain in uncertain "neutral" territory. We saw a marked improvement in stocks with PMO BUY signals which is finally confirming the intermediate-term rising trend.

Bias Assessment:We've added this new section called "bias assessment". It occurred to me that one of the ways we can measure market bias is to compare the SCI to the percent of stocks above their 20/50-EMAs. When the percentages are lower than the SCI, the market bias is bearish and if they are higher, it is bullish. Any "mechanical" signal requires additional analysis to confirm the numbers.

With improvement in participation in the short term, the market bias is bullish. Just be careful, short-term participation has reached near-term overbought territory. Given the percentage of stocks > 50-EMA is about the same as the SCI, I would consider the intermediate-term bias as neutral still.

CONCLUSION: Earnings seem to ginning the market as more buyers flock to companies that are blowing out their earnings numbers. Interestingly, of the FAANG+ stocks, the only stock that is seeing an earnings boost is Alphabet (GOOGL). Amazon (AMZN) reported earnings after the bell and investors aren't thrilled as the stock is down -7.24% in after hours trading. Participation is improving amongst the other players in the market which is improving the short-term picture. I'm cautiously optimistic in the short term given the sharp improvement on the STOs. I'm considering expanding my exposure to 50% depending on how the market opens tomorrow. I have a few Diamonds in the Rough I'm considering in Healthcare and possibly Industrials.

Have you subscribed the DecisionPoint Diamonds yet? DP does the work for you by providing handpicked stocks/ETFs from exclusive DP scans! Add it with a discount! Contact support@decisionpoint.com for more information!

Tom Bowley joins Erin in the DP Trading Room August 2nd!

It's a reunion for Tom and Erin! Remember MarketWatchers LIVE!? Tom will join me for an extended "10 in 10" as he shares his trading wisdom that combines technical analysis with fundamentals and earnings in particular! You can find him at EarningsBeats.com where he is the Chief Technical Analyst. Register HERE if you haven't already!

BITCOIN

Yesterday's comments still apply:

"Price is now testing overhead resistance at the top of its trading channel. While the PMO looks good and has reached positive territory, the RSI is entering overbought territory. This is a prime spot for Bitcoin to turn back down or at least consolidate somewhat to get the RSI out of overbought territory. I suspect we might see a breakout here, but overhead resistance will likely hold at $42,500."

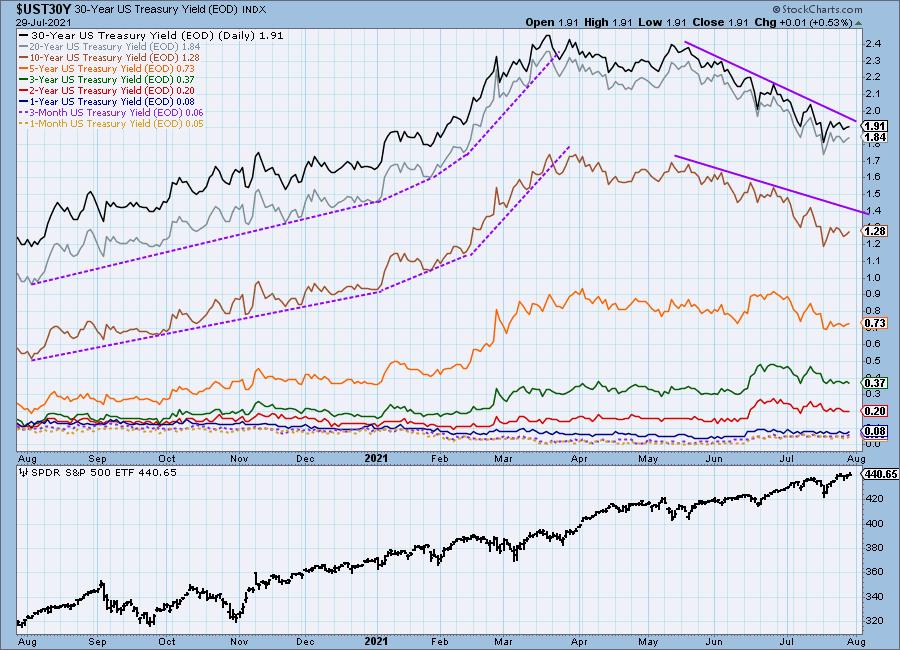

INTEREST RATES

Longer-term rates are continuing in their declining trend.

10-YEAR T-BOND YIELD

$TNX wasn't able to break the steep declining tops trendline. The PMO is at the ready to have a positive crossover, but the negative RSI suggests to me that the 10-year yield will simply consolidate sideways. If a sideways move breaks that declining trend, don't get too excited. A "drift" that breaks a declining trend isn't a bullish sign.

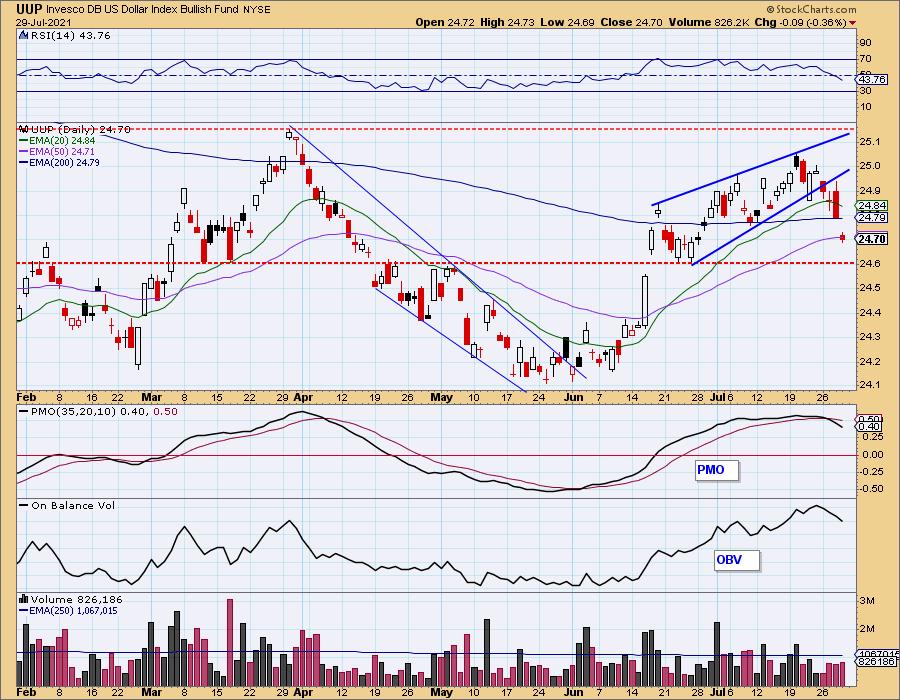

DOLLAR (UUP)

IT Trend Model: BUY as of 6/22/2021

LT Trend Model: SELL as of 7/10/2020

UUP Daily Chart: Yesterday's giant bearish engulfing candlestick played out as expected. Although I wasn't expecting a drop below the 50-EMA. The indicators remain very negative so I'm looking for a test of at least $24.60 on UUP.

It's time to consider the large bullish double-bottom as fractured. Maybe a pullback to $24.10 will provide an opportunity for a bullish triple-bottom, but that is way too far away to consider. A decline to $24.10 does seem a likely scenario.

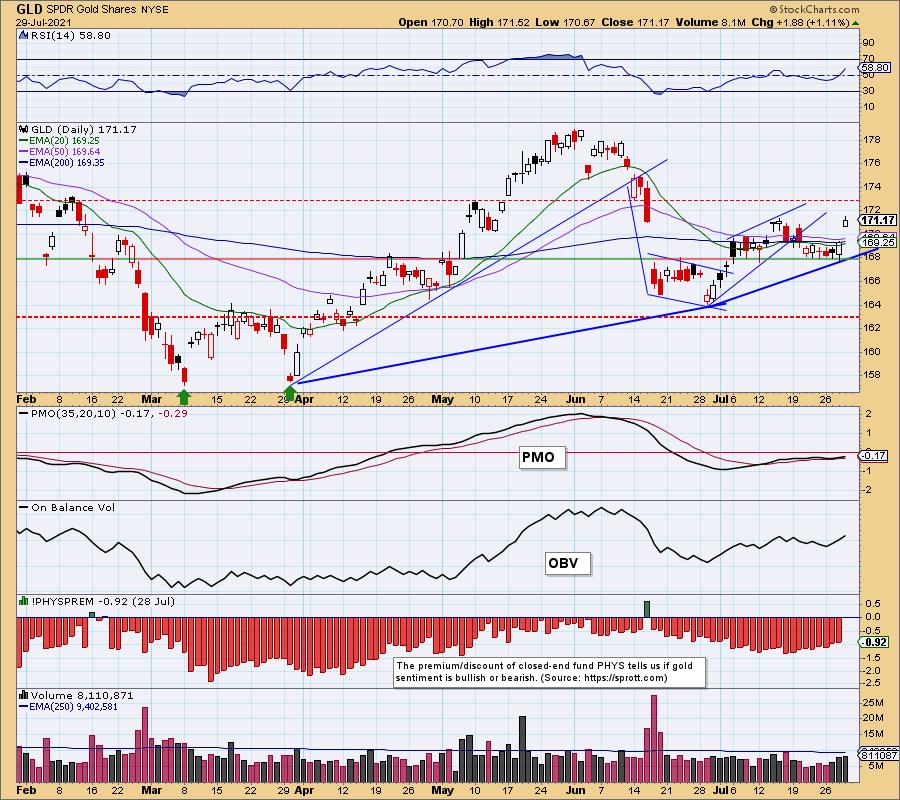

GOLD

IT Trend Model: NEUTRAL as of 6/24/2021

LT Trend Model: BUY as of 5/21/2021

GLD Daily Chart: A big decline in the Dollar will offer Gold an opportunity to recover from the June sell-off. Today's gap up on GLD looks good. With price well-above the EMAs, we should see a new IT Trend Model "Silver Cross" BUY signal. The RSI has popped into positive territory and the PMO is now putting a little distance from its signal line, but that crossover BUY signal is still somewhat vulnerable.

GOLD Daily Chart: We do see a slight short-term breakout on $GOLD. Discounts did expand slightly, but overall investors are getting more bullish on Gold. We will watch these discount numbers closely. When these discounts get close to zero or above, that tends to portend a price top.

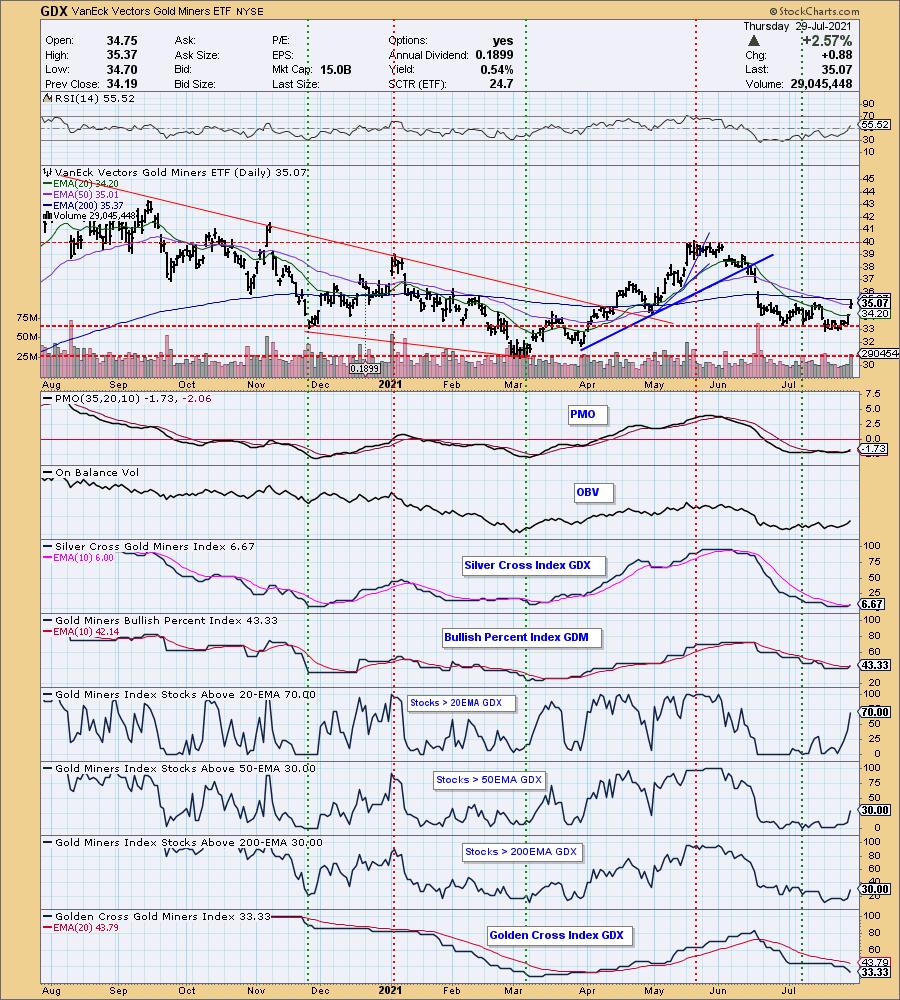

GOLD MINERS Golden and Silver Cross Indexes: Alright, I am now convinced that Miners are a good place to take advantage of beat down pricing. The SCI is now rising and had a positive crossover. The PMO had a positive crossover and participation is improving quickly. Some of my favorite Miners right now? AGI (Full Disclosure: I own it), ARMK, FNV, RIO and KL.

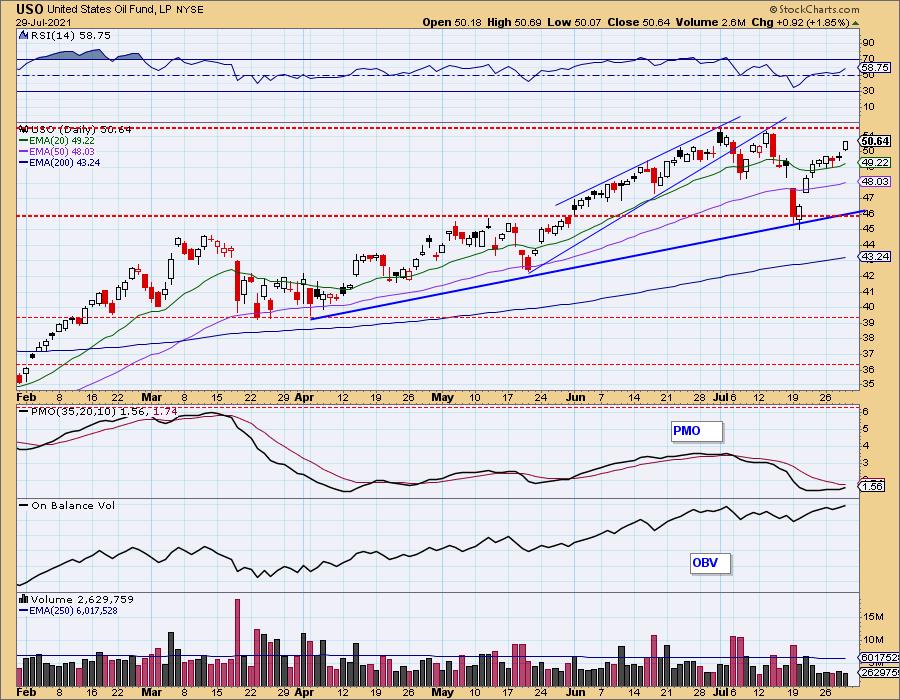

CRUDE OIL (USO)

IT Trend Model: BUY as of 11/23/2020

LT Trend Model: BUY as of 3/9/2021

USO Daily Chart: USO rallied strongly taking away the "toppy" look it's been sporting since it broke above the 20-EMA. The RSI is positive and the PMO is now going in for a crossover BUY signal.

I would look for a test of overhead resistance around $51.50. It will likely pass that test and move even higher.

BONDS (TLT)

IT Trend Model: BUY as of 6/10/2021

LT Trend Model: SELL as of 1/8/2021

TLT Daily Chart: Yesterday's comments still apply.

"TLT is riding a short-term rising trend. The intermediate-term rising trend is also safe." [A PMO SELL signal could appear soon.]

"The RSI is still positive, but the PMO appears to be topping again in somewhat overbought territory. Yields are in a downtrend and while they rebounded somewhat, I'm not expecting the declining trend in yields to be broken near term. TLT would be a hold candidate, but not a buy until we see a decisive breakout above resistance."

Technical Analysis is a windsock, not a crystal ball.

--Erin Swenlin

(c) Copyright 2021 DecisionPoint.com

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.

NOTE: The signal status reported herein is based upon mechanical trading model signals, specifically, the DecisionPoint Trend Model. They define the implied bias of the price index based upon moving average relationships, but they do not necessarily call for a specific action. They are information flags that should prompt chart review. Further, they do not call for continuous buying or selling during the life of the signal. For example, a BUY signal will probably (but not necessarily) return the best results if action is taken soon after the signal is generated. Additional opportunities for buying may be found as price zigzags higher, but the trader must look for optimum entry points. Conversely, exit points to preserve gains (or minimize losses) may be evident before the model mechanically closes the signal.

Helpful DecisionPoint Links:

DecisionPoint Alert Chart List

DecisionPoint Golden Cross/Silver Cross Index Chart List

DecisionPoint Sector Chart List

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

DecisionPoint is not a registered investment advisor. Investment and trading decisions are solely your responsibility. DecisionPoint newsletters, blogs or website materials should NOT be interpreted as a recommendation or solicitation to buy or sell any security or to take any specific action.