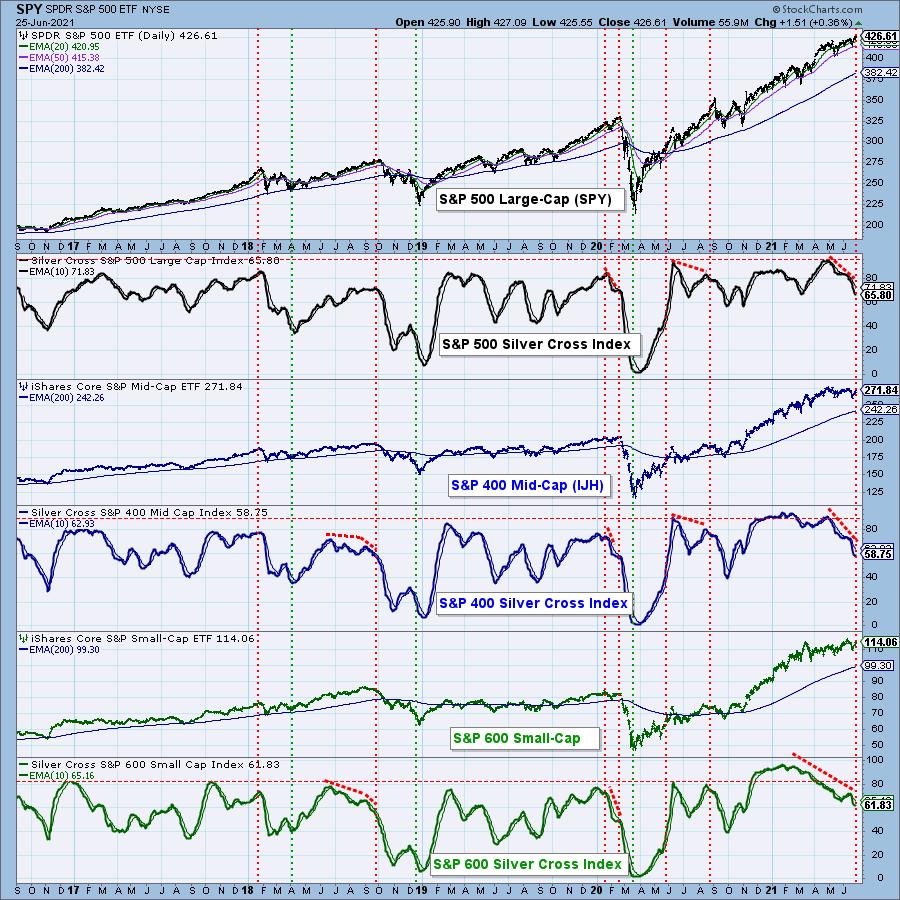

When the 20-EMA crosses up through the 50-EMA, we consider that to be an intermediate-term BUY signal (a "silver cross"), and we track the percentage of stocks with BUY signals in a given market index with the Silver Cross Index (SCI). The chart below shows the SCIs for the S&P 500 Large-Cap, S&P 400 Mid-Cap, and S&P 600 Small-Cap Indexes, and there are significant negative divergences on all three SCIs. Specifically, the price indexes are at or near all-time highs, while all three SCIs show fewer and fewer stocks on BUY signals. Emphasize: This is happening from large-cap to small-cap indexes. This cannot continue.

The DecisionPoint Alert Weekly Wrap presents an end-of-week assessment of the trend and condition of the Stock Market, the U.S. Dollar, Gold, Crude Oil, and Bonds. The DecisionPoint Alert daily report (Monday through Thursday) is abbreviated and gives updates on the Weekly Wrap assessments.

Watch the latest episode of DecisionPoint on StockCharts TV's YouTube channel here!

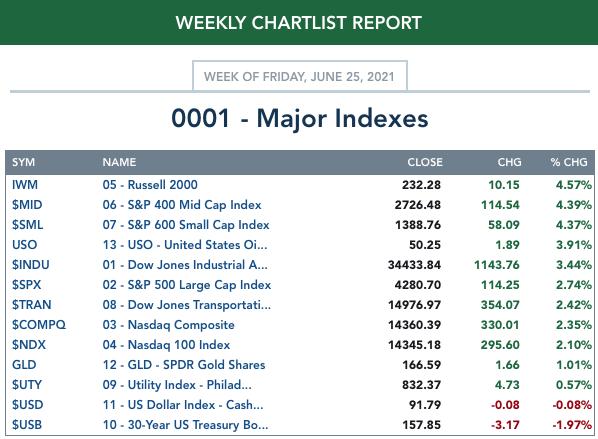

MAJOR MARKET INDEXES

For Friday:

For the week:

SECTORS

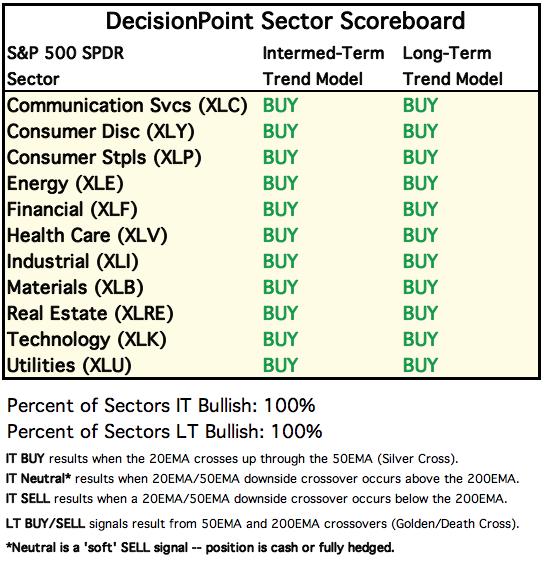

Each S&P 500 Index component stock is assigned to one, and only one, of 11 major sectors. This is a snapshot of the Intermediate-Term (Silver Cross) and Long-Term (Golden Cross) Trend Model signal status for those sectors.

For Today:

For the Week:

CLICK HERE for Carl's annotated Sector charts.

THE MARKET (S&P 500)

IT Trend Model: BUY as of 5/8/2020

LT Trend Model: BUY as of 6/8/2020

SPY Daily Chart: Price has now broken out of the bearish rising wedge. Bullish resolutions to bearish patterns is very bullish. However, we know there are problems that we will address shortly.

The RSI is positive and the PMO basically gave us crossover BUY signal today, but it still looks rather unenthusiastic.

SPY Weekly Chart: The longer-term rising wedge is still intact. Price is getting ever closer to the apex of this pattern meaning it will resolve on any "drift" in price. For now, it does tell us that the intermediate-term trend could be in peril. The weekly PMO is on a crossover SELL signal in this timeframe as well.

SPY Monthly Chart: It's a few days early, but we decided we would cover monthly charts in the Weekly Wrap. If there are any significant changes to these charts on Wednesday night, Erin will update you.

Currently the market is in a parabolic advance on the monthly chart. These end quickly and furiously to the downside so we must stay alert. For now the monthly PMO continues to climb. It is now in overbought territory.

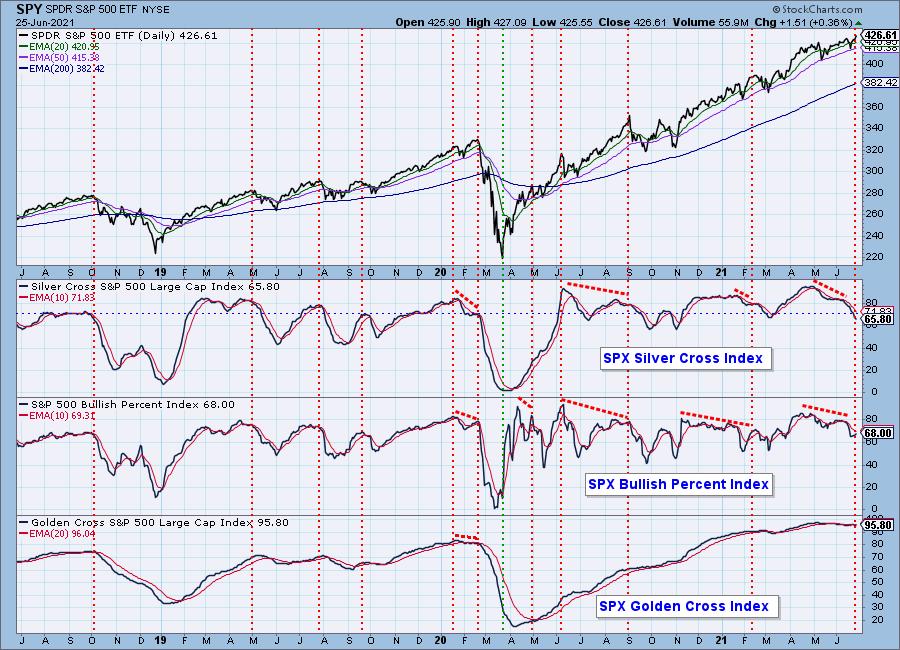

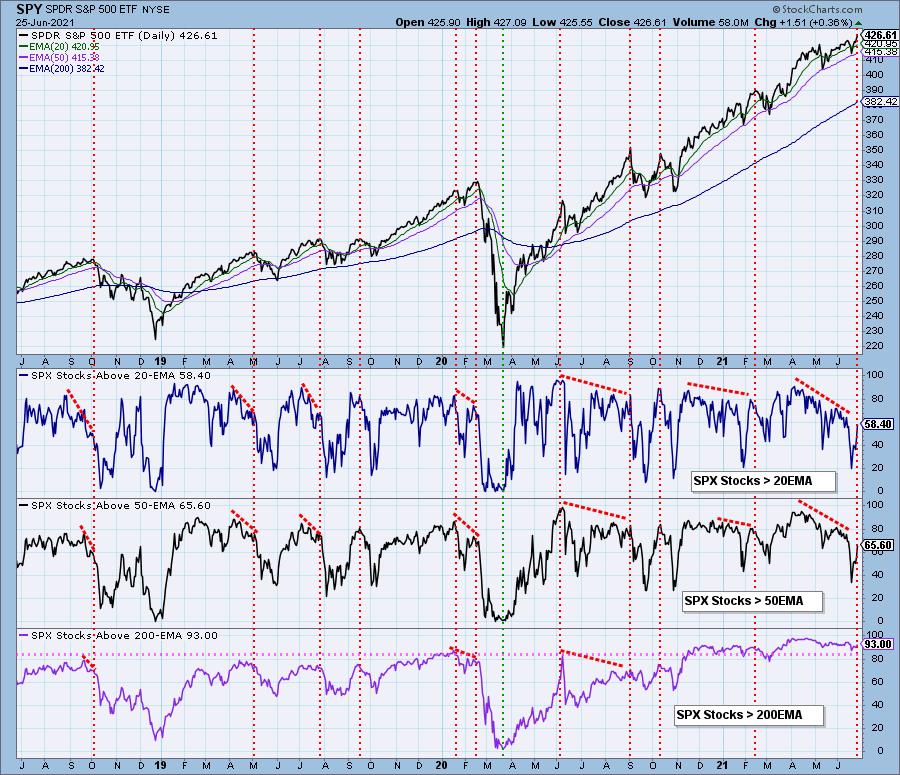

PARTICIPATION: The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA).

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA).

- The Bullish Percent Index (BPI) shows the percentage of SPX stocks on Point & Figure BUY signals.

Fading participation is a huge issue for the market. The Silver Cross Index (SCI) shows only 66% of S&P 500 stocks have the 20EMA above the 50EMA, and the trend of the SCI is down. This implies that the larger-cap stocks in the index are holding it up. This condition can persist, but, unless the SCI trend reverses, the tipping point will be reached and we'll see prices hit an air pocket.

There are still sharp negative divergences on the Stocks > 20EMA and Stocks > 50EMA even with the improved readings this week.

Climax Analysis: We have climactic readings on Net A-D and New Highs are beginning to contract. The VIX punctured the upper Bollinger Band this week, but we didn't see any damage to the trend. When the Bollinger Bands squeeze, we see more of these penetrations, so these punctures may not result in the accompanying trend changes.

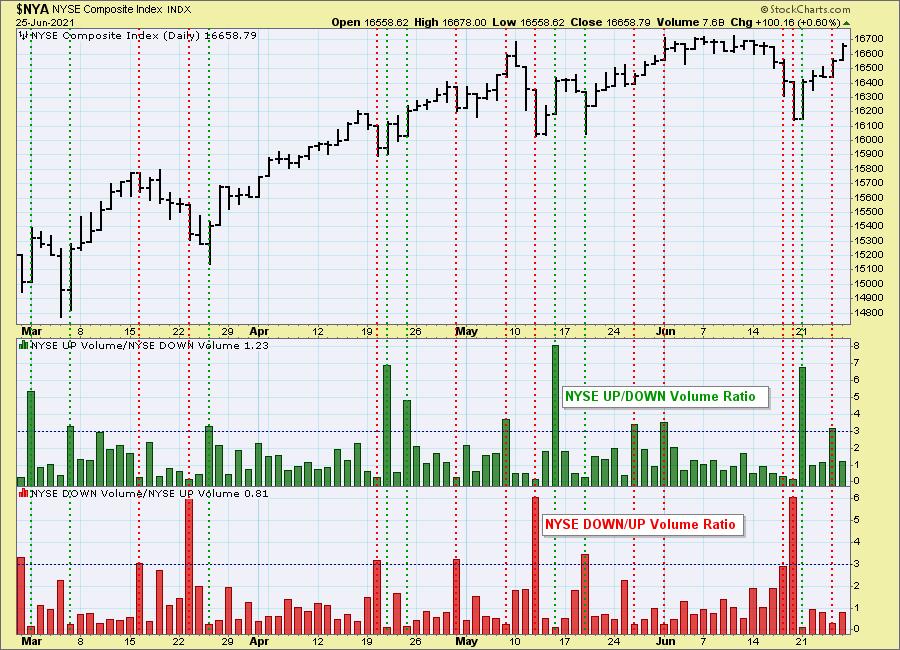

NYSE Up/Down and Down/Up volume ratios are also climax detectors. The 9:1 ratio suggested by the late Dr. Martin Zweig in his book, Winning on Wall Street, is especially significant, but we primarily look for spikes outside the normal range to clarify a particular event. We have an NYSE and S&P 500 version of the ratios, and normally they will only be published when there is a notable reading.

Volume ratios did hit climactic readings this week on Monday (upside initiation climax) and yesterday (upside exhaustion climax). Given today's climactic Net A-D, this is a continuation of this condition.

The S&P 500 version can get different results than the NYSE version because: (a) there are only 500 stocks versus a few thousand; and (b) those 500 stocks are all large-cap stocks that tend to move with more uniformity.

The upside climax accompanying yesterday and today's Net A-D does suggest that we are reaching an exhaustion of the current short-term rising trend.

Short-Term Market Indicators: The short-term market trend is UP and the condition is OVERBOUGHT.

The huge increase on the STOs yesterday and today have already moved them into overbought territory. This tells us the current short-term rising trend is in jeopardy. We are seeing more stocks above their 20-EMA and new momentum, but ultimately these readings are not high enough to support the short-term rally and intermediate-term rising trend.

Intermediate-Term Market Indicators: The intermediate-term market trend is UP and the condition is Neutral. The market bias is NEUTRAL.

The ITBM/ITVM have moved higher the past two days, but not enough to come close to erasing the negative divergences. With only 27% of the SPX on crossover BUY signals, we have more evidence that mega-cap stocks are keeping this rising trend intact.

CONCLUSION: This week the SPY enjoyed a nice short-term rally. However, this has pushed our STOs into overbought territory in a hurry. We have a short-term buying exhaustion based on climactic indicators and volume ratios. Participation and negative divergences are a serious problem and combined with the exhaustion climax it leads us to believe this rising trend will falter next week. We are seeing some improvement on intermediate-term indicators, but not enough. Next week will likely be rocky. When mega-cap stocks begin to turn, the market will too. According to our indicators that will be sooner rather than later.

Have you subscribed the DecisionPoint Diamonds yet? DP does the work for you by providing handpicked stocks/ETFs from exclusive DP scans! Add it with a discount! Contact support@decisionpoint.com for more information!

BITCOIN

Bitcoin had begun to bounce off support this week, but today it failed to get above resistance at the 20-EMA. It is back to testing support. This time support is being tested alongside a new PMO SELL signal and an RSI that is declining. Bitcoin is on the precipice of a breakdown.

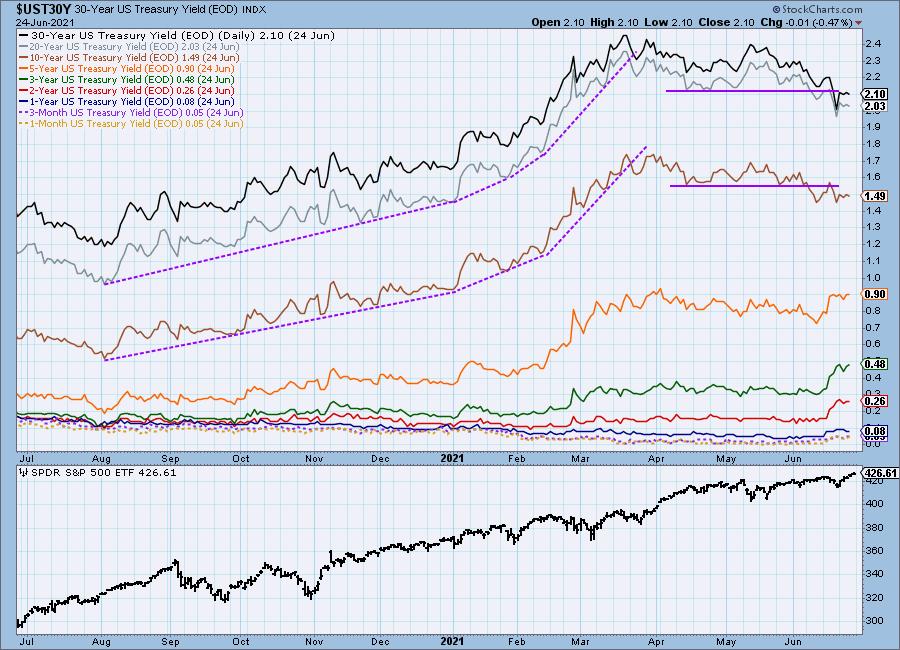

INTEREST RATES

Long-term yields continued to unsuccessfully pound away at overhead resistance this week.

10-YEAR T-BOND YIELD

Today the 10-year yield rallied strongly, but it hasn't overcome resistance at the 50-EMA or the April lows. The PMO is now rising. Price is within a bullish falling wedge so there is a high likelihood we will see a breakout.

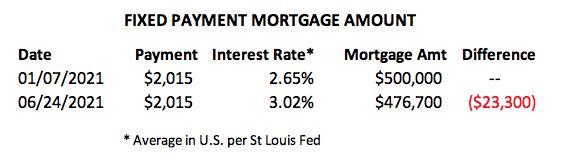

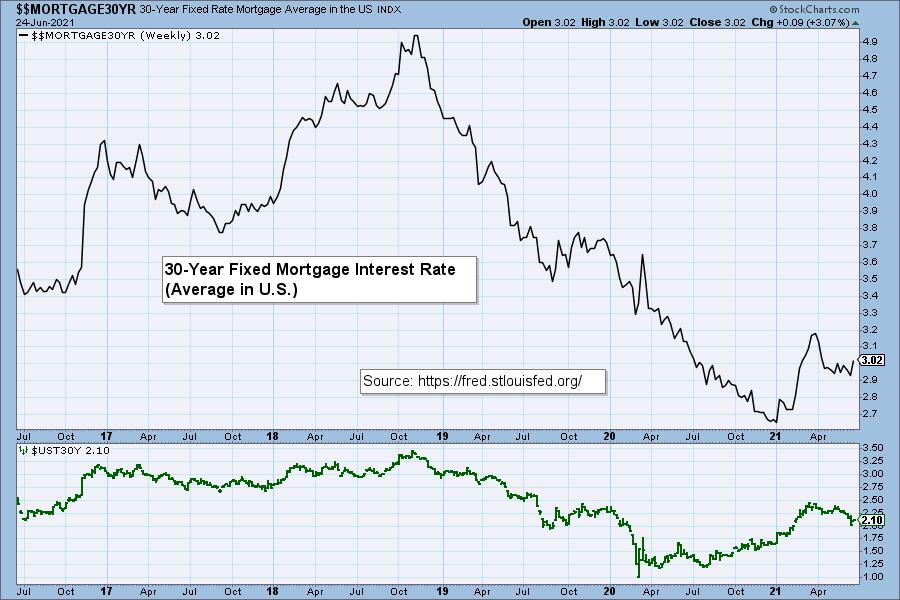

MORTGAGE INTEREST RATES (30-Yr)

We want to watch the 30-Year Fixed Mortgage Interest Rate, because, for the most part, people buy homes based upon the maximum monthly payment they can afford. As rates rise, a fixed monthly payment will carry a smaller mortgage amount. (See table.) As mortgages are forced to shrink, real estate prices will have to fall, and many sellers will increasingly find that they are upside down with their mortgage.

Rates are rising again. This could cool the housing market somewhat. Given anecdotal stories of well-above asking offers not being accepted, the sellers market will likely continue.

DOLLAR (UUP)

IT Trend Model: BUY as of 6/22/2021

LT Trend Model: SELL as of 7/10/2020

UUP Daily Chart: The Dollar cooled this week but still remains comfortably above support. The PMO was damaged much and the RSI remains positive.

There is a very large cup and handle formation that tells us we could see the Dollar break above the 200-EMA again.

UUP Weekly Chart: The weekly charts shows a bullish double-bottom forming. The PMO has whipsawed back into a BUY signal suggesting we will at least see the confirmation line of the pattern tested.

UUP Monthly Chart: The monthly chart is less rosy. The PMO is nearing negative territory and the RSI is negative.

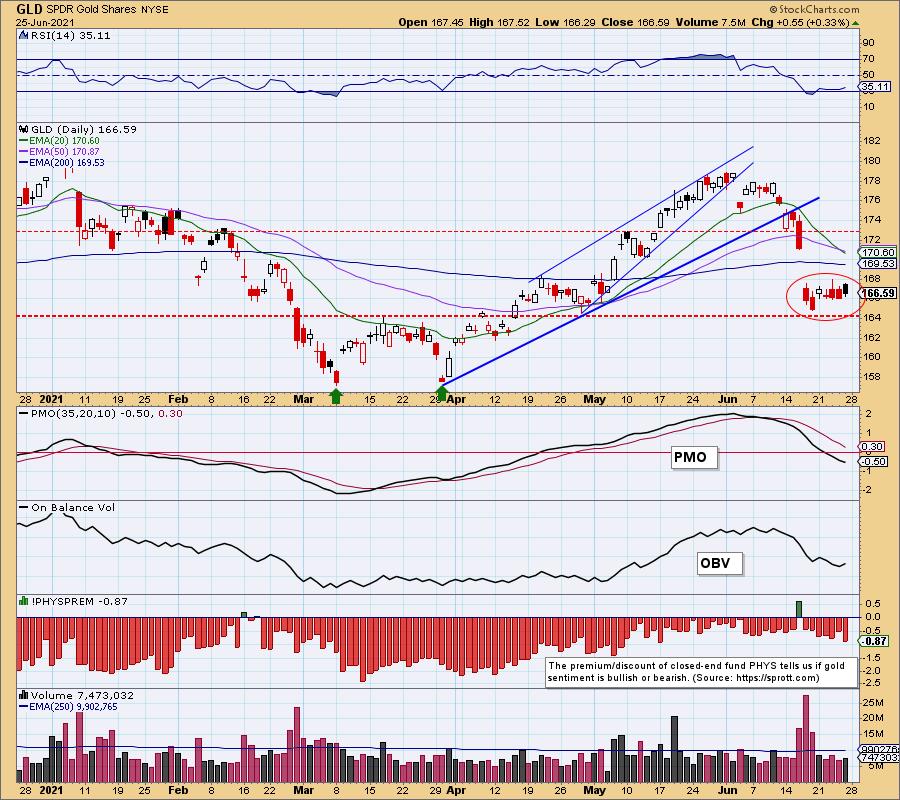

GOLD

IT Trend Model: NEUTRAL as of 6/24/2021

LT Trend Model: BUY as of 5/21/2021

GOLD Daily Chart: There is a nice little island cluster forming, and it makes us think "island reversal." Let's keep that in mind, but we should also remember that recently gold hasn't been delivering positive outcomes.

On this one-year daily chart of $GOLD we see opposing signs: a bearish reverse flag formation, sitting on a fairly solid line of support.

GOLD Weekly Chart: In this time frame, further decline to the rising trend line could be tolerated before serious technical damage is done.

GOLD Monthly Chart: The monthly PMO has dropped below the signal line, leaving us in a bearish long-term configuration.

GOLD MINERS Golden and Silver Cross Indexes: Following Gold's example, Gold Miners are consolidating along support and also could be forming a possible bullish "island reversal". Participation is dismal and the PMO is moving further down into negative territory. This will eventually be an interesting area for investment, but it isn't ripe yet.

CRUDE OIL (USO)

IT Trend Model: BUY as of 11/23/2020

LT Trend Model: BUY as of 3/9/2021

USO Daily Chart: USO reinforced its rising trend by rallying all week. The RSI is now overbought, but it was overbought throughout February. The PMO is not overbought and continues to rise.

After breaking out of the bearish rising wedge, USO has continued to rally strongly with just a hiccup of a pullback to the 20-EMA.

USO/$WTIC Weekly Chart: The weekly RSI is overbought again, but the PMO is still rising. $WTIC is nearing overhead resistance. That could stunt this rally, but won't likely damage it given the current adminstration's negative bias on fossil fuels.

WTIC Monthly Chart: There is pretty clear resistance for crude at 78.00, so perhaps we'll see it consolidate the one-year gains.

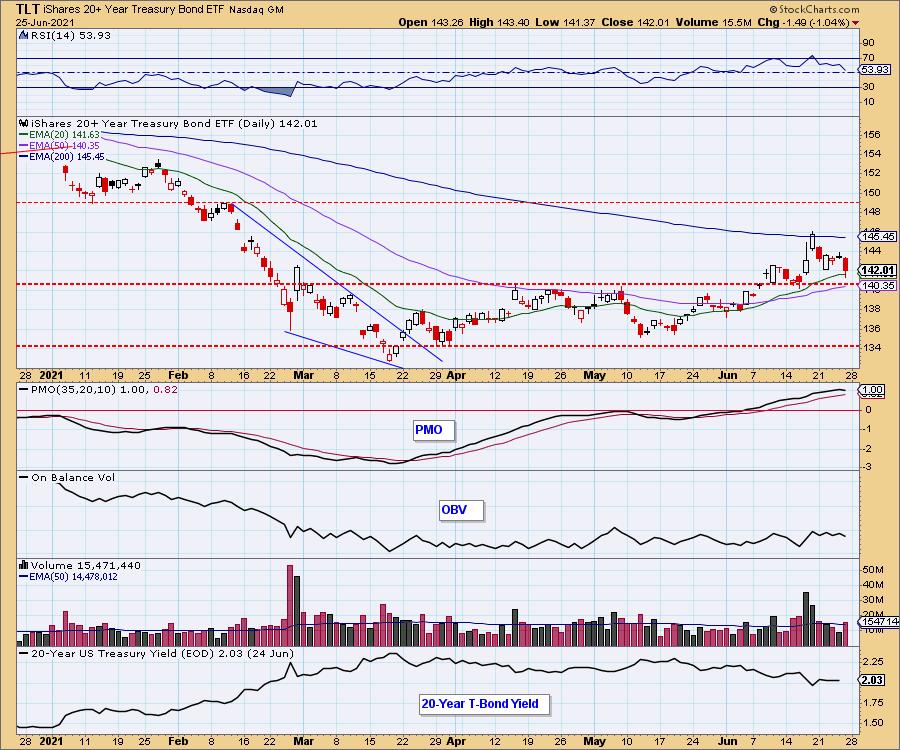

BONDS (TLT)

IT Trend Model: BUY as of 6/10/2021

LT Trend Model: SELL as of 1/8/2021

TLT Daily Chart: With the strong rally in yields today, TLT suffered a more than 1% loss on the day. However, support is still holding up.

The PMO is seeing some damage and is topping in overbought territory. If yields finally break above resistance, this rally from the May low will be in serious jeopardy.

TLT Weekly Chart: The weekly chart shows a double-bottom, but it reached its minimum upside target and now is breaking down. The weekly RSI entered negative territory. The weekly PMO is bullish given its oversold crossover BUY signal.

TLT Monthly Chart: The monthly chart is bearish based on the monthly PMO and RSI. There is a bounce off the $130 level of support, but overhead resistance 2019 highs are pressuring this possible breakout.

Technical Analysis is a windsock, not a crystal ball.

-- Carl & Erin Swenlin

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.

NOTE: The signal status reported herein is based upon mechanical trading model signals, specifically, the DecisionPoint Trend Model. They define the implied bias of the price index based upon moving average relationships, but they do not necessarily call for a specific action. They are information flags that should prompt chart review. Further, they do not call for continuous buying or selling during the life of the signal. For example, a BUY signal will probably (but not necessarily) return the best results if action is taken soon after the signal is generated. Additional opportunities for buying may be found as price zigzags higher, but the trader must look for optimum entry points. Conversely, exit points to preserve gains (or minimize losses) may be evident before the model mechanically closes the signal.

Helpful DecisionPoint Links:

DecisionPoint Alert Chart List

DecisionPoint Golden Cross/Silver Cross Index Chart List

DecisionPoint Sector Chart List

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

DecisionPoint is not a registered investment advisor. Investment and trading decisions are solely your responsibility. DecisionPoint newsletters, blogs or website materials should NOT be interpreted as a recommendation or solicitation to buy or sell any security or to take any specific action.